Small Cell Power Amplifier Market Outlook:

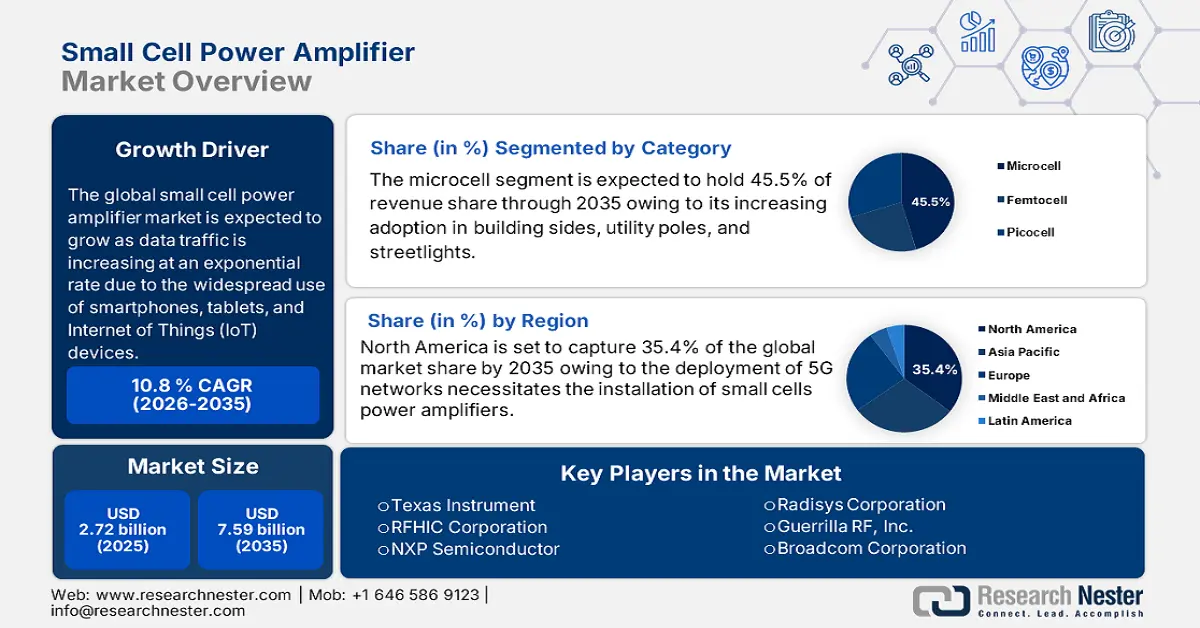

Small Cell Power Amplifier Market size was over USD 2.72 billion in 2025 and is poised to exceed USD 7.59 billion by 2035, witnessing over 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of small cell power amplifier is estimated at USD 2.98 billion.

The adoption of cell power amplifier is expected to expand at a rapid pace due to rising data traffic across smartphones, tablets, and Internet of Things (IoT) devices. Through faster and more dependable communication, small-cell power amplifiers allow network operators to offload traffic from crowded macro cells, improving the user experience and by 2030, it is predicted that there will be 40 billion connected IoT devices. The development of cell power stations is anticipated to increase the use of small cell power amplifier technologies. The most crucial element in the small cell power amplifier market for internet connectivity is the user experience. A quick, smooth, high-quality internet access offers a great user experience. Many customers search for an internet service provider that offers the best services.

In addition, in crowded cities, indoor spaces, and distant areas where conventional macro cell towers are constrained, small cells are essential for increasing network coverage and capacity. In this environment, small cell power amplifiers that boost and amplify signals to improve network performance have become crucial. These power amplifiers offer better coverage, capacity, and spectral efficiency as they are made to run at lower power levels. For example, in September 2023, iCana introduced the standard design for the 5G NR FR1 RF front-end, which includes analog devices made for indoor small cells. The Analog Devices ADRV9029 RF Transceiver Platform is connected to the RF front-end, showcasing iCana's high-performance, cost-effective, and power-efficient product line.

Key Small Cell Power Amplifier Market Insights Summary:

Regional Highlights:

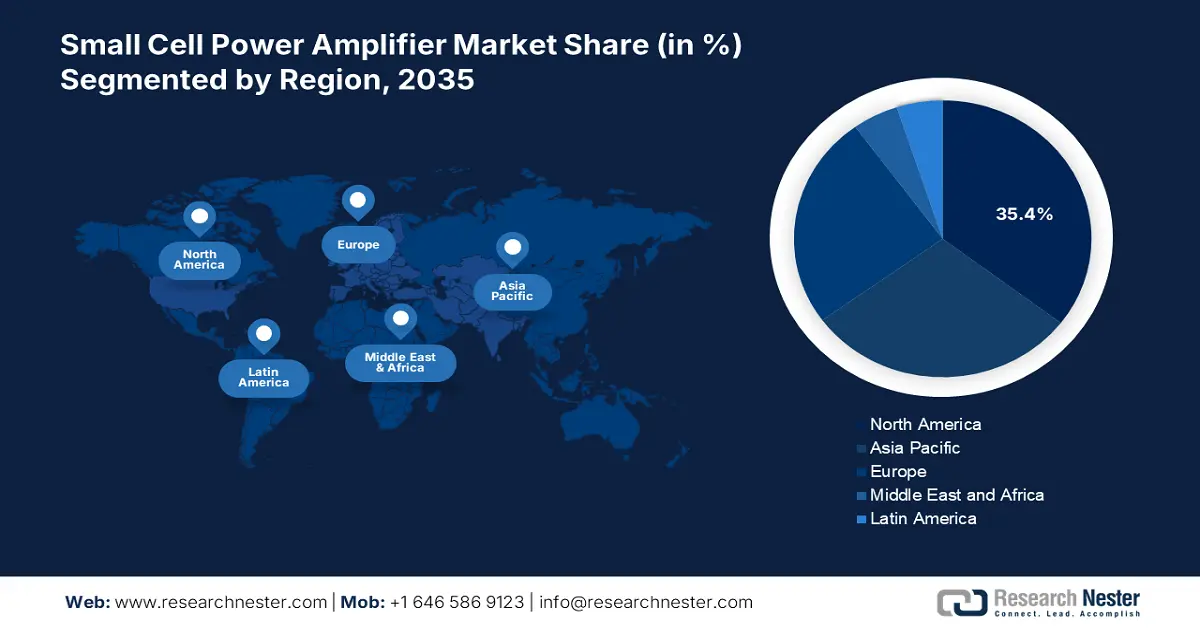

- North America leads the Small Cell Power Amplifier Market with a 35.4% share, driven by increased 5G deployment and rising mobile broadband services, ensuring robust growth through 2035.

- The Small Cell Power Amplifier Market in Asia Pacific is expected to maintain stable growth through 2026–2035, driven by growing need for high-speed networks and investments in 5G infrastructure.

Segment Insights:

- Wideband instrumentation segment is projected to achieve notable market share by 2035, driven by the versatility of small cell power amplifiers in applications requiring broad frequency ranges.

- The Microcell segment is expected to secure a 45.5% share by 2035, propelled by its use in urban settings to provide network coverage over greater distances and support multiple devices.

Key Growth Trends:

- Using small cell power techniques to optimize 5G

- Initiatives for smart cities and urbanization

Major Challenges:

- Technical and regulatory difficulties

- The rise of open RAN

- Key Players: TekTelic Communications Inc., Texas Instrument, RFHIC Corporation, NXP Semiconductor, Radisys Corporation, Guerrilla RF, Inc., Broadcom Corporation, Qorvo Inc., and Anadigics Inc.

Global Small Cell Power Amplifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.72 billion

- 2026 Market Size: USD 2.98 billion

- Projected Market Size: USD 7.59 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 13 August, 2025

Small Cell Power Amplifier Market Growth Drivers and Challenges:

Growth Drivers

- Using small cell power techniques to optimize 5G: As wireless networks transition to denser and more efficient architectures; small-cell technology is crucial for preserving coverage and capacity. These technologies, which fill the coverage and bandwidth gaps left by huge macro cells, improve the efficiency of small cell deployment with high gain, wide bandwidth, and superior thermal management in an affordable package. The rapid and dependable deployment of 5G networks in densely populated areas is made possible by these power amplifiers to improve the efficiency and affordability of small cells. For instance, in June 2021, Qualcomm Technologies, Inc. unveiled the second-generation Qualcomm 5G RAN Platform for Small Cells (FSM200xx), the first 3GPP Release 16 5G Open RAN platform in the industry. All commercial global mmWave and Sub-6 GHz bands, including the new n259 (41 GHz), n258 (26 GHz), and FDD bands are supported by the new platform, which significantly improves radio frequency.

- Initiatives for smart cities and urbanization: The need for better network coverage and capacity increases as urban areas become more crowded. Network densification is made possible by small cells with power amplifiers, which guarantee dependable connectivity in metropolitan settings. The need for small cell power amplifiers is also increased by smart city projects that integrate cutting-edge technology like connected infrastructure, driverless cars, and smart grids. For instance, with projected revenues of USD 104.8 billion in 2024 and USD 120 billion in 2025, the pattern of impressive expansion continues. Revenue from smart cities is expected to rise to a notable USD 135.3 billion by 2026.

Challenges

- Technical and regulatory difficulties: Technical obstacles in designing small-cell power amplifiers with improved linearity, reduced distortion, and increased power efficiency are some of the key challenges in the small cell power amplifier market. To get beyond these obstacles and produce power amplifiers that justify the needs of next-generation networks, manufacturers are bound to spend money on research and development. Small cell deployment requires negotiating several regulatory frameworks, including spectrum allotment, site acquisition, and local law compliance. For deployments to go smoothly and on schedule, market participants must adjust to these regulatory issues.

- The rise of open RAN: The small cell power amplifier market faces challenges with the introduction of Open Radio Access Network (Open RAN) architecture. Although it makes cost-effective deployments and multi-vendor interoperability possible, it also necessitates greater flexibility and adaptability from power amplifiers in order for them to interact with a variety of network equipment.

Small Cell Power Amplifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 2.72 billion |

|

Forecast Year Market Size (2035) |

USD 7.59 billion |

|

Regional Scope |

|

Small Cell Power Amplifier Market Segmentation:

Category (Femtocell, Picocell, Microcell)

In small cell power amplifier market, microcell segment is set to capture revenue share of over 45.5% by 2035. The segment is expanding as they are placed on building sides, utility poles, and streetlights. Microcells may provide network coverage over greater distances and support up to 200 devices simultaneously. Furthermore, in densely populated locations, microcells need dependable connectivity via fiber, cable, or microwave backhaul. Consequently, the small cell power amplifier market is expanding due to the use of microcells in urban settings.

End user (Wideband Instrumentation, Customer Premises Equipment, Data cards with Terminals, Small Cell Base Stations, Power Amplifier Driver)

Based on the end user, the wideband instrumentation segment in small cell power amplifier market is likely to hold a notable share by the end of 2035. Broad frequency range amplifiers are frequently used for wideband instrumentation applications. To meet the diverse frequency needs of various instrumentation instruments, the small cell power amplifiers aimed at this market should be built to accommodate broad bandwidths. Different broadband instrumentation configurations may have different measurement circumstances and particular frequency needs. The modularity and versatility of small cell power amplifiers made for this market could help users tailor and modify the amplification features to the specific requirements of their instrumentation systems.

Our in-depth analysis of the global small cell power amplifier market includes the following segments:

|

Product Type |

|

|

Category |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Small Cell Power Amplifier Market Regional Analysis:

North America Market Analysis

By 2035, North America small cell power amplifier market is set to capture over 35.4% revenue share. In North America, major network operators have started to roll out 5G services. The deployment of 5G networks necessitates the installation of small cells, including power amplifiers, to satisfy the increased capacity and coverage demands. Owing to this, there is a great need for small cell power amplifiers in the region. For instance, more than 55% of the region's connections were 5G by the middle of 2024. Additionally, 5G fixed wireless access (FWA) services have become quite popular, by the end of Q2 2024, there were close to 10 million FWA users in the U.S.

High-speed mobile broadband services are becoming increasingly important to businesses and consumers in the U.S. as augmented reality, cloud computing, and video conferencing become more widely used. To fulfill these expectations, small cell power amplifiers improve network performance and capacity in both indoor and outdoor settings. For instance, in October 2024, Axyom.Core, a pioneer in cloud-native wireless core and radio access network (RAN) technologies, unveiled the first 4G/5G dual-mode enterprise femtocell product to be commercially available.

Due to the extensive use of consumer gadgets like laptops, tablets, and smartphones, Canada has a high rate of mobile data usage. Due to the increase in mobile data traffic, small cell power amplifiers are necessary to increase network capacity and coverage. Furthermore, the small cell power amplifier market's expansion is being accelerated by Canada's growing adoption of IoT-enabled products. A key component of creating effective communication networks amongst IoT devices is small cell power amplifiers. For example, the Canada IoT market is anticipated to generate an astounding USD 12.46 billion by 2025.

Asia Pacific Market Analysis

Asia Pacific in small cell power amplifier market is expected to experience a stable CAGR during the forecast period, due to the region's growing need for high-speed mobile networks, the rise in internet penetration, and the acceleration of consumer electronics expenditure. Asia Pacific which includes nations like China, Japan, South Korea, and India, is rapidly expanding its 5G network and making attempts to densify it. For instance, with an anticipated USD 227 billion to be invested by mobile operators between 2022 and 2025, 5G infrastructure is projected to receive significant investment throughout Asia-Pacific. It is anticipated that there will be 1.4 billion 5G connections by 2030, or around 41% of all mobile connections in the area.

The trend of urbanization and population expansion in cities is driving the need for more cellular coverage and capacity in India. Telecom operators can use amplifier-powered small cell installations to fill coverage gaps and maintain reliable network performance in densely populated metropolitan regions. For instance, in November 2024, Vedang Radio Tech. Pvt. Ltd., C-DOT, and Linearized Amplifier Technologies and Services Pvt. Ltd. signed a contract for the development and demonstration of IP cores for millimeter-wave power amplifiers and chips for 5G FR2 in a major development for indigenous solutions in India's telecom technology sector.

Regulations aimed at expanding broadband access and promoting competition in the telecom sector facilitate the deployment of small cells and associated infrastructure in China. Spectrum availability and allocation policies also have a big impact on the adoption of small cells and the requirement for power amplifiers. For example, approximately 78% of China people had internet access as of June 2024.

Key Small Cell Power Amplifier Market Players:

- Skyworks Solutions

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TekTelic Communications Inc.

- Texas Instrument

- RFHIC Corporation

- NXP Semiconductor

- Radisys Corporation

- Guerrilla RF, Inc.

- Broadcom Corporation

- Qorvo Inc.

- Anadigics Inc.

In order to keep ahead of the competition, major small cell power amplifier market players are collaborating with other businesses. To increase the variety of products they offer, many businesses are also investing in the introduction of new products. Another important tactic that companies employ to increase the variety of products they offer is mergers and acquisitions.

Here are some leading players in the small cell power amplifier market:

Recent Developments

- In September 2023, Radisys Corporation announced the release of its award-winning Connect RAN 5G FR1 software solution which is compatible with 3GPP Release-17 and runs on the Qualcomm FSM200 5G RAN Platform. It has advanced SA and NSA features, such as high data throughput and support for multiple bands.

- In June 2023, Guerrilla RF, Inc. announced the GRF5123 and GRF5124, two new high gain, high linearity driver amplifiers made especially for 5G mMIMO transmitters. Each device can cover all major mMIMO bands with distinct tunes spanning 1.8-2.2GHz, 2.3-2.7GHz, 3.3-4.2GHz, and 4.4-4.7GHz, with a rated operational range of 1.8-5GHz.

- Report ID: 6933

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Small Cell Power Amplifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.