SiC-on-Insulator Film Market Outlook:

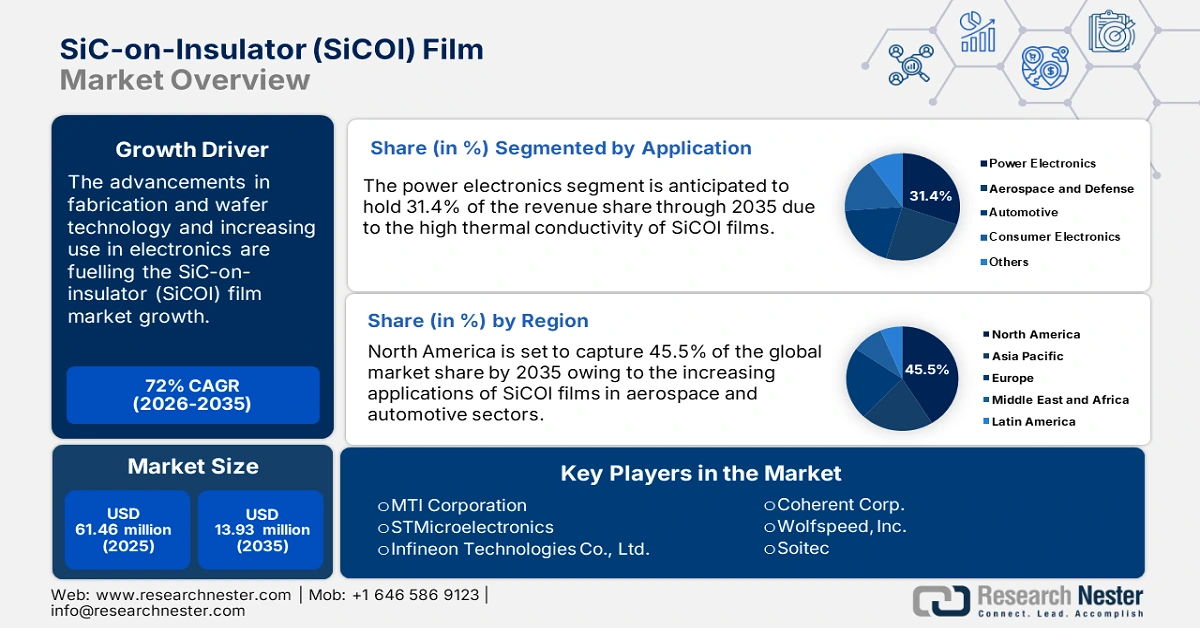

SiC-on-Insulator Film Market size was over USD 61.46 million in 2025 and is poised to exceed USD 13.93 billion by 2035, growing at over 72% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of SiC-on-Insulator film is evaluated at USD 101.29 million.

SiC-on-insulator (SiCOI) films exhibit vast applications in energy-efficient devices, gaming controls, quantum photonics, and optoelectronics. In the coming years, continuous technological advancements are estimated to expand the applications of SiCOI insulator films. These films play several roles in optoelectronic devices including, optoelectronic transistors such as passivation coating and permeation/encapsulation of layers. For instance, the global optoelectronic transistor market is projected to record significant growth during the forecast period. Considering these statistics, the rise in the demand for optoelectronic transistors is set to have a direct influence on the sales of SiC-on-insulator films.

SiC-on-insulator films effectively incorporate photonic integrated circuits, which leads to the formation of a strong platform that is effectively compatible with complementary metal-oxide semiconductor (CMOS) processing, a fabrication process used to manufacture integrated circuits. Also, SiC-on-insulator films are known for their superior thermal conductivity and ability to operate on high voltages and temperatures, this makes it an ideal component for high-performance products such as power electronics used in printed circuit boards. Thus, the increasing use of CMOS in printed circuit board production is set to positively influence the sales of SiC-on-insulator films in the coming years.

Key SiC-on-Insulator (SiCOI) Film Market Insights Summary:

Regional Highlights:

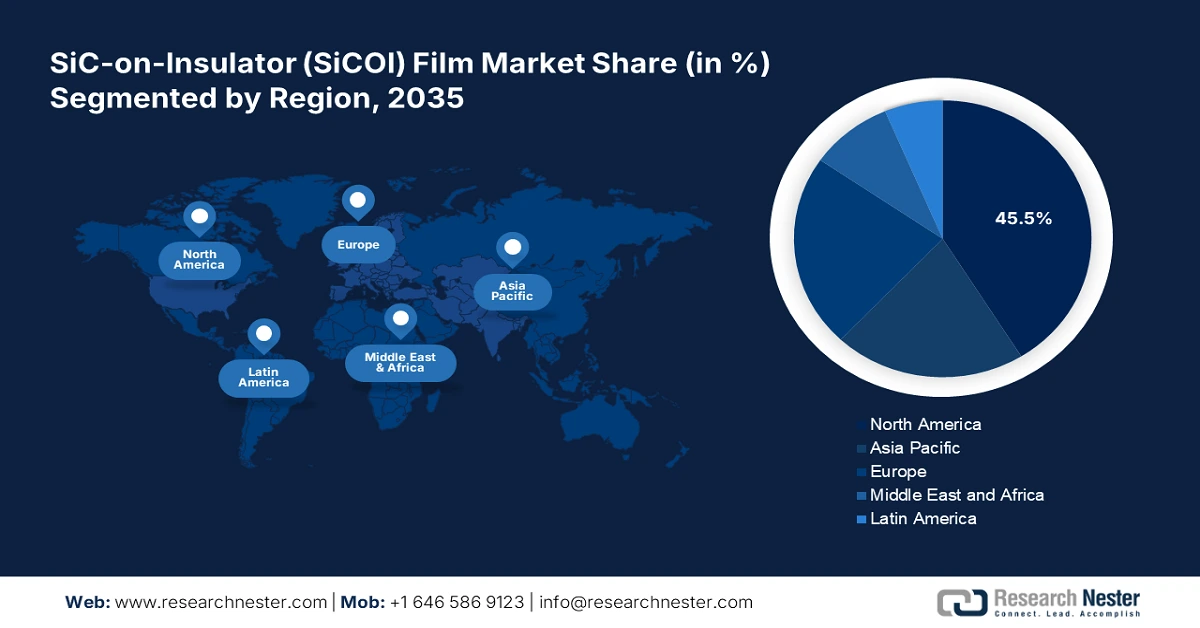

- North America commands a 45.5% share in the SiC-on-insulator film market, fueled by expanding aerospace and automotive sectors through 2026–2035.

- The Asia Pacific region is expected to see the fastest growth in the SiC-on-Insulator Film Market from 2026 to 2035, driven by advancing semiconductor and telecom sectors.

Segment Insights:

- Power Electronics segment is forecasted to achieve over 31.4% share by 2035, attributed to high thermal conductivity, energy efficiency, and use in renewable energy systems.

- The 300mm (12-inch) SiC Wafers segment of the SiC-on-Insulator Film Market is poised for lucrative growth from 2026-2035, propelled by demand for cost-effective, high-productivity wafers in semiconductor manufacturing.

Key Growth Trends:

- Innovations in SiCOI semiconductor manufacturing

- High usage of SiC-on-insulator films to enhance connectivity and boost data exchange in 5G and IoT devices

Major Challenges:

- Lack of reliable information

- High production costs

Key Players: MTI Corporation, SICC Co., Ltd., Soitec, STMicroelectronics, Infineon Technologies Co., Ltd., and Wolfspeed, Inc.

Global SiC-on-Insulator (SiCOI) Film Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.46 million

- 2026 Market Size: USD 101.29 million

- Projected Market Size: USD 13.93 billion by 2035

- Growth Forecasts: 72% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, Taiwan, Singapore

Last updated on : 14 August, 2025

SiC-on-Insulator Film Market Growth Drivers and Challenges:

Growth Drivers

- Innovations in SiCOI semiconductor manufacturing: The advancements in the fabrication techniques including wafer bonding and epitaxial growth are significantly aiding in enhancing the performance and scalability of SiC-on-insulator films. Through wafer bonding technology, the thin SiC layers can be integrated into the insulator, which reduces the size of the material needed, leading to cost savings. The SiC-on-insulator film-combined semiconductors also enhance the performance of electronic devices.

For instance, in September 2024, Resonac Holdings Corporation signed a strategic partnership agreement with Soitec to co-produce 200mm (8-inch) silicon carbide (SiC) bonded substrates, which are used as SiC epitaxial wafers in power semiconductors. The Resonac Holdings Corporation’s high-quality SiC single crystal substrates were combined using the substrate bonding technology of Soitec to enhance the productivity of 8-inch SiC wafers and expand the supply chain in the SiC epi-wafer trade. - High usage of SiC-on-insulator films to enhance connectivity and boost data exchange in 5G and IoT devices: SiC-on-insulator films are set to witness increasing applications in wireless communications such as 5G and the Internet of Things (IoT) in the coming years. The integration of SiC-on-insulator films leads to improved connectivity and quick data exchange in 5G technologies. IoT devices are interconnected to each other and require reliable technologies such as SiC-on-insulator films for effective communication and information transmission. Thus, the rising demand for 5G communication technology and IoT devices in the manufacturing sector is forecasted to boost the revenue shares of SiC-on-insulator film manufacturers in the foreseeable future.

Challenges

- Lack of reliable information: SiC-on-insulator film is an emerging technology, and many researchers are still working on its potential uses, importance, and limitations. The lack of research, awareness, and knowledge of SiC-on-insulator films is deterring end users from its use and trends. Also, the low availability of reliable data challenges the outcome accuracy of SiC-on-insulator films, making it difficult to understand its true market potential. Thus, a lack of information can limit the use of SiC-on-insulator films to some extent.

- High production costs: The complexities associated with SiC-on-insulator film manufacturing techniques are creating significant challenges for SiC-on-insulator (SiCOI) film market participants. The fabrication and manufacturing of SiC-on-insulator films require the availability of advanced materials such as silicon carbide and technologies including layer cutting and ion cutting, which increases the overall production costs.

SiC-on-Insulator Film Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

72% |

|

Base Year Market Size (2025) |

USD 61.46 million |

|

Forecast Year Market Size (2035) |

USD 13.93 billion |

|

Regional Scope |

|

SiC-on-Insulator Film Market Segmentation:

Application (Power Electronics, Aerospace and Defense, Automotive, Consumer Electronics, Others)

Power electronics segment is set to hold SiC-on-insulator (SiCOI) film market share of more than 31.4% by 2035. SiC-on-insulator films are majorly used in power electronics such as motor drives, converters, and inverters owing to their high thermal conductivity and wide bandgap. SiC-on-insulator films with a wide bandgap of 3.2 eV aid it in operating on high temperature and power levels. SiC-on-insulator film integrated power electronics compared to conventional devices significantly lowers switching losses, which makes it crucial in power converters that manage energy from several sources. Also, in renewable energy technologies such as solar inverters, SiC-on-insulator films maximize energy extraction and lower losses, improving overall system performance.

Wafer Size (100 mm (4-inch) Wafers, 150 mm (6-inch) Wafers, 200 mm (8-inch) Wafers, 300 mm (12-inch) Wafers)

300mm (12-inch) SiC wafers segment in the SiC-on-insulator (SiCOI) film market is poised to register lucrative growth till 2035. The high demand for this type of wafers is due to their larger surface area and bigger size, which increases the productivity level. 300mm (12-inch) SiC wafers find applications in the production of transistors and integrated circuits. Also, its bigger size contributes to cost-effectiveness and in the production of complex device design structures. The manufacturers of NAND (Not AND) and DRAM (Dynamic Random Access Memory) flash memory are major users of 300mm (12-inch) SiC wafers as it helps them to maximize their productivity. For instance, in July 2022, STMicroelectronics and GlobalFoundries Inc. collaborated to operate a 300mm wafer manufacturing facility in Crolles, France. This collaboration aims to produce 6,20,000 300mm wafers per year to meet the high demand from the automotive, industrial, and communication sectors.

Our in-depth analysis of the global market includes the following segments:

|

Substrate |

|

|

Wafer Size |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

SiC-on-Insulator Film Market Regional Analysis:

North America Market Forecast

North America SiC-on-insulator (SiCOI) film market is predicted to hold revenue share of more than 45.5% by 2035. The rapidly expanding aerospace and automotive sectors are swiftly fuelling the demand for SiC-on-insulator films. The increasing investments in research and development activities by key market players and supportive government policies encouraging the production of advanced power systems are further contributing to the overall market growth.

In the U.S., the local government is investing substantially in advancing the semiconductors and aerospace sector, which is expected to positively influence the demand for advanced SiC-on-insulator films. These SiCOI films are used in these sectors to increase the overall performance of the final products. For instance, the U.S. Department of Commerce reveals that the central government (Biden-Harris Administration) invested around USD 1.6 billion to establish and boost the domestic production of semiconductor advanced packaging. Furthermore, aerospace component manufacturers are actively planning to expand their manufacturing facilities by making high-investment decisions. Such moves by these firms would directly augment the demand for SiC-on-insulator films in the coming years. For instance, GE Aerospace announced its plan to invest over USD 650 million in its production units and supply chain during 2024.

Canada is also showcasing a positive contribution to the SiC-on-insulator (SiCOI) film market growth owing to expanding activities in telecommunications. For instance, the Canadian Telecommunications Association revealed that the Canada telecommunication sector invested USD 11.4 billion in capital expenditures in 2023 to enhance connectivity in the country.

Asia Pacific Market Statistics

The SiC-on-insulator (SiCOI) film market in Asia Pacific is expected to expand at a fast pace during the projected period. The expanding semiconductor manufacturing activities, advancements in fabrication and wafer technology, and swiftly developing telecommunications sector are expected to open lucrative opportunities for SiCOI film producers in the region. China, India, South Korea, and Japan are some of the high-growth markets in Asia Pacific.

China is one of the major consumers of electronics and the rapid advancements in chip and semiconductor technologies are contributing to the high adoption of SiCOI films. To enhance the semiconductor manufacturing sector the Government of China is investing over USD 150 billion from 2014 through 2030.

India’s fastest-expanding electronics system design and manufacturing and telecommunications sectors are pushing the adoption of advanced power materials including SiC-on-insulator films. According to the India Brand Equity Foundation, under the scheme for the promotion of the manufacturing of electronic components and semiconductors, the government invested around USD 1.06 billion.

Key SiC-on-Insulator Film Market Players:

- MTI Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Resonac Holdings Corporation

- SICC Co., Ltd.

- Soitec

- STMicroelectronics

- Wolfspeed, Inc.

- GlobalWafers

- Homray Material Technology

- Precision Micro-optics Inc.

- Xiamen Powerway Advanced Material Co. Ltd.

- Coherent Corp.

- SK siltron Co., Ltd

- Tianyu Semiconductor Technology Co., Ltd.

- Infineon Technologies Co., Ltd.

Leading companies in the SiC-on-insulator (SiCOI) film market are focused on the production of technologically advanced solutions. To enhance their product offerings, they are also collaborating with other players and research firms. The increasing investments in research and development activities are set to expand the application areas for SiC-on-insulator (SiCOI) films in the coming years. Apart from this, they are also employing strategies such as regional expansion and mergers & acquisitions to maximize their profit shares.

Some of the key players include:

Recent Developments

- In September 2024, Coherent Corp. announced the launch of its 200 mm silicon carbide epitaxial wafers. The company is focused on the robust production of substrate and epi-wafer of 350 microns and 500-micron thickness.

- In August 2024, Infineon Technologies Co., Ltd. revealed the opening of one of the largest and most competitive 200-millimeter silicon carbide (SiC) power semiconductor fabs in Malaysia. This factory operates on green electricity and employs sustainable manufacturing practices.

- Report ID: 6645

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.