Small Molecule Immunomodulators Market Outlook:

Small Molecule Immunomodulators Market size was valued at USD 187.7 billion in 2025 and is likely to cross USD 352.34 billion by 2035, expanding at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of small molecule immunomodulators is assessed at USD 198.68 billion.

The small molecule immunomodulators market is gaining traction owing to the increasing chronic diseases such as rheumatoid arthritis, multiple sclerosis, inflammatory bowel disease, and cancer. For instance, in September 2024, the data published by the National Library of Medicine sourced from the National Multiple Sclerosis Society estimates that over 2.9 million people worldwide and almost a million in the U.S. suffer from multiple sclerosis, which is driving the growing use of immunomodulator therapy. For instance, in January 2022, with incidences ranging from 100 to 300 per 100,000, Western Europe and North America had the highest rates of Crohn's disease, according to a MedlinePlus report. In addition, more than 500,000 Americans had Crohn's disease, and immunomodulator treatments became increasingly necessary.

Furthermore, small molecules are generated owing to great precision in modulation of immune pathways and other advantages including oral bioavailability, cost-effectiveness, as well as scalable production. In addition, clinical trials for the next-generation immunomodulators in oncology and autoimmune diseases also forecast an increase in their therapeutic application. For instance, in February 2025, Positive topline results from the Phase 2 study evaluating itolizumab in the treatment of moderate to severe ulcerative colitis (UC) were announced today by Biocon and Equillium, Inc. Itolizumab demonstrated clinical efficacy with a clinical remission rate of 23.3% following 12 weeks of treatment, compared to 20% for adalimumab and 10% for a placebo. Endoscopic remission, a crucial secondary endpoint, was attained by itolizumab at 16.7%, adalimumab at 16.7%, and placebo at 6.7%.

Key Small Molecule Immunomodulators Market Insights Summary:

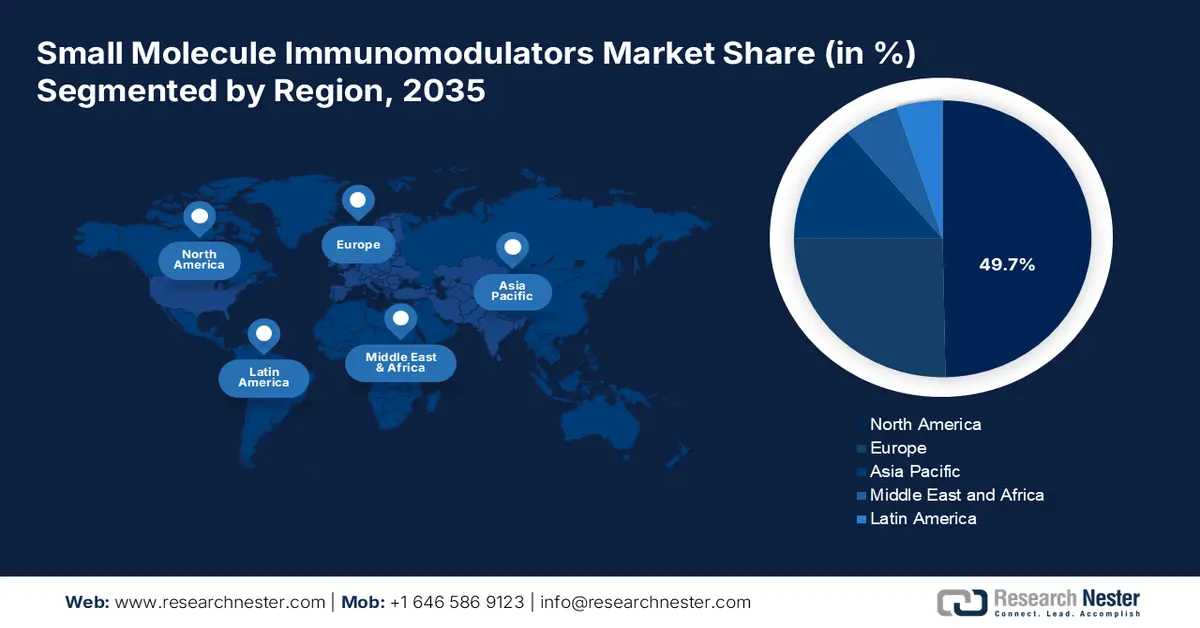

Regional Highlights:

- By 2035, North America is expected to hold over 49.7% share of the small molecule immunomodulators market, bolstered by active partnerships and portfolio‐expansion expertise.

- By 2035, Asia Pacific is set to observe notable market gains, sustained by the rising prominence of outpatient care and rapid recovery through ambulatory surgical clinics.

Segment Insights:

- By 2035, the disposable segment of the small molecule immunomodulators market is projected to secure over 62.5% share, supported by its increased demand for convenient, cost-effective, and safe products.

- By 2035, the orthopedics segment is anticipated to command the leading share, underpinned by the higher prevalence of autoimmune and inflammatory diseases such as rheumatoid arthritis and osteoarthritis.

Key Growth Trends:

- Combination therapy potential

- Strategic portfolio expansion

Major Challenges:

- Intellectual property and patent issues

- High R&D costs and failure risks

Key Players: Cardinal Health, Inc., B. Braun Melsungen AG, Halyard Health, Inc., Smith & Nephew plc, Thermo Fisher Scientific Inc, and more.

Global Small Molecule Immunomodulators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 187.7 billion

- 2026 Market Size: USD 198.68 billion

- Projected Market Size: USD 352.34 billion by 2035

- Growth Forecasts: 6.5%

Key Regional Dynamics:

- Largest Region: North America (49.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 3 December, 2025

Small Molecule Immunomodulators Market - Growth Drivers and Challenges

Growth Drivers

- Combination therapy potential: Increased adoption of combination therapy, which has led to better efficacy of therapy as well as increased treatment alternatives in autoimmune diseases, oncology, and inflammation, are key market drivers for the small molecule immunomodulators market. For instance, in October 2023, the study between NexImmune, Yale University, and JDRF was extended to explore using NexImmune's AIM nanoparticles. This study was conducted in conjunction with anti-CD3 mAb to prevent, eradicate, or substitute diabetes antigen-specific T cells, according to a statement released by NexImmune, Inc. Combination therapies lead to better patient outcomes through minimized resistance potential and wide clinical applications due to synergistic mechanisms.

- Strategic portfolio expansion: The crucial growth driver in the small molecule immunomodulators market is allowing companies to diversify their product portfolios and enhance competitive positioning. The new introduction of immunomodulatory drugs, including specificity to particular pathways of the immune system, can help pharmaceutical firms cater to the expanding range of therapeutic indications thereby improving market shares. For instance, in March 2023, Pfizer Inc. and Seagen Inc. announced that they reached a final merger agreement. Pfizer paid for a total enterprise value of USD 43 billion, to acquire Seagen, a global biotechnology company that finds, develops, and markets revolutionary cancer medications.

Challenges

- Intellectual property and patent issues: Small-molecule immunomodulators market would be plagued by much more issues of intellectual property and patents. With such therapeutics on the horizon of immune-related diseases, this calls for a greater need to protect these proprietary technologies. Patent issues, more so towards scope and patent validity, become major delays in preventing full entry into the market. Hence, creates a brake to innovation, and also increase the development costs. The complications in patent expirations, generic competition, and some potential risks of infringement create a very complicated landscape for competition.

- High R&D costs and failure risks: The expensive research and developments costs coupled with a high level of failure are two main causes of problems which the small molecule immunomodulators market faces. This is very costly because more preclinical or clinical testing should be conducted, thus taking many long years of hard testing before finally establishing its use and safety case. The failure rate in the clinical trial, therefore, can be high in such cases of immune modulation and might result in a loss if not successful financially and delay to bring the product to the market. This financial pressure and the uncertainty about regulatory approvals put companies under a precarious balance between innovation and sustainable investment.

Small Molecule Immunomodulators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 187.7 billion |

|

Forecast Year Market Size (2035) |

USD 352.34 billion |

|

Regional Scope |

|

Small Molecule Immunomodulators Market Segmentation:

Product Segment Analysis

The disposable segment is expected to capture small molecule immunomodulators market share of over 62.5% by 2035, due to its increased demand for convenient, cost-effective, and safe products. For instance, in May 2022, Nemvaleukin alfa injections prevented tumor growth or caused some shrinkage for at least 6 months. It is possible in 4 out of 22 18% in men and women with advanced kidney cancer, according to the most recent international phase 1/2 study, headed by a researcher at NYU Langone Health and its Perlmutter Cancer Center. Researchers discovered that the combination of drugs produced a 10-fold increase in natural killer cells and CD8 T cells, which are highly specialized immune cells known to combat cancer.

Application Segment Analysis

The orthopedics segment is anticipated to dominate the small molecule immunomodulators market by 2035 attributable primarily to the higher prevalence of autoimmune and inflammatory diseases such as rheumatoid arthritis and osteoarthritis. Such immunomodulators are very crucial as they modulate the activity of the immune system and, therefore, prevent inflammation and hindrance to the joint. For instance, in January 2024, Enovis purchased LimaCorporate S.p.A. By adding Lima's tried-and-true surgical techniques and technologies to its portfolio, this calculated move raises Enovis' profile in the international orthopedic reconstruction market by integrating Lima's portfolio, which includes 3D printed Trabecular Titanium implants and a thorough shoulder revision offering.

Our in-depth analysis of the global small molecule immunomodulators market includes the following segments:

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small Molecule Immunomodulators Market - Regional Analysis

North America Market Insights

North America small molecule immunomodulators market is anticipated to capture revenue share of over 49.7% by 2035, fostering partnerships and exchange of portfolios expertise. For instance, in August 2024, Mallinckrodt plc and CVC Capital Partners declared that they had reached a final agreement1 whereby CVC Capital Partners Fund IX will buy the Therakos company for USD 25 million, with the amendment specifying the precise amount of consideration.

The U.S. Small molecule immunomodulators market is likely to unfold remarkable growth opportunities during the projected timeline due to smooth approvals by regulatory bodies. For instance, in January 2024, as per the data revealed by the National Library of Medicine, in 2023, the FDA approved 55 new drugs, which is consistent with the average of 53 approved per year over the preceding five years. As a result, 2023 ranks second in the series for FDA harvests, with 59 approvals, after 2018. Monoclonal antibodies (mAbs) have received an astounding 12 approvals, making this the most notable year for this class of drugs. In 2023, five proteins and enzymes received approval, the same number as in 2022.

The small molecule immunomodulators market in Canada is witnessing significant growth due to improving operational efficiency while preserving high-quality patient care. Furthermore, the future of hospital custom procedure kits is being shaped by data-driven customization and technology improvements. For instance, in February 2025, Ingelheim Boehringer Canada announced that Health Canada approved SPEVIGO, a novel, selective antibody blocks the activation of the immune system's interleukin-36 receptor (IL-36R), a signaling pathway connected to GPP.

Asia Pacific Market Insights

The small molecule immunomodulators market in Asia Pacific is gaining traction and is expected to witness lucrative growth. With the growing emphasize on outpatient care and quick patient recovery, ambulatory surgical clinics are gaining significant attention. As it provides a convenient and affordable substitute for traditional hospital-based surgery. Moreover, customizing kits to meet the specific requirements is becoming more and more popular in the market for small-molecule immunomodulators.

The small molecule immunomodulators market in India is expecting substantial growth due to improved clinical trials. Such efforts are made to maximize effectiveness and resource use in outpatient settings, guaranteeing that ASCs have access to certain tools and materials for a range of operations. For instance, in September 2024, The Indian Council of Medical Research (ICMR) formally signed Memorandums of Agreement (MoAs) with several sponsors under its network for phase 1 clinical trials. These agreements mark the start of first-in-human clinical trials for four promising molecules.

The small molecule immunomodulators market in China is unfolding remarkable growth opportunities owing to the expansion of manufacturing facilities to facilitate their research and development. For instance, in June 2023, to improve its CDMO services, Porton Pharma Solutions Ltd. set up the small molecule platform headquarters in Shanghai which has two separate buildings and is more than 26 acres in size. The building spans 22,000 square meters, houses state-of-the-art labs and synthesis facilities for a variety of compounds.

Small Molecule Immunomodulators Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medline Industries, Inc.

- Teleflex Incorporated

- Boston Scientific Corporation

- BD (Becton, Dickinson, and Company)

- Owens & Minor, Inc.

- Mölnlycke Health Care

- Cardinal Health, Inc.

- B. Braun Melsungen AG

- Halyard Health, Inc.

- Smith & Nephew plc

- Thermo Fisher Scientific Inc.

- Mölnlycke Health Care AB

- Johnson & Johnson Services, Inc.

The small molecule immunomodulators market is revolutionizing as the increasing importance of mergers and acquisitions is the rising trend in firm portfolios for small molecule immunomodulators development. For instance, in December 2022, Eli Lilly and Company and Sosei Group Corporation worked together to identify, create, and market small molecules that alter new G protein-coupled receptor targets linked to diabetes and metabolic disorders. Such strategic alliances allow organizations to enhance their R&D capabilities, introduce new technologies into the business, and better their market positions.

Here's the list of some key players:

Recent Developments

- In February 2024, NeoPhore Limited secured USD 12.2 million from new investors to expand its small molecule drug pipeline and advance drug discovery.

- In August 2023, Johnson & Johnson's Janssen Pharmaceuticals Companies, received FDA approval for TALVEY, a first-in-class bispecific therapy, to treat adult patients with multiple myeloma who have had a lot of previous treatment.

- In June 2022, MilliporeSigma, a Merck KGaA subsidiary, established a USD 65.0 million Highly Potent Active Pharmaceutical Ingredient (HPAPI) manufacturing facility. This acquisition aimed to concentrate on cancer treatments.

- Report ID: 7151

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.