Small Signal Transistor Market Outlook:

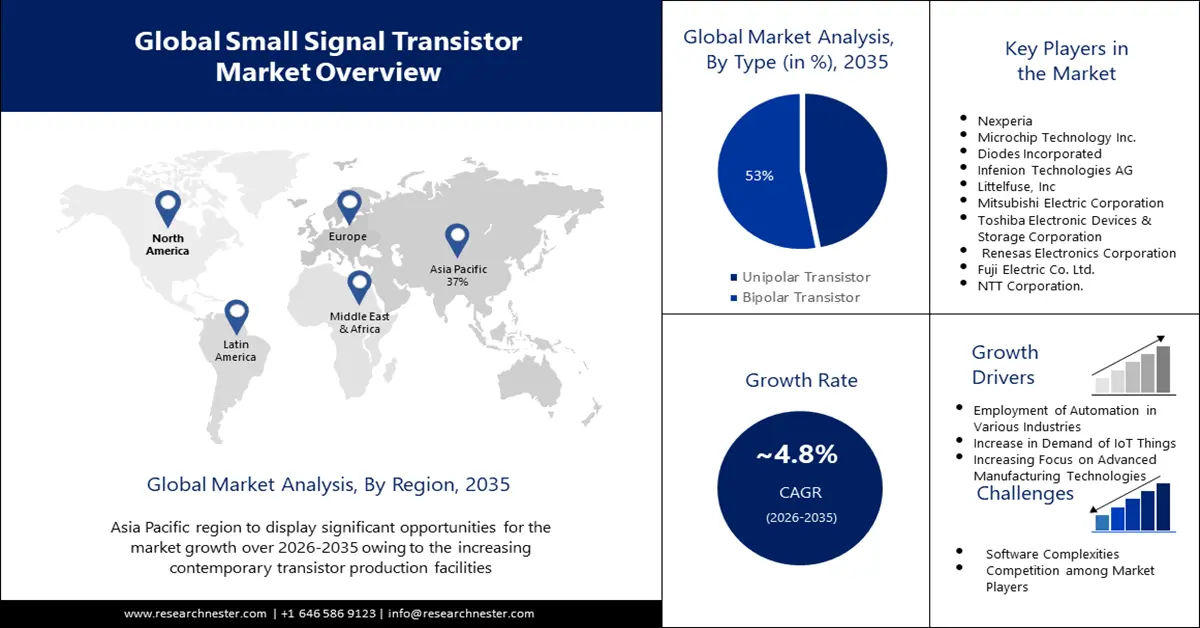

Small Signal Transistor Market size was valued at USD 3.63 billion in 2025 and is expected to reach USD 5.8 billion by 2035, registering around 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of small signal transistor is evaluated at USD 3.79 billion.

Small signal transistor are widely used in customer electronics like smartphones, laptops, and televisions. Thus, the increasing demand for consumer electronics is driving the market growth. Samsung held the largest share of 19.6% of television sets in 2022 in terms of sales volume.

Small signal transistor demand has increased in a number of applications due to the growing demand for energy-efficient electronics. As per a recent report, Taiwan originally planned to use offshore wind energy and solar power to generate 20% of its electricity from renewable sources by 2025.

Key Small Signal Transistor Market Insights Summary:

Regional Highlights:

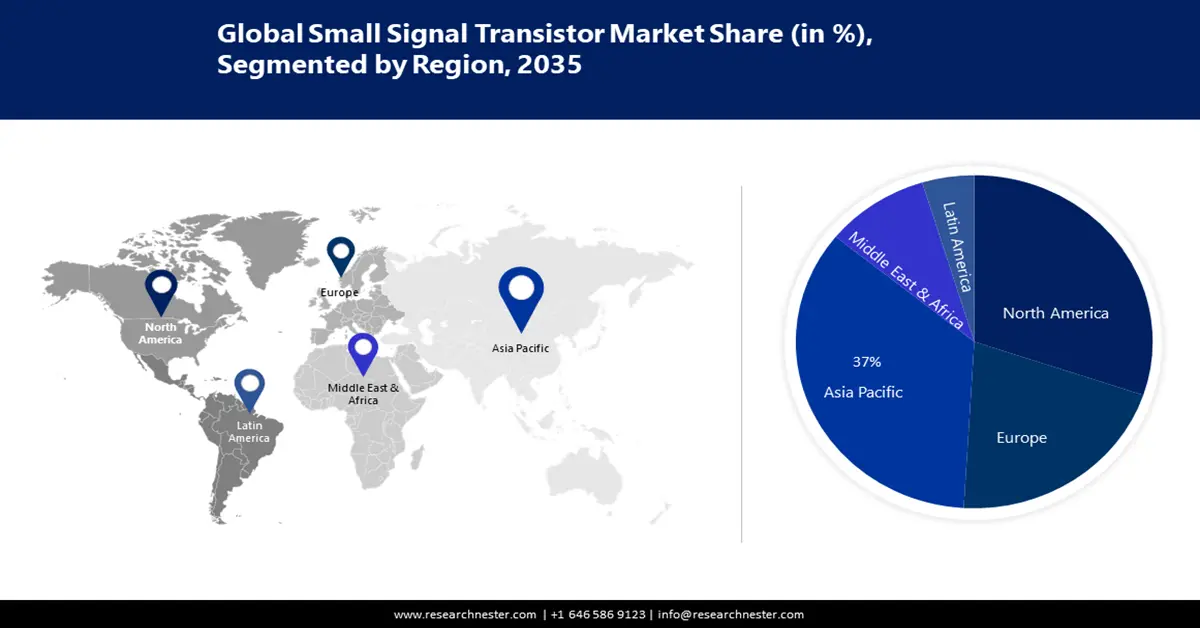

- Asia Pacific small signal transistor market is projected to capture a 37% share by 2035, driven by the presence of advanced transistor production facilities and major suppliers in the region.

- North America market is expected to secure a 23% share by 2035, driven by the presence of key businesses and government investments in the semiconductor sector.

Segment Insights:

- The bipolar transistor segment in the small signal transistor market is forecasted to secure a 53% share by 2035, influenced by increasing electric vehicle production and automotive sector expansion.

- The industrial application segment in the small signal transistor market is projected to capture a 35% share by 2035, attributed to rising automation in OEM and ODM industrial systems.

Key Growth Trends:

- Increasing Focus on Advanced Manufacturing Technologies

- Increase in Demand for IoT Things

Major Challenges:

- Decline in the Sales of Electronic Devices

- Software Complexities

Key Players: NXP Semiconductors N.V., Infineon Technologies AG, ON Semiconductor Corporation, Toshiba Electronic Devices & Storage Corporation, STMicroelectronics N.V., Renesas Electronics Corporation, Diodes Incorporated, Texas Instruments Incorporated, Analog Devices, Inc., Microchip Technology Inc.

Global Small Signal Transistor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.63 billion

- 2026 Market Size: USD 3.79 billion

- Projected Market Size: USD 5.8 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 8 November, 2024

Small Signal Transistor Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Focus on Advanced Manufacturing Technologies - Increasing emphasis on cutting-edge manufacturing technologies like laser and 3D printing. Also, 3D printing is used by 27% of businesses to produce finished consumer goods. Small signal transistor production is predicted to become more effective and high-quality, resulting in quicker turnaround times and reduced prices. This factor is escalating the market growth.

- Employment of Automation in Various Industries- Businesses are automating their production facilities to maintain the highest levels of productivity, cost-effectiveness, product quality, and safety. For instance, South Korea, which has increased its investments in the automation of industrial plants, is one of the key nations that has focused on the extensive adoption of automation in industries. During the projection period, market expansion will be fueled by the rising usage of automation across several industries.

- Increase in Demand for IoT Things – Smart home appliances, wearable technology, and systems for industrial automation have all seen their deployment of linked devices rise as a result of the IoT. These gadgets depend on small signal transistor for accurate and dependable signal transmission. Also, China contributed more than USD 16.5 billion of revenue from smart appliances in 2023.

Challenges

- Decline in the Sales of Electronic Devices – Because of the negative effects of inflation on consumer demand for electronics, sales of smartphones, desktop computers, and tablets have abruptly decreased. Additionally, higher inventories that cost suppliers more money will result in lower sales of electrical products. This will consequently limit market expansion over the timeframe of the forecast.

- Software Complexities

- Competition among Market Players

Small Signal Transistor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 3.63 billion |

|

Forecast Year Market Size (2035) |

USD 5.8 billion |

|

Regional Scope |

|

Small Signal Transistor Market Segmentation:

Type Segment Analysis

The bipolar transistor segment is expected to hold 53% share of the global small signal transistor market during the forecast period. A bipolar transistor is used in the creation of electric vehicles, thus the growing demand for electric vehicles is expected to propel the market growth. Moreover, the recent expansion of the automobile sector has considerably impacted the market. For instance, the International Energy Agency (IEA) forecasts that global sales of electric cars will increase to 6.6 million in 2021, more than doubling those of 2020. With an expected sales volume of slightly under 918,500 light electric vehicles in 2022, the electric vehicle (EV) market in the US set new milestones.

Application Segment Analysis

Small signal transistor market from the industrial segment will account for a revenue share of 35% by 2035. The demand for small signal transistor in the industrial systems used in industrial automation would also increase due to the increasing use of industrial automation by original equipment manufacturers (OEMs) and original design manufacturers (ODMs). In 2020, the value of all automobile original equipment manufacturers worldwide was 1.5 trillion US dollars. Toyota and Denso are two of the biggest OEMs and suppliers in the world, respectively. Thus, this factor is expected to drive the growth of the industrial segment during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small Signal Transistor Market Regional Analysis:

APAC Market Insights

The small signal transistor market in Asia Pacific is expected to hold a share of 37% during the foreseen period. The existence of the most cutting-edge and contemporary transistor production facilities in the region is responsible for the market expansion. Furthermore, developed nations like Taiwan, China, South Korea, and Singapore serve as the market's major suppliers of different transistor, which is accelerating the market growth rapidly. There were 632 import shipments of transistor forming from China, purchased by 54 global buyers from 58 Chinese suppliers.

North American Market Insights

In North America, the market to hold a share of 23% in 2035. Due to the presence of important businesses in the area, the market is expanding. Additionally, throughout the past few years, the US government has made investments in the semiconductor sector. For instance, according to a report, the America Competes Act would spend USD 52 billion in March 2022 to promote goods in the semiconductor industry. This factor is driving the market growth in the region.

Small Signal Transistor Market Players:

- Microchip Technology Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nexperia

- Diodes Incorporated

- Infenion Technologies AG

- Littelfuse, Inc

Recent Developments

- Nine new power bipolar transistor have been introduced by Nexperia, a leader in critical semiconductors, expanding its line of products in the thermally and electrically advantageous DPAK package to cover applications from 2 A to 8 A and from 45 V to 100 V. The new MJD series components provide considerable reliability advantages in addition to being pin-to-pin interoperable with other MJD devices in DPAK package.

- Diodes Incorporated has released a new transistor array. The DIODESTM ULN62003A comprises seven open-drain, 500mA-rated transistor, all of whose sources are wired to the same ground pin.

- Report ID: 5266

- Published Date: Nov 08, 2024

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Small Signal Transistor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.