Global Sinus Dilation Devices Market

- Introduction

- Market Definition

- Market Segmentation

- Product overview

- Research Methodology

- Research process

- Primary research

- Sinus dilation device vendors

- End-users

- Secondary research

- Market size estimation

- Primary research

- Research process

- Executive Summary- Global Sinus Dilation Devices Market

- Industry Value Chain Analysis

- Raw material procurement

- Profiles of major suppliers

- Price trend analysis

- Manufacturing

- Major manufacturers, by region

- Mapping for major raw material suppliers and sinus dilation devices manufacturers

- Analysis on payment policies

- Investment analysis

- Distribution

- Major distributors & suppliers of sinus dilation devices, by region

- End-user outlook

- Annual demand for sinus dilation devices from major end-users

- Hospitals

- Ambulatory surgical centres

- ENT clinics

- Annual demand for sinus dilation devices from major end-users

- Raw material procurement

- Regulatory landscape

- Manufacturing standards & compliances

- Regulatory impact analysis

- Analysis of market dynamics

- Growth drivers

- Market trends

- Key market opportunities

- Product based

- Procedure based

- Patient type based

- Geography based

- Impact of covid-19 on the Global Sinus Dilation Devices Market

- Impact on raw material procurement

- Impact on market strategy

- Impact on the production

- Impact on sales

- Impact on end-use applications

- Impact on pricing

- Impact on trade

- Impact on key market players

- Key market opportunities

- Strategic competitive opportunities

- Geographic opportunities

- End-use based opportunities

- Regional analysis on the basis of patient type

- Strategic competitive opportunities

- Analysis on the global sinus dilation devices ecosystem

- North America

- Leading sinus dilation devices manufacturers and distributor

- Analysis on the end-user profile

- Major end-user industries

- Analysis on end-user size

- Key end-user profile

- Price trend analysis (USD million)

- Latin America

- Leading sinus dilation devices manufacturers and distributor

- Analysis on the end-user profile

- Major end-user industries

- Analysis on end-user size

- Key end-user profile

- Price trend analysis (USD million)

- Europe

- Leading sinus dilation devices manufacturers and distributor

- Analysis on the end-user profile

- Major end-user industries

- Analysis on end-user size

- Key end-user profile

- Price trend analysis (USD million)

- Asia-Pacific

- Leading sinus dilation devices manufacturers and distributor

- Analysis on the end-user profile

- Major end-user industries

- Analysis on end-user size

- Key end-user profile

- Price trend analysis (USD million)

- Middle east and Africa

- Leading sinus dilation devices manufacturers and distributor

- Analysis on the end-user profile

- Major end-user industries

- Analysis on end-user size

- Key end-user profile

- Price trend analysis (USD million)

- North America

- Competitive landscape

- Competitive benchmarking

- Detailed overview

- Assessment of key offerings

- Analysis of growth strategies

- Exhaustive analysis on key financial indicators

- SWOT analysis

- Company assessment

- Global sinus dilation devices market outlook

- By value, 2019-2028 (USD million)

- By patient type

- Adult patients, 2019-2028 (USD million)

- Pediatric patients, 2019-2028 (USD million)

- Competitive analysis

- Market dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Covid-19 impact analysis

- Market value & growth (quarterly market analysis, 2020–2023)

- Competitive strategy analysis

- Impact on demand

- Impact on revenue of existing companies

- Impact on new entrants

- Adult

- By product type

- Balloon sinuplasty devices, 2019-2028 (USD million)

- Sinus stents/implants, 2019-2028 (USD million)

- By balloon diameter

- <5mm, 2019-2028 (USD million)

- 5-10mm, 2019-2028 (USD million)

- >10mm, 2019-2028 (USD million)

- By procedure

- Standalone sinus dilation, 2019-2028 (USD million)

- Hybrid sinus dilation, 2019-2028 (USD million)

- By end user

- Hospitals, 2019-2028F (USD million), 2019-2028 (USD million)

- Ambulatory surgical centers, 2019-2028F (USD million)

- ENT clinics, 2019-2028F (USD million)

- By product type

- Paediatric

- By product type

- Balloon sinuplasty devices, 2019-2028 (USD million)

- Sinus stents/implants, 2019-2028 (USD million)

- By balloon diameter

- <5mm, 2019-2028 (USD million)

- 5-10mm, 2019-2028 (USD million)

- > 10mm

- By procedure

- Standalone sinus dilation, 2019-2028 (USD million)

- Hybrid sinus dilation, 2019-2028 (USD million)

- By end user

- Hospitals, 2019-2028F (USD million)

- Ambulatory surgical centers, 2019-2028F (USD million)

- ENT clinics, 2019-2028F (USD million)

- By product type

- Regional analysis

- North America, 2019-2028F (USD million)

- Latin America, 2019-2028F (USD million)

- Europe, 2019-2028F (USD million)

- Asia Pacific, 2019-2028F (USD million)

- Middle East & Africa, 2019-2028F (USD million)

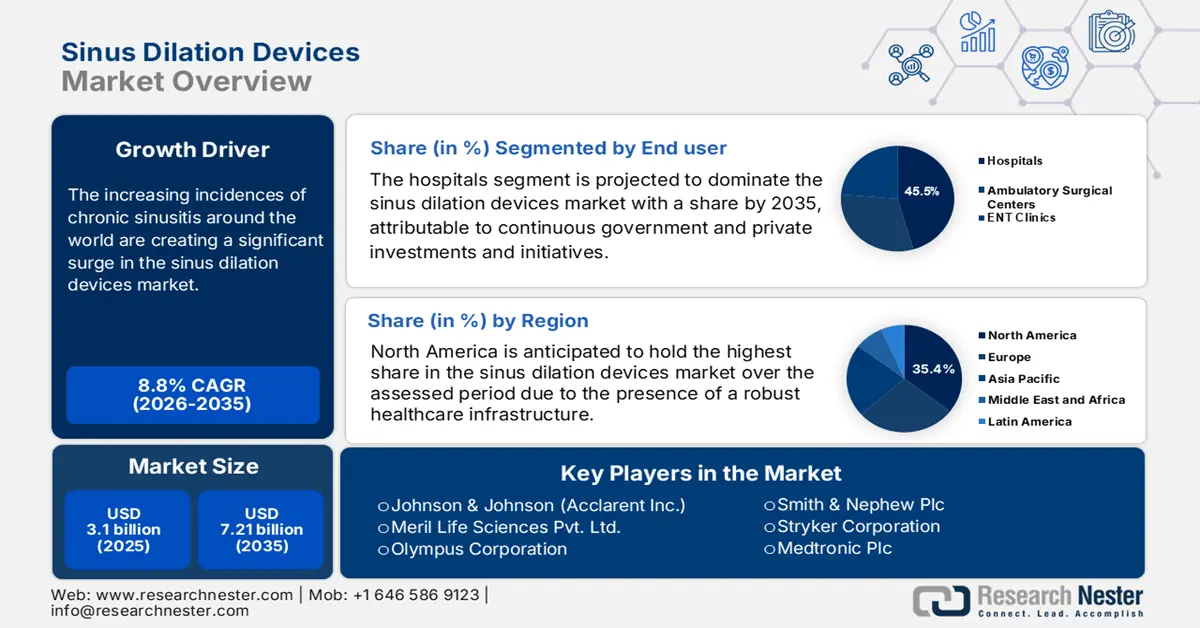

Sinus Dilation Devices Market Outlook:

Sinus Dilation Devices Market size was valued at USD 3.1 billion in 2025 and is expected to reach USD 7.21 billion by 2035, expanding at around 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sinus dilation devices is evaluated at USD 3.35 billion.

The increasing incidences of chronic sinusitis around the world are creating a significant surge in the market. According to a 2024 report from the Centers for Disease Control and Prevention (CDC), more than 12.3% of the adult population, totaling 30.1 million, in the U.S. is affected by this medical condition. Similarly, in 2025, over 5.3 million new cases of this ailment were recorded in Germany, registering a 15.2% increment from 2018, as per the study published by the Robert Koch Institute. Additionally, in Europe and Asia, this demography is emphasized due to the rapid aging among citizens. Additionally, expansion and development in the ENT devices industry are also contributing to the growth of this sector.

Inflationary pressures in the market are primarily induced by the heightening price of raw materials and supply chain disruptions. The complexity and volatility of outsourcing specialized medical-grade components, such as polymers, semiconductors, and nitinol, often impact the payers' pricing of the finished products. For instance, in 2024, the producer price index (PPI) for sinus dilation devices (SDDs) rose by 4.3% year-over-year (YoY). As a result, the consumer price index (CPI) for ENT procedures witnessed an increase of around 6.0% in the same year, as per the Centers for Medicare & Medicaid Services. Thus, leaders in the key marketplaces are focusing on cultivating and escalating localized sources and production.

Key Sinus Dilation Devices Market Insights Summary:

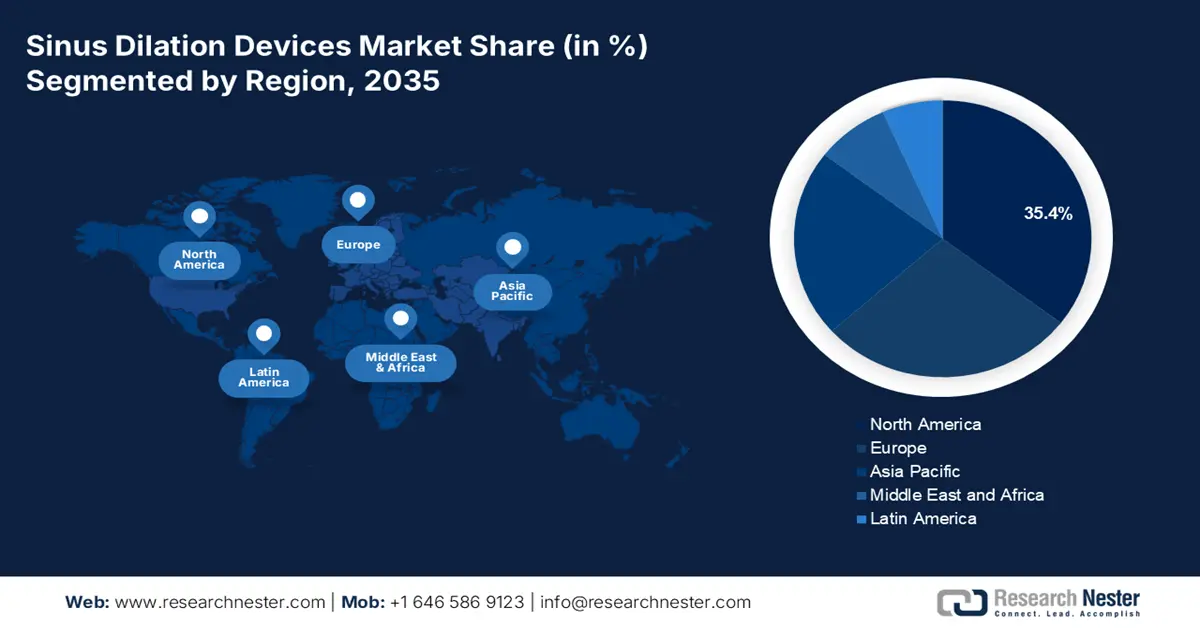

Regional Highlights:

- The North America sinus dilation devices market is forecasted to achieve a 35.4% share by 2035, driven by the region's robust healthcare infrastructure and expanding reimbursement coverages.

- The Asia Pacific market is poised for the fastest growth over the forecast period 2026–2035, driven by infrastructural development in healthcare and government support.

Segment Insights:

- The hospitals segment in the sinus dilation devices market is expected to achieve a 45.50% share by 2026-2035, fueled by adaptation to minimally invasive procedures and advanced ENT technologies.

- The balloon sinus dilation devices segment in the sinus dilation devices market is forecasted to secure a 42.40% share by 2035, driven by its less invasive nature and comparable efficacy to traditional surgeries.

Key Growth Trends:

- Investments to leverage accessibility

- Tech-based innovations and upgradations

Major Challenges:

- Investments to leverage accessibility

- Tech-based innovations and upgradations

Key Players: Acclarent, Inc., Stryker, Medtronic, InnAccel Technologies Pvt. Ltd., Meril Life Sciences Pvt. Ltd., Dalent Medical, Smith & Nephew.

Global Sinus Dilation Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.35 billion

- Projected Market Size: USD 7.21 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 8 September, 2025

Sinus Dilation Devices Market Growth Drivers and Challenges:

Growth Drivers

- Investments to leverage accessibility: The substantial expansion in reimbursement coverage, particularly in established economies, is securing a stable inflow of capital in the market. For instance, in 2023, the U.S. Medicare spending on associate procedures surpassed USD 850.2 million. Additionally, the out-of-pocket cost per procedure accounted for USD 1,200.3 during the same timeline. This reflects the increase in procedural volume and demand for advanced sinus dilation technologies. Furthermore, these financial dynamics are pushing MedTech companies to develop more cost-effective solutions, backed by public and private R&D funding.

- Tech-based innovations and upgradations: The sinus dilation devices market is rapidly progressing due to the continuous flow of R&D investments. Advancements in the existing pipeline are improving procedural efficiency while addressing long-term cost challenges and enhancing biocompatibility. As a result, this is stimulating the sector for global widespread adoption and accelerated growth. Such breakthrough innovations are also being supported by regulatory frameworks, demonstrating an opportunity to generate USD 252.5 million in revenue by 2030. In this regard, the National Institute of Health (NIH) allocated USD 220.2 million for research on ENT devices in 2023, which majorly focused on AI-assisted surgical navigation and biodegradable implants.

Historical Patient Growth Analysis: Shaping the Future of Market

The patient pool in the sinus dilation devices market has been highly influenced by several factors, including aging populations and enhanced diagnostic efficacy, during the past decade from 2010 to 2020. The efforts from both public and private organizations to mitigate cost barriers and spread awareness also propelled this demography, helping companies shape the current manufacturing scalability and pricing strategies. Moreover, the high procedure volume and economic burden are pushing organizations to procure tailored solutions and cultivate localized production. Additionally, the enlarging patient pool pushes reimbursement service providers to broaden their coverage policies, ensuring a steady capital influx in this sector.

Historical Patient Growth (2010–2020) for Sinus Dilation Devices Users

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR (2010–2020) |

Key Market Driver |

|

U.S. |

8.5 |

15.0 |

6.3% |

Medicare CPT coverage |

|

Germany |

3.4 |

6.1 |

6.8% |

Aging population |

|

France |

2.7 |

4.5 |

6.1% |

ASC adoption |

|

Spain |

2.0 |

3.4 |

6.5% |

Medical tourism |

|

Australia |

1.5 |

2.6 |

7.0% |

Private insurance growth |

|

Japan |

3.2 |

4.8 |

4.8% |

Late-stage adoption |

|

India |

1.0 |

2.9 |

12.8% |

ENT clinic expansion |

|

China |

1.7 |

5.7 |

14.0% |

Government healthcare reforms |

Feasible Expansion Models Shaping the Market

The transformative growth in the sinus dilation devices market is significantly attributed to the strategized commercial initiatives taken by key players. They are implementing and benefiting from several new approaches to trading through localized partnerships and hybrid procedural adoption. For instance, between 2022 and 2024, alliance formation between suppliers and regional ENT clinics raised revenue generation by 12.1% in India, as per a report from the NITI Aayog. On the other hand, pioneers in Germany focused on strengthening their distribution channels through the nationwide network of ASCs, escalating device penetration by 18.4% in 2023. Furthermore, the shift toward outpatient adoption is also propelling the sector's reach through fastening recovery times and optimizing resource allocation.

Feasibility Models for SDD Market Expansion (2025–2030)

|

Model |

Region |

Revenue Impact (2025–2030) |

Key Strategy |

|

Local Manufacturing |

India |

USD 800.4 million |

30.2% cost reduction |

|

Hybrid Procedure Kits |

U.S. |

USD 300.2 million |

35.1% procedural share |

|

AI Navigation Systems |

Japan |

USD 500.5 million |

25.4% precision gain |

|

Government Tenders |

China |

USD 1.7 billion |

USD 150.2 billion healthcare budget |

Challenge

- Volatilities and commercial losses from regulatory delays: Prolonged approval timelines, indifferent frameworks, and additional expenses accumulatively impact the financial output from new launching and commercializing strategies. Thus, the disruptions in the process of acquiring compliance with stringent regulatory criteria often create a notable hurdle in the progress of the sinus dilation devices market. For instance, the process of attaining approval from the Pharmaceuticals and Medical Devices Agency in Japan is 6-12 months slower than the FDA or CE Mark. However, global leaders are procuring new strategies to mitigate these issues. In this regard, in 2024, Olympus pre-submitted clinical data to cut delays by 4 months.

Sinus Dilation Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 7.21 billion |

|

Regional Scope |

|

Sinus Dilation Devices Market Segmentation:

End user Segment Analysis

In terms of end users, the hospitals segment is projected to dominate the sinus dilation devices market with a share of 45.5% throughout the forecasted timeframe. Its leadership is highly pledged to its adaptive nature toward minimally invasive procedures and advanced ENT technologies. In this regard, WHO reported that the number of sinus dilation procedures, performed in hospitals, surged by 20.4% from 2024 to 2025. Additionally, continuous government and private investments and initiatives, supporting infrastructural development in the healthcare industry, are also positioning this segment at the forefront. Moreover, being the primary center of care for complex cases is also a driver for this medical setting in this category.

Product Segment Analysis

Based on Product, the balloon sinus dilation devices segment is expected to garner a significant share of 42.4% in the sinus dilation devices market by the end of 2035. This subtype is the most preferred choice for professionals in treating chronic sinusitis due to being less invasive than traditional surgical methods while offering comparable efficacy. Testifying this, a 2022 study from the Agency for Healthcare Research and Quality (AHRQ) demonstrated that early adoption of balloon sinus dilation devices reduced hospitalizations by 22.3%. It also mentioned that this tool saved approximately USD 1.6 billion for the U.S. healthcare system over 2 years. Furthermore, the significant clinical and economic benefits of these devices have made them a mainstream accommodation in outpatient settings.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Procedure |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sinus Dilation Devices Market Regional Analysis:

North America Market Insights

North America is anticipated to hold the highest share of 35.4% in the sinus dilation devices market by 2035. The region's dominance stems from its robust healthcare infrastructure, expanding reimbursement coverages, and Federal investments in innovative medical technologies. This can be testified by the USD 1.2 billion provincial fund allocation for backing public health spending in Ontario in 2023. Similarly, Federal expenditure on medical care in Canada reached USD 3.3 billion in 2023. Such capital influx is improving public access to advanced ENT treatments, ultimately fueling growth in this sector. Furthermore, the ongoing technological advancements and growing patient needs are creating a strong foundation for sustained demand in North America.

The U.S. market is augmenting with substantial growth with the rising chronic sinusitis cases, tech-based innovations, and increased federal funding. For instance, till 2024, Medicare expenditures in this merchandise increased by 15.2%. Simultaneously, Medicaid sanctioned a total of USD 1.4 billion for associated treatments in 2024. These financial backups, coupled with an additional USD 5.1 billion investment in 2023 (as per CDC), are strengthening accessibility and innovation in this category. Furthermore, the shifting preference toward ENT surgeries with minimal incisions and AI-integrated diagnostics is enhancing precision in sinus treatments, propelling nationwide adoption.

APAC Market Insights

Asia Pacific is predicted to become the fastest-growing region in the sinus dilation devices market over the assessed timeline. Several factors are contributing to its pace of propagation, including infrastructural development in healthcare and government support. In this regard, the Ministry of Health in India observed a surge in making treatment accessible for patients, totaling 2.5 million in 2023, which was backed by an 18.2% rise in government funding. Similarly, the governing body of Japan allocated 12.1% of the net national medical care spending to sinus devices in 2024, as per the Ministry of Health, Labour, and Welfare. Additionally, the support for early diagnosis is fostering emergence in several countries, such as Malaysia.

The China market is expanding significantly with the increasing patient demand and government investment. For instance, the country's efforts in making advanced ENT healthcare helped treat more than 1.6 million patients in 2023. On the other hand, in 2023, the National Medical Products Administration (NMPA) reported that government spending on sinus dilation technologies grew by 15.3% in the past 5 years. Moreover, the nation's ambitious goals and commitments reinforce access and affordability in every clinical discipline is propelling the rate of adoption in this field. In this regard, a USD 4.2 billion fund was allocated to ENT devices as a part of the national strategy of technological advancements and hospital infrastructure improvements.

Sinus Dilation Devices Market Players:

- Medtronic Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson (Acclarent Inc.)

- Olympus Corporation

- Smith & Nephew Plc

- Stryker Corporation

- Meril Life Sciences Pvt. Ltd.

- SinuSys Corporation

- TE Connectivity (Creganna Medical)

- Dalent Medical

- InnAccel Technologies

- Accurate Surgical & Scientific Instruments

- KARL STORZ SE & Co. KG

- SPIGGLE & THEIS Medizintechnik

- Boston Scientific Corporation

- Cook Medical

- ENTellus Medical (Stryker Subsidiary)

- Opto Circuits (India) Ltd.

- United Surgical Industries

- ResMed Ltd.

- Alpinion Medical Systems

Multinational companies, including Medtronic, Johnson & Johnson, and Stryker, are strengthening their cohort of ongoing product innovations and strategic acquisitions to consolidate their pipeline. Other key players in the sinus dilation devices market are currently focusing on maintaining competency in pricing and global expansion. Moreover, the commercial success of next-generation solutions, such as drug-eluting implants and AI-enhanced ENT devices, is inspiring others to invest more in extensive R&D. On the other hand, pioneers in emerging marketplaces are developing cost-effective alternatives, tailored to the requirements of the local consumer base.

Top 20 of such innovators are:

Recent Developments

- In March 2024, Medtronic strengthened its ENT portfolio with the launch of its NuVent EM Sinus Dilation System, featuring integrated electromagnetic navigation for precise chronic sinusitis treatment. The innovative balloon dilation device reduces procedure times while improving surgical accuracy.

- In January 2024, Stryker announced the commercial launch of its upgraded RELIEVA SpinX 2.0 system, with a more compact design and superior irrigation for office-based procedures. The innovation captured an impressive 15.4% of the U.S. in-office sinus dilation market within just 3 months.

- Report ID: 841

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sinus Dilation Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.