Global Small Hydropower Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- ANDRITZ

- AtkinsRéalis (SNC Lavalin Group)

- Bharat Heavy Electricals Limited

- FLOVEL Energy Private Limited

- General Electric

- Gilkes

- Natel Energy

- Siemens Energy

- TOSHIBA CORPORATION

- Voith GmbH & Co.

- Ongoing Technological Advancements

- Capacity Overview

- Market Share by Component

- Type Overview

- Growth Forecast of Small Hydropower Market By Type

- Patent Analysis

- Component Analysis

- SWOT Analysis

- Analysis of Strategic Initiatives Adopted by Key Players

- Integration Of Advanced Technology

- Global Demand and Supply Analysis of Small

- Hydropower Systems by Sector

- Root Cause Analysis (RCA) For Small Hydropower

- Market

- Recent Developments Analysis

- Porter Five Forces Analysis

- Industry Risk Assessment

- Growth Outlook

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2023-2035, By

- Capacity, Value (USD Million)

- Upto 1 MW

- 1-10 MW

- Component, Value (USD Million)

- Civil Construction

- Power Infrastructure

- Electromechanical Equipment

- Others

- Type, Value (USD Million)

- Pico Hydropower (below 5kW)

- Micro Hydropower (5kW- 100 kW)

- Mini Hydropower (100kW to 1 MW)

- Small Hydropower (1-10 MW)

- End user, Value (USD Million)

- Residential

- Commercial

- Industrial

- Agriculture

- Others

- Capacity, Value (USD Million)

- Regional Synopsis, Value (USD Million), 2023-2035

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035,

- Capacity, Value (USD Million)

- Upto 1 MW

- 1-10 MW

- Component, Value (USD Million)

- Civil Construction

- Power Infrastructure

- Electromechanical Equipment

- Others

- Type, Value (USD Million)

- Pico Hydropower (below 5kW)

- Micro Hydropower (5kW- 100 kW)

- Mini Hydropower (100kW to 1 MW)

- Small Hydropower (1-10 MW)

- End user, Value (USD Million)

- Residential

- Commercial

- Industrial

- Agriculture

- Others

- Country Level Analysis Value (USD Million), 2023-2035

- U.S.

- Canada

- Capacity, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035,

- Capacity, Value (USD Million)

- Upto 1 MW

- 1-10 MW

- Component, Value (USD Million)

- Civil Construction

- Power Infrastructure

- Electromechanical Equipment

- Others

- Type, Value (USD Million)

- Pico Hydropower (below 5kW)

- Micro Hydropower (5kW- 100 kW)

- Mini Hydropower (100kW to 1 MW)

- Small Hydropower (1-10 MW)

- End user, Value (USD Million)

- Residential

- Commercial

- Industrial

- Agriculture

- Others

- Country Level Analysis Value (USD Million), 2023-2035

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Capacity, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035,

- Capacity, Value (USD Million)

- Upto 1 MW

- 1-10 MW

- Component, Value (USD Million)

- Civil Construction

- Power Infrastructure

- Electromechanical Equipment

- Others

- Type, Value (USD Million)

- Pico Hydropower (below 5kW)

- Micro Hydropower (5kW- 100 kW)

- Mini Hydropower (100kW to 1 MW)

- Small Hydropower (1-10 MW)

- End user, Value (USD Million)

- Residential

- Commercial

- Industrial

- Agriculture

- Others

- Country Level Analysis Value (USD Million), 2023-2035

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Capacity, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035,

- Capacity, Value (USD Million)

- Upto 1 MW

- 1-10 MW

- Component, Value (USD Million)

- Civil Construction

- Power Infrastructure

- Electromechanical Equipment

- Others

- Type, Value (USD Million)

- Pico Hydropower (below 5kW)

- Micro Hydropower (5kW- 100 kW)

- Mini Hydropower (100kW to 1 MW)

- Small Hydropower (1-10 MW)

- End user, Value (USD Million)

- Residential

- Commercial

- Industrial

- Agriculture

- Others

- Country Level Analysis Value (USD Million), 2023-2035

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Capacity, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2023-2035

- Increment $ Opportunity Assessment, 2023-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2023-2035,

- Capacity, Value (USD Million)

- Upto 1 MW

- 1-10 MW

- Component, Value (USD Million)

- Civil Construction

- Power Infrastructure

- Electromechanical Equipment

- Others

- Type, Value (USD Million)

- Pico Hydropower (below 5kW)

- Micro Hydropower (5kW- 100 kW)

- Mini Hydropower (100kW to 1 MW)

- Small Hydropower (1-10 MW)

- End user, Value (USD Million)

- Residential

- Commercial

- Industrial

- Agriculture

- Others

- Capacity, Value (USD Million)

- Country Level Analysis Value (USD Million), 2023-2035

- Saudi Arabia

- UAE

- Oman

- South Africa

- Morocco

- Tunisia

- Algeria

- Rest of Middle East & Africa

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

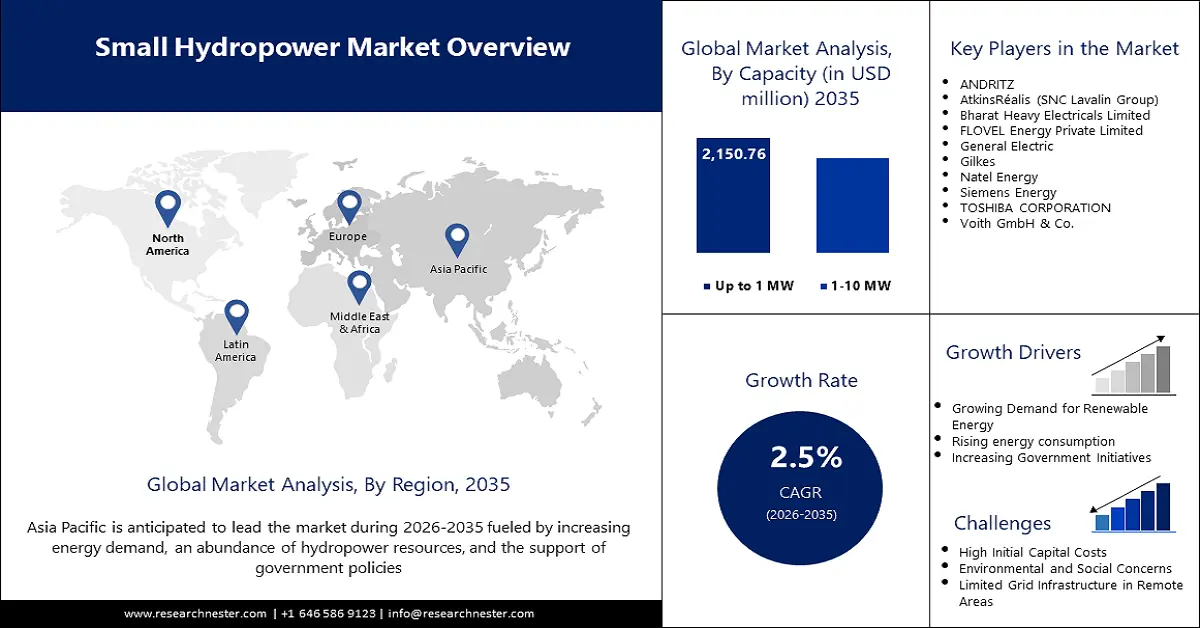

Small Hydropower Market Outlook:

Small Hydropower Market size was over USD 3.06 billion in 2025 and is poised to exceed USD 3.92 billion by 2035, witnessing over 2.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of small hydropower is estimated at USD 3.13 billion.

The small hydropower market is expanding at a stable rate as countries try to increase the share of renewable energy sources in their electric power generation mixes and improve rural electrification. Small hydropower systems generally refer to those systems that do not exceed 10 MW, and are well suited for the countries that are endowed with adequate water supplies. To increase their net-zero targets and bolster energy security, governments, and private sectors are turning to small hydropower adoption. In March 2024, two projects were inaugurated in Nigeria by the European Union in the energy sector, including a small hydropower project launched under a USD 9.49 million contract aimed at helping Nigeria switch to green energy.

Another factor that is proving influential in small hydropower market is technology which is making the process more efficient and cutting costs at the same time. In April 2023, Shizen Energy of Japan commissioned a 2.2 MW Pelton turbine to the Kuroda Hydroelectric Power Plant in cooperation with GUGLER. This was the first megawatt-class turbine installation in Japan for GUGLER, and showed how innovation played a crucial part in increasing the power of hydropower. The given developments have pointed out the significance of partnership and technology in the improvement of small hydropower plants internationally.

Key Small Hydropower Market Insights Summary:

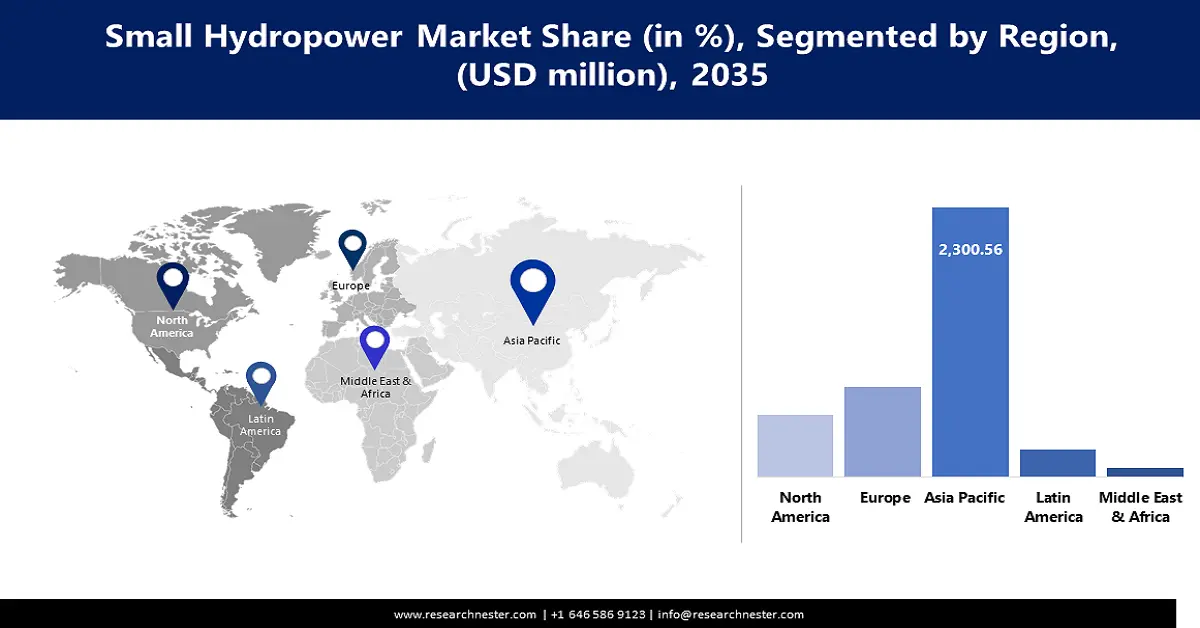

Regional Highlights:

- Asia Pacific small hydropower market is projected to account for 34% share by 2035, owing to the shift towards sustainable growth to foster economic development.

- North America small hydropower market is expected to experience substantial growth by 2035, propelled by the modernization of infrastructure and investments in renewable energy.

Segment Insights:

- The electromechanical equipment segment in the small hydropower market is projected to achieve a 38.20% share by 2035, attributed to its significance in power generation within the hydropower system.

- The 1–10 mw segment in the small hydropower market is expected to experience substantial growth during 2026-2035, driven by the rising need for mid-reach renewable power.

Key Growth Trends:

- Government initiatives and funding support

- Rural electrification and decentralized energy solutions

Major Challenges:

- Environmental and ecosystem concerns

- Complex regulatory and permitting processes

Key Players: ANDRITZ, AtkinsRéalis (SNC Lavalin Group), Bharat Heavy Electricals Limited, FLOVEL Energy Private Limited, General Electric, Gilkes, Natel Energy, Siemens Energy, TOSHIBA CORPORATION, Voith GmbH & Co.

Global Small Hydropower Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.06 billion

- 2026 Market Size: USD 3.13 billion

- Projected Market Size: USD 3.92 billion by 2035

- Growth Forecasts: 2.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Small Hydropower Market Growth Drivers and Challenges:

Growth Drivers

- Government initiatives and funding support: Global governments are increasingly directing efforts towards the development of renewable energy sources, with small hydropower being prominent. In January 2024, the United State Department of Agriculture (USDA) released USD 16.6 million for a 3MW hydro unit on the Kentucky River, indicating a rising capital outlay for sustainable rural electricity. These initiatives encourage the creation of power from within the region, thus making less use of fossil-based products for the community as well as the environment in the long run. Additional government incentives and tax credits also provide additional stimuli for the private sector of hydropower development. This support is important in the case of enhancing the level of deployment of small-scale hydro projects in unserved areas.

- Rural electrification and decentralized energy solutions: Small hydropower projects are vital sources of electricity to areas that are hard to reach or where access to electricity supply is limited. In November 2024, the government of Kyrgyzstan provided USD 2.47 million to implement small hydropower stations in Salam-Alik and Sary-Bee villages to improve energy supply in rural areas. They are evidence that decentralized energy systems are essential for enhancing economic growth and the standard of living. Small hydropower plants are a reliable and virtually maintenance-free solution to energy gaps in remote and isolated societies. This localized approach strengthens energy resilience and cuts the need for expensive investments in infrastructure.

- Growing emphasis on carbon reduction: The global drive for carbonless power generation is increasing the growth of small hydropower as a low-emission power source. In September 2024, USDA provided USD 72 million for renewable energy comprising four hydro plants in rural Kentucky. It supports the international trend towards decarbonization of the economy and re-establishes hydropower as a key tool for reducing emissions in the energy sector. Whereas hydroelectric power can provide firm-capacity energy in a way that other renewable resources, such as wind and solar cannot. As climate targets become more stringent, small hydropower remains a rapidly emerging imperative in the development of more sustainable energy systems.

Challenges

- Environmental and ecosystem concerns: Small hydropower projects have the advantage of providing renewable energy, but at the same time, they affect the local aquatic environment by changing the river flow and influencing fish distribution. Minor changes in river systems result in the loss of habitats and reduced biodiversity, a factor that has alarmed environmental conservationists and residents. Meeting energy needs and conserving biodiversity is one of the key issues facing developers attempting to undertake renewable energy development. The achievement of this balance quite often involves expensive compensatory measures such as fish ladders or altered flow designs that influence project economics.

- Complex regulatory and permitting processes: Regulations and permits remain one of the biggest challenges that small hydropower plant developers have to face. The government has set various measures, such as environmental impact assessment and public hearings, that often take a couple of years of a project’s timeline. There are multiple levels of regulation, local, regional, and national, and obtaining approvals lengthens the project cycle and increases costs. The issues of legal compliance in developing projects require developers to interact with several authorities, such as the government, social members, and environmental organizations.

Small Hydropower Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.5% |

|

Base Year Market Size (2025) |

USD 3.06 billion |

|

Forecast Year Market Size (2035) |

USD 3.92 billion |

|

Regional Scope |

|

Small Hydropower Market Segmentation:

Capacity Segment Analysis

The 1-10 MW segment in the small hydropower market is poised to exhibit substantial CAGR till 2035, due to the rising need for mid-reach renewable power. These systems are suitable for regional grids, the extension of electricity to rural areas, and industrial use because they do not require many installations. For example, Meghalaya successfully commissioned the 7.5 MW Ganol Hydro Project in January 2023 and demonstrated that mid-range capacities can ensure local energy self-sufficiency. They help in mitigating grid stress situations and integrating more diverse sources of electricity in the development parts of the world. Realization of the scale and cost-of-capital constraints in scaling hydropower requires careful consideration of this segment’s growth.

Component Segment Analysis

The electromechanical equipment segment is likely to dominate small hydropower market share of over 38.2% by 2035, due to its significance in the generation of power in the system. Sophisticated turbines, generators, and controls are necessary to enhance the efficiency of the hydropower plant and the plant’s durability. In April 2024, Voith Hydro acquired modern equipment that would be used in the production of parts that are used to build hydropower plants to show its strategic direction towards modernization. The emphasis on the modernization of equipment correlates with the tendencies observed worldwide regarding improving the performance of plants and their emissions. The increasing requirement for effective hydropower solutions is anticipated to increase investments in the electromechanical segment globally.

Our in-depth analysis of the global small hydropower market includes the following segments:

|

Capacity |

|

|

Component |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small Hydropower Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific small hydropower market share is poised to reach 34% by 2035, with factors like growing investments in renewable energy and a need for small hydropower. The region is moving quickly to clean energy to reduce carbon emissions and play a part in the overall decarbonization process. Small hydropower is gradually presenting itself as a key solution to the difficulties of rural electrification and power supply scarcity. This increase is due to the shift in the region to employ sustainable growth as a way to foster economic growth.

India plays a pivotal role in the small hydropower market in Asia Pacific. As per a report, the total installed capacity of small hydropower in India was 5003.25 MW in March 2024. In the fiscal year 2023-24, all these small hydropower plants together generated 9,485.04 million units (MUs) of electricity. These installations are equally important for improving rural electrification as well as supplying stable energy to the unserved regions. The strategic vision of the National Electricity Plan to diversify and reduce reliance on fossil fuels in India also plans to increase the hydropower capacity.

Hydropower development is witnessing rapid advancements in China due to large-scale investment and policies. In May 2024, the National Development and Reform Commission (NDRC) endorsed the construction of a hydropower plant in the Xizang autonomous region that will cost USD 8.43 billion. The plant is expected to produce more than 11, 280 GWh of electricity per year according to the power output of each plant. This project shows China’s efforts to increase renewable energy plants, secure energy sources, and control greenhouse gas emissions. Hydropower continues to be an important part of the country’s renewable energy mix and strengthens its position in the global small hydropower market.

North America Market Insights

North America small hydropower market size is expected to register substantial growth till 2035, primarily due to the rising number of investments going into renewable energy and the modernization of infrastructure in the region. The strategy of carbon emission decrease and improvement of the stability of grid has stimulated the development of the small hydropower market in the region. Small hydropower has been identified as vital in the development of additional power sources, especially in rural areas that cannot support the big power plants. This consistent increase underlines the need to preserve sustainable energy to support North America future climate targets.

The U.S. is one of the leading countries in North America small hydropower market, with its total number of hydropower plants being 2,252 and the total installed capacity of hydropower plants being 80.58 GW in 2024. While evaluating the hydropower position in the overall renewable energy generation mix in 2022, the hydropower share of renewable electricity generation was at 28.7 percent, which is significant. To sustain this output, the modernization of existing facilities and the construction of small hydropower plants are crucial. Furthermore, the increase in the generation of small hydropower will additionally contribute to more electrification of rural areas and enhance energy security.

Hydropower further remains a dominant source of renewable energy in Canada in its continued bid to shift to green energy sources. In April 2024, Ontario Power Generation (OPG) signed a memorandum to invest in the modernization of five hydropower plants in the Niagara area during the next fifteen years with the help of GE Vernova. This initiative shows Canada approach to bringing new life to aging structures to increase productivity and production. These upgrades shall enhance the stability of the grids and decrease emissions, further enhancing the country’s position as a leader in sustainable energy development. Hydropower is central to Canada’s plan for achieving the goals of reducing emissions and extending power to isolated regions.

Small Hydropower Market Players:

- ANDRITZ

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AtkinsRéalis (SNC Lavalin Group)

- Bharat Heavy Electricals Limited

- FLOVEL Energy Private Limited

- General Electric

- Gilkes

- Natel Energy

- Siemens Energy

- TOSHIBA CORPORATION

- Voith GmbH & Co.

The small hydropower market is relatively fragmented, with key companies aiming at technology development and M&A strategies. The market is highly concentrated, with Voith GmbH, ANDRITZ, and Siemens Energy being the key players in the small hydropower market that offer turbines or control systems. In April 2023, Shizen Energy partnered with GUGLER to set up a 2.2 MW Pelton turbine in the Kuroda Hydroelectric Power Plant in Japan, first introducing a megawatt-class turbine in its country. This is a significant achievement for the plant as it enhances Japan renewable power capacity to show the country’s dedication to investing in more green energy. The collaboration demonstrates the production competition in the small hydropower market and the pressure companies experience as they seek to use the latest technologies to meet society’s increasing energy needs.

Here are some leading companies in the small hydropower market:

Recent Developments

- In September 2024, ENERGO-PRO, a leading hydropower investor, finalized an agreement to acquire seven small hydropower facilities in Brazil. This acquisition expands ENERGO-PRO’s renewable energy portfolio, reinforcing its commitment to sustainable energy growth and increasing its footprint in the Latin American hydropower market.

- In August 2024, Tata Power and Druk Green Power Corporation (DGPC) partnered to develop the 600 MW Khorlochhu Hydropower facility. DGPC holds a 60% equity stake, while Tata Power owns 40%. This initiative aims to enhance regional energy security and aligns with Tata Power’s broader vision of promoting renewable energy solutions to support a greener future.

- In April 2024, Downing partnered with HYDROGRID to optimize the operation of its 32 hydropower plants in Sweden. The collaboration integrates advanced technology to enhance performance and automation across Downing’s hydropower portfolio. The initiative, starting in September 2024, will implement inflow integration and cascade optimization to improve efficiency.

- Report ID: 3683

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Small Hydropower Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.