Silica Analyzers Market Outlook:

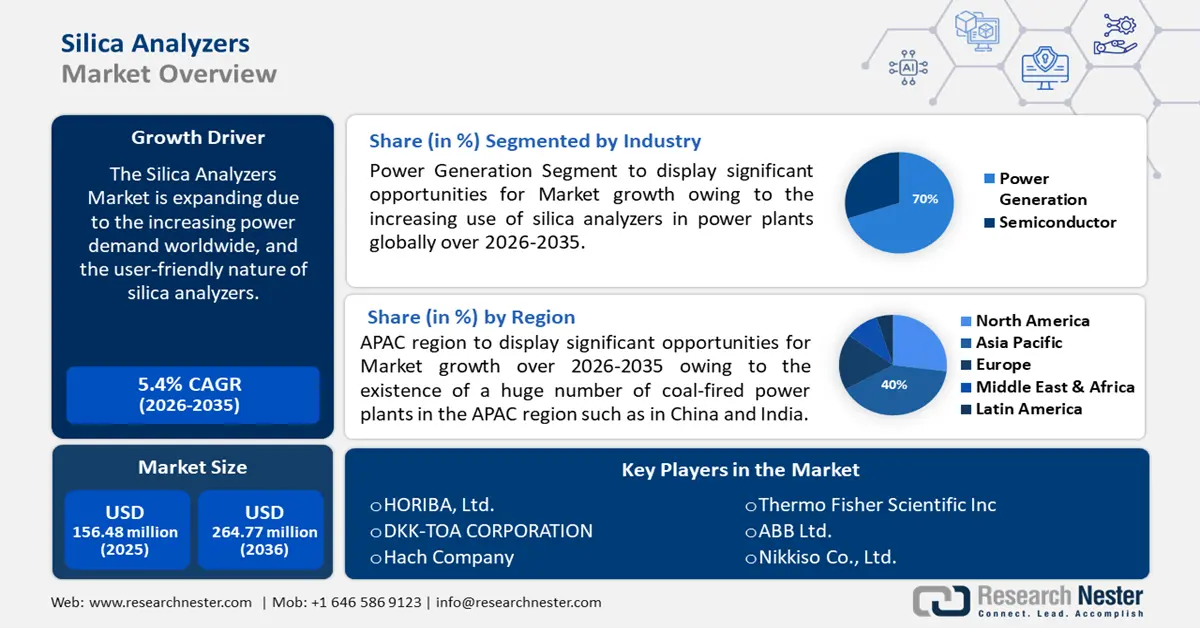

Silica Analyzers Market size was over USD 156.48 million in 2025 and is projected to reach USD 264.77 million by 2035, witnessing around 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of silica analyzers is evaluated at USD 164.08 million.

The main reason behind the expansion of the silica analyzers' market share is the increasing power demand worldwide. For instance, according to the World Data Organization’s report, in 2021 and 2022, electricity generated from fossil fuels met 45% and 40% of the additional demand, respectively, with the remaining electricity coming from nuclear power. The global population is expanding and people are becoming wealthier, which is driving up energy consumption in many countries.

Key Silica Analyzers Market Insights Summary:

Regional Highlights:

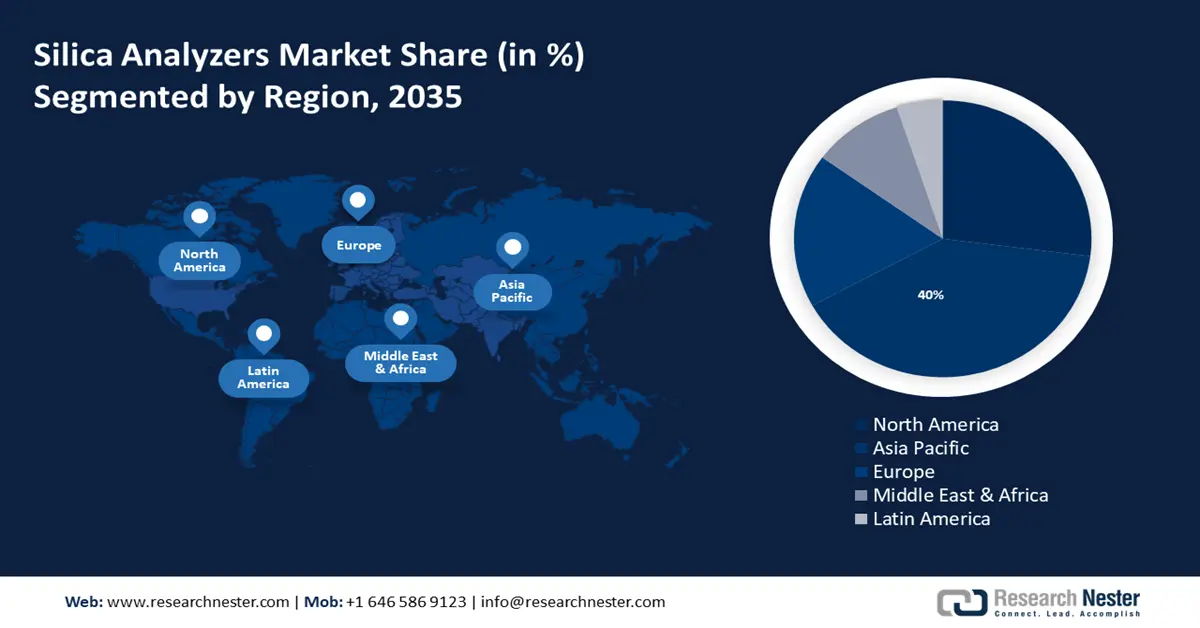

- Asia Pacific silica analyzers market will dominate around 40% share by 2035, fueled by the large number of coal-fired power plants and decarbonization initiatives in the region.

- North America market will capture a 27% share by 2035, driven by rising electricity demand, silica analyzer use in nuclear plants, and the presence of high-energy-consuming data centers.

Segment Insights:

- The equipment segment in the silica analyzers market is projected to hold a 75% share by 2035, fueled by its usage in determining elemental composition and identifying impurities across multiple industries.

- The power generation segment in the silica analyzers market is expected to hold a 70% share by 2035, driven by the necessity of monitoring silica levels in power plant operations to avoid equipment damage and inefficiencies.

Key Growth Trends:

- The user-friendly nature of silica analyzers increases its use, globally

- Increasing concerns about water quality

Major Challenges:

- Health problems related to silica

- The increasing limitation in GHG release

Key Players: HORIBA, Ltd., Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsDKK-TOA CORPORATION, Hach Company, Thermo Fisher Scientific Inc, ABB Ltd., Nikkiso Co., Ltd., METTLER TOLEDO, Swan Analytische Instrumente AG, SPX FLOW, Inc., Waltron Bull & Roberts, LLC.

Global Silica Analyzers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 156.48 million

- 2026 Market Size: USD 164.08 million

- Projected Market Size: USD 264.77 million by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 17 September, 2025

Silica Analyzers Market Growth Drivers and Challenges:

Growth Drivers

-

The user-friendly nature of silica analyzers increases its use, globally - The silica analyzers are user-friendly, easy to install, and configured which increases the use of silica analyzers globally. For instance, up to 40% of marine primary production is produced by diatoms, which need silicic acid to develop and form their opal shell.

Controlling and measuring silica (Si) concentrations is more important than ever because of the growing industry demands for more efficient energy generation and the rise in operating pressures in modern boilers. - Increasing concerns about water quality - Water is a vital component of the natural world and a resource that humans depend on. In addition to drinking it, humans utilize water for cleaning, swimming, showering, and cooking. In a similar vein, water is essential to all of the economic sectors, including manufacturing, transportation, energy, and agriculture.

As stated by the UN-Water Organization, over 80% of wastewater in the world is released back into the environment untreated or repurposed. Other than that the increasing use of silica analyzers in professional skincare products. - Extending industrial uses - The silica analyzers are widely used in different industries such as construction, pharmaceutical, food and beverages, and many more. For instance, under various experimental settings, the removal of iron from silica sand using oxalic acid has been researched to maximize process efficiency and achieve a high level of iron removal at a low cost of operation.

Since it has been discovered that silica in plants can reduce a variety of abiotic and biotic challenges, silicates are frequently added to fertilizers.

Challenges

-

Health problems related to silica - Lung illness can result from breathing in dust from materials containing crystalline silica. Particles of silica dust get lodged in lung tissue, resulting in scarring and inflammation. Additionally, the particles lessen the capacity of the lungs to absorb oxygen.

- The increasing limitation in GHG release - The rising restrictions to mitigate greenhouse gas (GHG) emissions can further impede the silica analyzers market gains. To illustrate, for carbon dioxide (CO2) emissions from fossil fuel-fired power plants, the EPA is recommending Clean Air Act emission limits and guidelines based on practical and affordable control methods.

Silica Analyzers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 156.48 million |

|

Forecast Year Market Size (2035) |

USD 264.77 million |

|

Regional Scope |

|

Silica Analyzers Market Segmentation:

Type

Equipment segment is poised to dominate around 75% silica analyzers market share by the end of 2035. The equipment of silica analyzers are used in different industrial sectors and they are determined through different measures.

Determining the precise elemental composition of advanced materials and identifying potential impurities are consequently essential components of the silica analyzers' characterization. Both the end product's qualities and production processes can be optimized with the use of this knowledge. ICP-OES or ICP-MS are flexible instruments that can be used to frequently get such information since they enable sensitive multi-element analysis in a range of matrices (e.g., high-purity materials, semiconductors, electronic materials, metals, alloys, ceramics, and polymers).

Industry

By the end of 2035, power generation segment is estimated to account for more than 70% silica analyzers market share.

Moreover, the database of the World Resource Institute contains thermal (coal, gas, oil, nuclear, biomass, waste, and geothermal) and renewable (hydro, wind, and solar) power plants, totaling over 35,000 units across 167 nations. Silica can create severe issues in power plants such as material harm, and decrease effectiveness. Silica analyzers are implemented in power plants to supervise and manage the silica level in boiled feedwater, steam, and cold water. For instance, in power plants, silicate and phosphate are measured in boiler water; 60–120 samples can be evaluated every hour.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Industry |

|

|

Silica Analyzers Type |

|

|

Technology |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Silica Analyzers Market Regional Analysis:

APAC Market Insights

Asia Pacific region in silica analyzers market is poised to dominate around 40% revenue share by the end of 2035. This advancement will be credited to the existence of a huge number of coal-fired power plants in the APAC region. In line with the International Energy Agency (IEA), to promote decarbonization initiatives, including a just transition away from coal power, two new Just Energy Transition Partnerships (JETP) were announced in 2022 in Indonesia (with a budget of USD 20 billion) and Viet Nam (USD 15.5 billion).

The rising refurbishment of coal plants and increasing coal power generation in China will propel the expansion of the silica analyzers industry. In 2021, China's installed coal-based power generation capacity amounted to 1080 GW, which represents about 50% of the country's total installed power station capacity.

The rising government support in Korea to increase the manufacturing industry will be the primary reason behind the silica analyzers market expansion in this region. To support the semiconductor sector, the Korean government plans to increase tax incentives by up to 25 percent, from the current 16 percent.

The rising construction industry in Japan will exponentially expand the industry growth of silica analyzers. In fact, even though Japan has around 475 thousand licensed construction businesses, the country's construction industry is dominated by Super Zenecon, a group of five large general contractors.

North American Market Insights

By 2035, North America region in silica analyzers market is expected to account for around 27% share and will hold the second position with a size of around 50 Million propelled by the rising demand for electricity in this region and the requirement for silica analyzers in the nuclear plants. AI in IoT uses a lot of energy, especially when it's testing, and its use is predicted to increase significantly over the next ten years. Furthermore, the United States (15) and Canada (2) account for 17 of the world's top 50 power-hungry data centers, with 14 of them situated in zones of heightened risk and one in a high-risk zone.

The rising nuclear reactor plants in the U.S. will help to create the market growth of silica analyzers in this region. Moreover, according to the U.S. Energy Information Administration (EIA), the total number of nuclear reactors in the U.S. is around 93.

Canada will account for a significant market expansion depending on the rising use of robotics in different sectors. Geographically, 81% of supplier offices for robots are located in Central Canada and these offices require silica analyzers to develop the robots properly.

Silica Analyzers Market Players:

- HORIBA, Ltd.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DKK-TOA CORPORATION

- Hach Company

- Thermo Fisher Scientific Inc

- ABB Ltd.

- Nikkiso Co., Ltd.

- METTLER TOLEDO

- Swan Analytische Instrumente AG

- SPX FLOW, Inc.

- Waltron Bull & Roberts, LLC

The expansion of the various market segments aids in the acquisition of knowledge about the various growth variables anticipated to be present across the board and in the formulation of various tactics to assist in identifying key application areas and the distinctions within the target market. Some famous key players in the silica analyzers sector are

Recent Developments

- HORIBA, Ltd. unleashed the PD Xpadion EX Reticle / Mask Particle Detection System on March 18th, 2024. As a gadget essential to the lithography technique of semiconductor manufacturing, a lot of consumers worldwide have come to love HORIBA’s series of particle detection (PD) systems, which glorifies 40 years of constant creation to address an extensive range of demands since its first inauguration in 1984.

- HORIBA TECHNO SERVICE Co., Ltd., a subsidiary of Horiba Group coupled with the research group directed by Professor Hisayoshi Yurimoto from Hokkaido University to begin the assessment of rocks, dregs, and other specimens cultivated from the Bennu asteroid by the National Aeronautics and Space Administration (NASA) OSIRIS-REx sample collector.

- Report ID: 6034

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Silica Analyzers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.