Sildenafil Citrate Market Outlook:

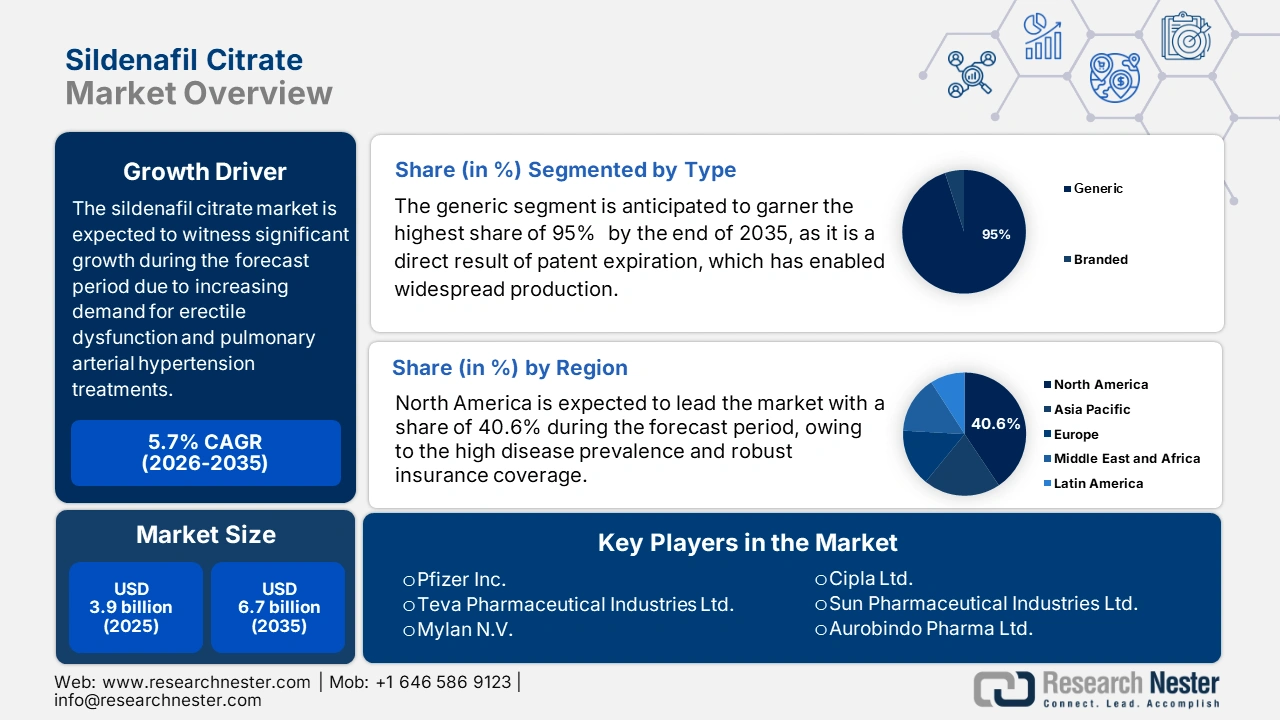

Sildenafil Citrate Market size was valued at USD 3.9 billion in 2025 and is projected to reach USD 6.7 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of sildenafil citrate is estimated at USD 4.1 billion.

The sildenafil citrate market is witnessing tremendous growth, shaped by its large patient pool affected by erectile dysfunction. For instance, the NLM study in January 2024 depicts that 150 million men around the globe have erectile dysfunction. The U.S. alone accounts for more than 52% of ED-associated prevalence, and this number increases with the rise in age. Further, this has encouraged investment in available efficient treatment procedures for such disorders. On the other hand, the supply chain for this market is global and highly consolidated.

The growing prevalence of lifestyle diseases such as hypertension, diabetes, and cardiovascular disorders has fueled rising erectile dysfunction cases worldwide, boosting demand for sildenafil citrate. As per the CDC report in July 2025, the deaths due to cardiovascular disease are registered at 32% globally. Further, many people are seeking therapy as a result of changing social norms and a decline in the stigma associated with sexual health. The availability of low-cost generics further expands consumer reach. Trade data from the U.S. International Trade Commission shows the large import and export volumes, while generics continue to ease consumer costs.

Key Sildenafil Citrate Market Insights Summary:

Regional Highlights:

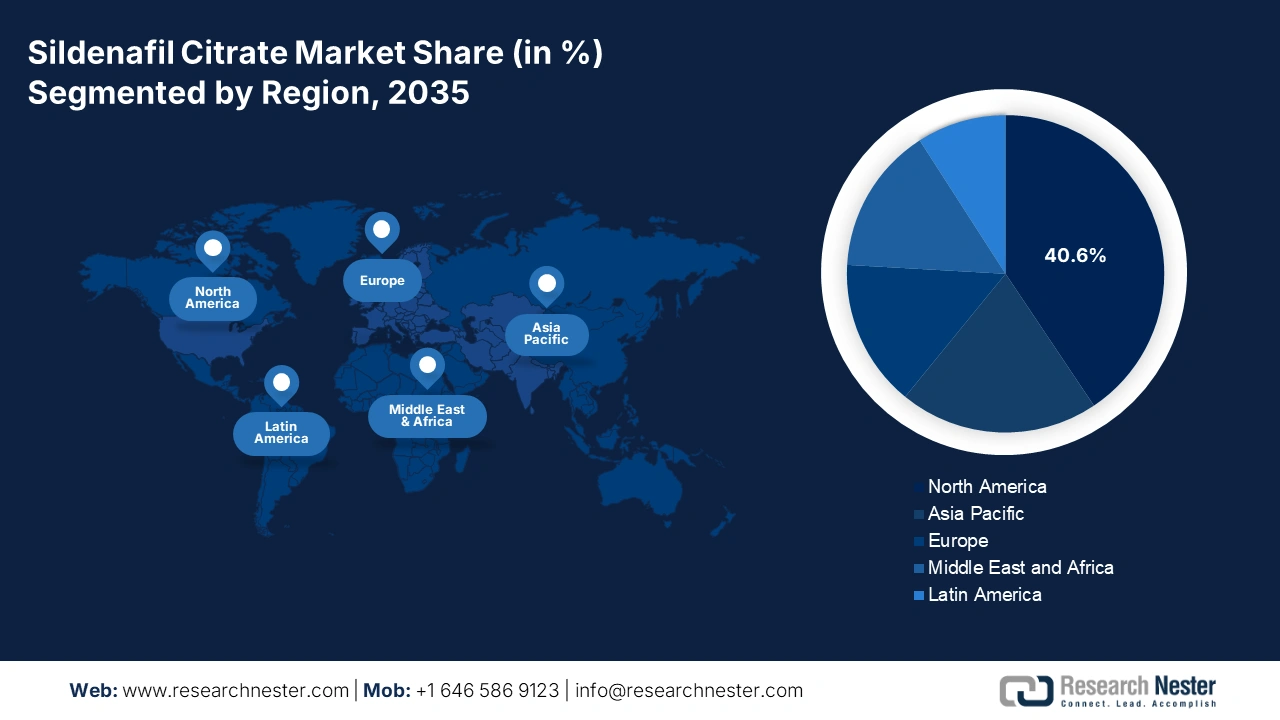

- North America is anticipated to secure a 40.6% share by 2035 in the sildenafil citrate market, underpinned by expanding insurance coverage and broader OTC accessibility owing to increasing Medicare-supported therapeutic expenditures.

- By 2035, Asia Pacific is set to attain a considerable share, supported by the rise of e-pharmacy channels and growing diagnostic awareness for erectile dysfunction fueled by the region’s extensive consumer base.

Segment Insights:

- By 2035, the generic segment in the sildenafil citrate market is expected to command a 95% type-based revenue share, reinforced by post-patent mass production enabled through payer preference for low-cost generics.

- Over 2026-2035, the adult male sub-segment is projected to retain the leading share, sustained by high erectile dysfunction prevalence among aging males propelled by rising comorbidities such as diabetes and cardiovascular disease.

Key Growth Trends:

- Increasing awareness of disease detection

- Patent expirations and affordable therapeutics

Major Challenges:

- Patent litigation risks

- Patient affordability and out-of-pocket expenses

Key Players: Pfizer Inc, Teva Pharmaceutical Industries Ltd, Viatris Inc, Aurobindo Pharma Ltd, Sun Pharmaceutical Industries Ltd, Cipla Ltd, Sandoz International GmbH, Dr. Reddy's Laboratories Ltd, Lupin Ltd., Zydus Cadila, Amneal Pharmaceuticals, Inc, Alembic Pharmaceuticals Ltd, Hikma Pharmaceuticals PLC, Sanofi S.A, Takeda Pharmaceutical Co. Ltd, Aspen Pharmacare Holdings Ltd, STADA Arzneimittel AG, Mayne Pharma Group Ltd., Hanmi Pharmaceutical Co., Ltd, Duopharma Biotech Berhad.

Global Sildenafil Citrate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 6.7 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Brazil, Indonesia, Mexico, Turkey, South Korea

Last updated on : 30 September, 2025

Sildenafil Citrate Market - Growth Drivers and Challenges

Growth Drivers

- Increasing awareness of disease detection: There is a fast-rising prevalence of erectile dysfunction that increases diagnostic awareness, driving growth in the sildenafil citrate market. In this regard, NLM data in April 2025 states that PAH cases have increased by 13.9% in high socio‐demographic index countries, highlighting the demand for the market. Besides, USPSTF now highly recommends ED screening for diabetes in men, broadening the patient pool for phosphodiesterase-5 inhibitors. Hence, these factors, which increase awareness and accessibility to affordable therapeutics, are expected to propel market growth.

- Patent expirations and affordable therapeutics: The demand for generics and patent expirations is another major driver for the sildenafil citrate market. In this regard, the U.S. FDA orange book reported that there have been 92 sildenafil approvals till date, reflecting the exceptional regulatory support. Besides, the lowered prices when compared to branded therapeutics are expanding business in emerging nations. Furthermore, the WHO report stated that its prequalification accelerated generic adoption in developing countries. Therefore, this further drags the interest of global players to invest in effective therapeutics.

- Health care cost containment and generic substitution: Payer pressure to keep costs down decisively favors generic sildenafil citrate. Multiple Abbreviated New Drug Applications (ANDAs) approved by the FDA have established a price-cutting, competitive market. AHRQ studies on cost-effective interventions always point to generic medications as critical to preventing runaway healthcare spending without sacrifice of quality. This driver forces manufacturers to compete on price and supply chain efficiency, making sildenafil one of the most cost-effective treatments in its class, which in turn expands access and volume.

Summary of Key Clinical Trials of Sildenafil Citrate

|

Trial/Study Title |

Year |

Clinical Trial Focus |

Study Population/Condition |

Key Findings |

|

Multicenter Study on Sildenafil Dosage in PAH |

2024 |

Comparison of 5 mg, 20 mg, 80 mg TID for pulmonary arterial hypertension (PAH) |

Patients with idiopathic PAH or PAH with connective tissue or congenital heart disease |

80 mg dose showed no higher mortality than 5 mg, improved event-free survival and 6MWD at 6 months; led to FDA label updates allowing titration up to 80 mg TID |

|

Bioequivalence Study of Sildenafil Orodispersible Film vs Tablet |

2023 |

Pharmacokinetics and bioequivalence of 50 mg ODF sildenafil vs film-coated tablet |

Healthy subjects |

Demonstrated overlapping plasma concentration-time profiles and comparable pharmacokinetic parameters across formulations |

|

Comparative Absorption and Tolerability of Different Sildenafil Formulations |

2025 |

Drug absorption and adverse events under fed conditions |

Healthy adult males |

Measures Tmax, Cmax, and adverse events for liquid formulations vs tablets and chewables |

Source: AHA Journal May 2024, NLM June 2023, ClinicalTrials August 2025,

Challenges

- Patent litigation risks: One of the most significant hurdles experienced by the sildenafil citrate market is the legal challenges that potentially delay the product’s market entry. In this context, the USPTO in 2024 reported that paragraph IV filings lead to an average legal cost, acting as a major market restraint. Besides, once patents expire or are invalidated, it results in highly competitive pressures in the sector, making it restrictive for the manufacturer to opt for sildenafil citrate products.

- Patient affordability and out-of-pocket expenses: Even if a product is approved and reimbursed, excessive patient co-payments can curtail adherence and demand. In the U.S., even with Medicare Part D coverage, out-of-pocket expenses for branded products can be prohibitive. The CDC reports that cost-related non-adherence with prescription medication is a serious public health problem. This problem is particularly seen in developing markets without any strong insurance system, where the major share of the expense is paid directly by patients, which tightly limits the addressable market for all but the lowest-cost generics.

Sildenafil Citrate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 6.7 billion |

|

Regional Scope |

|

Sildenafil Citrate Market Segmentation:

Type Segment Analysis

The generic segment leads the type segment in the sildenafil citrate market and is expected to hold 95% of type-based revenue share by 2035. This is the direct result of patent loss, which has made it possible for mass production. Payers such as Medicare and Medicaid highly prefer low-cost generic drugs in their formulary arrangements. The U.S. FDA’s Orange Book has a approved list of generic manufacturers, which ensures intense price competition and solidifying generic sildenafil's position. Further, this makes a default choice for prescriptions and reimbursements, making branded versions a niche segment.

Patient Type Segment Analysis

The adult male sub-segment commands the largest share in the sildenafil citrate market. This dominance is driven by the primary indication for erectile dysfunction, which is prevalent in this demographic. As per the NLM study in January 2024, males aged 40 have mostly had erectile dysfunction. Conditions like diabetes and cardiovascular disease with increasing age, are the primary reasons for expanding the addressable patient pool. This trend underscores the sustained demand for sildenafil citrate, particularly among aging male populations with rising comorbidities.

Dosage Form Segment Analysis

Tablets are dominating the dosage form segment in the sildenafil citrate market and is propelled owing to their efficiency in manufacturing, stability, and convenience in patient usage. The widespread approvals of generic tablet formats by regulatory agencies such as the FDA have established them as market leaders. The AHA Journals in May 2024 have shown that the clinical basis for sildenafil's approval for pulmonary arterial hypertension (PAH) was provided by a landmark trial of 385 patients who were randomized to take 5 mg, 20 mg, or 80 mg tablets three times a day. This strong clinical and regulatory foundation continues to reinforce tablets as the preferred and most trusted dosage form in the market.

Our in-depth analysis of the sildenafil citrate market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Dosage Form |

|

|

Distribution Channel |

|

|

Type |

|

|

Patient Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sildenafil Citrate Market - Regional Analysis

North America Market Insights

North America is a key player in the sildenafil citrate market, projected to register a significant share of 40.6% in 2035. The region benefits from a substantial consumer base, insurance coverage offered by public healthcare systems such as Medicare and Medicaid, and the bolster accessibility of over-the-counter drugs. In this regard, the Medicare expenditure for therapeutics associated with erectile dysfunctions increased from 2020 to 2024 reflecting government support. Besides, the U.S. FDA approved generic sildenafil, which has significantly driven affordability, thereby readily blistering the region’s growth.

The U.S. sildenafil citrate market is expanding rapidly and is driven by a large base of erectile dysfunction patients and pulmonary arterial hypertension usage. Low-cost generics lead due to affordability and availability. Medicare Part D covered 3,500 medications in 2021 at a gross outlay of USD 216 billion on top-selling items, according to the July 2023 KFF study. Sildenafil citrate gains in this context, using Medicare coverage trends to increase prescription availability and strengthen its market base.

The Canada sildenafil citrate market is unfolding significant growth opportunities with a surge in OTC sales, as reported by Health Canada. Besides, the public health systems of Ontario are readily enhancing their expenditures for erectile dysfunction treatments. CIHA states that the generic version of sildenafil accounts for a significant proportion of prescriptions in Canada due to its affordability. The CMA data in 2025 has provided evidence that the total healthcare expenditure reached CAD 344 billion in 2023, with 12.1% of GDP, which is reflecting sustained federal and provincial investment and, indirectly, aid access to ED treatments.

Information on Drug Manufacturer-Approved Sales in Canada

|

DIN |

DIN name |

Active Ingredient(s) |

Strength |

Dosage Form |

Route of Administration |

|

02406152 |

SILDENAFIL |

SILDENAFIL (SILDENAFIL CITRATE) |

50 MG |

TABLET |

ORAL |

|

02406160 |

SILDENAFIL |

SILDENAFIL (SILDENAFIL CITRATE) |

100 MG |

TABLET |

ORAL |

Source: Government of Canada August 2021

APAC Market Insights

Asia Pacific’s sildenafil citrate market is witnessing the fastest growth with a considerable share by 2035, owing to the expansion of e-pharmacy, rising awareness of erectile dysfunction diagnosis, and affordability of generics. Besides, the business in the sector is fueled by the presence of a large consumer base, government healthcare expenditure, and domestic pharmaceutical firms. Countries such as India, China, Japan, and South Korea significantly contribute to the APAC market with their evolutionary prosperity.

India is a leader in the sildenafil citrate market by holding a significant share in the Asia Pacific region, fueled by factors such as affordable generics offering market penetration. Besides, the patient pool report in the JAPI study in May 2024 is 31.7%. Governing bodies in the country are offering their support with funding initiatives and expanding healthcare access. Local pharmaceutical manufacturing is on the rise, further driving business in the sector. Further, the government spending on specific drugs is not always transparent, the National Health Policy emphasizes reducing out-of-pocket expenditure, influencing the preference for generics.

China is the biggest potential sildenafil citrate market and is driven by a massive population base and rising healthcare spending. The NMPA regulates a market with many domestic generic producers. The China Health Statistics Yearbook indicates a rising prevalence of chronic diseases that contribute to ED, driving patient numbers. The Frontiers article in January 2025 provides evidence that the prevalence of ED among men aged 40 to 70 is projected to be around 26%. Government expenditure is concentrated on priority drugs, yet despite the availability of sildenafil being universal, considerable demand is fulfilled through out-of-pocket expenditure, with the private sector dominating distribution and sales.

Europe Market Insights

The sildenafil citrate market in Europe is driven by strict regulatory control by the European Medicines Agency (EMA) and diverse reimbursement strategies among member states. The European Commission's push for a stronger European Health Union improves the healthcare access, on the other hand the national budgets remains as the decisive factor for market access and growth. The main trends are a strong cost-containment focus, which leads to the penetration of generics, and the centralization of procurement in certain countries to secure lower prices.

Germany is the largest shareholder in the sildenafil citrate market in Europe. Its size is attributed to the growing population and robust health insurance system, which provides broad coverage. The Federal Joint Committee (G-BA) determines reimbursement, and while patients have access, the system emphasizes off-patent generics. The German Medical Association guidelines influences the prescribing habits. Further, the market growth is tempered by reference pricing policies that makes the reimbursement level aligned with the low-cost alternatives, compelling manufacturers to compete aggressively on price.

The demand for sildenafil citrate in the UK sildenafil citrate market is consistent due to an aging male population. Expenditure is controlled by the National Health Service (NHS) through rigorous generic prescribing and competitive tendering. The NHS has announced that 81% of drugs in primary care are prescribed generically. Although no specific budget percentages for sildenafil are ever disaggregated publicly, NHS Business Services Authority figures indicate stable expenditure on erectile dysfunction drugs, indicating a policy of cost-effectiveness. The Medicines and Healthcare products Regulatory Agency (MHRA) approves both generic and branded forms, but the market is predominantly generic, which maintains public payer costs low.

Key Sildenafil Citrate Market Players:

- Pfizer Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd

- Viatris Inc

- Aurobindo Pharma Ltd

- Sun Pharmaceutical Industries Ltd

- Cipla Ltd

- Sandoz International GmbH

- Dr. Reddy's Laboratories Ltd

- Lupin Ltd.

- Zydus Cadila

- Amneal Pharmaceuticals, Inc

- Alembic Pharmaceuticals Ltd

- Hikma Pharmaceuticals PLC

- Sanofi S.A

- Takeda Pharmaceutical Co. Ltd

- Aspen Pharmacare Holdings Ltd

- STADA Arzneimittel AG

- Mayne Pharma Group Ltd.

- Hanmi Pharmaceutical Co., Ltd

- Duopharma Biotech Berhad

The sildenafil citrate market is experiencing a gain in traction due to the intensifying competition between the global firms. The key trend that shaped the global market landscape is the expiration of Viagra’s patent, which dragged the interest of leading pharmaceutical firms to develop effective formulations. The domestic players in emerging nations are prioritizing affordable therapeutic production and enhanced distribution hubs to enhance their ecosystem in the global market. Furthermore, collaborations, acquisitions to expand the product portfolio also significantly contribute to the market expansion.

Below is the list of some prominent players operating in the sildenafil citrate market:

Recent Developments

- In June 2025, Daré Bioscience and Rosy Wellness announced a strategic collaboration to educate and market Daré’s DARE to PLAY sildenafil cream. The cream is a topical formulation of sildenafil citrate specifically to increase blood flow locally to genital tissues that is the sexual arousal response in women.

- In April 2025, Aspargo Labs, Inc. launched HEZKUE, which is an oral spray of sildenafil, an active ingredient in Viagra, for erectile dysfunction that is easily available in Spain and Germany, with anticipated launches in EU markets.

- In September 2024, Viatris announced the launch of Viagra ODF which is a sildenafil citrate orodispersible film in Canada used as a new form of the erectile dysfunction treatment, which dissolves in the mouth.

- Report ID: 2582

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sildenafil Citrate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.