Smart Bottles Market Outlook:

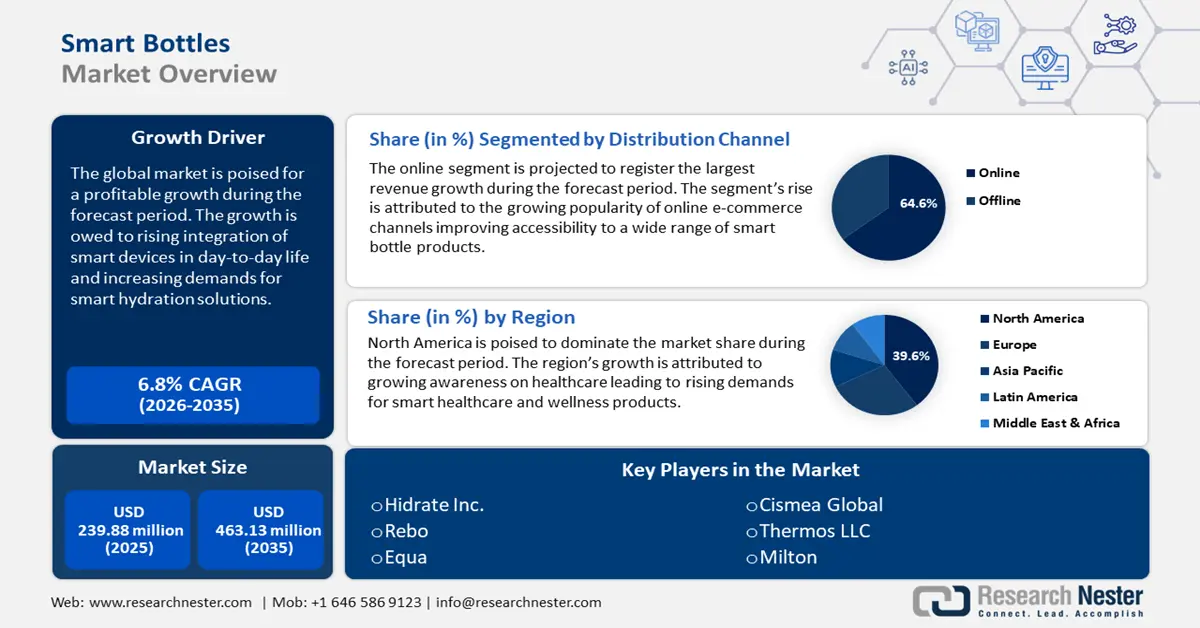

Smart Bottles Market size was over USD 239.88 million in 2025 and is projected to reach USD 463.13 million by 2035, growing at around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart bottles is evaluated at USD 254.56 million.

The market’s robust growth curve is attributed to the growing awareness of health and fitness, with consumer behavior tilting towards practicing a healthy lifestyle after the COVID-19 pandemic. Smart bottles are uniquely positioned to supplement the consumer demand for a healthy lifestyle by offering advanced features such as hydration tracking, temperature control, and integration with mobile applications.

Moreover, social media trends on hydration push consumer narratives on hydration as a health benefit, evident by the growing shelf space dedicated to water drinks, which opens opportunities for the smart bottles market. The rapid urbanization of the global population along with rising levels of disposable income allows manufacturers to market smart bottles as premium products to a consumer base that is willing to spend for convenience. For instance, the United Nations (UN) projected 68% of the global population to live in urban areas by 2050, a key factor poised to fuel the market’s rapid growth.

Manufacturers are also projected to find new opportunities to expand to niche segments such as sports and medical water bottles, to cater to athletes and patients who require strict hydration management. With a rising focus on health and wellness, the global smart bottles market is positioned to register a profitable growth curve by the end of 2037.

Key Smart Bottles Market Insights Summary:

Regional Highlights:

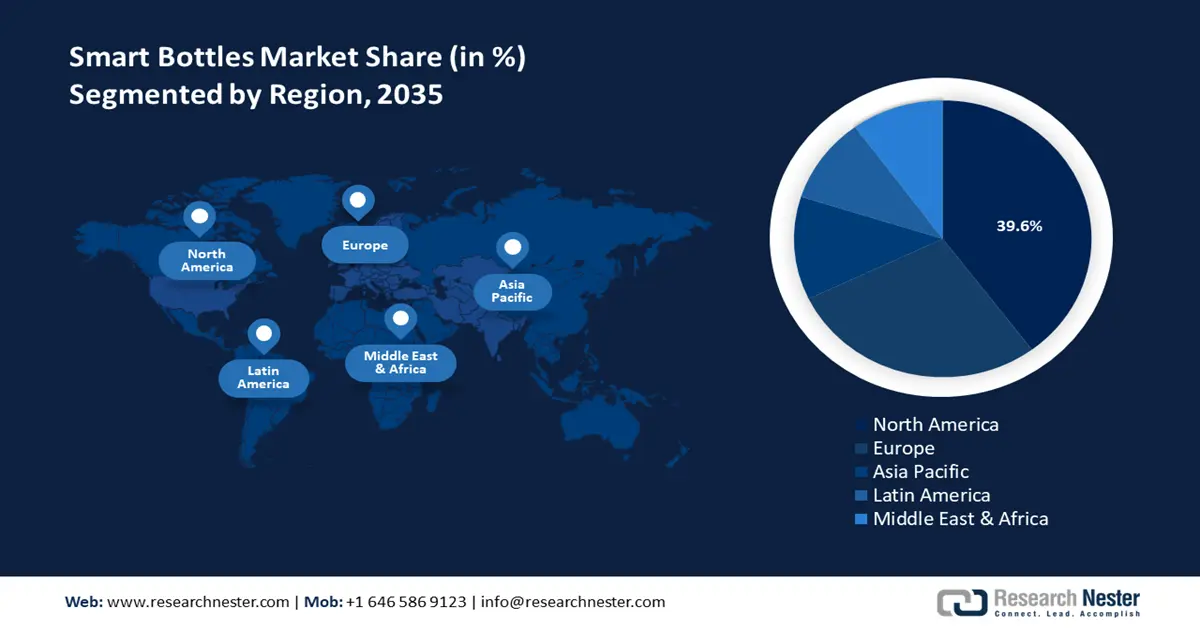

- North America holds a 39.6% share of the Smart Bottles Market, propelled by growing consumer demand for quick hydration and health & wellness solutions, alongside increasing smartphone penetration, ensuring dominance through 2026–2035.

- Europe's Smart Bottles market is expected to see robust growth by 2035, driven by the growing adoption of smart trackers for fitness and the launch of innovative products like the Adidas x Revo water bottle.

Segment Insights:

- The Online Segment is forecasted to capture a 64.6% share of the Smart Bottles Market by 2035, driven by the high preference for e-commerce platforms offering convenience and variety.

- The Smart Water Bottles segment is anticipated to experience rapid growth from 2026 to 2035, driven by increasing demand for health monitoring and hydration tracking via mobile app integration, Bluetooth, and IoT sensors.

Key Growth Trends:

- Rapid technological advancements and IoT integration

- Expansion of fitness and healthcare sectors

Major Challenges:

- Competition from traditional bottles

- Technological constraints on battery life and charging

- Key Players: Hidrate Inc., Rebo, Equa, HydraCoach, Thermos LLC, Aquaminder, Milton, Cismea Global, impacX.io, Phillips.

Global Smart Bottles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 239.88 million

- 2026 Market Size: USD 254.56 million

- Projected Market Size: USD 463.13 million by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Smart Bottles Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid technological advancements and IoT integration: The rapid rate of technological development and integration of smart devices in daily life is a significant driver of the smart bottles market. The internet of things (IoT) integration into everyday objects fuels the market’s growth as it shifts consumer behavior toward adopting smart devices. For instance, Google estimates that 61% of people own a smart device globally. Additionally, smart bottles can be interactive, which improves user convenience and can increase the consumer retention percentage, thereby boosting the market’s growth. For instance, in June 2024, PepsiCo unveiled smart cans with movement sensors and accelerometers that will customize the user experience.

-

Expansion of fitness and healthcare sectors: The growth of the fitness and healthcare sectors contributes to the revenue growth of the smart bottles market. Rising focus on personalized healthcare has increased trade and foreign direct investment (FDI) in the health tech sector. For instance, the India Brand Equity Foundation (IBEF) reports FDI inflow in India was USD 36,746 million during 2022-2023. These trends open new opportunities in emerging economies such as India.

Additionally, a global surge in healthcare expenditure promotes a healthier lifestyle, which becomes a prime opportunity for the smart bottles market. In the future, smart bottle products are uniquely positioned to make a mark in the fitness and sports sectors, by answering consumers’ pain points with accurate tracking and efficient measurements of hydration levels. -

Growing adoption of sustainable products: The global emphasis on sustainable products and reducing single-use plastic dependency is a major driver for the smart bottles market. A report by TheRoundup indicates global Google searches for topics pertaining to sustainable products increased by 130% between 2017 and 2022, indicating a rising trend of emphasis on green products.

The adoption of smart bottles benefits from the broader eco-conscious movement owing to the reusability factor of the product. For instance, Coca-Cola labels its smart bottles as using food-grade PET1 plastic known for its recyclable quality. The user-friendly features of the products, along with the sustainable quality, are poised to fuel a rapid growth of the smart bottles market as investments of brands in green marketing increase globally.

Challenges

-

Competition from traditional bottles: Smart water bottles do not have the market penetration of traditional water bottles and face a significant challenge in establishing themselves as the dominant bottle solution in comparison with regular bottles. Smart bottles can also face durability concerns owing to electrical component integration, which puts them at a disadvantage to the robust durability of traditional bottles. Additionally, the high costs can deter consumers, stymieing the smart bottles market growth, as a section of consumers may prefer other applications for water usage reminders or health tracking.

-

Technological constraints on battery life and charging: The overreliance on charging and batteries can be a major constraint in the growth of the market. A large section of consumers prefers the versatility in bottles and its ease-of-use capabilities, while the requirements for charging and limited battery life can deter them from investing in smart bottles market players ought to focus on integrating more convenient solutions with smart bottles to overcome this challenge.

Additionally, consumers can be irked by the planned obsolescence of smart bottles, as limited lifespans encourage re-purchases as frequently released new models render older smart bottles obsolete.

Smart Bottles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 239.88 million |

|

Forecast Year Market Size (2035) |

USD 463.13 million |

|

Regional Scope |

|

Smart Bottles Market Segmentation:

Distribution Channel (Online, Offline)

Online segment is estimated to account for more than 64.6% smart bottles market share by the end of 2035. The rapid growth of this segment is attributed to the high preference for e-commerce platforms. Online platforms provide convenience to consumers opting to purchase smart bottles by providing options to compare prices, check reviews, and access a wide range of products. E-commerce platforms also provide lucrative discounts and deals to consumers, prompting the growth of this segment as a premier distribution channel for smart bottles.

Additionally, large-scale penetration of 5G services globally improves the accessibility of smart bottles through online platforms. E-commerce platforms such as Amazon, Alibaba, E-bay, Flipkart, etc., have a wide assortment of smart bottles products under various segments from sports to healthcare, boosting the smart bottles market’s growth.

The offline segment is poised to increase its revenue share during the forecast period. The growth of the segment is owed to its strong presence in regions that prioritize physical retail as a dominant shopping channel. Consumer psychology to inspect products in person plays a role in the growth of the segment, as smart bottle product purchases in stores have witnessed a surge. Owing to the increasing popularity of health and sports-related hydration solutions, the shelf space in retail stores for hydration bottles has increased. Specialty stores, large retail chains, and health centers have dedicated spaces to stock smart bottles catering to health-conscious customers.

Additionally, impulse shopping trends among consumers benefits the growth of this segment as smart bottles with visually appealing packaging can impact the sales decision of a potential customer.

Product Type (Smart Water Bottles, Smart Pills Bottles, Others)

The smart water bottles segment in smart bottles market is projected for rapid growth by the end of 2035 owing to the rapidly growing niche of smart water bottles focused on health monitoring and hydration tracking. The segment benefits from the growth of the bottled water sector as a large percentage of consumers seek quick hydration solutions to complement their busy lifestyles.

The convenience provided by smart bottles fuels the rapid rise of the segment as mobile app integration, Bluetooth connectivity, and IoT sensors in a smart water bottle allow real-time hydration tracking. For instance, in October 2022, HidrateSpark expanded its smart water bottle line by adding a flip lid to the collection that can track hot and cold beverages.

Our in-depth analysis of the global market includes the following segments:

|

Distribution Channel |

|

|

Product Type |

|

|

Material |

|

|

Connectivity |

|

|

Capacity |

|

|

Price |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Bottles Market Regional Analysis:

North America Market Analysis

North America industry is poised to hold largest revenue share of 39.6% by 2035. The large revenue share of the region is attributed to growing consumer demands for quick hydration and health & wellness solutions. Consumer preferences for smart devices have grown significantly with the penetration of smartphones. With a rising demand for an all-in-one solution for hydration, smart bottles are poised to answer the demands with IoT sensor integrated products that can keep beverages hot or cold depending on the consumers’ preferences.

The U.S. held the largest share in the smart bottles market in North America in 2024 and is estimated to increase its revenue share by the end of the forecast period. The U.S. witnesses robust growth owing to a rising percentage of disposable personal income. For instance, the Organization of Economic Cooperation and Development (OECD) estimated the average disposable income per capita is USD 51147 in the U.S., higher than the OECD average of USD 30490 a year. Higher rates of disposable personal income allow consumers in the U.S. to purchase more convenience products, benefiting the market’s growth.

Additionally, hydration products are seeing a surge in growth in younger demographics across the nation, positioning market players to integrate smart bottles into their products at competitive pricing. For instance, Prime Hydration announced total sales of USD 1.2 billion in 2023.

Canada accounts for a large percentage of the smart bottles market share in North America. The market in Canada is poised to increase its revenue share owing to the rising popularity of smart health monitors, growing awareness on wellness, and a push for sustainable products. Additionally, the consumer preference for quality hydration solutions is growing, leading to opportunities in the market for premium smart bottles. Consumer preference for sustainable products benefits the market’s growth as smart bottle products are often made with reusable plastics. With a growing availability of smart bottle solutions across various verticals in retail stores or online marketplaces, Canada is poised to exhibit considerable growth by the end of the forecast period.

Europe Market Analysis

The smart bottles market in Europe is estimated to register the fastest growth in revenue share during the forecast period. Consumer preferences in Europe are characterized by health-conscious choices and the growing adoption of smart trackers for fitness. The market in Europe is also boosted by the launch of multiple smart bottles to improve consumer convenience. For instance, in February 2023, Adidas and Revo collaborated to launch a limited edition of the Adidas x Revo water bottle in select stores in Europe, with the bottle integrated with hydration coaching recommendations based on the user’s physical activity.

Germany has a leading share in the smart bottles market in Europe. The robust technological ecosystem in Germany facilitates the adoption of smart solutions by consumers. The regulatory ecosystem in Germany is known for stringent application of the Environmental, Social, and Governance (ESG) protocols after passing an act in January, 2023. The strict laws on sustainable supply chains position manufacturers of smart bottles to advertise the products as green solutions owing to their reusability. The consumer preferences in Germany are focused on the reusability factors of products, leading to the market’s steady growth in the region.

France is positioned to increase its revenue share in Europe during the forecast period. The smart bottles market’s growth is due to rising investment in health-tracking products and fitness technologies. The appeal of smart bottles to monitor hydration levels is growing in France owing to consumer preference for convenient, easy-to-use, health and hydration solutions. The large selection of new smart bottle products available in Western Europe benefits the market’s growth in France as more consumers are exposed to the benefits of smart bottle products. In October 2023, Hoali and La Vélodyssée partnered to provide smart hydration to cyclists by allowing them to geolocate water points via an interactive map.

Key Smart Bottles Market Players:

- Hidrate Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rebo

- Equa

- PepsiCo

- HydraCoach

- Thermos LLC

- Aquaminder

- Milton

- Cismea Global

- impacX.io

- Phillips

The smart bottles market is projected for a significant growth during the forecast period. The sector has a competitive presence of global and local companies vying to improve their revenue share. Key market players are investing to improve distributions, shelf presence in retail stores, and research technological improvements in smart bottles.

Here are some key players in the market:

Recent Developments

- In March 2024, Cismea Global announced the launch of the WaterH Boost smart water bottle that will provide a digital hydration coach experience for users to track, optimize, and motivate daily water consumption.

- In August 2023, AQUAMINDER launched a smart water bottle equipped with LED lights and beep sounds. The water bottle will send notifications to users to stay hydrated.

- In October 2022, impactX announced a partnership with Gatorade. The strategic partnership will see Gatorade’s Smart GX bottles to be powered with impactX’s technology.

- In March 2022, Auron Bottle announced the launch of its online store after a successful crowdfunding campaign. The launch will have Auron’s smart water bottle with self-cleaning capabilities in 60 seconds available for shipping.

- Report ID: 6524

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Bottles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.