Shell & Tube Heat Exchanger Market Outlook:

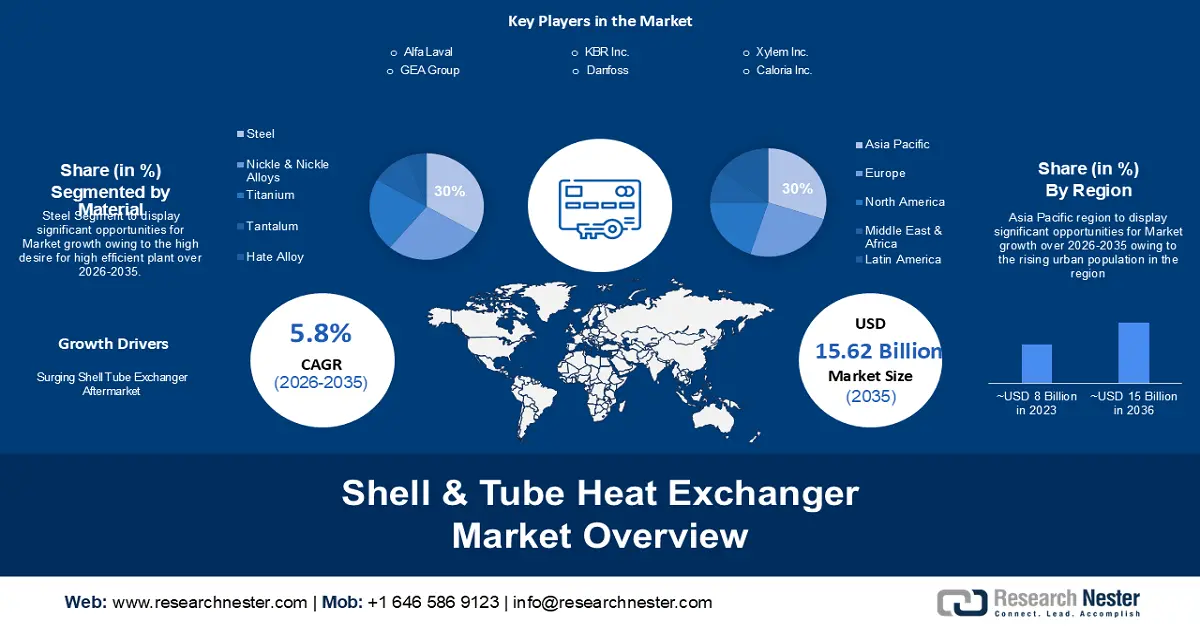

Shell & Tube Heat Exchanger Market size was over USD 8.89 billion in 2025 and is poised to exceed USD 15.62 billion by 2035, witnessing over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of shell & tube heat exchanger is estimated at USD 9.35 billion.

This growth of the market is poised to be growing demand for power generation. The world's energy consumption is predicted to rise by about 33% by 2050 as a result of rising living standards and greater regional manufacturing. Therefore, this is also estimated to increase demand for shell & tube heat exchanger. Power stations frequently utilize shell and tube heat exchangers to condense steam from turbines back into water for later usage.

Additionally, the market is expanding as a consequence of an increasing emphasis on sustainability and energy efficiency. The capacity of shell and tube heat exchangers for enhancing energy efficiency is widely recognized. They lessen the impact on the environment, operating expenses, and energy consumption by effectively transferring heat across fluids. This is in line with the global movement towards more sustainable and environmentally friendly manufacturing methods.

Key Shell & Tube Heat Exchanger Market Insights Summary:

Regional Highlights:

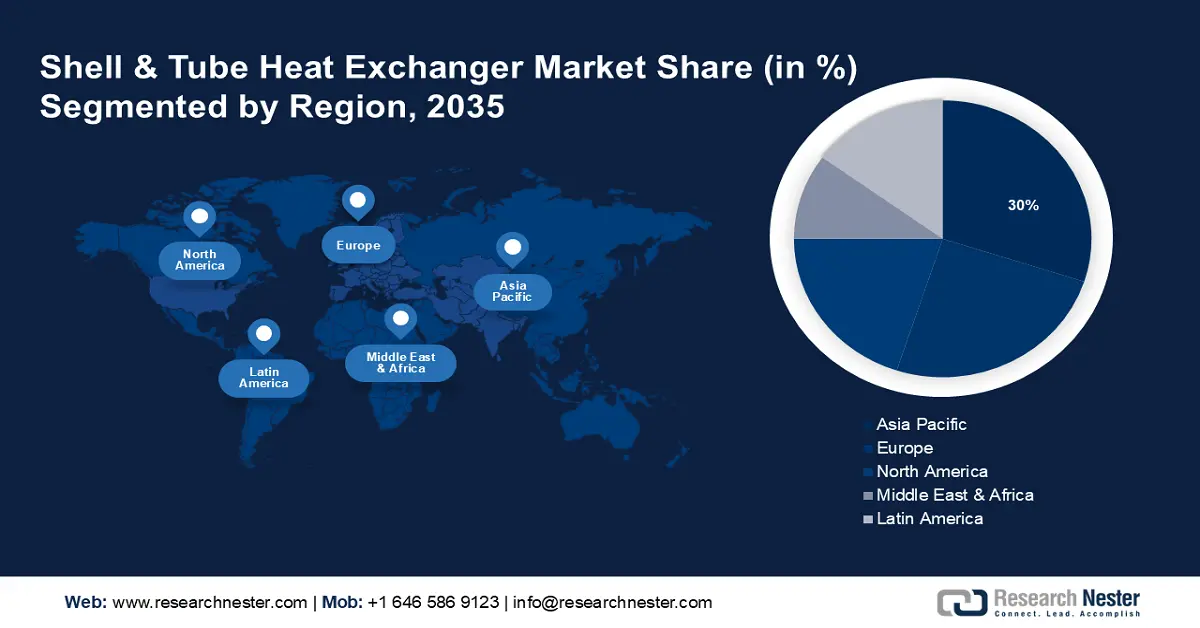

- Asia Pacific shell & tube heat exchanger market will hold more than 30% share, driven by the rising urban population and expanding chemical processing industry, forecast period 2026–2035.

Segment Insights:

- The steel segment in the shell & tube heat exchanger market is projected to attain a 30% share by 2035, fueled by the demand for efficient plant operations and corrosion-resistant, durable materials.

Key Growth Trends:

- Growing Use of Shell & Tube Heat Exchanger in Food & Beverages Industry

- Surging Shell Tube Exchanger Aftermarket

Major Challenges:

- Difficulty in Maintenance

- Volatility in Price of Raw Material

Key Players: Kelvion Holding GmbH, Alfa Laval, GEA Group, KBR Inc., SPX Flow, Inc., Danfoss, SWEP International AB, Xylem Inc., Caloria Inc., Parker Hannifin Corporation, Mitsubishi Electric Corporation, Kobe Steel, Ltd., Hitachi, Ltd., Ebara Corporation.

Global Shell & Tube Heat Exchanger Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.89 billion

- 2026 Market Size: USD 9.35 billion

- Projected Market Size: USD 15.62 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Shell & Tube Heat Exchanger Market Growth Drivers and Challenges:

Growth Drivers

- Growing Use of Shell & Tube Heat Exchanger in Food & Beverages Industry- Shell and tube heat exchangers lower energy usage, waste, and emissions while maximizing raw material utilization and production optimization. Shell and tube heat exchangers manage extremely delicate and viscous materials that can withstand high pressure pumping without obliterating food particles. It is utilized at optimal temperatures in ovens, cookers, food processing and preheating, milk pasteurization, beer cooling and pasteurization, refrigeration, and chilling of the finished product in the food and beverage industry. Additionally, through preventing the growth of dangerous bacteria, shell and tube heat exchangers prolong the shelf life of items and ensure their safety for consumption. Therefore, the shell & tube heat exchanger market will be driven during the projected period by the growing use of shell and tube heat exchangers in the food and beverage industry. Hence, with the growing demand for food the market is estimated to flourish. It is estimated that between 2010 and 2050, the overall worldwide demand for food will rise by over 34% to approximately 55%.

- Surging Shell Tube Exchanger Aftermarket- A heat exchanger is an essential part of every process industry, and its longevity and performance directly affect operating as well as capital expenditures. Shell and tube heat exchangers require routine maintenance, which can be less expensive than that of rotating equipment including pumps and compressors since breakdown repairs are always expensive. Maintaining heat exchangers is crucial to sustaining system uptime and production in order to prevent unexpected failures. Usually, preventative measures are less expensive than emergency repairs. Therefore, all these factors are projected to encourage the shell & tube heat exchanger market growth.

- Growing Utilization of Shell & Tube Exchanger in Paper & Pump Industry- The pulp and paper manufacturing sector require a lot more heat in its processes than the refining sector does, usually in the mid-to-low temperature range. In order to lower the facility's energy costs, the drying process necessitates that the air heat exchanger shell and tube be both highly successful and long-lasting. The steam generator, a U-tube heat exchanger, is used in pressurized water reactors to convert the thermal conductivity of the reactor vessel into vapor. The paper sector continues to lower its energy usage by recycling waste heat.

Challenges

- Difficulty in Maintenance - Given that a tube cooler needs enough leeway to one side in order to remove the tube nest, cleaning and maintenance becomes difficult. A shell exchange comprises several tubes installed within a cylindrical shell. is challenging to clean. If all of the tubes are not kept clean, the flow may be interrupted prematurely, which could lead to leaks and tube ruptures.

- Volatility in Price of Raw Material - A rise in the overall cost and duration of manufacturing has been caused by fluctuations in the raw material costs of steel, copper, aluminum, and other metals used in the production of shell and tube heat exchangers. Due to the volatility of raw material costs, many manufacturers find it difficult to accurately estimate the cost of manufacturing equipment. A number of variables, including the state of the economy, exchange rates, supply and demand, mining regulations, how the raw materials are processed, and others, affect how much these metals cost. Furthermore, fluctuations in prices have the potential to raise the operational costs for customers, leading to the postponement or cancellation of significant capital projects, ultimately impacting manufacturers' profitability.

- Require Huge Capital Cost

Shell & Tube Heat Exchanger Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 8.89 billion |

|

Forecast Year Market Size (2035) |

USD 15.62 billion |

|

Regional Scope |

|

Shell & Tube Heat Exchanger Market Segmentation:

Material Segment Analysis

The steel segment is predicted to account for 30% share of the global shell & tube heat exchanger market by 2035. The desire for highly efficient plant operations and the reduction of costly plant shutdowns are expected to drive an enormous rise in sales of stainless-steel shell and tube heat exchangers. The inexpensive cost of the material contributes to its increased adoption in multiple end-use industries. Stainless steel is expected to have more material penetration in heat exchangers due to its properties, which include durability against corrosion in chemical environments and cooling waters, high-temperature resistance to scaling and oxidation, good strength in low- and high-temperature applications, and resistance to corrosion-caused fouling.

End-Use Segment Analysis

The petrochemical and oil & gas industry segment is projected to generate the highest market share of over 30% over the forecast period. This growth of the segment is set to be influenced by rising demand for oil & gas. The demand for crude oil (including biofuels) was expected to reach approximately 100 million barrels per day in 2023, up from about 98 million barrels per day in 2022. Therefore, the demand for shell & tube heat exchanger is also projected to grow. This is since, high temperatures are frequently involved in oil and gas operations, and maintaining accurate temperature management is crucial to the operations' continued efficacy. By transferring heat between various fluids, shell & tube heat exchangers assist in temperature regulation and enable processes to be carried out at the appropriate temperature ranges. Furthermore, vaporization or condensation of fluids is a common process in the oil and gas industry. Shell & tube heat exchangers transmit heat among a cooling or heating medium and the fluid that needs to be evaporated or condensed, enabling these phase shifts.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Classification |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Shell & Tube Heat Exchanger Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 30% by 2035. This growth is set to be influenced by the rising urban population. For instance, Asia's cities are expanding at such a pace that by 2030, over 55 percent of the region's massive population will be living in cities. Hence, this has further increased manufacturing activities which is further set to increase demand for shell & tube heat exchanger. Furthermore, this region has a robust chemical processing industry, and the need for heat exchangers—which transmit heat in a variety of chemical processing applications—is being driven by the growing market for chemical goods.

European Market Insights

The shell & tube heat exchanger market is also set to have significant growth in the revenue during the forecast period. The major element to influence the market expansion in this region is growing infrastructure development which is further encouraging the demand for chemicals hence further influencing the market growth. Moreover, investment in renewable energy is also high in this region. As a result, the deployment of shell & tube heat exchangers is projected to rise in this region.

Shell & Tube Heat Exchanger Market Players:

- Kelvion Holding GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alfa Laval

- GEA Group

- KBR Inc.

- SPX Flow, Inc.

- Danfoss

- SWEP International AB

- Xylem Inc.

- Caloria Inc.

- Parker Hannifin Corporation

- Mitsubishi Electric Corporation

- Kobe Steel, Ltd.

- Hitachi, Ltd.

- Ebara Corporation

Recent Developments

- Kelvion has increased the range of its industrial air coolers in order to promote decarbonization through the use of natural refrigerants such as CO2, ammonia, or propane. A new piping system ensures low refrigerant charge and efficient performance. Useful for refrigerated plants, such as those found in food processing plants, distribution centers, storage facilities, and supermarkets.

- With the addition of three new facilities, Alfa Laval, a prominent worldwide supplier of specialized products and engineering solutions based on its core technologies of heat transfer, separation, and fluid handling, has bolstered its operations in the US and demonstrated its dedication to meeting the needs of its US clientele.

- Report ID: 5819

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Shell & Tube Heat Exchanger Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.