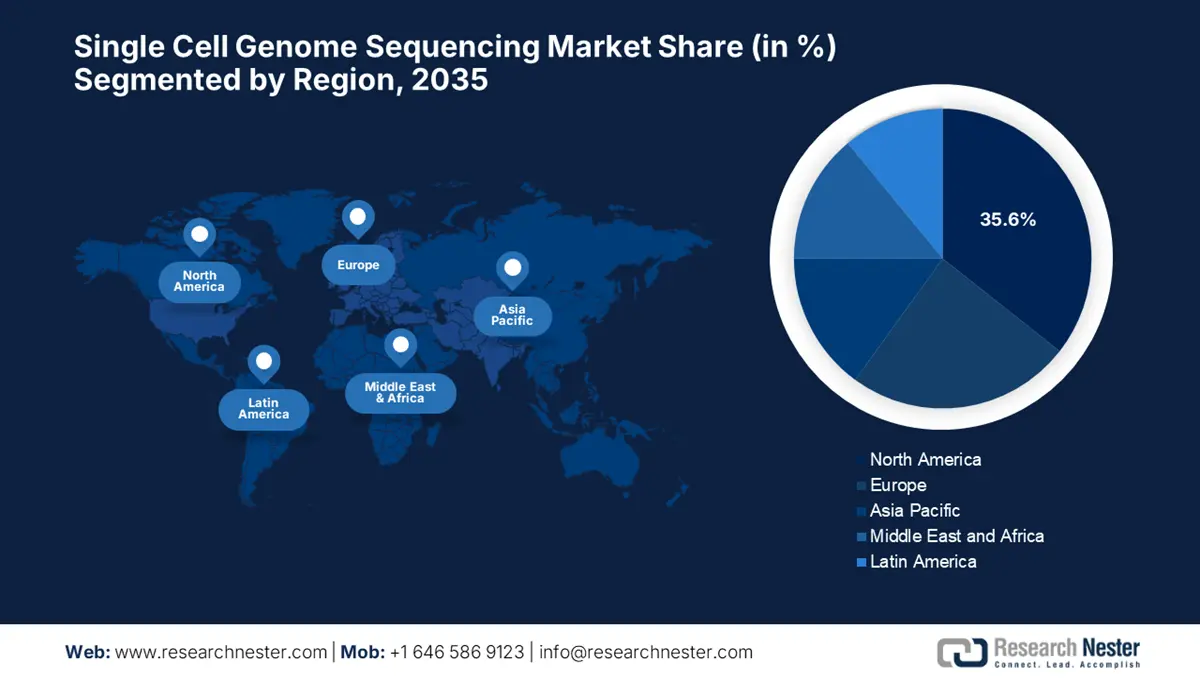

Single Cell Genome Sequencing Market - Regional Analysis

North America Market Insights

North America is poised to dominate with the largest revenue share of 35.6% in the single cell genome sequencing market by the end of 2035. The region benefits from the advancements in genomics and continued investments in precision medicine. In May 2023, Pfizer and Thermo Fisher Scientific together announced that they are expanding access to next-generation sequencing based cancer testing in over 30 countries, thereby aiming to improve localized testing capabilities for breast and lung cancer, enabling quicker diagnosis and more targeted treatment decisions.

U.S. market of single cell genome sequencing is at the forefront globally, which is growing owing to the presence of leading biotechnology firms, advanced research institutions, and major healthcare providers. In March 2025, researchers at the Herbert Irving Comprehensive Cancer Center unveiled DEFND-seq, which is a new single-cell sequencing method that enables simultaneous RNA and DNA analysis from thousands of cells more cost-effectively and at a greater scale, hence benefiting overall market growth.

Canada is also a key contributor to the regional market, effectively fueled by the government-funded genomics programs and collaborative public-private research initiatives. In March 2025, Genome Canada announced the Canadian Precision Health Initiative (CPHI), with a total USD 81 million federal investment and projected total funding of USD 200 million. Besides, this national effort is predicted to create the country’s largest-ever human genomic database, sequencing over 100,000 genomes to reflect Canada’s diverse population.

Cost of Genome Sequencing Over Time

|

Year |

Cost per Human Genome |

Notes |

|

2021 |

USD 600 |

Enables cost-effective single-cell sequencing |

|

2022 |

USD 500 |

Further boosts accessibility and throughput |

Source: NHGRI

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the regional single cell genome sequencing market from 2026 to 2035. The region’s progression in this field is facilitated by the ever-increasing investment in biotechnology and expanding healthcare infrastructure. Meanwhile, the major countries such as China, India, Japan, South Korea, and Australia are continuously making investments in genomic research, with strong government support. Besides, the region hosts a large population base and an increasing burden of chronic as well as genetic diseases, which provide an encouraging opportunity for firms to capitalize on this sector.

China is readily blistering growth in the regional market, facilitated by massive government funding under initiatives such as the China Precision Medicine Initiative and heightened demand for personalized therapies. In November 2024, Novogene participated in the TusPark UK China Series event, which is called Entering the Genomics Industry in China. It was also stated that 10% of its yearly revenue came from China and emphasized the importance of international collaboration to drive innovation in genomics, thereby positively impacting market growth.

India is also continuously growing in the Asia Pacific’s single cell genome sequencing market, owing to the rising awareness of genomics and increasing healthcare R&D. In this regard, at the Illumina India Genomics Summit, held in August 2024, the company announced the launch of a Global Capability Center in Bengaluru to grow its technology workforce and support global customers. The company also stated that conditions such as tuberculosis, HIV/AIDS, malaria, rare diseases, and cancer, expanding genomics access is seen as key to advancing healthcare.

Asia-Pacific Healthcare and Cancer Care Indicators (2022-2023)

|

Category |

Range / Value |

Notes |

|

Healthcare Spending Per Capita |

USD 2,189 to USD 4,880 |

Except Brunei (USD 633) |

|

Cancer Drug Expenditure Per Capita |

USD 30 to USD 138 |

Comprehensive health coverage |

|

Healthcare Financing Model |

50% to 84% |

Co-payments >30% in some countries |

|

Out-of-Pocket Spending |

44% to 76% |

Higher OOP due to less universal coverage |

Source: NIH

Europe Market Insights

Europe market is receiving support from robust research infrastructure and a collaborative scientific community. The region also benefits from heavy investments in personalized medicine and favourable regulatory frameworks. In March 2022, Macrogen Europe announced that it is expanding its single cell sequencing services, offering a wider range of options for input material, DNA library preparation, and data analysis. It also stated that the enhancement enables researchers with extremely detailed transcriptomic data, which is crucial for fields such as immunology and oncology.

U.K. holds a strong position in the regional single cell genome sequencing market, which is effectively propelled by research institutions such as the Wellcome Sanger Institute and substantial government initiatives. In August 2023, Almac Diagnostic Services announced a major expansion of its Next Generation Sequencing capabilities with the installation of the first Illumina NovaSeq X Plus instrument in Northern Ireland and the entire island of Ireland. Besides, this investment enhances Almac’s DNA and RNA sequencing services, boosting capacity, speed, accuracy, and cost-efficiency for biomarker discovery in terms of precision medicine.

France is gaining enhanced traction in the market, facilitated by a huge focus on biomedical research and a strong healthcare system that provides ground for the integration of single cell technologies into clinical and pharmaceutical research. For instance, in November 2022, Macrogen Europe announced the inauguration of a Sanger sequencing laboratory in Paris to better serve researchers in France. This new facility offers faster sample shipment and delivers results within 24 hours, maintaining their range of services, including Sanger sequencing, identification, and fragment analysis, hence suitable for standard market growth.