Sheet Metal Market - Growth Drivers and Challenges

Growth Drivers

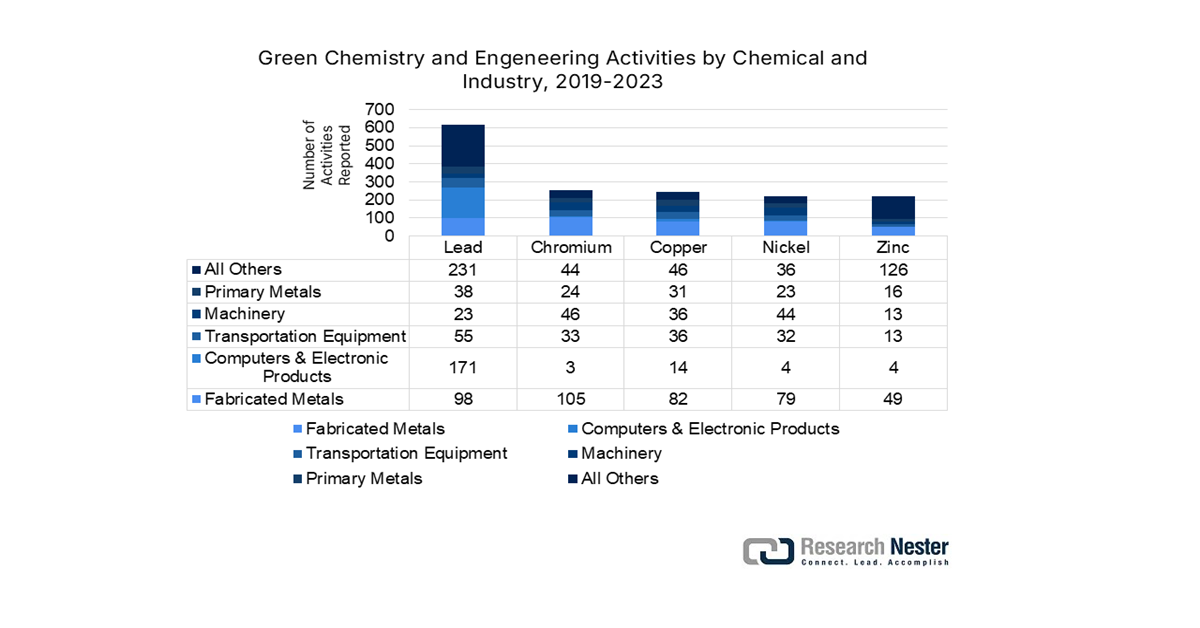

- Green chemistry and process innovation: Innovations play a crucial role in promoting sustainability within the sheet metal industry. The GREENSCOPE tool developed by the U.S. EPA aids in reducing resource consumption and hazardous waste, aligning with the objectives of its Green Chemistry Program. In a similar vein, India’s Ministry of Steel advocates for the implementation of clean technologies and process optimization to decrease energy usage and pollution. By embracing these environmentally friendly principles and innovations, the sheet metal industry can attain reduced emissions and waste, thereby improving its overall environmental performance.

Green chemistry boosts demand for sheet metal by focusing on building more energy-efficient equipment, decreasing waste that needs to be processed, and deploying innovative technologies that require long-lasting, corrosion-resistant materials. Activities include building closed-loop recycling systems that require tanks and pipes, developing novel catalytic reactors, and designing facilities for ambient temperature processing, all of which rely on sheet metal for structure and containment.

Source: epa.gov

- Automotive industry expansion: The automotive industry significantly influences the demand for sheet metal, as demonstrated by Thai Summit Kentucky Corp.'s substantial investment of $131 million aimed at expanding its operations and generating 78 full-time employment opportunities. This expansion bolsters prominent automakers, including Ford, Stellantis, Tesla, and Rivian, highlighting the vital importance of sheet metal parts in the production of vehicles. The lightweight and durable nature of sheet metal is crucial for enhancing fuel efficiency and safety within the fast-changing automotive sector.

- Infrastructure development enhances steel demand: The development of infrastructure serves as a crucial catalyst for the market. In India, the steel demand is anticipated to experience substantial growth over the coming decade, with annual growth rates projected between 5% and 7.3%. This increase is fueled by significant government investments in infrastructure initiatives, including the establishment of industrial corridors and related projects. Prominent states such as Maharashtra, Uttar Pradesh, Gujarat, Karnataka, and Tamil Nadu represented 41% of India's steel consumption in FY23, highlighting the critical role of infrastructure development in stimulating steel demand.

1. Global Sheet Metal Exports & Imports

Hot Rolled Sheet Metal Import/Export Volume (2023)

|

Region |

Import Value (in USD Mn) |

Region |

Export Value (in USD Mn) |

|

China |

145 |

U.S. |

112 |

|

Germany |

87.2 |

Jordan |

45.1 |

|

Japan |

72.1 |

Botswan |

39.8 |

Source: OEC

2. Global Aluminum Production

Aluminum Production (2025)

|

Region |

2025 Sales Volume (Million Units) |

|

China |

3870 |

|

Europe |

596 |

|

Asia-Pacific |

411 |

|

North America |

330 |

|

Africa |

140 |

|

South America |

134 |

Source: international-aluminium.org

Challenges

- Fluctuations in raw material prices: The sheet metal industry is particularly vulnerable to changes in the costs of raw materials such as steel, aluminum, and various alloys. Price fluctuations, influenced by global supply-demand disparities, trade tariffs, and geopolitical issues, can greatly affect manufacturing expenses and profit margins. This uncertainty compels companies to continuously revise their pricing strategies and manage inventory risks, complicating long-term planning.

- Environmental regulations and sustainability challenges: The sheet metal sector faces considerable challenges due to increasingly strict environmental regulations and a heightened focus on sustainability. Adhering to emission standards and waste management regulations often necessitates substantial investments in cleaner technologies and processes. Furthermore, the rising consumer preference for eco-friendly materials drives manufacturers to innovate, which can sometimes result in increased production costs and operational difficulties.

Sheet Metal Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 331.8 billion |

|

Forecast Year Market Size (2035) |

USD 510.3 billion |

|

Regional Scope |

|

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

The sheet metal market size was USD 331.8 billion in 2025.

The global sheet metal market size was USD 331.8 billion in 2025 and is likely to reach USD 510.3 billion by the end of 2035, expanding at a CAGR of 4.4% over the forecast period, i.e., 2026-2035.

Nucor Corporation, ArcelorMittal, Thyssenkrupp AG, POSCO, Tata Steel Limited, and BlueScope Steel Limited are some key players in the market.

The stainless-steel segment is expected to hold a leading share during the forecast period.

Asia Pacific is projected to offer lucrative prospects with a share of 40.5% during the forecast period.