Simulated Train Market Outlook:

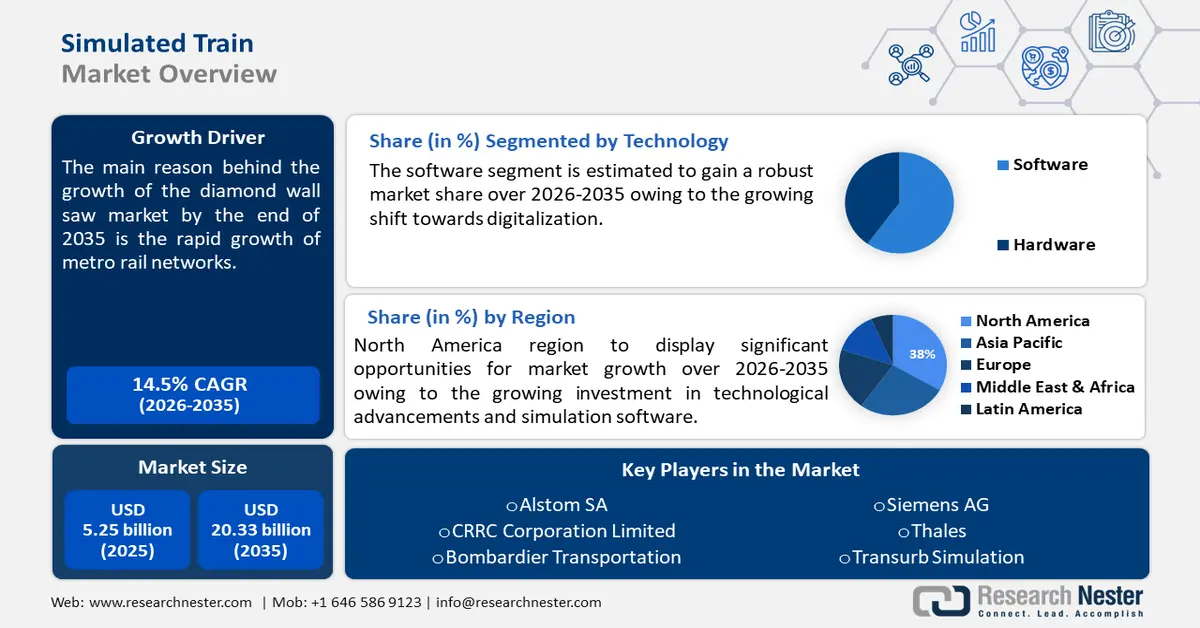

Simulated Train Market size was valued at USD 5.25 billion in 2025 and is likely to cross USD 20.33 billion by 2035, expanding at more than 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of simulated train is assessed at USD 5.94 billion.

The simulated train industry is expanding due to the rapid growth of metro rail networks. According to the International Energy Agency, most of the world's conventional rail networks are in China, Russia, India, Japan, North America, and Europe. Approximately 90% of all passenger movements on conventional rail worldwide occur in these regions, with India accounting for 39% of the total, followed by China (27%), Japan (11%), and the European Union (9%). Compared to traditional training techniques, this aids in the significantly faster training of licensed drivers and operators.

Key Simulated Train Market Insights Summary:

Regional Highlights:

- North America simulated train market will hold more than 38% share by 2035, driven by investment in technological advancements and simulation software.

- Asia Pacific market will achieve significant CAGR during 2026-2035, driven by the cost-effectiveness and adaptability of simulated trains.

Segment Insights:

- The software segment in the simulated train market is expected to achieve significant growth till 2035, driven by the growing shift towards digitalization and advanced AI features.

- The driving simulator segment in the simulated train market is forecasted to hold the largest share by 2035, driven by the emphasis on safety and operational excellence.

Key Growth Trends:

- Increased integration of VR and AR technologies

- Growing focus on safety in railways

Major Challenges:

- High upfront costs

- Growing focus on safety in railways

Key Players: Alstom SA, CRRC Corporation Limited, Bombardier Transportation, Siemens AG, Thales, Transurb Simulation, Opal-RT, CORYS, Foerst GmbH, Mechatronics.

Global Simulated Train Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.25 billion

- 2026 Market Size: USD 5.94 billion

- Projected Market Size: USD 20.33 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, Germany, United States, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Simulated Train Market Growth Drivers and Challenges:

Growth Drivers

- Increased integration of VR and AR technologies - VR/AR technology is being used by several train operators and manufacturers to create realistic scenarios that teach new hires how to manage crises such as evacuation in the event of an accident, a natural disaster, a technical malfunction, etc.

Operators such as Indian Railways, for instance, implemented VR-based simulations at different training institutes to get guards and loco pilots ready to deal with unanticipated situations effectively. For instance, in 2018 Honeywell unveiled a cloud-based simulation tool that trains plant staff on essential industrial job tasks by combining virtual reality (VR) and augmented reality (AR).

- Growing focus on safety in railways - Over the past few years, the railway sector has become more and more focused on improving passenger safety throughout the world. According to the European Commission, there were 1,615 major railway accidents in the EU in 2022, resulting in 808 fatalities and 593 major injuries. The number of serious railway accidents has been steadily declining since 2010, with 614 fewer incidents in 2022 than in 2010 (-27.5%), notwithstanding the increase in 2022.

Advances in simulated training techniques have been spurred by the growing emphasis on improving operator skill development to prevent catastrophic train accidents. These techniques provide drivers and engineers with immersive virtual environments where they can safely learn and practice real-life operational scenarios.

- Growing focus on R&D activities - Leading technology companies and associations for the rail sector are increasing their R&D efforts with the goal of developing train simulation systems that are more complex, adaptable, and accurate to actual conditions, which is leading to stimulated train market expansion. Train simulation technologies are becoming more capable and efficient with the development of solutions like artificial intelligence, cloud computing, and predictive analytics.

For instance, in 2021 Researchers from IIT Delhi and the Research Designs and Standards Organisation (RDSO), a subsidiary of the Ministry of Railways, partnered to create 'Runtrain#', a train simulation software that produces findings that may be used in timetabling procedures.

Challenges

- High upfront costs - Sophisticated train simulation systems require significant upfront expenditures in hardware and software technology. Integrating simulators with existing infrastructure can incur significant expenses. Smaller metro rail operators and training institutions sometimes struggle to afford expensive simulation technologies. Reduced finances may hinder adoption unless providers offer more cost-effective options. In consideration to these elements, high upfront costs may hinder the simulated train market.

- Need for special installation and maintenance - The expense of operating train simulators is increased by the need for specialized infrastructure, such as room, power, cooling, etc. Complex components in simulation equipment require specialist facilities for installation and upkeep. The necessity of personalized. Infrastructure might make simulated train market deployment challenging for smaller businesses or those with limited space.

Simulated Train Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 5.25 billion |

|

Forecast Year Market Size (2035) |

USD 20.33 billion |

|

Regional Scope |

|

Simulated Train Market Segmentation:

Component Segment Analysis

Software segment is set to account for more than 60% simulated train market share by the end of 2035. The segment growth can be attributed to the growing shift towards digitalization. According to the United Nations, over just two decades, digital technologies have reached about 50% of the developing world's population, revolutionizing society and advancing faster than any other innovation in human history. Advanced software solutions, which offer a variety of cutting-edge features and functionalities, are now the foundation of this revolution.

Leading the way are sophisticated algorithms that meticulously replicate the intricacies of train movements, track conditions, and environmental factors, creating remarkably lifelike virtual settings that closely resemble real-world train travel. The software's incorporation of artificial intelligence (AI) improves system efficiency and safety by streamlining operations, including predictive maintenance and route planning.

The simulated train market is undergoing a paradigm transition as a result of the software segment's expansion. This indicates that modern technology will one day completely merge with rail transportation, transforming safety, efficiency, and the whole passenger experience.

Simulator Type Segment Analysis

The driving segment is predicted to gain the largest market share in the year 2035. The segment growth can be credited to the growing emphasis on safety and operational excellence within the transportation industry. Driving simulators provide a safe environment where students can hone their abilities and gain self-assurance in handling challenging situations.

This consequently results in increased safety procedures and a reduction in possible hazards associated with real-world operational scenarios. Furthermore, driving simulators' versatility and scalability meet a range of training requirements by supporting various train kinds, terrains, and scenarios. They also enable operators to concentrate on particular skill sets or difficult scenarios through the facilitation of tailored training programs. The simulated trains market is expected to be significantly shaped by the driving segment as the need for competent and well-trained train operators grows.

Our in-depth analysis of the simulated train market includes the following segments:

|

Component |

|

|

Services |

|

|

Simulator Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Simulated Train Market Regional Analysis:

North America Market Insights

North America industry is expected to dominate majority revenue share of 38% by 2035. The market growth in the region is also expected on account of the growing investment in technological advancements and simulation software. The region's transportation industry is increasingly recognizing the benefits of virtual training environments for operators.

These simulations provide a risk-free environment for improving skills, responding to emergencies, and maximizing operational efficiency. Furthermore, the cost-effectiveness and scalability of simulated trains make them an appealing option for modernizing rail transportation. With a growing desire for creative, safe, and efficient solutions, North America is at the forefront of simulated train market growth.

The increased adoption of simulation technology and the presence of leading simulator manufacturers are propelling the growth of the simulated train market in the United States. For instance, NeTrainSim is a nationwide multi-train simulation program developed by researchers at Virginia Tech Transportation Institute (VTTI). Several simulations of the nation's network of freight trains running on alternative fuels such electricity, biodiesel, hydrogen, and hybrid vehicles were conducted by the open-source model. The most efficient powertrains are electric ones, consuming 56% less energy.

The simulated train market is growing in Canada due to stringent operator training requirements and increasing focus on the optimization of training costs. According to the Railway Association of Canada, the Railway Safety Act requires all federally regulated railways and anybody operating on their tracks to maintain a Safety Management System (SMS). Over the past decade, Canada's railways have invested over USD 21.5 billion in improving tracks and rail beds, as well as implementing innovative technologies to detect risk indicators, meet regulatory standards, and ensure network safety.

APAC Market Insights

Asia Pacific region is likely to observe significant growth till 2035. This is owing to the cost-effectiveness and adaptability of simulated trains. Leaders in the business and governments alike are realizing how much virtual training environments can provide train operators. These simulations provide a safe environment in which to improve abilities, handle crises, and streamline processes.

In China, the simulated train market is growing due to the growing railway infrastructure in the region. According to China’s State Council Information Office, by the end of 2023, high-speed railways made up 45,000 km of the approximately 159,000 km that made up China's operational railway network.

The surge in the adoption of simulation-based training by railway operators in Korea is propelling the growth of the simulated train market. Also, growing domestic travels in the region is influencing the growth of simulated train market in the region. For instance, an analysis of travel trends in Korea indicates that almost 21 million regional travels are made on average each day. Remarkably, the percentage of rail transportation increased to 20% in 2019, which is a notable rise from the 16.3% percentage in 2010.

Simulated Train Market Players:

- Alstom SA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CRRC Corporation Limited

- Bombardier Transportation

- Siemens AG

- Thales

- Transurb Simulation

- Opal-RT

- CORYS

- Foerst GmbH

- Mechatronics

The industry's leading service providers are always updating their technology to maintain an edge over rivals and to guarantee effectiveness, reliability, and security. To get a competitive advantage over their rivals and take a sizeable portion of the market, these players concentrate on collaboration, product advancements, and partnerships.

Recent Developments

- Alstom SA created virtual reality (VR) technology primarily to train drivers and personnel on how to operate a new rolling stock product, whether on an existing, modified, or fully new transportation system. Customers and operators have the issue of training a big number of people in a short period of time, especially when the product is not yet ready. A driving simulator makes this possible in a safe way. A simulator also allows us to show the safety of any product or rail system.

- Thales has created the Robust Train Positioning System, which offers accurate train positioning data as well as a digital map of the track, in order to improve railway safety and efficiency in the UK. The system attempts to improve safety by utilizing a range of sensors that collect essential data on train positioning, which is then coupled with a digital map of the track to provide accurate and continuous positioning output to train drivers and other personnel.

- Report ID: 6173

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Simulated Train Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.