Single Cell Genome Sequencing Market Outlook:

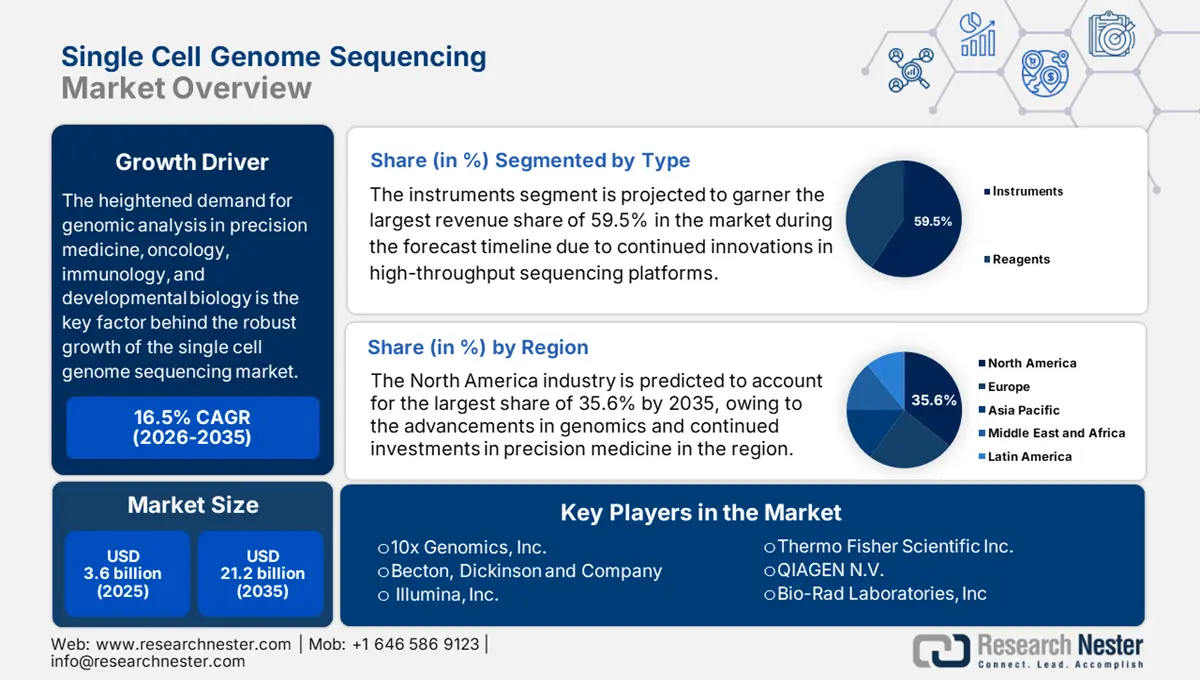

Single Cell Genome Sequencing Market size was valued at USD 3.6 billion in 2025 and is projected to reach approximately USD 21.2 billion by the end of 2035, rising at a CAGR of about 16.5% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of single cell genome sequencing is anticipated at USD 4.2 billion.

The heightened demand for genomic analysis in precision medicine, oncology, immunology, and developmental biology is the key factor behind the robust growth of the single cell genome sequencing market. As evidence WHO in February 2025 stated that cancer accounted for approximately 10 million deaths in a year, representing 1 in 6 of all global deaths. The report further stated that the most prevalent cancers were breast with 2.3 million cases and lung with 2.2 million. Hence, this highlights the urgent need for technologies such as single-cell genome sequencing, which are proven to provide high-resolution insights into tumor heterogeneity.

Furthermore, preceding innovations in terms of sequencing platforms, sample preparation, and data analytics are enhancing scalability and accuracy, thereby fostering a profitable business environment. As per the May 2023 NHGRI data cost of producing a sequenced human genome, including reagents, labor, instruments, and data processing, is reported to be below USD 1,000. Therefore, this significant cost reduction is readily accelerating the adoption of genome sequencing in clinical and research settings across different nations.

Key Single Cell Genome Sequencing Market Insights Summary:

Regional Highlights:

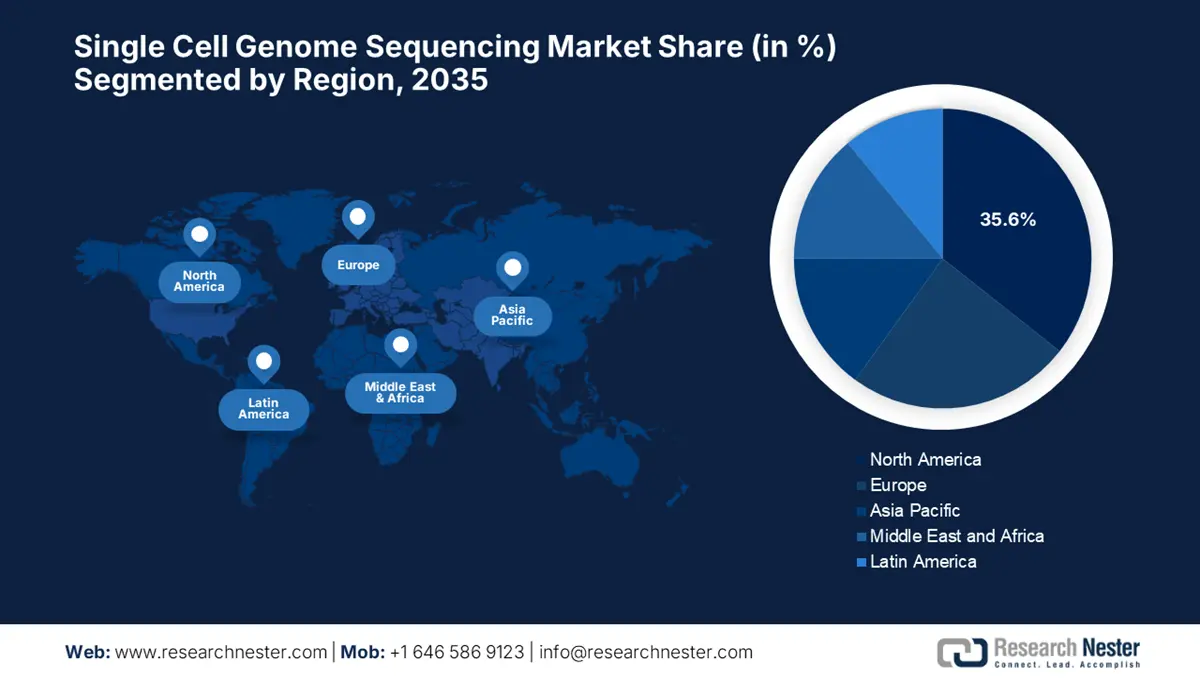

- North America is set to command a 35.6% share by 2035 in the single cell genome sequencing market, supported by advances in genomics and sustained precision-medicine investments.

- Asia Pacific is projected to accelerate as the fastest-growing region from 2026-2035, underpinned by rising biotechnology funding and expanding healthcare infrastructure.

Segment Insights:

- The instruments segment is projected to secure a 59.5% share by 2035 in the single cell genome sequencing market, bolstered by ongoing innovation in high-throughput sequencing platforms.

- The next-generation sequencing segment is expected to capture a 45.3% share by 2035, sustained by its cost efficiency, scalability, and deep genomic-profiling capabilities.

Key Growth Trends:

- Rising demand for precision medicine

- Advancements in sequencing platforms

Major Challenges:

- Extensive technical complexity

- Increased equipment and consumable costs

Key Players: 10x Genomics, Inc., Becton, Dickinson and Company (BD), Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., Bio-Rad Laboratories, Inc., Pacific Biosciences (PacBio), Oxford Nanopore Tech plc, BGI Genomics, NanoString Technologies, Inc., Parse Biosciences, Fluidigm Corporation, Singleron Biotechnologies, Dolomite Bio, RareCyte, Inc., MedGenome Labs Pvt. Ltd., Proteona Pte. Ltd.

Global Single Cell Genome Sequencing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.6 billion

- 2026 Market Size: USD 4.2 billion

- Projected Market Size: USD 21.2 billion by 2035

- Growth Forecasts: 16.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 5 September, 2025

Single Cell Genome Sequencing Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for precision medicine: The proven efficiency of products from the market, such as detailed analysis of genetic heterogeneity, assisting in early disease detection, remarkably drives the market growth. In this context, NIH January 2022 revealed that recent advances in single-cell sequencing technologies, such as single-cell epigenome sequencing, lineage tracing, and spatial transcriptomics, have productively enhanced resolution and accuracy in understanding cellular heterogeneity.

- Advancements in sequencing platforms: Preceding innovations in NGS technologies, automation, and bioinformatics are readily driving business in the single cell genome sequencing market. In February 2025, Roche announced the introduction of sequencing by expansion (SBX) technology, which is combined with an innovative sensor module, offers ultra-rapid, high-throughput sequencing that is both flexible and scalable for a wide range of applications, hence suitable for standard market growth.

- Funding grants from governing bodies: The aspect of continued funding from major research bodies is driving academic and clinical adoption in the market. For instance, in July 2025, Bigelow Laboratory for Ocean Sciences reported that it received nearly USD 3.5 million from the National Science Foundation to advance environmental single-cell genomics research to expand potential applications in biotechnology and marine ecosystem science, thus denoting a positive market outlook.

Historic Global Cancer Burden: Incidence and Mortality Statistics (2020)

|

Cancer Type |

New Cases (2020) |

Deaths (2020) |

|

Breast |

2.26 million |

685,000 |

|

Lung |

2.21 million |

1.80 million |

|

Colon & Rectum |

1.93 million |

916,000 |

Source: WHO 2025

Revenue Opportunities in Single Cell Genome Sequencing (2024-2025)

|

Company Name |

Initiative |

Year |

Revenue Opportunity |

|

Almac Diagnostic Services |

Launched single-cell RNA-Seq services with the 10x Genomics platform |

2025 |

Attracted biopharma clients for biomarker discovery and precision medicine |

|

Bio-Rad Laboratories |

Released ddSEQ 3' RNA-Seq Kit with integrated analysis software |

2024 |

Tapped cost-sensitive researchers with a complete, affordable workflow |

|

MDC-BIMSB (Ashley Sanders) |

Developed a DNA-focused single-cell sequencing technique |

2024 |

Opened new research markets in autoimmune and inflammatory diseases |

Source: Company Official Press Releases

Challenges

- Extensive technical complexity: This aspect poses a major challenge to the single cell genome sequencing market since it involves isolating and analyzing genetic material from individual cells, which causes considerable complexities. Besides, this data is quite often sparse, noisy, and high-dimensional, making it challenging to process with standard genomic tools. Therefore, this results in overtime consumption, thereby increasing the risk of inconsistent or inaccurate results.

- Increased equipment and consumable costs: The increasing costs of single-cell genome sequencing make it challenging for small-scale manufacturers to leverage them. Besides these advanced instruments, specialized reagents and high-throughput consumables are necessary for single-cell workflows, which are expensive and often require continued investment. Also, the necessity of a skilled workforce is highly essential for operation and maintenance, adding to the operational costs, thereby hindering widespread adoption.

Single Cell Genome Sequencing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.5% |

|

Base Year Market Size (2025) |

USD 3.6 billion |

|

Forecast Year Market Size (2035) |

USD 21.2 billion |

|

Regional Scope |

|

Single Cell Genome Sequencing Market Segmentation:

Type Segment Analysis

The instruments segment is projected to garner the largest revenue share of 59.5% in the market during the forecast timeline. The dominance of this subtype is effectively attributed to the continued innovations in high-throughput sequencing platforms for clinical and research environments. NIH in August 2022 revealed that FACS is widely used for marker-based sorting but requires high cell numbers and may cause cellular damage. Besides, microfluidic platforms, such as droplet-based systems, offer high-throughput, precise separation with integrated amplification, reducing pipetting errors and improving efficiency, hence a wider segment scope.

Technology Segment Analysis

Next-generation sequencing segment is expected to gain a share of 45.3% in the single cell genome sequencing market by the end of 2035. Cost efficiency, scalability, and capacity for deep genomic and transcriptomic profiling at the single-cell level are key factors behind this leadership. In July 2024, Thermo Fisher Scientific declared a partnership with the National Cancer Institute for the myeloMATCH precision medicine trial targeting AML and MDS. The initiative uses Thermo Fisher’s NGS technology for rapid genomic profiling of patient samples. Hence, this is the evidence for a wider market scope.

Disease Area Segment Analysis

Cancer segment is predicted to grow at a considerable rate with a share of 40.9% in the market during the discussed timeframe. This is an area of growth since single-cell sequencing unlocks tumor heterogeneity, driver mutations, and clonal evolution, which are highly essential for precision oncology. In February 2025, Takara Bio USA, Inc., a subsidiary of Takara Bio Inc., introduced two new single-cell NGS profiling technologies designed to advance oncology research. The newly launched Shasta Total RNA-Seq and Shasta Whole-Genome Amplification Kits offer high-throughput, automated solutions for single-cell transcriptome and genomic analysis.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

Disease Area |

|

|

Application |

|

|

Work Flow |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Single Cell Genome Sequencing Market - Regional Analysis

North America Market Insights

North America is poised to dominate with the largest revenue share of 35.6% in the single cell genome sequencing market by the end of 2035. The region benefits from the advancements in genomics and continued investments in precision medicine. In May 2023, Pfizer and Thermo Fisher Scientific together announced that they are expanding access to next-generation sequencing based cancer testing in over 30 countries, thereby aiming to improve localized testing capabilities for breast and lung cancer, enabling quicker diagnosis and more targeted treatment decisions.

U.S. market of single cell genome sequencing is at the forefront globally, which is growing owing to the presence of leading biotechnology firms, advanced research institutions, and major healthcare providers. In March 2025, researchers at the Herbert Irving Comprehensive Cancer Center unveiled DEFND-seq, which is a new single-cell sequencing method that enables simultaneous RNA and DNA analysis from thousands of cells more cost-effectively and at a greater scale, hence benefiting overall market growth.

Canada is also a key contributor to the regional market, effectively fueled by the government-funded genomics programs and collaborative public-private research initiatives. In March 2025, Genome Canada announced the Canadian Precision Health Initiative (CPHI), with a total USD 81 million federal investment and projected total funding of USD 200 million. Besides, this national effort is predicted to create the country’s largest-ever human genomic database, sequencing over 100,000 genomes to reflect Canada’s diverse population.

Cost of Genome Sequencing Over Time

|

Year |

Cost per Human Genome |

Notes |

|

2021 |

USD 600 |

Enables cost-effective single-cell sequencing |

|

2022 |

USD 500 |

Further boosts accessibility and throughput |

Source: NHGRI

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the regional single cell genome sequencing market from 2026 to 2035. The region’s progression in this field is facilitated by the ever-increasing investment in biotechnology and expanding healthcare infrastructure. Meanwhile, the major countries such as China, India, Japan, South Korea, and Australia are continuously making investments in genomic research, with strong government support. Besides, the region hosts a large population base and an increasing burden of chronic as well as genetic diseases, which provide an encouraging opportunity for firms to capitalize on this sector.

China is readily blistering growth in the regional market, facilitated by massive government funding under initiatives such as the China Precision Medicine Initiative and heightened demand for personalized therapies. In November 2024, Novogene participated in the TusPark UK China Series event, which is called Entering the Genomics Industry in China. It was also stated that 10% of its yearly revenue came from China and emphasized the importance of international collaboration to drive innovation in genomics, thereby positively impacting market growth.

India is also continuously growing in the Asia Pacific’s single cell genome sequencing market, owing to the rising awareness of genomics and increasing healthcare R&D. In this regard, at the Illumina India Genomics Summit, held in August 2024, the company announced the launch of a Global Capability Center in Bengaluru to grow its technology workforce and support global customers. The company also stated that conditions such as tuberculosis, HIV/AIDS, malaria, rare diseases, and cancer, expanding genomics access is seen as key to advancing healthcare.

Asia-Pacific Healthcare and Cancer Care Indicators (2022-2023)

|

Category |

Range / Value |

Notes |

|

Healthcare Spending Per Capita |

USD 2,189 to USD 4,880 |

Except Brunei (USD 633) |

|

Cancer Drug Expenditure Per Capita |

USD 30 to USD 138 |

Comprehensive health coverage |

|

Healthcare Financing Model |

50% to 84% |

Co-payments >30% in some countries |

|

Out-of-Pocket Spending |

44% to 76% |

Higher OOP due to less universal coverage |

Source: NIH

Europe Market Insights

Europe market is receiving support from robust research infrastructure and a collaborative scientific community. The region also benefits from heavy investments in personalized medicine and favourable regulatory frameworks. In March 2022, Macrogen Europe announced that it is expanding its single cell sequencing services, offering a wider range of options for input material, DNA library preparation, and data analysis. It also stated that the enhancement enables researchers with extremely detailed transcriptomic data, which is crucial for fields such as immunology and oncology.

U.K. holds a strong position in the regional single cell genome sequencing market, which is effectively propelled by research institutions such as the Wellcome Sanger Institute and substantial government initiatives. In August 2023, Almac Diagnostic Services announced a major expansion of its Next Generation Sequencing capabilities with the installation of the first Illumina NovaSeq X Plus instrument in Northern Ireland and the entire island of Ireland. Besides, this investment enhances Almac’s DNA and RNA sequencing services, boosting capacity, speed, accuracy, and cost-efficiency for biomarker discovery in terms of precision medicine.

France is gaining enhanced traction in the market, facilitated by a huge focus on biomedical research and a strong healthcare system that provides ground for the integration of single cell technologies into clinical and pharmaceutical research. For instance, in November 2022, Macrogen Europe announced the inauguration of a Sanger sequencing laboratory in Paris to better serve researchers in France. This new facility offers faster sample shipment and delivers results within 24 hours, maintaining their range of services, including Sanger sequencing, identification, and fragment analysis, hence suitable for standard market growth.

Key Single Cell Genome Sequencing Market Players:

- 10x Genomics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson and Company (BD)

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Pacific Biosciences (PacBio)

- Oxford Nanopore Tech plc

- BGI Genomics

- NanoString Technologies, Inc.

- Parse Biosciences

- Fluidigm Corporation

- Singleron Biotechnologies

- Dolomite Bio

- RareCyte, Inc.

- MedGenome Labs Pvt. Ltd.

- Proteona Pte. Ltd.

The organizations involved in the single-cell genome sequencing market are implementing numerous strategies to secure their global positions. Intensive R&D to improve scalability and collaborations with pharmaceutical and academic institutions are a few innovative steps taken by these pioneers. On the other hand, the specialized firms are competing in terms of niche and cost-effective platforms. The landscape is further evolving with strong participation from Asia-based players who are focusing on clinical translation.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Mission Bio declared that it had successfully finished the equity financing to advance single-cell tri-omics capabilities and clinical applications across Cancer, led by Ally Bridge Group.

- In January 2025, Illumina announced significant advancements to its NovaSeq X Series, including the launch of a single-flow-cell system, which is a powerful software upgrade, and new 100-cycle and 200-cycle kits, thereby enhancing the platform’s multiomic capabilities.

- Report ID: 2666

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.