Simulation Table Market Outlook:

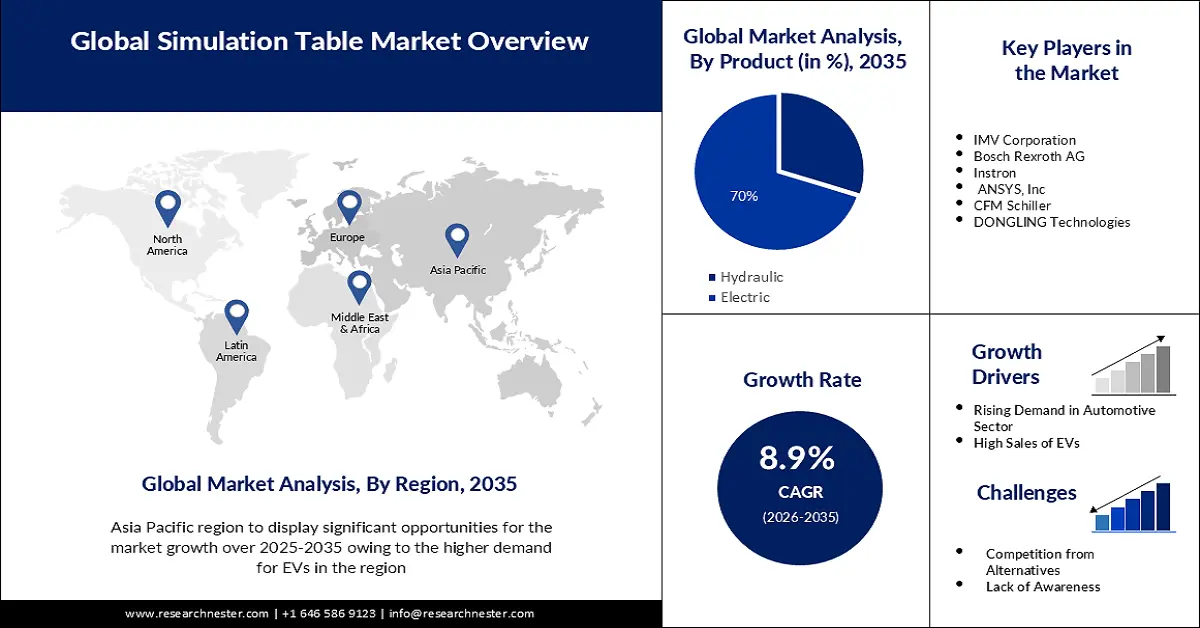

Simulation Table Market size was valued at USD 1.82 billion in 2025 and is likely to cross USD 4.27 billion by 2035, registering more than 8.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of simulation table is assessed at USD 1.97 billion.

The number of modeling parameters has grown along with the market for electric vehicles, which is expanding at a quicker rate. Noise is ultimately produced by coolant flows, temperature modulation, and how it affects electromagnetics. These factors all have an impact on efficiency and component structural performance. The market would expand more quickly if simulation tables with intricate models to evaluate and optimize important car systems and components were available. Global sales of plug-in electric vehicles reached over 6 million in 2021, more than double those of 2020.

Many businesses use simulation tables extensively because they lower production costs. They assist in the development and virtual testing of several prototypes. Additionally, it facilitates the realization of error-free output in a production process, preventing the creation of defective items and the associated expenses. It also reduces the amount of time needed for R&D tasks. The simulation table market is anticipated to increase as a result of all these factors.

Key Simulation Table Market Insights Summary:

Regional Highlights:

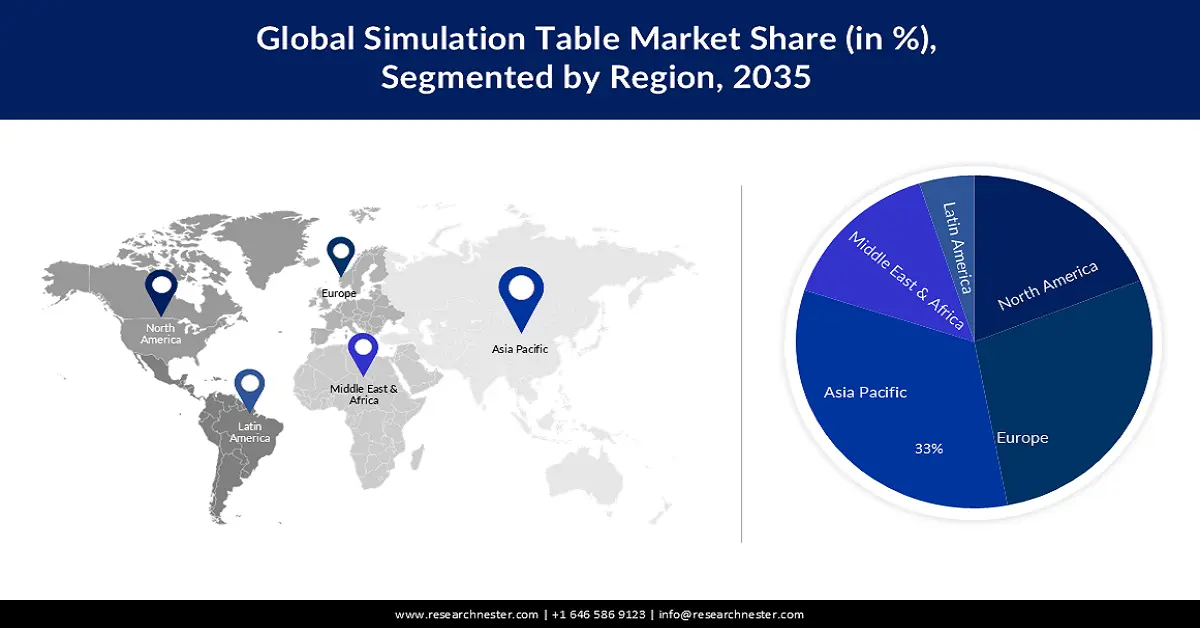

- Asia Pacific simulation table market will secure over 33% share by 2035, fueled by rising demand in automotive and healthcare sectors.

Segment Insights:

- The electric product segment in the simulation table market is projected to capture a 70% share by 2035, driven by stricter vehicle emissions regulations and the need for EV design optimization.

- The passenger car segment in the simulation table market is expected to achieve a 50% share by 2035, driven by increasing autonomous vehicle development requiring extensive simulation testing.

Key Growth Trends:

- High Demand in the Automotive Sector

- Expansion of ADAS System in Vehicles

Major Challenges:

- High Demand in the Automotive Sector

- Expansion of ADAS System in Vehicles

Key Players: of IMV Corporation, Bosch Rexroth AG, Instron, ANSYS, Inc, CFM Schiller, DONGLING Technologies, Team Corporation.

Global Simulation Table Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.82 billion

- 2026 Market Size: USD 1.97 billion

- Projected Market Size: USD 4.27 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Simulation Table Market Growth Drivers and Challenges:

Growth Drivers

- High Demand in the Automotive Sector - These days, designing cars is a difficult task because of constrained resources, shortened time to simulation table market, changing client demands, and tighter budgets. To create a simulation that is equivalent to thousands of kilometers, simulation tables can be utilized nonstop for several days. A new component can now be introduced to the market in as little as 18 months, compared to 4 years in the past. The development of real simulation technology to shorten this period is a key factor fueling the market for simulation tables. Players in the automotive industry are using simulation technologies, such as the simulation table, to meet cost and performance targets, customer needs, and regulatory requirements. Therefore, this is accelerating the growth of the market in the future.

- Expansion of ADAS System in Vehicles - The simulation table market is growing as a result of the growing popularity of ADAS, or advanced driving assistance systems, in automobiles. This is driving up demand for enhanced testing and calibration tools. These cutting-edge tools are being used by automakers to create smarter cars.

Challenges

- High Cost and Complexity - Simulation tables are sophisticated equipment requiring advanced engineering and manufacturing leading to high initial investment costs. Additionally, their operation and maintenance can be complex, demanding specialized personnel and ongoing training. This is predicted to hamper the market growth further in the upcoming period.

- Limited Integration and Awareness of the Simulation Table are Set to Hamper the Market Growth in the Upcoming Period.

- Competition from Alternatives is Predicted to Pose Limitations on the Simulation Table Market Growth in the Forecast Period.

Simulation Table Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 1.82 billion |

|

Forecast Year Market Size (2035) |

USD 4.27 billion |

|

Regional Scope |

|

Simulation Table Market Segmentation:

Product Segment Analysis

In terms of product, the electric segment is projected to dominate the simulation table market by registering share of 70% during the prediction period. Governments across the globe are implementing stricter emissions regulations for vehicles. For instance, an executive order was released by the governor of California recently instructing that by 2035 all passenger light trucks and new cars will be zero-emission vehicles. This is putting pressure on automakers to develop cleaner and more efficient vehicles. Simulation tables can help to optimize EV designs for fuel efficiency and emissions reduction. Additionally, the simulation technology is constantly evolving and new features and capabilities are being added to simulation tables all the time. This is making them even more valuable for EV development. Such as some simulation tables can now be integrated with virtual reality and augmented reality technologies that can create even more realistic and immersive testing environments.

End Use Segment Analysis

In terms of end user, the passenger car segment is set to dominate the simulation table market reaching a share of 50% during the time period between. Simulation tables are utilized in the automotive sector to test and develop new car models under various simulated driving conditions. This helps to ensure that the cars are safe, reliable, and perform well in real-world conditions. Furthermore, the increasing popularity of autonomous driving cars, requires extensive testing in simulated environments.

Our in-depth analysis of the global simulation table market includes the following segments:

|

Product |

|

|

Payload Capacity |

|

|

Table Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Simulation Table Market Regional Analysis:

APAC Market Insights

The simulation table market in the Asia Pacific region is anticipated to hold the largest revenue share of 33% by the end of the projected time period. As the largest country in terms of population and carbon emissions, China's seemingly strong commitment to renewable energy is encouraging. China will have 1.2 million electric vehicles by 2020, according to the IEA's Global Electric Vehicle Outlook, making it the second largest country in the world. China is the largest consumer of these tables due to an increasing demand for conventional as well as energy vehicles. Increased production activities in regional industries and sectors, e.g. cars and healthcare, can be attributed to the fast growth rate. The growth of the regional market is then driven by rising construction and healthcare sectors in countries, for example, India.

European Market Insights

The simulation table market in the European region is set to grow significantly by the end of 2035. Germany is Europe's largest producer, home to many famous car companies, and has been one of the biggest consumers of simulation tables throughout Europe. In the country, where car manufacturers test their vehicles before making them available on the market, there are several independently run testing facilities. These facilities make it possible to meet the high-quality standards of automotive manufacturers and their suppliers, and increasingly sophisticated and complex testing procedures are becoming the order of the day.

Simulation Table Market Players:

- Mogg Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Weiss Technik

- MTS System Corporation

- IMV Corporation

- Bosch Rexroth AG

- Instron

- ANSYS, Inc

- CFM Schiller

- DONGLING Technologies

- Team Corporation

Recent Developments

- The Suzhou, China-based Centre Testing International Corporation, a supplier of vehicle components strength testing administrations, as of late chosen Moog to supply a customized Pressure driven Reenactment Table to test powertrain mount toughness. CTI needed the multi-axle street reenactment testing capabilities for its client GM PATAC – a joint wander between Common Engines and Shanghai Auto Bunch. The H-ST comprises of a compact and light stage and base plates on which stretch safe hydrostatic jacks are amassed with bars bulging from the jacks associated to the stage structure. To meet the one of a kind needs of the application, Moog engineers customized the framework in a few special ways.

- In June 2022, ANSYS, Inc reported that the company has joined the Intel Foundry Administrations Cloud Collusion. Intel Foundry Administrations could be a totally vertical, autonomous foundry company by Intel. This interoperable, semiconductor plan workflow empowered with cloud innovation is made conceivable by Ansys items.

- Report ID: 5616

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Simulation Table Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.