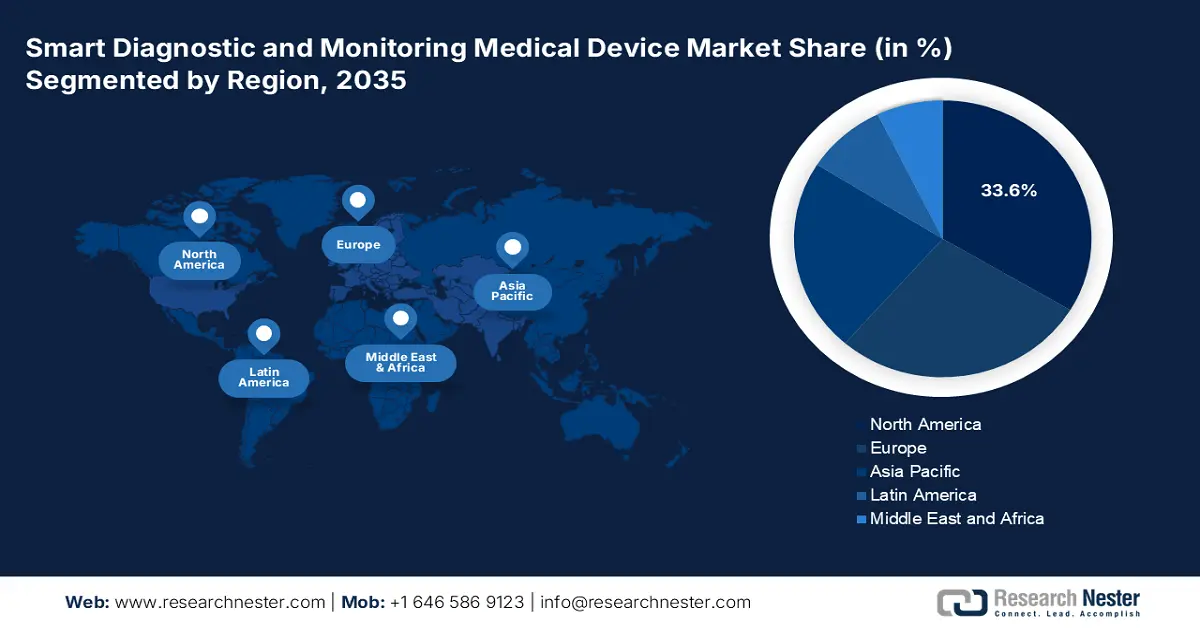

Smart Diagnostic and Monitoring Medical Device Market - Regional Analysis

North America Market Insights

The smart diagnostic and monitoring medical device market dominates the North America region and is expected to hold a share of 33.6% by 2035. This dominance is due to the rising chronic disease burden, payer-backed RPM/RTM reimbursement, and AHRQ-supported quality/safety initiatives. Hospitals scale interoperable platforms (HHS/ONC) linking EMR, analytics, and device data, while NIH grants surge AI diagnostics and sensor R&D. According to the Office of Industry and Competitiveness Analysis report released in September 2023, the export of electro-diagnostic patient monitoring systems increased by $622 million (65.9%) to $1.57 billion in 2022, reflecting major growth in North America's smart diagnostic and monitoring medical devices market.

The U.S. smart diagnostic and monitoring device market in North America is driven due to the rising chronic disease, surging for continuous monitoring and episodic at its core, to value-based care. As per the CMS report in April 2025, Remote Physiologic Monitoring CPT codes such as 99453, 99454, 99457, 99458, and Remote Therapeutic Monitoring 98975–98977/98980–98981, aiding in device data capture, transmission, and clinical management reimbursement. On the other hand, AHRQ enhances patient safety, quality measurement, and digital tool adoption in ambulatory and inpatient environments, and NIH aids AI/ML diagnostics, wearable sensors, and digital biomarkers.

Trade Data on Medical Devices and Instruments in 2023

|

Country |

TradeFlow |

Product Description |

Trade Value 1000USD |

|

U.S. |

Export |

Medical Diagnostic Test instruments and apparatus |

64,346.28 |

|

Canada |

Export |

Medical Diagnostic Test instruments and apparatus |

3,271.83 |

|

U.S. |

Import |

Instruments and appliances used in medical |

19,524,852.48 |

|

Canada |

Import |

Instruments and appliances used in medical |

1,706,884.72 |

Source: WITS, 2023

APAC Market Insights

Asia Pacific is the fastest-growing region in the smart diagnostic and monitoring device market and is projected to hold a considerable share by 2035. The region is driven by the rapid aging, chronic disease burden, and national digital-health programs that expand remote and in-hospital monitoring. Smart hospitals in the region contributes to the regional market growth by incorporating the latest technologies such as IoT, robotics and AI to improve the operations in the healthcare sector. Further strategic partnerships and collaborations improves the telehealth expansion for rural access. For example, in January 2022, Advantech in Vietnam signed an agreement with Thai Hoa General Hospital located in Vietnam’s Ninh Thuan province for integrating advanced medical technologies to support doctors and medical staff and improve efficiency.

China holds the largest share in the smart diagnostic and monitoring medical device market in the Asia Pacific and is expected to hold a substantial share by 2035. The country is influenced by the prevalence of chronic diseases as well as robust government investment in digital health. Additionally, according to the evidence in the NLM article in July 2024, almost 53% of the devices that are connected have vulnerabilities, and there have been several regulatory reforms in place to prevent such an incident. Recently, in 2022, in China, regulatory guidelines have been issued for the classification and designation of artificial intelligence medical software.

Europe Market Insights

Europe is dominating the smart diagnostic and monitoring medical device market and is propelled by the aging population, growth of chronic diseases (cardiovascular, diabetes, COPD), and country-level digital-health initiatives that spur remote monitoring, hospital-at-home, and integrated diagnosis. Interoperability (FHIR/HL7), cybersecurity, and SaMD lifecycle management are in high demand by hospitals and health systems to address regulatory requirements. The EU4Health 2025 Work Programme allocates more than €39 million specifically to the digital strand, including funding provided to digital diagnostics such as AI-based diagnostic devices, health data integration, and digital medical devices.

Germany is Europe's largest smart diagnostic and monitoring medical device market and is expected to retain a significant share by 2035. According to the NLM report in September 2022, Germany's statutory health insurance system covered digital health applications (DiGAs), many of which are smart diagnostic and monitoring medical devices, and earned revenues that exceeded €73 million. Strong hospital uptake driven by university/university-clinic networks, DiGA/digital health ecosystem, and digital therapeutics channels; statutory health insurance (GKV) pilots and reimbursement channels promote adoption.