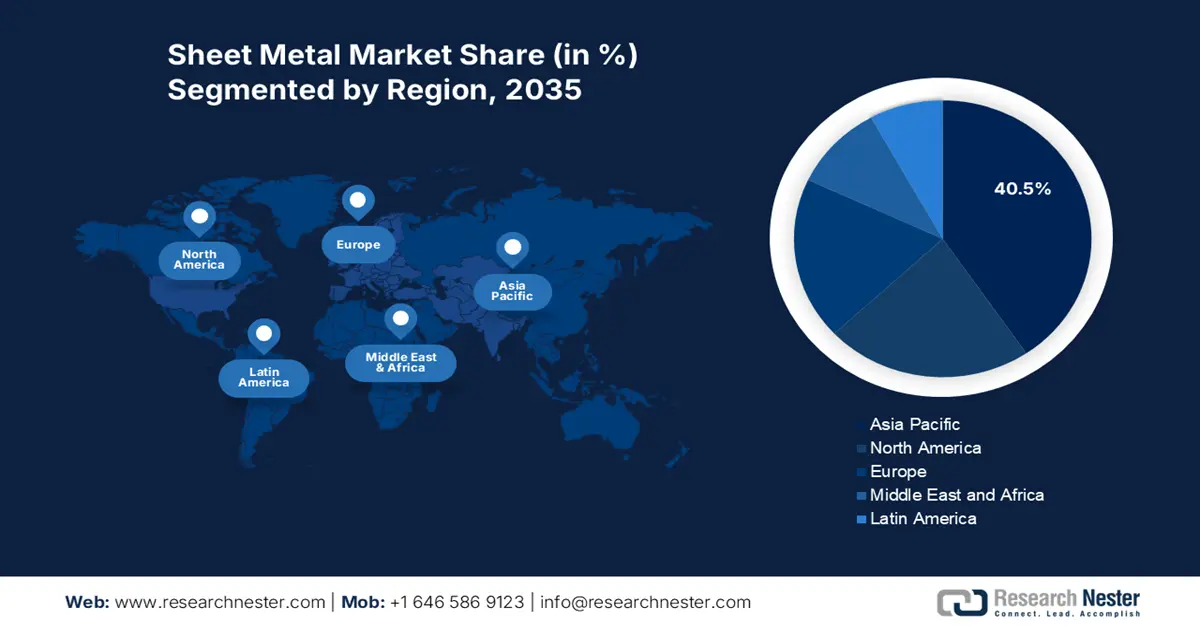

Sheet Metal Market - Regional Analysis

Asia Pacific Market Insights

By 2035, it is anticipated that the entire APAC sheet metal market will account for 40.5% of worldwide revenue, with a compound annual growth rate (CAGR) of 4.4% from 2026 to 2035. Strong industrialization, growing chemical processing demand for corrosion-resistant materials, and government-supported environmental initiatives are some of the motivators. To increase sector growth, nations place a lot of emphasis on eco-friendly chemicals, green manufacturing, and revolutionary wafer technologies (GaAs). The adoption of sustainable practices is accelerating in emerging economies, aided by financial incentives and regulatory frameworks.

By 2035, China is predicted to hold the largest revenue share in the APAC sheet metal market, accounting for 18.1% of worldwide sales. Massive industrial output, particularly in the production of chemicals and automobiles, and aggressive government investments in sustainable industrial development are important motivators. The NDRC actively promotes green technology innovation and sustainable practices, with plans to enhance enterprise roles, fiscal support, and international cooperation, aiming for green factories to exceed 40% of manufacturing output by 2030.

India is the world’s second-largest producer of crude steel, and its output has been rising steadily in recent years, reflecting growth in both industrial and infrastructure sectors. The government has set ambitious targets under the National Steel Policy to increase per capita steel consumption significantly, as well as to scale up crude steel production capacity by 2030-31. Domestic demand for finished steel is growing across end-use segments such as automotive, construction, and infrastructure, supported by policy initiatives like the Production Linked Incentive (PLI) scheme for specialty steel. With the rising consumption, India has also become more active in importing and exporting steel products, as well as investing in higher-grade steel and alloys to meet technical specifications required by sheet metal uses. Increased capacity expansions, modernization of steel mills, and regulatory support are enhancing both quality and supply reliability, which in turn reinforce growth in downstream segments like sheet metal fabrication and processing.

North America Market Insights

By 2035, the North American sheet metal market, which includes the United States and Canada, is projected to account for about 22.5% of the global market revenue share, with a compound annual growth rate (CAGR) of 3.9% from 2026 to 2035. The demand for corrosion-resistant and long-lasting materials in the chemical industry, as well as the automotive, aerospace, and construction sectors, is the main driver of the market. The industry is expanding due to advancements in lightweight metals and sophisticated fabrication techniques. Demand is also fueled by government programs that promote environmental sustainability and energy efficiency, particularly in sectors that depend on premium sheet metal components. The U.S. Department of Energy (DOE), for instance, funds advanced manufacturing research, including methods for fabricating sheet metal that use less energy and produce less waste.

Strong government assistance is advantageous to the U.S. chemical industry, which uses sheet metal extensively in infrastructure and equipment. The U.S. Department of Energy's Office of Manufacturing and Energy Supply Chains was allocated $750 million to strengthen critical material supply chains essential for clean energy technologies, including metal production equipment. Additionally, advanced manufacturing methods related to sheet metal fabrication are supported by federal funding, including initiatives run by the National Institute of Standards and Technology (NIST) that encourage environmental compliance and materials science research.

It is anticipated that Canada's sheet metal industry will expand gradually due to rising demand from the chemical, construction, and automotive industries. Canada's share of the worldwide sheet metal market is projected to reach 5.3% by 2035, with a compound annual growth rate (CAGR) of roughly 3.7% during this time frame. Strong manufacturing, a plentiful supply of raw materials, and government backing for green manufacturing projects all benefit the nation.

Europe Market Insights

The European sheet metal market represents 18.3% revenue share, characterized by high-value manufacturing and strict environmental regulations. The primary drivers of growth include the strong automotive industry, the expansion of renewable energy, and the advanced aerospace and defense sectors. The region's significant emphasis on sustainability, highlighted by the European Green Deal, is promoting the adoption of energy-efficient fabrication processes and the use of recycled materials. Furthermore, advancements in automation, laser cutting, and additive manufacturing are improving productivity, enabling manufacturers to counterbalance high labor costs and sustain global competitiveness in the face of economic challenges.

European Union Expanded Sheet Metal by country in 2022

|

Region |

Total Value (1000) USD |

Quantity (Kg) |

|

UK |

12,673.85 |

4,877,710 |

|

China |

6562.42 |

2,951,040 |

|

U.S. |

1,025.76 |

16,362 |

|

Japan |

21.69 |

1,021 |

|

India |

16.80 |

5,049 |

|

Malaysia |

3.67 |

24 |

|

Canada |

1.18 |

1,071 |

|

Indonesia |

0.02 |

2 |

|

Thailand |

0.01 |

1 |