Silica Aerogel Market Outlook:

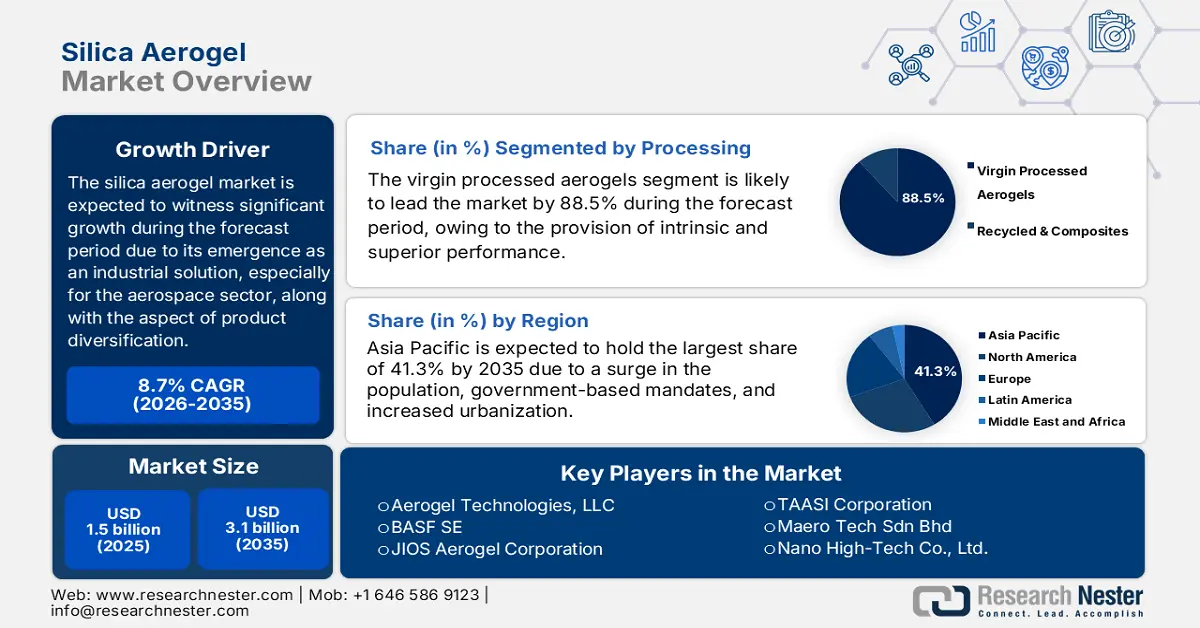

Silica Aerogel Market size was over USD 1.5 billion in 2025 and is estimated to reach USD 3.1 billion by the end of 2035, expanding at a CAGR of 8.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of silica aerogel is assessed at USD 1.6 billion.

The international silica aerogel market is currently witnessing a transformative phase, evolving from a specialized and high-cost material, which is readily utilized in aerospace, to a mainstream industrial solution. Silica aerogel is considered the lightest solid material that comprises exceptional thermal insulation properties, and it is uniquely positioned to address a few of the world’s challenges. These include the safety of electric vehicles, sustainable construction, and industrial decarbonization. According to an article published by NLM in July 2023, aerogel has a thermal conductivity of only 0.02 W/(m·K)−1, along with an ambient temperature of 25 degrees Celsius, which is considered lower than static air at 0.025 W/(m·K)−1. Besides, SiO2-based aerogel includes 80% to 99.8% high porosity, 100 to 1,400 m2/g of high specific gravity, and low density ranging between 0.003 to 0.4 g/cm3, thereby making it suitable for bolstering the silica aerogel market globally.

Furthermore, product diversification, hybrid materials, increased focus on the Asia-Pacific supply chain, vertical integration for supply chain security, and the emergence of high-performance apparel are also fueling the silica aerogel market across different nations. In the case of supply chain security, notable players are increasingly backward-integrating into exporting raw materials to ensure quality, overcome logistical disruptions, and control expenses. In this regard, the March 2023 EPA Government article denoted that the domestic production accounts for 108,000 M kg, followed by 389 M kg as imports for consumption, and 5,540 M kg for export of domestic production. Besides, as per an article published by Construction and Building Materials in March 2025, the mortar samples’ flexural strength has been evaluated through a three-point bending evaluation, and samples with added 3%, 5%, and 7% silica aerogel constituted flexural strength of 2.22 MPa, 1.94 MPa, and 1.80 MPa. Therefore, the purpose is to ensure standard silica aerogel, which is positively impacting the overall market.

Flow Value, Compressive Strength, and Flexural Strength Comparison of Different Silica Aerogel (2025)

|

Silicon Aerogel Type |

Flow Value (mm) |

Compressive Strength (MPa) |

Flexural Strength (MPa) |

|

Cement-based mortar with silica aerogel and recycled PET plastic |

165 to 122 |

9.6 to 6.3 |

2.3 to 1.5 |

|

Lightweight cement-based composite mortars using aerogel |

143 to 151 |

3.9 to 0.5 |

- |

|

Effect of micro-sized silica aerogel on lightweight cement composite |

355 to 100 |

35.7 to 8.6 |

- |

|

Aerogel incorporated concrete |

- |

61 to 8.3 |

7 to 1.2 |

|

Silica aerogel and glass aggregates size in lightweight concrete |

151 to 100 |

12.8 to 8.3 |

4.6 to 2.7 |

|

Ultra-lightweight cementitious composites |

- |

67.6 to 51.3 |

6.5 to 3.5 |

Source: Construction and Building Materials

Key Silica Aerogel Market Insights Summary:

Regional Insights:

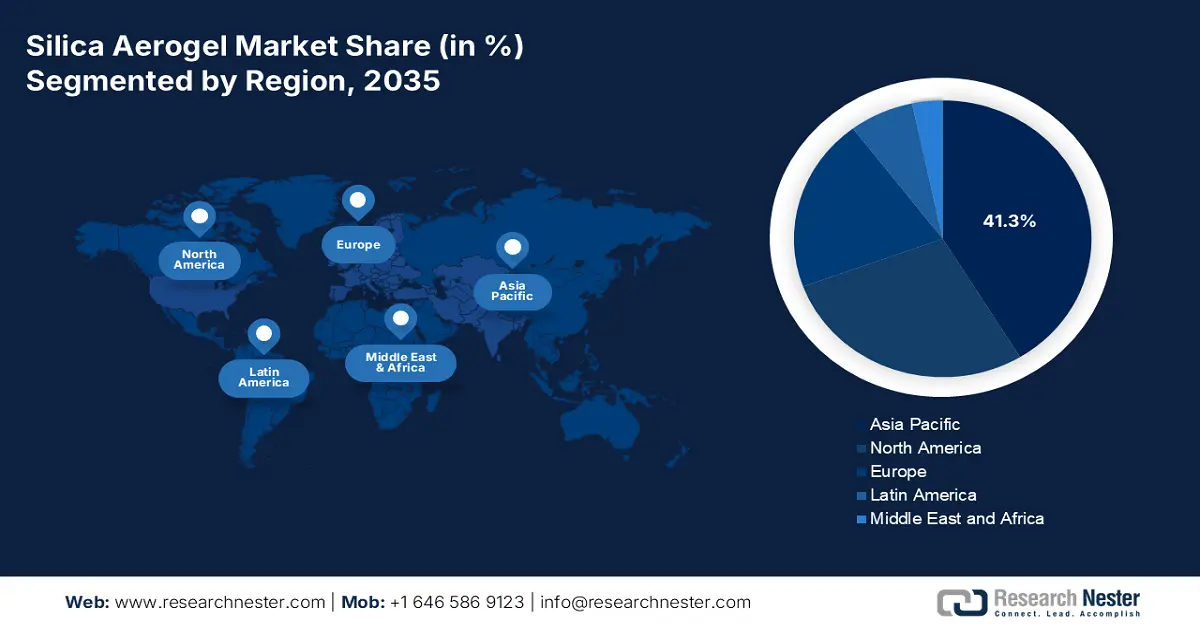

- The Asia Pacific in the silica aerogel market is projected to command a 41.3% share by 2035, supported by massive industrial expansion, government energy-efficiency mandates, and accelerating urbanization.

- Europe is expected to be the fastest-growing region by 2035, underpinned by stringent regulatory frameworks such as the EPBD and the Europe Green Deal that mandate high-performance insulation materials.

Segment Insights:

- The virgin processed aerogels sub-segment is projected to hold an 88.5% share by 2035 in the silica aerogel market, owing to its high purity and superior intrinsic performance characteristics.

- The direct sales (B2B) sub-segment is expected to secure the second-largest share by 2035, reinforced by its requirement for complex technical consultations and customized engineering integration for large-scale industrial users.

Key Growth Trends:

- Expansion in the electric vehicle battery industry

- Increasing demand from the oil and gas sector

Major Challenges:

- Handling and fragility limitations

- Intensified competition from established insulation materials

Key Players: Cabot Corporation (U.S.), Armacell International S.A. (Luxembourg), Aerogel Technologies, LLC (U.S.), BASF SE (Germany), JIOS Aerogel Corporation (South Korea), Svenska Aerogel AB (Sweden), Green Earth Aerogel Technologies (GEAT) (China), Active Aerogels (Portugal), Enersens (France), Guangdong Alison Hi-Tech Co., Ltd. (China), American Elements (U.S.), TAASI Corporation (U.S.), Maero Tech Sdn Bhd (Malaysia), Nano High-Tech Co., Ltd. (China), Surnano Aerogel Co., Ltd. (China), Ocellus, Inc. (U.S.), Gelanggang Hijau Sdn Bhd (Malaysia), Kaneka Corporation (Japan), Guizhou Aerospace Sincerity Titanium Industry Co., Ltd. (China).

Global Silica Aerogel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.1 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.3% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries:China, United States, Germany, Japan, South Korea

- Emerging Countries:India, Indonesia, Vietnam, Saudi Arabia, Mexico

Last updated on : 25 November, 2025

Silica Aerogel Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in the electric vehicle battery industry: The rapid international transition to electromobility is a strong new driver for the silica aerogel market globally. Silica aerogel’s outstanding form-factor flexibility and thermal resistance have made it a suitable material for thermal insulation and barriers within the EV battery sector, which is essential for removing thermal runaway and enhancing safety. According to the 2024 IEA Organization article, there has been a surge in EV battery demand, reaching over 750 GWh as of 2023, denoting a 40% increase since 2022. In addition, electric cars readily account for 95% of the growth, and internationally, this growth took place, owing to an increase in EV sales, while the remaining 5% growth derived from a larger average battery size, thus suitable for the market’s growth.

- Increasing demand from the oil and gas sector: The oil and gas industry is considered a mature application, which continues to be one of the major customers to utilize aerogel blankets for pipeline insulation, offshore platforms, and LNG facilities. The purpose is to combat corrosion under insulation and optimize process efficiency, which is driving the silica aerogel market’s growth. As per the 2025 IEA Organization report, the worldwide demand for oil increased due to a rise in consumption by 0.8%, which is from 1.5 EJ to 193 EJ, after jumping by 1.9% in 2023. Meanwhile, in the case of natural gas, there has been an increase in demand by 2.7%, which is 115 billion cubic metres (bcm) as of 2024. This denotes a 2.0% yearly growth rate from previous years, which is positively impacting the market’s development.

- Economic viability through manufacturing advancement: The aspect of continuous research and development (R&D), along with scaling of production processes, is steadily lowering the increased expense of aerogel manufacturing. This is further improving the return on investment (ROI) and making it accessible for a wide range of applications, which include construction. According to an article published by the World Manufacturing Foundation in October 2024, globalization has significantly developed interdependencies, based on which China is the U.S.’s primary trading partner, accounting for an estimated USD 860 billion. Besides, the international diversification of severe supply chain has increased foreign investments for setting semiconductor manufacturing centers in Malaysia, with an investment of USD 13.5 billion as of 2023.

Challenges

- Handling and fragility limitations: The intrinsic fragility of conventional silica aerogel monoliths has posed a substantial risk for many applications, which is negatively impacting the overall silica aerogel market globally. While aerogel blankets have combated this for industrial utilization, the base material is brittle and can produce dust upon handling, which has limited its utilization in applications that require structural integrity or clean environments. This dust, in turn, can also be irritant, demanding safety protocols during installation. Besides, the mechanical weakness has complicated its integration into composite materials without careful engineering to overcome crushing or cracking under load. This particular property has excluded itself from different potential applications in load-bearing and dynamic environments, including structural building elements or automotive body parts.

- Intensified competition from established insulation materials: The silica aerogel market is significantly dominated by well-entrenched and low-cost insulation materials. Products such as mineral wool, polyurethane, and polystyrene foam comprise established supply chains, a proven track record, and familiar installation protocols, which make them the default option for various contractors and engineers. Besides, the performance benefit of aerogel, while being technically superior, is frequently not compelling enough to justify increased cost for standard applications. These conventional materials continue to witness incremental optimization in their respective performance and fire resistance, further narrowing the value proposition barrier.

Silica Aerogel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 3.1 billion |

|

Regional Scope |

|

Silica Aerogel Market Segmentation:

Processing Segment Analysis

The virgin processed aerogels sub-segment in the processing segment is anticipated to garner the largest share of 88.5% by the end of 2035. The segment’s upliftment is highly attributed to its provision of high purity and possesses the superior and intrinsic performance characteristics of the basic aerogel material in its most potent form. According to an article published by NLM in July 2023, silica aerogel-based composites are significantly reinforced with fibers, and the global production of textile fibers has readily increased from 8.4 to 14.3 kg per person every year. Besides, the leftover fabric from the clothing sector accounts for nearly 20% of the textile materials’ consumption. These, in turn, are readily utilized and are considered a notable approach to diminishing the carbon footprint of the textile sector, which is further suitable for boosting the overall segment’s exposure.

Distribution Channel Segment Analysis

By the end of 2035, the direct sales (B2B), which is part of the distribution channel segment, is projected to hold the second-largest share in the silica aerogel market. The sub-segment’s development is highly fueled by its association with the product’s nature as a performance-critical and high-value engineered material. Besides, sales are not only simple transactions, but comprise complicated technical consultations, in-depth integration, and customized engineering into consumers’ operational framework. Aerogel manufacturers are dedicatedly maintaining technical sales that operate directly with large-scale industrial end users, including construction giants, automotive OEMs, and oil and gas conglomerates, to readily specify the suitable product form, offer long-lasting performance guarantees, and ensure proper installation protocols, thus suitable for bolstering the segment’s development.

Density Segment Analysis

The low density (≤ 0.1 g/cm³) sub-segment, as part of the density segment, is expected to cater to the third-largest share in the silica aerogel market by the end of the predicted duration. The segment’s development is highly fueled by aerogel’s value proposition, by achieving the maximum thermal performance with minimal mass and volume. The ultra-porous nanostructure of the sub-segment readily grants the lowest thermal connectivity of any solid material, which makes it the undisputed champion for high-efficiency insulation. Besides, its usual benefit originates in space-based properties, and it offers a similar insulating power as thick layers of conventional materials, which is regarded as the most critical factor in applications, such as building retrofits, aerospace systems, and subsea pipelines. Therefore, with such advantages, there is a huge growth for the segment within the silica aerogel market.

Our in-depth analysis of the silica aerogel market includes the following segments:

|

Segment |

Subsegments |

|

Processing |

|

|

Distribution Channel |

|

|

Density |

|

|

Form |

|

|

End user Industry |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Silica Aerogel Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the silica aerogel market is anticipated to account for the highest share of 41.3% by the end of 2035. The market’s upliftment in the region is propelled by the massive industrial expansion, government-based energy efficiency mandates, and unprecedented urbanization. Besides, the presence of manufacturing sectors and colossal buildings in China, and the rapid infrastructure development in India, are also responsible for boosting the market in the region. Meanwhile, the increasing adoption of aerogel in the EV supply chain for thermal management and its extensive utilization in large-scale LNG facility projects across Southeast Asia are also driving the silica aerogel market. As per a report published by the UN-HABITAT Organization in 2025, 2.2 billion people, or 54% of the international population, reside in Asia, and by the end of 2050, this is expected to increase by 50%, leading to 1.2 billion people, which is uplifting the market.

The silica aerogel market in China is growing significantly, owing to the National Development and Reform Commission's (NDRC) mandate availability for energy intensity reduction, which has enforced upgradation in notable industries, including building materials, steel, and petrochemicals. In addition, the Ministry of Ecology and Environment's strict enforcement of emissions policy has further compelled state-based enterprises and the private sector to generously invest in standard insulation technologies. As stated in the March 2025 NLM article, the energy consumption and carbon emissions of the construction sector in the country accounted for 36% of the international energy consumption. Besides, the heat transfer caters to 35% to 495 for exterior walls, for which regional scholars are improving materials and structures of buildings, which is creating an optimistic outlook for the silica aerogel market.

The silica aerogel market in India is also growing due to the potential convergence of governmental strategies, huge infrastructure investment, and an increase in the demand for energy efficiency. Additionally, the National Green Hydrogen Mission, which is administered by the Ministry of New and Renewable Energy (MNRE), has readily allocated generous grants for hydrogen production and electrolyzer manufacturing infrastructure. As per a data report published by the India Investment Grid Government in October 2025, the Housing for All strategy in the country has been initiated by the government, wherein cost-effective housing will be offered to the urban poor population with a target of building 20 million affordable houses. Besides, USD 90.0 million funding has been provided to cities for ensuring housing requirements, which is proactively impacting the market’s growth.

Europe Market Insights

Europe in the silica aerogel market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by its establishment as a regulatory-driven and high-value field. Besides, the region’s leadership in strict governmental policy, especially the Energy Performance of Buildings Directive (EPBD) and the Europe Green Deal, is also considered a primary growth engine. These particular regulations have mandated in-depth energy advancements and near-zero-emission buildings, which have created a strong and legislated need for high-performance insulation materials. As per an article published by the World GBC Organization in March 2024, the energy performance of overall non-residential buildings is recommended to be above the 16% worst performing level by the end of 2030, while the 26% worst performing level should be achieved by the end of 2033, thus driving the overall silica aerogel market.

The silica aerogel market in Germany is gaining increased traction, owing to the presence of a robust convergence of regulatory pressure, financial commitment, and industrial demand. Besides, the cornerstone is the country’s energy transition, which has been enforced by the Federal Ministry for Economic Affairs and Climate Action for mandating a radical restriction in the building and industrial sector energy consumption. As stated in the August 2022 ETUI Organization article, the country’s chemical industry is projected to optimize its current plants and utilize electricity with lower carbon dioxide, which can result in reduced carbon dioxide emissions by 27% from 112.8 million to 82.1 million tons by the end of 2050. However, to achieve this, an overall EUR 15.0 billion of funds is expected to be allocated by the end of the same year, which is suitable for bolstering the overall market.

The silica aerogel market in Poland is also developing due to its urgent demand for transitioning from coal and successfully catering to the regional climatic obligations that attract modernization funding. Apart from these, the country is readily channeling generous grants into energy efficiency upgradation for its building and industrial sectors, being the largest beneficiary of the overall region’s Recovery and Resilience Facility (RRF) and the Modernization Fund. According to the Warsaw Business Journal in October 2022, the country’s government adopted the Long-Term Strategy for Renovation of Buildings, and 70% of the 14.2 million buildings do not significantly meet energy efficiency standards and do not comprise thermal insulation. Therefore, financial support is in huge demand, which operates under the Thermomodernization and Renovation Fund, resulting in the provision of 50,000 bonuses that amounted to PLN 3.0 billion. This is extremely suitable for optimizing energy efficiency and the technical condition of advanced residential buildings.

North America Market Insights

North America in the silica aerogel market is projected to grow steadily by the end of the stipulation period. The market’s growth in the region is highly propelled by the presence of strict energy efficiency standards, along with a developed oil and gas industry that uses aerogel for potential insulation to combat Corrosion Under Insulation (CUI). As per a data report published by the EIA Government in December 2024, the U.S. oil production, which comprises lease condensate and crude oil, has averaged 12.2 million barrels every day, and the U.S. natural gas production accounts for 121.1 billion cubic feet per day. Additionally, the region’s oil and natural gas production both successfully increased as of 2023, with an average of 13.3 million b/d and 128.8 Bcf/d. Besides, there has been a surge in producing wells, which has reached 1,031,086, thereby making it suitable for boosting the silica aerogel market in the region.

The U.S. in the silica aerogel market is gaining increased exposure, owing to the presence of federal mandates for environmental protection and energy efficiency. In addition, governmental funding, advanced manufacturing technologies, chemical safety, and green chemistry are also responsible for bolstering the market in the country. As per a data report published by the Department of Energy in September 2023, almost USD 6.0 billion has been spent on advanced and transformational industry-based facilities. Besides, USD 100 million to USD 250 million in federal share has been allocated to ensure net-zero facility build projects, while USD 75 million to USD 500 million has been allocated to provide facility-specific large installations. Meanwhile, USD 35 million to USD 75 million has been offered to ensure system upgradation and retrofits for severe unit operations, all of which positively contribute to the market’s upliftment.

Federal Funding for Energy-Intensive Industries and Processes in the U.S. (2023)

|

Industry Type |

Total Projects |

Total DOE Funding Requested (USD Billion) |

Total Private Sector Cost Share (USD Billion) |

|

Chemicals and Refining |

153 |

25.1 |

46.9 |

|

Iron, Steel, and Steel Mill Products |

40 |

11.0 |

22.7 |

|

Cement and Concrete |

53 |

5.8 |

8.3 |

|

Pulp and Paper |

26 |

3.4 |

3.8 |

|

Aluminum |

17 |

2.6 |

2.8 |

|

Glass |

17 |

2.3 |

2.4 |

|

Cross-cutting |

26 |

3.5 |

3.7 |

|

Other Energy-Based Industrial Processes |

79 |

8.1 |

9.1 |

|

Overall Requests |

411 |

More than 60.0 |

Approximately 100.0 |

|

Overall Encouraged |

130 |

- |

- |

|

Overall Target Grants |

22 to 65 |

6.0 |

- |

Source: U.S. Department of Energy

Canada in the silica aerogel market is also growing due to green construction, building energy efficiency, the presence of oil and gas, along with mining industries, the existence of a low-carbon economy, generous investments in innovative manufacturing and clean technology, and alignment with carbon pricing. According to a report published by the Government of Canada in August 2025, a commitment has been initiated to combat greenhouse gas emissions by 40% to 45% by the end of 2031, along with gaining net-zero emissions by the end of 2050. In this regard, the actual Low Carbon Economy Fund offered USD 2.0 billion for more than 7 years, and after its renewal in Budget 2022, the fund amounted to USD 2.2 billion for a similar duration. Meanwhile, Budget 2023 and 2024 significantly outlined strategies, based on which the Government of Canada diminished expenditure, and the renewed Low Carbon Economy Fund (2022) is worth USD 820 million.

Key Silica Aerogel Market Players:

- Aspen Aerogels, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cabot Corporation (U.S.)

- Armacell International S.A. (Luxembourg)

- Aerogel Technologies, LLC (U.S.)

- BASF SE (Germany)

- JIOS Aerogel Corporation (South Korea)

- Svenska Aerogel AB (Sweden)

- Green Earth Aerogel Technologies (GEAT) (China)

- Active Aerogels (Portugal)

- Enersens (France)

- Guangdong Alison Hi-Tech Co., Ltd. (China)

- American Elements (U.S.)

- TAASI Corporation (U.S.)

- Maero Tech Sdn Bhd (Malaysia)

- Nano High-Tech Co., Ltd. (China)

- Surnano Aerogel Co., Ltd. (China)

- Ocellus, Inc. (U.S.)

- Gelanggang Hijau Sdn Bhd (Malaysia)

- Kaneka Corporation (Japan)

- Guizhou Aerospace Sincerity Titanium Industry Co., Ltd. (China)

- Aspen Aerogels, Inc. is considered a dominating international leader, well-known for its PyroThin aerogel blankets that are suitable for thermal management in the electric vehicle battery industry. The organization significantly drives industrial growth through huge capacity extensions, along with its core product line of high-performance aerogel insulation for the energy and industrial sectors. As stated in its 2024 annual report, the organization generated USD 452.7 million as consolidated revenue, along with a surge in profit margins from 24.0% in 2023 to 40.0% in 2024.

- Cabot Corporation is a notable player through its engineered silica gels and aerogels, leveraging its massive experience as an international specialty chemicals producer. The firm has focused on creating aerogel particles as well as powders for high-value applications in daylighting systems, composites, and coatings. As per its 2024 annual report, the firm generated USD 692.0 million in operational cash flow, along with USD 479.0 million as discretionary free cash flow. Additionally, the firm successfully returned USD 265.0 million to shareholders through share purchases and dividends.

- Armacell International S.A. is considered a leader in flexible foams, which has tactically entered the aerogel market by implementing aerogel technology into its established ArmaGel product line. This particular move permits the company to provide high-performance and flexible insulation solutions that tend to compete directly in technical insulation and industrial segments.

- Aerogel Technologies, LLC is one of the significant innovators, recognized for commercializing and developing the proprietary Airlane brand of flexible and polymer-based silica aerogel blankets. The organization specializes in offering custom-based aerogel solutions for applications in industrial, defense, and aerospace domains.

- BASF SE is considered the world’s largest chemical producer that contributes to the aerogel market through its research into notable inorganic materials and its Slentite product, which is a pioneering aerogel-specific insulation panel for the construction sector. The company’s involvement readily signals the material’s tactical importance and generates huge R&D capability in the industry.

Here is a list of key players operating in the global silica aerogel market:

The international silica aerogel market is semi-consolidated, with the top five organizations collectively holding a significant revenue share. Their landscape is highly characterized by intensified research and development (R&D), along with tactical expansions. Moreover, U.S.-based Aspen Aerogels and Cabot Corporation are readily dominating the silica aerogel market by leveraging robust patent portfolios as well as established industrial consumer bases. Notable strategies, such as capacity expansion and vertical integration, are suitable enough to secure supply chains and diminish expenses. Besides, in April 2025, Nouryon declared the introduction of Demeon ReNu100 propellant, which is suitable for aerosol applications in Amsterdam. This particular product readily features dimethyl ether, along with a natural origin index of 1, and has been developed from 100% bio-based methanol, thereby making it suitable for boosting the silica aerogel market’s growth.

Corporate Landscape of the Silica Aerogel Market:

Recent Developments

- In August 2025, Adani Power Ltd. successfully received the Letter of Award (LOA) for the long-lasting electricity procurement from Bihar State Power Generation Company Ltd. (BSPGCL), for supplying and setting 2,400 MW (800 MW X 3) greenfield ultra-super critical plant at Pirpainti in Bhagalpur district of Bihar.

- In April 2023, JIOS Aerogel has achieved the latest investment from Owens Corning to generously fund the introduction of its plant in Singapore, which effectively caters to the increasing demand for its technology in electric vehicle batteries.

- Report ID: 250

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Silica Aerogel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.