SLI Battery Market Outlook:

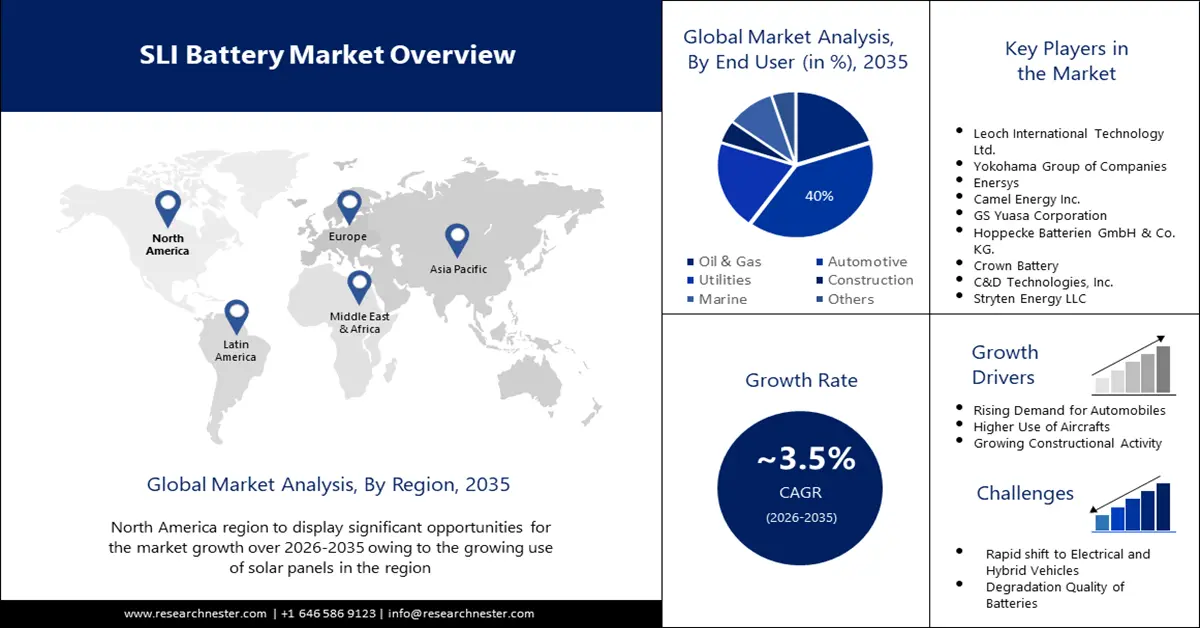

SLI Battery Market size was valued at USD 41.53 billion in 2025 and is expected to reach USD 58.58 billion by 2035, expanding at around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of SLI battery is evaluated at USD 42.84 billion.

The growth of the market is propelled by rising construction activities. The use of SLI batteries increases the demand for cranes and other industrial machinery. For the year 2021, demand was expected to be around 50-60 units for the 20-60 tonnes category and nearly 30-35 units for the 80-100 tons category.

Additionally, the factors that are believed to fuel the growth of the SLI battery market include the rise in demand for these batteries in the automotive sector and other industrial and commercial applications. Smart technologies, such as start-stop systems in the vehicle are increasing the demand for more advanced batteries.

Key SLI Battery Market Insights Summary:

Regional Highlights:

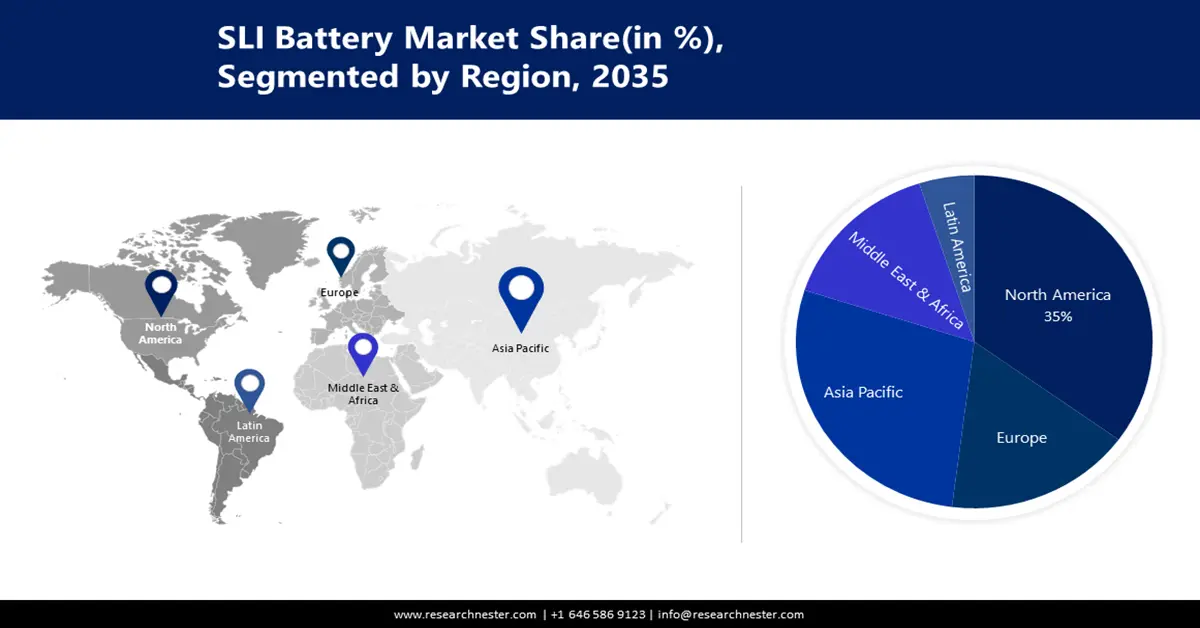

- The North America SLI battery market is forecasted to hold a 35% share by 2035, driven by increasing use of solar panels at residential and commercial levels.

- The Asia Pacific market is expected to secure a 28% share by 2035, driven by rising grid power capacity and increasing number of lead acid battery importers.

Segment Insights:

- The portable application segment in the sli battery market is expected to capture a 46% share by 2035, driven by rising use of mobile phones and small electrical devices needing power backup.

- The automotive end-user segment in the SLI battery market is anticipated to achieve a 38% share by 2035, driven by rising demand for automobiles globally.

Key Growth Trends:

- Growing Number of Automobiles

- Rise in the Number of Aircraft

Major Challenges:

- Increasing adoption of electric vehicles

- High production of the battery is leading to quality degradation of the battery

Key Players: Stryten Energy LLC, Leoch International Technology Ltd., Yokohama Group of Companies, Enersys, Camel Energy Inc., GS Yuasa Corporation, Hoppecke Batterien GmbH & Co. KG., Crown Battery, C&D Technologies, Gridtential Energy, Inc.

Global SLI Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 41.53 billion

- 2026 Market Size: USD 42.84 billion

- Projected Market Size: USD 58.58 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 May, 2025

SLI Battery Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Number of Automobiles – An SLI battery powers the vehicle's three most vital features: the starter motor, illumination, and ignition system. By the end of 2023, car sales are predicted to reach around 70 million.

-

Rise in the Number of Aircraft– During pre-flight, SLI batteries are used to power up the electrical system and start the Auxiliary Power Unit or the engines of the aircraft.

- Higher Production of Lead– Increased production of lead is likely to continue the supply of raw materials for manufacturing SIL batteries. Following an 8% fall in CY 2020 owing to the pandemic, the output of lead-mined metal increased by about 6% in CY 2021 bringing the total to around 5 Mt across the globe.

- Higher Adoption of Solar Panels –SIL batteries are a good choice for small-scale solar panel systems or backup power applications. In the Net Zero Emissions by 2050 Scenario, the number of households dependent on solar PV climbs from 25 million now to more than 100 million by 2030 around the world.

Challenges

-

Increasing adoption of electric vehicles – The automotive industry is undergoing significant technological changes, such as transitioning towards electric and hybrid models of vehicles. SLI batteries are not suitable for hybrid vehicles or EVs as they are unable to provide enough current and are required for sustained driving. Therefore, it compromises its range and performance.

-

High production of the battery is leading to quality degradation of the battery

- The cost of raw materials is high

SLI Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 41.53 billion |

|

Forecast Year Market Size (2035) |

USD 58.58 billion |

|

Regional Scope |

|

SLI Battery Market Segmentation:

End-User

The automotive segment is slated to account for 38% share of the global SLI battery market by 2035, impelled by the rising demand for automobiles. In 2021, the world manufactured 79.1 million motor vehicles. In 2020, China, Japan, and Germany were the top three makers of automobiles and commercial vehicles. SLI battery is an important part of a vehicle’s electrical system, as it provides the necessary power to start the engines and operate the electrical systems. SLI batteries are not used in electric vehicles, as these batteries are relatively heavy and would add unwanted weight to an EV, thus impacting its performance and range.

Application

The portable segment in the SLI battery market is set to account for a significant share of around 46% by 2035, driven by the rising use of mobile phones and other small electrical devices. Portable SLI battery are used to kick-start the electrical devices. Moreover, they are also used as a source of power backup during emergencies. In India, there are nearly 25 million houses in the rural region that are living with the power.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Sales Channel |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

SLI Battery Market Regional Analysis:

North American Market Insights

The SLI battery market in North America is predicted to be the largest with a share of about 35% by 2035. The growth of the market is driven by the increasing use of solar panels at both residential and commercial levels. According to the National Renewable Energy Laboratory, the number of US households with installed solar panels has climbed by an average of 32% per year since then. There were around 2.7 million household solar systems in the United States by the end of 2020. Residential solar provided enough power to power an average of approximately 633,000 houses in 2014 and almost 1.9 million homes in 2019.

APAC Market Insights

The Asia Pacific SLI battery market is slated to register a significant share of about 28% by 2035. The market growth is credited to the rising capacity of grid power systems. In 2021, China's off-grid renewable energy capacity increased by almost 5% to 906.23 gigawatts. The region's market growth is also being linked to an increase in the number of lead acid battery importers. Under Rule 5 of the Batteries (Management & Handling) Regulations, 2001, the Ministry of Environment, Forest & Climate Change (MoEFCC) / Central Pollution Control Board has registered 82 importers of lead-acid batteries in India.

SLI Battery Market Players:

- Stryten Energy LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Leoch International Technology Ltd.

- Yokohama Group of Companies

- Enersys

- Camel Energy Inc.

- GS Yuasa Corporation

- Hoppecke Batterien GmbH & Co. KG.

- Crown Battery

- C&D Technologies

- Gridtential Energy, Inc.

Recent Developments

- Stryten Energy LLC. conducted an in-depth investigation of the Stryten Energy Enhanced Flooded Battery (EFB) performance in comparison to the Stryten Energy SLI and a competitive premium flooded battery.

- Gridtential Energy Inc. announced the collaboration with Camel Energy Inc., the largest manufacturer of SLI batteries in the Asia Pacific. The agreement's goal is to offer start/stop batteries for internal combustion engine (ICE) automobiles.

- Report ID: 4903

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

SLI Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.