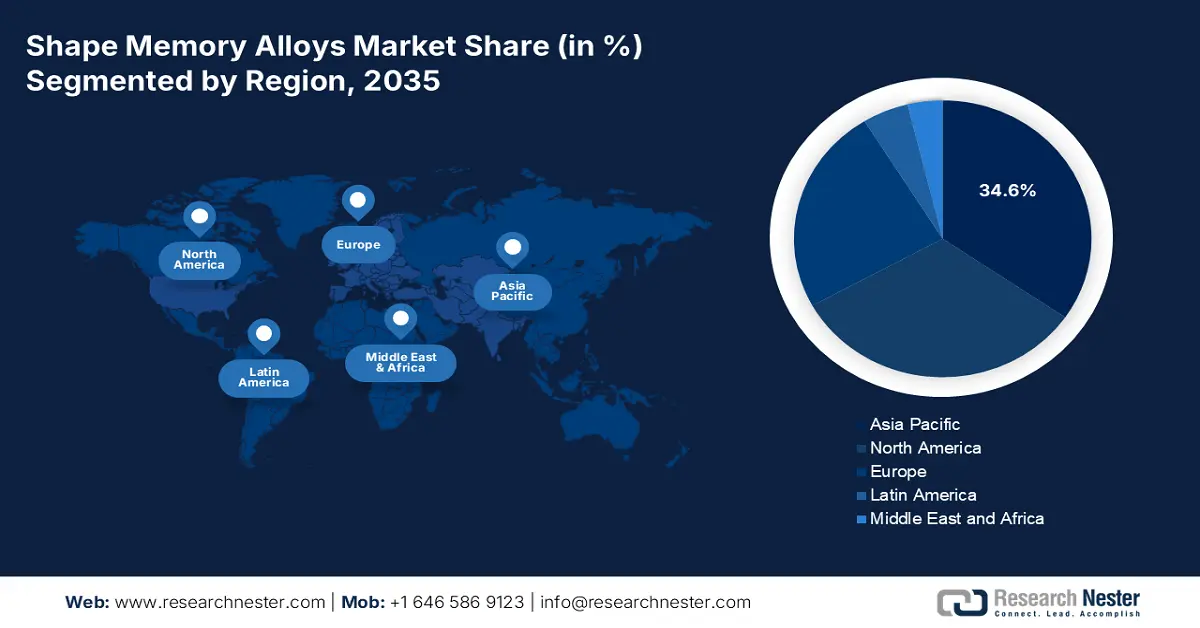

Shape Memory Alloys Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the shape memory alloys market is anticipated to hold the highest share of 34.6% by the end of 2035. The market’s upliftment in the region is primarily attributed to automotive electrification implementing compact SMA actuators, electronics miniaturization, and expansion in the biomedical. Besides, in terms of medical devices growth, the June 2025 ITA report denoted that the medical device sector in India is predicted to grow from USD 12 billion as of 2024 to USD 50 billion by the end of 2030. In addition, the country’s international medical device market share is predicted to surge from 1.6% to a range between 10% and 12% over the upcoming 25 years. Besides this, the overall region comprises a massive share of medtech clusters, OEM integration, and robust electronics ecosystems, thereby creating an optimistic outlook for the shape memory alloys market’s growth.

China in the shape memory alloys market is growing significantly, owing to standards alignment, energy efficiency, a wide-ranging industrial policy for supporting cleaner processes, and eventually benefiting thermomechanical, melting, and remelting lines. As per an article published by the State Council in September 2023, the consumer electronics sector in the country is continuously witnessing stabilized growth, with the majority of electronic device, communications, and computer manufacturers experiencing profits, amounting to 276.3 billion yuan (USD 38.3 billion) as of 2024. Besides, for instance, the mobile phone output has reached 810 million units, including 593 million smartphones. Therefore, with the country’s focus on electronic devices, there is a huge growth opportunity, along with increased expansion for the overall market in the country.

India in the shape memory alloys market is also growing due to industrial modernization, automotive electrification, and expansion in medtech capacity. In addition, standards development, process electrification, and policy for emphasizing sustainable chemistry are optimizing the environmental performance and processing quality. According to an article published by the PIB Government in September 2025, the industrial production index of the country upsurged to 3.5% year-over-year (YoY), which has been possible by the 5.4% YoY manufacturing growth. Besides, schemes such as Skill India, National Manufacturing Mission, PM MITRA, and PLI are readily fueling the industrial production processes, which in turn are uplifting the demand for shape memory alloys in the overall nation.

Europe Market Insights

Europe in the shape memory alloys market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by the presence of automotive electrification integrating compact SMA actuators, aerospace actuation, and light-weight structures, and an increase in the medtech adoption. According to an article published by the ITA in August 2024, the additive manufacturing industry in France displays 3% of the international additive market and is significantly valued at USD 600 million as of 2023. In addition, with a 17% growth rate, this industry is projected to reach a turnover of an estimated USD 700 million by the end of 2030. Moreover, standards and regulatory alignment also enhance qualification and commercialization cycles across different regional OEMs, which is creating an optimistic outlook for the shape memory alloys market’s growth in the region.

The shape memory alloys market in Germany is gaining increased traction due to automotive Tier-1 integration of actuators, aerospace primes, along with the medtech device manufacturing. In addition, the country’s ecosystem is focused on supply chain certification, testing infrastructure, and standards development, which readily escalates the commercialization of nitinol wires and tubes, as well as actuator components. As per a data report published by the GTAI in 2025, the medical technological industry in the country accounts for EUR 538 billion for the overall healthcare expenditure as of 2024, along with more than EUR 35 billion for the medical technology industry as of 2025. Besides, the domestic medtech market in the country is continuously growing at 3.3%, with approximately 1,500 medtech manufacturers, with over 20 employees, which positively caters to the market’s growth.

Medical Technology Industry by Product Area in Germany (2025)

|

Medical Technology Segments |

Market Size (EUR Billion) |

Segment Share of Total Market Volume |

|

Consumables |

8.6 |

24.3% |

|

Diagnostic Imaging |

6.1 |

17.1% |

|

Orthopedics and Prosthetics |

4.7 |

13.2% |

|

Dental Products |

3.5 |

12.3% |

|

Other Medical Products |

12.7 |

35.6% |

|

Total |

35.6 |

|

Source: GTAI

The shape memory alloys market in France is also developing due to the rapid adoption of progressive manufacturing, medtech development, and the presence of strong aerospace programs. Additionally, the double-digit growth ensured through the 2030 strategy readily supports OEM expansion for qualified SMA utilization in morphing structures, guidewires, and stents, thereby uplifting the market’s exposure. As stated in a data report published by France 2030 in March 2023, based on the Hybrid HPC Quantum approach, there has been the provision of €72.3 million in budget for ensuring research and development. In addition, the country’s government has significantly entrusted GENCI by acquiring quantum and simulators for an amount of €36.3 million. Moreover, collaboration between industry associations and research institutions has escalated standards-driven qualification, thus denoting a positive impact on the market’s upliftment.

North America Market Insights

North America is projected to experience considerable growth in the shape memory alloys market by the end of the specified period. The market’s growth in the region is extremely driven by automotive smart components, aerospace actuation systems, and biomedical device manufacturing. Besides, as per a clinical study conducted by the Oak Ridge National Laboratory in July 2023, three different Nitinol alloy compositions have been readily evaluated, with a size range between 20 to 53 µm for Alloy A, along with 53 to 109 µm for Alloy B and C. The clinical evaluation was readily performed in an argon-based atmosphere, with oxygen controlled below 500 ppm. Based on the processing, it has been evaluated that Alloy C demonstrated a significant increase in oxygen content, ranging from 53 to 109, 109 to 250, and more than 250 µm. Therefore, this further indicates higher oxygen content for the ingot, effectively utilized for atomization, thereby driving the market’s growth.

Measured Powder Composition for Nitinol Alloys (2023)

|

Alloy Type |

Certified Ni Composition (weight% %) |

Certified Ni Composition (%) |

|

Alloy A |

54.8 |

49.8 |

|

Alloy B |

55.8 |

50.8 |

|

Alloy C |

56.0 |

51.0 |

Source: Oak Ridge National Laboratory

The U.S. in the shape memory alloys market is gaining increased exposure, owing to an increase in demand, particularly in aerospace and biomedical, the existence of governmental programs and expenditure, along with federal budget allocation for chemical strategies. As per an article published by the Association for Manufacturing Technology in December 2025, there has been an increase in the latest orders for metalworking machinery, amounting to USD 538.9 million. This denotes a 9% surge from September 2025, as well as a 40.3% surge since October 2024. Additionally, machinery orders are readily tracked by USMTO, totaling USD 4.4, constituting a 19.7% increase over the past 10 months as of 2024. Moreover, this particular machinery further surpassed USD 500 million, demonstrating a rise in generous investments, thereby making it suitable for bolstering the market in the country.

Canada, in the shape memory alloys market, is also growing due to an increase in biomedical applications, aerospace and defense, automotive electrification, along with advanced manufacturing and sustainability. As stated in an article published by the Government of Canada in November 2025, the Minister of Energy and Natural Resources declared for more than USD 10 million in federal funding to assist in paving the way for adopting electric vehicles. This particular funding comprises USD 9 million through the Zero Emission Vehicle Infrastructure Program (ZEVIP). This is for projects with the New Brunswick Power Corporation and Green Economy Canada to successfully install 1,200 electric vehicle chargers. In addition, the remaining USD 1.3 million has been provided through the Energy Innovation Program for developing the latest magnetic materials to diminish the cost and optimize electric vehicle motors performance, thus fueling the market’s exposure.