Smart Automotive Steering System Market Outlook:

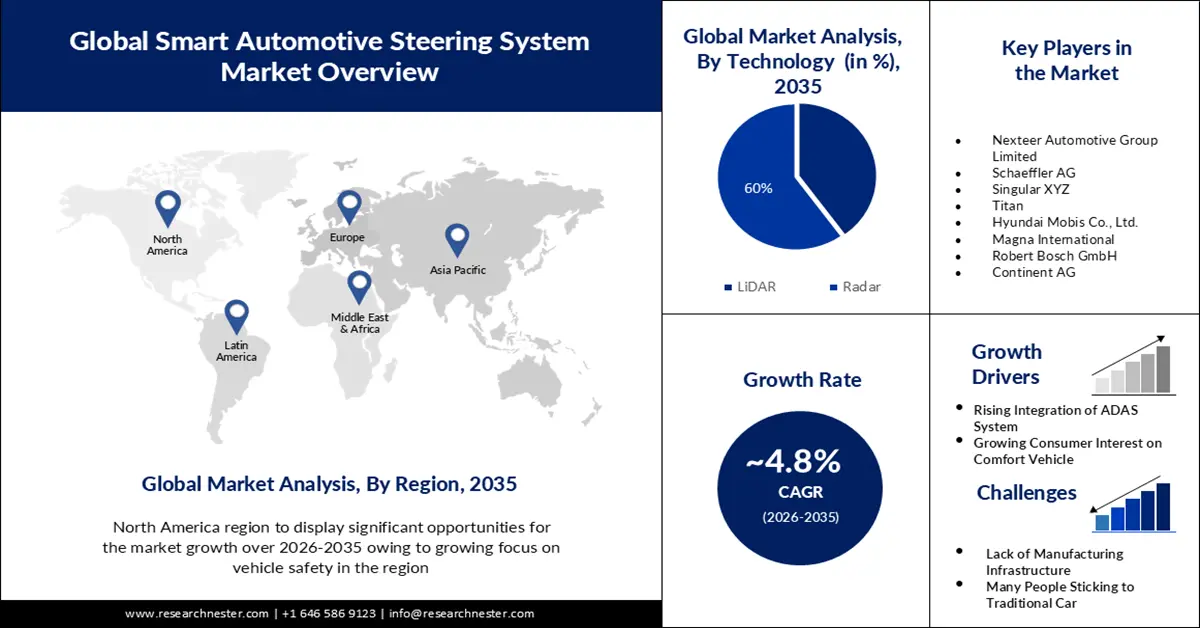

Smart Automotive Steering System Market size was valued at USD 32.98 billion in 2025 and is likely to cross USD 52.71 billion by 2035, registering more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart automotive steering system is assessed at USD 34.4 billion.

The growth of the market can be attributed to the increasing integration of electric power steering (EPS) and electric hydraulic power steering (EHPS) systems. Based on installation volume in vehicle production, the predicted EPS system to be installed in 2035 is more than 99 thousand units by 2035 across the globe. Nexteer, a global steering specialist, has produced more than 70 million EPS systems for over 60 customers worldwide.

In addition to these, factors that are believed to fuel the growth of smart automotive steering system market are expanding the product pipeline of the smart steering system. LeddarTech, a global pioneer in ADAS and AD sensing technology has introduced LeddarSteer, a digital beam steering solution for LiDAR smart sensor makers and first and second-tier automotive suppliers. Additionally, the rising establishment of engineering facilities is also driving market growth. For instance, to support its software-centric product developments, Robert Bosch Engineering and Business Solutions (RBEI) has created a new smart campus at HITEC City in India.

Key Smart Automotive Steering System Market Insights Summary:

Regional Highlights:

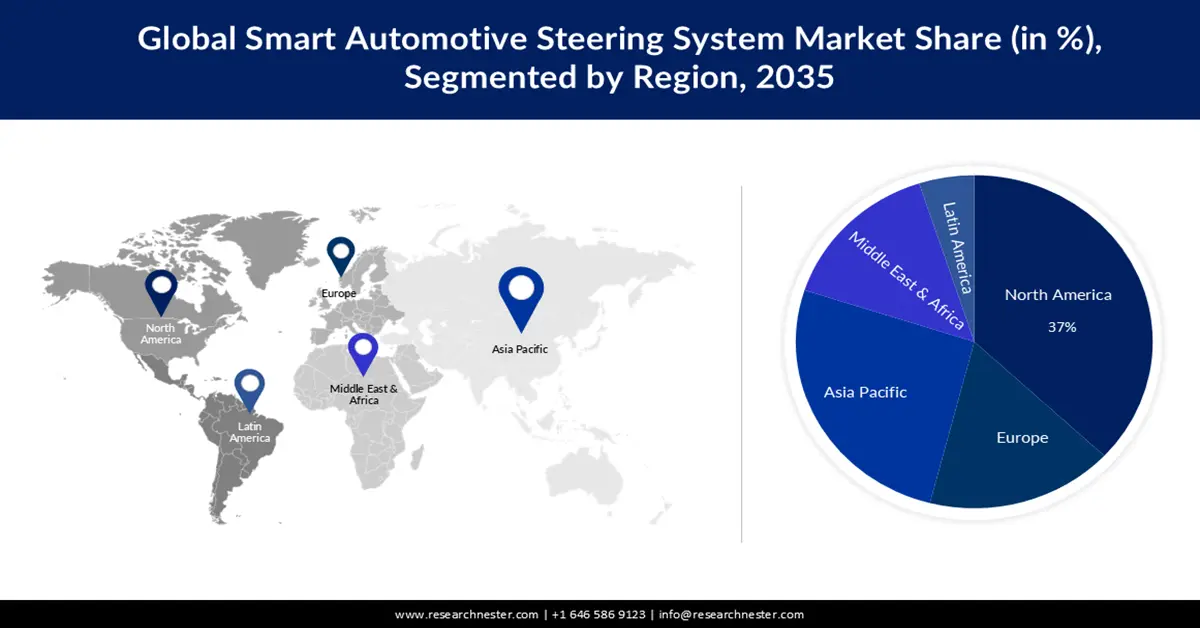

- North America is poised to secure a 37% share by 2035 in the Smart Automotive Steering System Market, underpinned by escalating government regulations that tighten vehicle safety and fuel-efficiency requirements.

- The Asia Pacific region is projected to account for nearly 26% of the market by 2035, propelled by rising vehicle demand and rapid manufacturing expansion.

Segment Insights:

- The radar segment in the Smart Automotive Steering System Market is projected to command about a 60% share by 2035, supported by the growing popularity of smart vehicles integrated with the ADAS radar system.

- The passenger vehicle segment is anticipated to secure nearly a 40% share by 2035, spurred by rising demand for passenger vehicles especially autonomous ones.

Key Growth Trends:

- Growing Integration of ADAS System in the Vehicle

- Rising Focus on Vehicle Safety

Major Challenges:

- Consumer is Still Sticking to Traditional Cars

- Lack of adequate manufacturing infrastructure

Key Players: Titan, Nexteer Automotive Group Limited, Schaeffler AG, Singular XYZ, NSL Ltd., Hyundai Mobis Co., Ltd, Magna International, Robert Bosch GmbH, Continent AG, HELLA GmbH & Co., KgaA.

Global Smart Automotive Steering System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.98 billion

- 2026 Market Size: USD 34.4 billion

- Projected Market Size: USD 52.71 billion by 2035

- Growth Forecasts: 4.8%

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Thailand, Indonesia

Last updated on : 19 November, 2025

Smart Automotive Steering System Market - Growth Drivers and Challenges

Growth Drivers

- Growing Integration of ADAS System in the Vehicle- Since the majority of road accidents are caused by human error, ADAS are designed to automate, evolve, and improve vehicle technology for safety and smarter driving. ADAS has been shown to reduce road fatalities by reducing human error. Currently, the ADAS technology is at Level 2.5 autonomy and heading closer to Level 3, when taking one's eyes off the road allows drivers to function as just another passenger by automating full steering control. Demand for advanced driver assistance systems (ADAS) is at a record-breaking level, as is the necessity for the automotive industry to evolve production and sourcing processes. It takes a lot of effort to develop ADAS technology that will eventually allow for fully autonomous driving.

- Rising Focus on Vehicle Safety- Nowadays, customers in the place a high value on vehicle safety ratings when determining which vehicle to purchase. The rising demand from customers for improved vehicles is going to increase the adoption of more advanced technology not in just luxury models but in standard models as well. Predictive braking systems, cameras, lane departure alerts, and electronic stability control are already standard technologies in today's vehicles. More potential advancements await in the future, numerous of which will be prompted by consumers themselves.

- Growing Interest of Consumer in Future Automotive- The car is losing its clout as a status symbol, but it is gaining clout as a solution based on user experience, which is becoming increasingly reliant on digital elements. Consumers who are automobile enthusiasts have a strong interest in digital technology and everything car-related, as well as a strong involvement in the driving experience. Furthermore, the cautious driver group is highly involved in the driving experience but is too apprehensive about new technologies. In addition to this, around Fifty-three percent of working families with children who exhibit interest in self-driving cars are also automobile enthusiasts.

Challenges

- Consumer is Still Sticking to Traditional Cars – Smart automotive steering systems, desperate for their numerous capability to bring about changes in unprecedented ways. The sector still faces challenges at the consumer end. There is a vast pool of consumers that still want to stick to traditional cars, for multiple reasons. The primary reason is unaffordability, smart driving features are still part of luxury vehicles which is not economical for consumers. Moreover, some enjoy manually driven vehicles and do not want to shift to automatic steering systems.

- Lack of adequate manufacturing infrastructure

- High cost of the integration of a smart automatic steering system

Smart Automotive Steering System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 32.98 billion |

|

Forecast Year Market Size (2035) |

USD 52.71 billion |

|

Regional Scope |

|

Smart Automotive Steering System Market Segmentation:

Technology Segment Analysis

The radar segment in the smart automotive steering system market is estimated to gain the largest revenue share of about 60% in the year 2035. The growth of the segment can be attributed to the growing popularity of smart vehicles especially the one integrated with the ADAS radar system. Today, more than half of all new cars include one or more radar sensors. Furthermore, the affordability of this technology brings a more lucrative opportunity for the segment. These solid-state sensors cost manufacturers less than USD 100 each and are small enough to be hidden around the vehicle. The radars are utilized for running several functions, such as adaptive cruise control, automatic emergency braking, lane keeping, and other advanced driver-assistance operations.

Vehicle Type Segment Analysis

The passenger vehicle segment in the smart automotive steering system market is expected to garner a significant share of around 40% in the year 2035. The growth of the segment is expected on account of rising demand for passenger vehicles especially autonomous ones. Automakers continue to stretch out AV launch dates, while consumer adoption remains stable. According to this scenario, only 4% of new passenger cars delivered in 2030 will be equipped with L3+ AD features, which will further reach 17% in 2035. Moreover, by 2030, around 12 percent of new passenger cars sold will have L3+ autonomous technologies, and nearly 37 percent will have advanced AD technologies by 2035.

Our in-depth analysis of the global market includes the following segments:

|

Vehicle Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Automotive Steering System Market - Regional Analysis

North American Market Insights

North America industry is set to hold largest revenue share of 37% by 2035. The growth of the market can be attributed majorly to the increasing government regulation to ensure the safety of vehicles and fuel-efficient vehicles, which will increase the demand for electric steering systems. The National Highway Traffic Safety Administration (NHTSA) of the United States Department of Transportation has established minimum safety standards for commercial vehicles, including regulations for steering columns. In addition to this, the Environmental Protection Agency (EPA) of the United States establishes minimum emissions criteria for commercial vehicles, which must be maintained by all manufacturers to be marketed in the United States.

APAC Market Insights

The Asia Pacific smart automotive steering system market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The growth of the market can be attributed majorly to the rising demand for vehicles and rapid manufacturing. Last year, India's domestic passenger vehicle market reached an all-time high of about 4 million units, propelling the country to third place in the world, following only the United States and China. Moreover, the yearly passenger vehicle market in India is expected to grow to 6 to 7 million units by FY31.

Smart Automotive Steering System Market Players:

- NSL Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nexteer Automotive Group Limited

- Schaeffler AG

- Singular XYZ

- Titan

- Hyundai Mobis Co., Ltd.

- Magna International

- Robert Bosch GmbH

- Continent AG

- HELLA GmbH & Co. KgaA

Recent Developments

- September 2023: Titan has announced the launch of an innovative electric steering system suitable for everything from commercial vehicles to hypercars for specialized low-volume vehicle makers. The high-tech steer-by-wire system is the outcome of research and development at the company's Cambridgeshire, UK location. Titan, which began manufacturing race vehicles in the 1960s, claims that the new technology was planned, established, and manufactured entirely in-house, with the business holding much of the intellectual property essential.

- April 2023: Nexteer Automotive has unveiled its Modular rack-assisted electric Power Steering (mREPS) system, enhancing the company's low-cost, modular EPS options. Nexteer's mREPS delivers the versatility needed to suit OEMs' diverse requirements for improved steering systems in heavier cars such as EVs and light commercial vehicles. The mREPS from Nexteer also has a full-cylindrical integrated powerpack that delivers superior safety and dependability in small packaging for SAE ADAS Levels 3 to 5.

- Report ID: 1964

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.