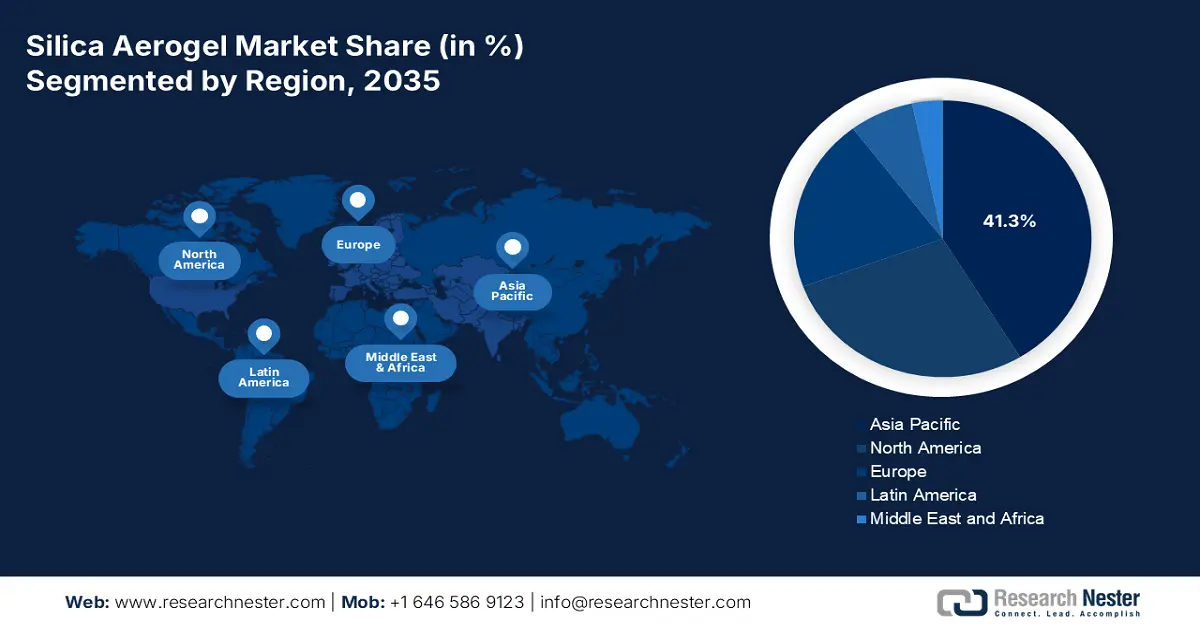

Silica Aerogel Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the silica aerogel market is anticipated to account for the highest share of 41.3% by the end of 2035. The market’s upliftment in the region is propelled by the massive industrial expansion, government-based energy efficiency mandates, and unprecedented urbanization. Besides, the presence of manufacturing sectors and colossal buildings in China, and the rapid infrastructure development in India, are also responsible for boosting the market in the region. Meanwhile, the increasing adoption of aerogel in the EV supply chain for thermal management and its extensive utilization in large-scale LNG facility projects across Southeast Asia are also driving the silica aerogel market. As per a report published by the UN-HABITAT Organization in 2025, 2.2 billion people, or 54% of the international population, reside in Asia, and by the end of 2050, this is expected to increase by 50%, leading to 1.2 billion people, which is uplifting the market.

The silica aerogel market in China is growing significantly, owing to the National Development and Reform Commission's (NDRC) mandate availability for energy intensity reduction, which has enforced upgradation in notable industries, including building materials, steel, and petrochemicals. In addition, the Ministry of Ecology and Environment's strict enforcement of emissions policy has further compelled state-based enterprises and the private sector to generously invest in standard insulation technologies. As stated in the March 2025 NLM article, the energy consumption and carbon emissions of the construction sector in the country accounted for 36% of the international energy consumption. Besides, the heat transfer caters to 35% to 495 for exterior walls, for which regional scholars are improving materials and structures of buildings, which is creating an optimistic outlook for the silica aerogel market.

The silica aerogel market in India is also growing due to the potential convergence of governmental strategies, huge infrastructure investment, and an increase in the demand for energy efficiency. Additionally, the National Green Hydrogen Mission, which is administered by the Ministry of New and Renewable Energy (MNRE), has readily allocated generous grants for hydrogen production and electrolyzer manufacturing infrastructure. As per a data report published by the India Investment Grid Government in October 2025, the Housing for All strategy in the country has been initiated by the government, wherein cost-effective housing will be offered to the urban poor population with a target of building 20 million affordable houses. Besides, USD 90.0 million funding has been provided to cities for ensuring housing requirements, which is proactively impacting the market’s growth.

Europe Market Insights

Europe in the silica aerogel market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by its establishment as a regulatory-driven and high-value field. Besides, the region’s leadership in strict governmental policy, especially the Energy Performance of Buildings Directive (EPBD) and the Europe Green Deal, is also considered a primary growth engine. These particular regulations have mandated in-depth energy advancements and near-zero-emission buildings, which have created a strong and legislated need for high-performance insulation materials. As per an article published by the World GBC Organization in March 2024, the energy performance of overall non-residential buildings is recommended to be above the 16% worst performing level by the end of 2030, while the 26% worst performing level should be achieved by the end of 2033, thus driving the overall silica aerogel market.

The silica aerogel market in Germany is gaining increased traction, owing to the presence of a robust convergence of regulatory pressure, financial commitment, and industrial demand. Besides, the cornerstone is the country’s energy transition, which has been enforced by the Federal Ministry for Economic Affairs and Climate Action for mandating a radical restriction in the building and industrial sector energy consumption. As stated in the August 2022 ETUI Organization article, the country’s chemical industry is projected to optimize its current plants and utilize electricity with lower carbon dioxide, which can result in reduced carbon dioxide emissions by 27% from 112.8 million to 82.1 million tons by the end of 2050. However, to achieve this, an overall EUR 15.0 billion of funds is expected to be allocated by the end of the same year, which is suitable for bolstering the overall market.

The silica aerogel market in Poland is also developing due to its urgent demand for transitioning from coal and successfully catering to the regional climatic obligations that attract modernization funding. Apart from these, the country is readily channeling generous grants into energy efficiency upgradation for its building and industrial sectors, being the largest beneficiary of the overall region’s Recovery and Resilience Facility (RRF) and the Modernization Fund. According to the Warsaw Business Journal in October 2022, the country’s government adopted the Long-Term Strategy for Renovation of Buildings, and 70% of the 14.2 million buildings do not significantly meet energy efficiency standards and do not comprise thermal insulation. Therefore, financial support is in huge demand, which operates under the Thermomodernization and Renovation Fund, resulting in the provision of 50,000 bonuses that amounted to PLN 3.0 billion. This is extremely suitable for optimizing energy efficiency and the technical condition of advanced residential buildings.

North America Market Insights

North America in the silica aerogel market is projected to grow steadily by the end of the stipulation period. The market’s growth in the region is highly propelled by the presence of strict energy efficiency standards, along with a developed oil and gas industry that uses aerogel for potential insulation to combat Corrosion Under Insulation (CUI). As per a data report published by the EIA Government in December 2024, the U.S. oil production, which comprises lease condensate and crude oil, has averaged 12.2 million barrels every day, and the U.S. natural gas production accounts for 121.1 billion cubic feet per day. Additionally, the region’s oil and natural gas production both successfully increased as of 2023, with an average of 13.3 million b/d and 128.8 Bcf/d. Besides, there has been a surge in producing wells, which has reached 1,031,086, thereby making it suitable for boosting the silica aerogel market in the region.

The U.S. in the silica aerogel market is gaining increased exposure, owing to the presence of federal mandates for environmental protection and energy efficiency. In addition, governmental funding, advanced manufacturing technologies, chemical safety, and green chemistry are also responsible for bolstering the market in the country. As per a data report published by the Department of Energy in September 2023, almost USD 6.0 billion has been spent on advanced and transformational industry-based facilities. Besides, USD 100 million to USD 250 million in federal share has been allocated to ensure net-zero facility build projects, while USD 75 million to USD 500 million has been allocated to provide facility-specific large installations. Meanwhile, USD 35 million to USD 75 million has been offered to ensure system upgradation and retrofits for severe unit operations, all of which positively contribute to the market’s upliftment.

Federal Funding for Energy-Intensive Industries and Processes in the U.S. (2023)

|

Industry Type |

Total Projects |

Total DOE Funding Requested (USD Billion) |

Total Private Sector Cost Share (USD Billion) |

|

Chemicals and Refining |

153 |

25.1 |

46.9 |

|

Iron, Steel, and Steel Mill Products |

40 |

11.0 |

22.7 |

|

Cement and Concrete |

53 |

5.8 |

8.3 |

|

Pulp and Paper |

26 |

3.4 |

3.8 |

|

Aluminum |

17 |

2.6 |

2.8 |

|

Glass |

17 |

2.3 |

2.4 |

|

Cross-cutting |

26 |

3.5 |

3.7 |

|

Other Energy-Based Industrial Processes |

79 |

8.1 |

9.1 |

|

Overall Requests |

411 |

More than 60.0 |

Approximately 100.0 |

|

Overall Encouraged |

130 |

- |

- |

|

Overall Target Grants |

22 to 65 |

6.0 |

- |

Source: U.S. Department of Energy

Canada in the silica aerogel market is also growing due to green construction, building energy efficiency, the presence of oil and gas, along with mining industries, the existence of a low-carbon economy, generous investments in innovative manufacturing and clean technology, and alignment with carbon pricing. According to a report published by the Government of Canada in August 2025, a commitment has been initiated to combat greenhouse gas emissions by 40% to 45% by the end of 2031, along with gaining net-zero emissions by the end of 2050. In this regard, the actual Low Carbon Economy Fund offered USD 2.0 billion for more than 7 years, and after its renewal in Budget 2022, the fund amounted to USD 2.2 billion for a similar duration. Meanwhile, Budget 2023 and 2024 significantly outlined strategies, based on which the Government of Canada diminished expenditure, and the renewed Low Carbon Economy Fund (2022) is worth USD 820 million.