Small Drone Market Outlook:

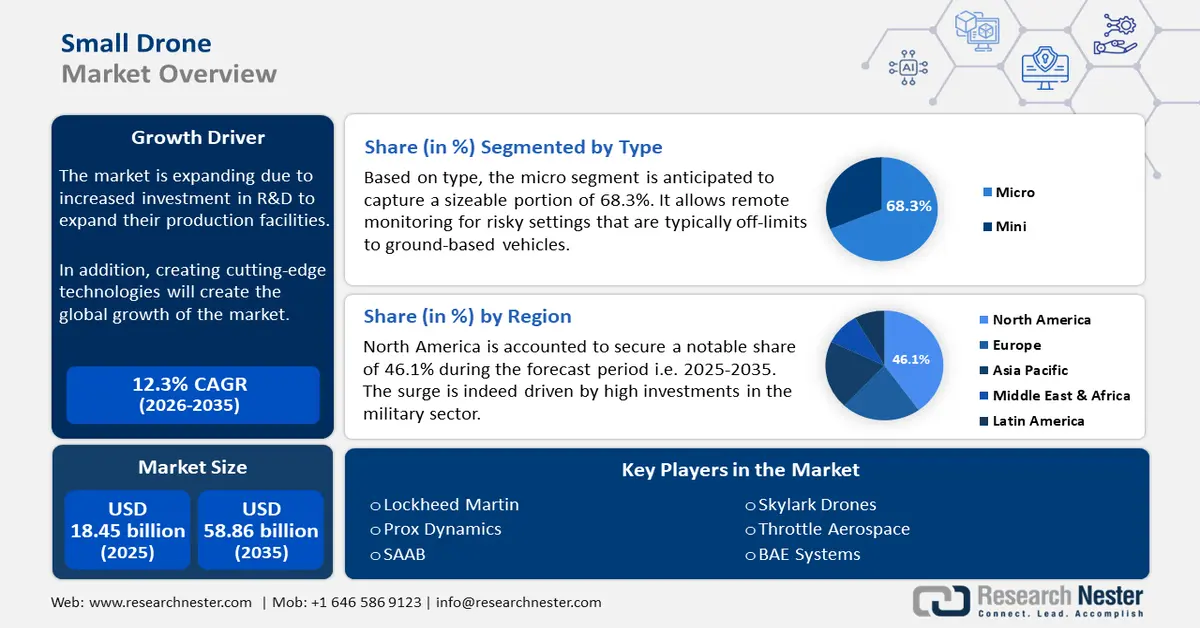

Small Drone Market size was over USD 18.45 billion in 2025 and is poised to exceed USD 58.86 billion by 2035, witnessing over 12.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of small drone is evaluated at USD 20.49 billion.

The market's revenue is highly sourced from the defense sector as governments are increasingly using small drone in surveillance and tactical operations. Moreover, innovations in sensors, communication systems, and AI-powered autonomous features rank among the most critical contributors to this surge in small drone market growth.

Investments are an imperative strategy to increase the tactical autonomous fleets of the drone services. For example, in July 2024, Canberra signed contracts equivalent to USD 67.6 million to provide the army and air force with small unmanned aerial systems (sUAS). This resulted in protecting the safety of warfighters and improving their capacity for multiple-payload logistics, surveillance, and reconnaissance in land, littoral, small marine craft, and urban operations. Thus, leveraging heavy investments to widen the small drone market size and increase operational compatibilities stimulates growth in the market.

The regulatory evolution by several unions across different regions acts as a catalyst for stimulation of the market expansion. Furthermore, when integrating drones into their airspace, safety and privacy remain the primary concern. For instance, in June 2024, the Defense Minister of France signed a UAV pact. It was aimed at developing a strategic unmanned capacity under 150 kg while also fostering innovation between the military and the country's drone industry. Such factors are also projected to boost the small drone market growth in the upcoming years.

Key Small Drone Market Insights Summary:

Regional Highlights:

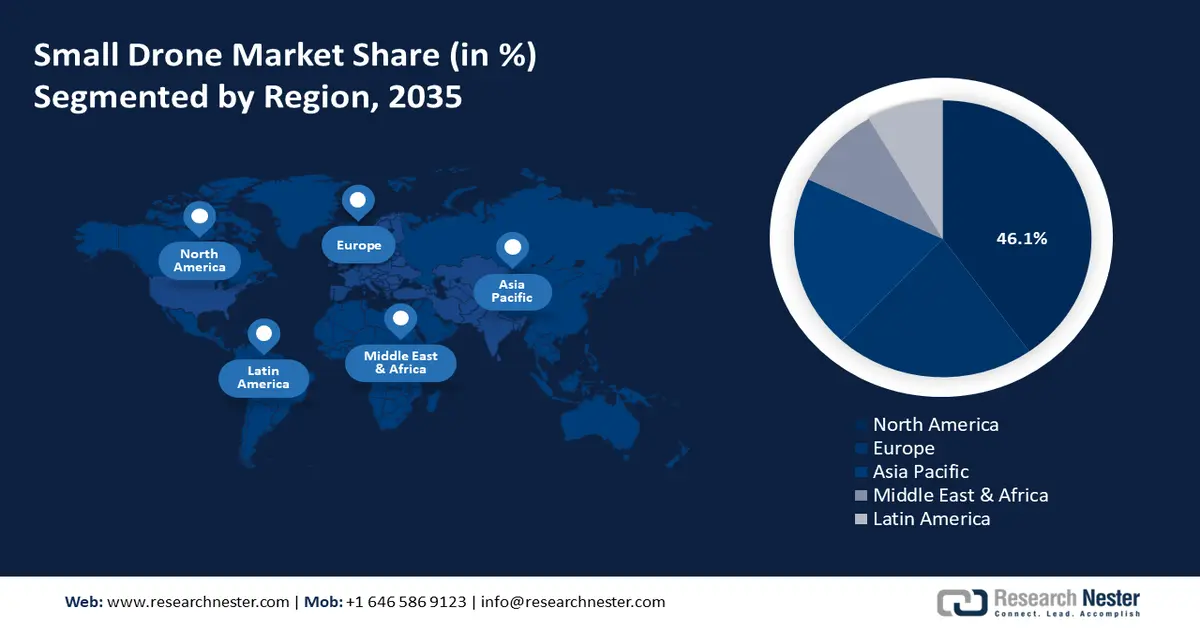

- North America's 46.1% share dominates the Small Drone Market, propelled by high technology infrastructure, advanced defense sectors, and industrialization, driving robust growth through 2026–2035.

Segment Insights:

- The Micro segment is projected to hold a 68.3% share from 2026-2035, driven by its versatility, compact size, and wide defense and commercial applications.

Key Growth Trends:

- Technological advancement

- Increased military applications

Major Challenges:

- High initial costs and skill requirements

- Risk of collisions and air traffic management

- Key Players: Throttle Aerospace, Hindustan Aeronautics Limited, Prox Dynamics, Crystal Balls, Elbit Systems Ltd..

Global Small Drone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.45 billion

- 2026 Market Size: USD 20.49 billion

- Projected Market Size: USD 58.86 billion by 2035

- Growth Forecasts: 12.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 14 August, 2025

Small Drone Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancement: The small drone market is expanding owing to the state-of-the-art innovations in its capabilities and applications. For instance, in August 2024, EndureAir in collaboration with the team at IIT Kanpur, developed a UAV technology using state-of-the-art research. The newest addition is the Sabal, a UAV with heli-drone technology that is intended for the middle-mile market. Technologies incorporating artificial intelligence and machine learning have provided larger autonomics in offering more independence. Thus, enabling small drone to function without human interference to evade obstacles and optimize routes.

-

Increased military applications: Defense forces across the globe increasingly incorporate drones into critical operations. Additionally, by merging autonomous navigation, AI-based analytics, and communication systems, their efficiency has improved in target acquisition and border patrol operations. For instance, in October 2024, India and the US signed an agreement worth USD 345 billion to purchase MQ9B drones for the military. Thirty-one of the long-range drones will be acquired by the Indian armed forces and divided among the army, air force, and navy as part of a government-to-government agreement.

Challenges

-

High initial costs and skill requirements: The sophisticated UAV systems, with their sensing paradigm that combines AI capabilities and long-lasting batteries, might be too expensive. These high-tech drones also need specific operating skills and training, together with awareness of regulatory compliance and airspace management. Thus, these would restrict the adoption of small drone, particularly in areas intending the cost-to-benefit ratio has to be watched carefully, and the overall small drone market growth would be slowed.

-

Risk of collisions and air traffic management: The significant obstacles in the small drone market include concerns over the growth of drones in the commercial and recreational sectors. It also stems from the absence of standardized systems for drone flight paths and distance coordination in air traffic management. Thus, the threat of mid-air collision in densely populated areas or highly trafficked areas also emerges. For instance, in October 2024, a sophisticated Russian S-70 Okhotnik stealth drone was shot down, over Kostiantynivka, in the Donetsk region of Ukraine.

Small Drone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 18.45 billion |

|

Forecast Year Market Size (2035) |

USD 58.86 billion |

|

Regional Scope |

|

Small Drone Market Segmentation:

Type (Micro, Mini)

Micro segment is projected to capture small drone market share of around 68.3% by the end of 2035, owing to its versatility, cost-effectiveness, and wide applications. It is highly preferred due to its small size. Its defense application includes close-range ISR missions where the data would be available in real-time tactical operations. For instance, in August 2021, Aeronautics created the small unmanned aerial vehicle (UAV), Orbiter for use in homeland security and military applications. The Orbiter UAV is capable of close-quarters intelligence, surveillance, and reconnaissance (ISR) missions, low-intensity engagements, urban warfare, and over-the-hill reconnaissance missions.

Application (Civil Commercial, Military Defense, Others)

The civil commercial segment is projected to account for a significant share of the small drone market. The potential sectors for utilization of UAV applications are surveying mapping and inspection to save considerable time and expense over traditional methods. For example, in September 2023, Teledyne Flir unveiled a technology that allowed multiple drones to be launched and recovered autonomously from military vehicles. Its 'Black Recon' system includes a small, agile micro-drone that can fly for up to 45 minutes and weighs only 350 grams. Additionally, with increased demand from the media and entertainment industries for aerial photography and videography, the scope of segment expansion is marked by an increase in the use of such capabilities.

Our in-depth analysis of the global small drone market includes the following segments:

|

Type |

|

|

Application |

|

|

Platform |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small Drone Market Regional Analysis:

North America Market Statistics

North America industry is estimated to account for largest revenue share of 46.1% by 2035, due to high technology infrastructure, advanced defense sectors, and industrialization of various industries. Furthermore, the strong presence of aerospace giants such as Textron and Northrop Grumman, drone manufacturers such as FLIR Systems and DJI, and startups such as Skydio and Airmap are shaping the future of the region. Thus, altogether boosting innovation and continuous growth in the small drone market.

The U.S. has long been one of the world’s leading innovators, allowing it to rapidly adopt emerging technology to strengthen U.S. national defense. It has made the maintenance of air superiority a major priority and thus favors strategic investments to expand the growth. For instance, in May 2024, Boeing Co. committed USD 240 million toward an aerospace cluster located in the Montreal area. As the cornerstone of a provincial plan to establish Quebec as a global hub for the development of drones and environmentally friendly aircraft.

Canada strives to ensure the safety and security of its citizens as well as its international allies and partners. It involves purchasing cutting-edge military equipment to create a strong base. The government of Canada, in December 2023, committed USD 2.49 billion towards acquiring the capability of a remotely piloted aircraft system (RPAS). With certain components obtained through a Foreign Military Sale with the US government, the acquisition was accomplished through a direct commercial sale contract with General Atomics Aeronautical Systems, Inc.

Asia Pacific Market Analysis

The pro-UAV integration initiatives from the government side and favorable regulations complement each other. The region's rapidly growing tech ecosystem, along with rising demand for aerial surveillance is also one of the significant reasons for positioning it as an emerging region in the market. Overall, the small drone market will continue to grow steadily forward in a tremendous way, owing to technology being adapted. Furthermore, emerging trends clubbed with the realization of its increased functionalities will inculcate pioneering spirit amongst the market players.

The developing economy clubbed with government initiatives supports the expansion of the small drone market in India. For instance, in August 2024, it was announced that National Aerospace Laboratories (NAL) had undergone revolutionary development and transformed the defense arsenal. It introduced a fully indigenous kamikaze drone each approximately 2.8 meters in length with a wingspan of 3.5 meters and weight around 120 kilograms. Furthermore, it is equipped with exceptional capabilities to strike enemy targets with precision.

China has a strong research and development base within the country that relentlessly strives towards groundbreaking innovations and advancements. For instance, in July 2024, a revolutionary drone technology breakthrough was revealed. At Beihang University, the CoulombFly drone was created by a team of eminent researchers, having a wingspan of only 20 centimeters, and weight only 4.21 grams. They have created the tiniest and lightest solar-powered drone in the world, which is an engineering marvel that has the potential to completely change the industry.

Key Small Drone Market Players:

- AeroVironment Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DJI

- Elbit Systems Ltd.

- Prox Dynamics

- Israel Aerospace Industries Ltd.

- SAAB

- Hindustan Aeronautics Limited

- Throttle Aerospace

- Redwing Labs

- Crystal Ball

The companies heavily invest in developing their UAV capabilities. In addition, emerging startups also play a vital role by driving innovation in niche markets. Overall, strategic partnerships and collaborations in the industry further boost the growth of the overall ecosystem of small drone technologies. For instance, in May 2024, Airbus purchased the Aerovel, a UAS based in the U.S., along with its Flexrotor module. It is a small tactical unmanned aerial system used in maritime and terrestrial intelligence, surveillance, target acquisition, and reconnaissance (ISTAR) operations.

Major contributors are:

Recent Developments

- In September 2024, SAN LEANDRO, a pioneer in small drone, announced the arrival of Trace, a new nano drone. It is designed to satisfy the critical demands of infrastructure management, law enforcement, and national security.

- In July 2024, a memorandum of understanding (MOU) was signed between GE Aerospace and Kratos Turbine Technologies to collaborate on the development and manufacturing of small and reasonably priced engines. These engines that to be used towards power unmanned aerial systems (UAS) and other related applications.

- Report ID: 6588

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Small Drone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.