Small-scale LNG Market Outlook:

Small-scale LNG Market size was over USD 24.24 billion in 2025 and is anticipated to cross USD 53.31 billion by 2035, witnessing more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of small-scale LNG is assessed at USD 26.03 billion.

The global push for cleaner energy has driven up demand for small-scale LNG as it serves as a replacement option for conventional fossil fuels. The rising inclination toward lower carbon emissions from governments and industries supports the increasing use of LNG as a substitute for fossil fuels in shipping vessels, power plants, and various industrial operations. The Marine Fuel Regulation by the International Maritime Organization has encouraged shipping companies to choose LNG as an alternative fuel, attributed to its reduced sulfur emissions compared to standard ocean-based fuels. With this, shipping companies either modernize their current fleet or build new ships that run on LNG due to environmental restriction standards.

Companies are forging key partnerships to build up their LNG infrastructure and supply chain operations due to recent small-scale liquefied natural gas (LNG) market transformations. For instance, in October 2021, OQ joined forces with Marubeni Corporation, Linde, and Dutco to establish a partnership, investigating green ammonia and hydrogen production in Salalah Oman. Technical operators are pursuing this dual-purpose initiative to use LNG as a short-term bridging energy solution on their way to implementing more sustainable fuel alternatives. The LNG market expansion requires direct business-to-business collaboration to create crucial infrastructure systems.

Key Small-scale LNG Market Insights Summary:

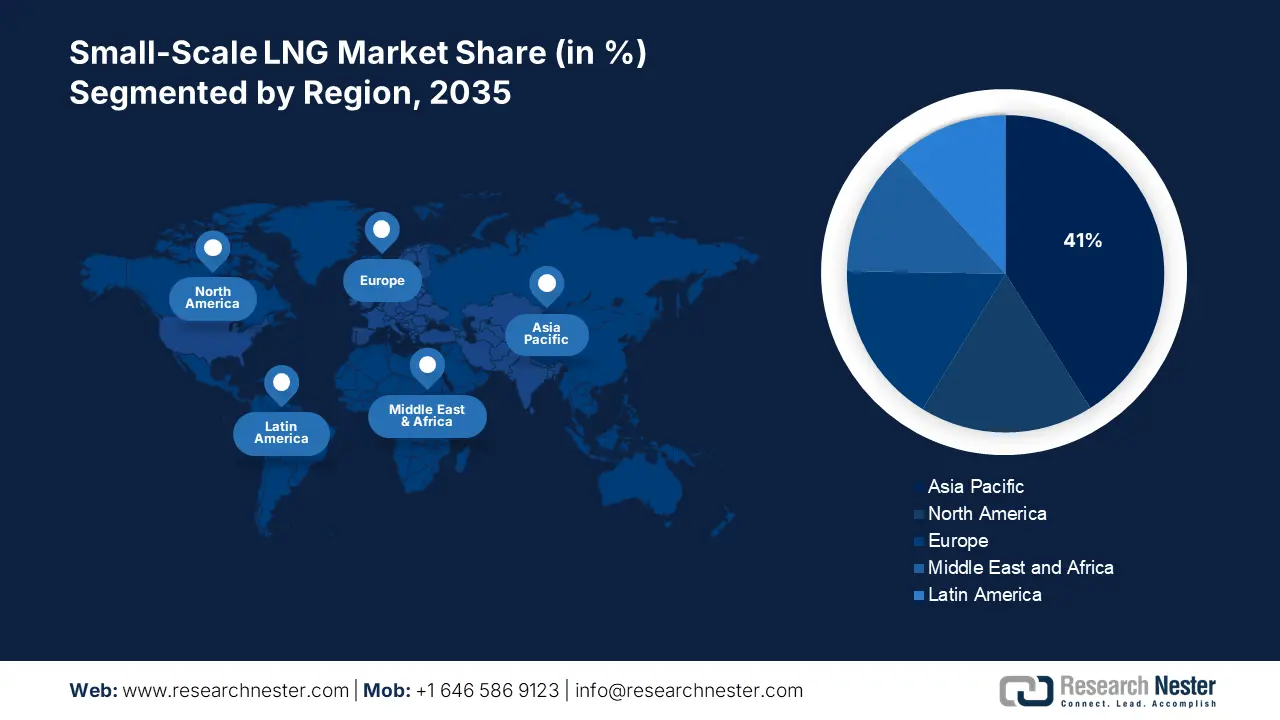

Regional Highlights:

- Asia Pacific leads the Small-scale LNG Market with a 41% share, fueled by low deployment costs and flexible LNG infrastructure supporting energy access in remote areas, positioning it as a key market hub through 2026–2035.

- North America's Small-scale LNG Market is set for rapid expansion by 2035, fueled by vast shale gas reserves and advancements in extraction technologies.

Segment Insights:

- The Liquefaction segment is expected to capture a 64.2% share by 2035, driven by the rapid deployment and scalability of modular liquefaction plants.

- The Heavy-Duty Vehicles segment of the Small-scale LNG Market is expected to experience significant revenue growth from 2026 to 2035, fueled by rising emission reduction requirements and the cost-effectiveness of LNG as a fuel source.

Key Growth Trends:

- Expansion of LNG bunkering infrastructure

- Increasing adoption in remote and off-grid areas

Major Challenges:

- Limited distribution network

- Fluctuations in natural gas prices

- Key Players: Engie, Linde plc, Wärtsilä, Gazprom, and Royal Dutch Shell plc.

Global Small-scale LNG Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.24 billion

- 2026 Market Size: USD 26.03 billion

- Projected Market Size: USD 53.31 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Small-scale LNG Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of LNG bunkering infrastructure: The maritime industry is adopting small-scale LNG, due to increasing LNG bunkering infrastructure around the world. The maritime sector has been witnessing escalated investments in LNG bunkering infrastructure to find alternative marine fuels which meet current emission standards. LNG storage and transfer technologies are undergoing advancements to create more efficient and cost-efficient bunkering operations and reduce fueling procedures duration while improving supply chain stability. Floating storage and regasification units along with dedicated LNG bunker vessels create effective distribution routes for smooth fuel delivery so that multiple vessels can seamlessly shift to using LNG as fuel without any production hindrances.

The current advancements in technology have enabled the creation of automatic systems that control LNG bunkering operations. In November 2023, Endress+Hauser developed a specially designed LNG bunkering solution that performs real-time measurements alongside compound analysis. The automated system increases LNG transfer safety while ensuring high accuracy and operational efficiency through complete monitoring and data visibility. Such automated systems demonstrate industry commitment to innovative improvements in LNG bunkering operations. - Increasing adoption in remote and off-grid areas: Remote and off-grid regions are embracing small-scale liquefied natural gas systems to power industries including mining and supplying electricity to isolated communities that depend on alternative energy distribution rather than pipeline networks. Natural gas delivery to these regions is faster and more economical, due to small-scale LNG operations at below 1 million tons per annum capacities. Using this solution provides locations with a dependable energy supply and delivers cleaner natural gas energy instead of diesel or fossil fuels.

Various small-scale initiatives for LNG solutions have been put into action across remote locations in recent years. The bitcoin mining company MARA Holdings Inc. introduced its pilot project for mining operation power supply in December 2024, through the U.S. shale region natural gas excess. The conversion of natural gas that goes unused through flaring serves dual purposes for MARA: it minimizes environmental damage and creates a model for commercial implementation of small-scale LNG in remote industrial applications.

Challenges

- Limited distribution network: The small-scale LNG market growth can be hampered due to weak distribution network development in the market. The infrastructure network supporting large-scale LNG operations exceeds those built for small-scale LNG operations, as remote and emerging markets lack proper pipelines, refueling stations, and bunkering hubs. The limited efficiency of supply chains leads to high costs and intricate transportation along with storage operations, restricting the sales of LNG to industrial as well as transportation sectors. Inadequate logistics infrastructure investments prevent businesses from easily incorporating small-scale LNG in their energy systems which constrains its widespread spread.

- Fluctuations in natural gas prices: The small-scale LNG market is expected to experience various price stress, as the global natural gas markets remain sensitive to disruptions in supply chains, political conflicts, and seasonal variations in consumer demand. Rising LNG prices make industries along with transportation sectors choose diesel coal and alternative fuel options, therefore, leading to reduced LNG adoption. Price volatility in the small-scale LNG market creates business risks by increasing investor uncertainty and making long-term contracts, along with infrastructure developments more risky to implement. Existing price instability works against market stability, impeding market growth.

Small-scale LNG Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 24.24 billion |

|

Forecast Year Market Size (2035) |

USD 53.31 billion |

|

Regional Scope |

|

Small-scale LNG Market Segmentation:

By Product Type (Liquefaction, Regasification)

In small-scale LNG market, liquefaction segment is set to dominate revenue share of over 64.2% by 2035, as it makes operations more productive and less expensive. Rapid deployment and scalable functionality of modular liquefaction plants can appropriately serve diverse demand levels. New compact liquefaction systems enable remote LNG facility development, so these locations have obtained localized energy solutions. Better technology has been transforming small LNG production economics, leading investors to expand operations in the industry.

Companies have been forming strategic partnerships to combine expertise that generates innovative liquefaction technology advancements. Remodeled liquefaction processes resulted from recent energy industry alliances between power firms and technology companies. The market growth expands through alliances, that work to enhance all steps in the LNG value chain starting from production and continuing through distribution. Joint ventures have been proven vital to address technical difficulties by steering global small-scale LNG market growth through better technologies.

Application (Heavy-Duty Vehicle, Marine Transport, Industrial and Power)

The heavy-duty vehicles segment in small-scale LNG market is expected to register significant revenue during the forecast period, attributed to rising emission reduction requirements from government agencies alongside efficiency requirements from operators. The replacement of diesel fuel through LNG delivers improved sustainability, as it reduces emissions of carbon dioxide together with nitrogen oxides and particulate matter. Heavy-duty fleet operators choose LNG-powered trucks, as the stricter environmental rules exist in pollution-prone areas. LNG provides transportation and logistics operators with cost-effectiveness, as its price stability outranks diesel markets, leading to predictable operational expenditure.

The growth of heavy-duty vehicles get additional support from expanding LNG refueling stations that enable more widespread adoption of LNG-powered trucks. The integration of advanced LNG engine engineering and improved cryogenic storage solutions through technological progress is enhancing performance and encouraging vehicle adoption markets. Multiple factors including supportive regulations and new infrastructure alongside reduced costs are enabling heavy-duty vehicles to adopt LNG as their power source on a global scale.

Our in-depth analysis of the global small-scale LNG market includes the following segments:

|

Product Type |

|

|

Application |

|

|

Mode of Supply |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small-scale LNG Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific small-scale LNG market is likely to capture revenue share of around 41% by the end of 2035, attributed to lower deployment costs for a wide range of geographical locations. The new technologies permit construction of LNG infrastructure in areas that lack standard pipeline networks beyond practical reach. FSRUs along with micro-scale LNG plants continue to develop as key assets for natural gas delivery to remote industrial facilities and rural island populations together with marginal regions. These solutions can be implemented at a fast pace with less requirement for land or financial investments, delivering better LNG access to support regional economic development and secure energy supply in distant areas.

Public support for clean energy through government programs is creating favorable conditions that drive regional investors to develop small-scale LNG projects. National policies allowing LNG consumption as a temporary solution toward carbon footprint reduction are expanding applications of LNG power generation and transportation networks across various sectors. The small-scale liquefied natural gas (LNG) market's expansion receives additional acceleration, due to regulatory frameworks that allow private sectors to increase their involvement in LNG distribution networks. The combination of regulatory support and technological innovations is expected to establish small-scale LNG as a permanent element in the region’s power sector.

The China small-scale LNG market is expected to propel, due to the expansion of decentralized LNG infrastructure. China builds multiple small LNG terminals together with satellite stations and distribution hubs across the country to reach industries and remote locations with insufficient pipeline access. The decentralized energy system protects the country from energy disruptions and helps achieve dual-carbon objectives through reduced dependence on coal. The establishment of micro-LNG plants by companies near end-use locations allows industrial zones and nearby power facilities to change to sustainable fuel options.

Developments in this sector are crucial, as they enable secure continuous delivery of LNG to destinations outside standard pipeline distribution areas. The small-scale liquefied natural gas (LNG) market continues to expand attributed to new strategic alliances combined with ongoing infrastructure development projects. Pavilion Energy Trading & Supply Pte. Ltd. established a term agreement with Zhejiang Hangjiaxin Clean Energy Co. Ltd. in December 2021, for delivering up to 0.5 million tonnes annually of LNG to serve the Jiaxing LNG Terminal in Zhejiang China. The distribution service for LNG started in 2023, expanding distribution capabilities in the region.

The small-scale LNG industry in India is growing rapidly, attributed to rising heavy-duty truck and bus use of LNG as fuel. LNG-powered commercial vehicles by private and public entities have motivated investments that have developed LNG refueling stations along major highways and industrial areas. The Ministry of Road Transport and Highways accepted LNG as a fuel for transportation, as it produces lower emissions and costs less than diesel fuels. The rising number of LNG-powered vehicles is anticipated to drive strong market demand that requires small-scale LNG infrastructure development.

Industrial decarbonization initiatives in India have strengthened the market adoption of small-scale LNG by manufacturing facilities and textile and ceramic producers, as LNG provides them with a pollution-free alternative to coal and furnace oil. Environmentally sensitive industries located outside metropolitan areas are relying on small-scale LNG systems to obtain energy supplies in regions, where natural gas pipelines do not exist. The country sees simultaneous investment growth in small-scale LNG storage facilities together with distribution and liquefaction units due to these driving factors.

North America Market

The North America small-scale LNG market is expected to witness a rapid expansion between 2025 and 2035. The growth is attributed to the excessive shale gas reserves that exist in the country. The advancement of extraction technologies has made it possible to boost natural gas output, creating economical and dependable material for building small-scale LNG facilities. The substantial gas reserves enable the creation of independent LNG production centers that serve communities outside main pipeline areas. Regional expansion of small-scale LNG infrastructure occurs, as the region can access low-cost natural gas supplies easily.

The small-scale liquefied natural gas (LNG) market is also experiencing rapid growth due to the continual enhancements in liquefaction process technology. Scalable modular liquefaction units enable quick deployment, minimizing financial costs while shortening construction duration. The implementation of advanced cryogenic systems together with automation technology in LNG production facilities leads to enhanced operational efficiency, coupled with reduced operational expenses and increased accessibility. New technologies in digital monitoring systems are expected to improve LNG plant reliability alongside predictive maintenance systems, helping reduce operational downtime. The developments made in small-scale LNG technology help industries with power generation, transportation, and remote energy supply to expand their usage of this technology.

The U.S. small-scale LNG market is increasing, owing to newer liquefaction technology developments. Liquefaction equipment designed as custom modular systems reduces deployment costs and speeds up project development timelines. The Plaquemines LNG export plant of Venture Global LNG began its operations in December 2024 in Louisiana. The facility applies modular functionalities, improving the operational speed while cutting down project timelines. Modern technological improvements allow quick reaction to market needs and enable LNG delivery for various usage sectors from power generation to transportation.

The small-scale LNG market expansion exports receives support from the U.S. Department of Energy through regulatory support. The government has been optimizing the small-scale LNG export application approval process, which is motivating the creation of new projects to supply LNG to Caribbean, Central American, and South American markets. Through regulatory support, companies have been gaining the capability to exploit new market opportunities, and adjusting to rising worldwide LNG market needs.

The small-scale LNG market in Canada is expected to experience significant growth, as the country’s natural gas producers have been obtaining extended partnerships that enable them to reach foreign international LNG markets. The company NuVista Energy secured thirteen years of firm sales contracts with Trafigura in November 2024. NuVista is expected to commence supplying 21,000 metric million British thermal units per day of natural gas to Trafigura, starting from January 2027, under the terms where prices are linked to the Japan-Korea Market. The agreement is expected to help NuVista access worldwide LNG market rates, as it enables the development of global small-scale LNG infrastructure systems.

Key Small-scale LNG Market Players:

- Engie

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Linde plc

- Wärtsilä

- Gazprom

- Royal Dutch Shell plc

- Chart Industries, Inc.

- Honeywell International Inc.

- Gasum Oy

- Skangas AS

- Total SE

- Eni S.p.A.

- Stabilis Energy

- Novatek

- Air Products and Chemicals, Inc.

- China National Offshore Oil Corporation (CNOOC)

- Petronas

- Sempra Energy

- ConocoPhillips Company

- BP plc

The competitive landscape of the small-scale LNG market is rapidly evolving, attributed to the integration of advanced technologies in energy management systems by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global small-scale liquefied natural gas (LNG) market:

Recent Developments

- In April 2024, IGX launched contracts for small-scale liquefied natural gas on its platform after it received approval from the Petroleum and Natural Gas Regulatory Board.

- In August 2023, Axpo announced that it signed a ten-year deal to charter an LNG bunkering vessel. The ship is expected to begin operations in 2025 and to make an important contribution to the maritime industry’s green energy transition.

- Report ID: 7217

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Small-scale LNG Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.