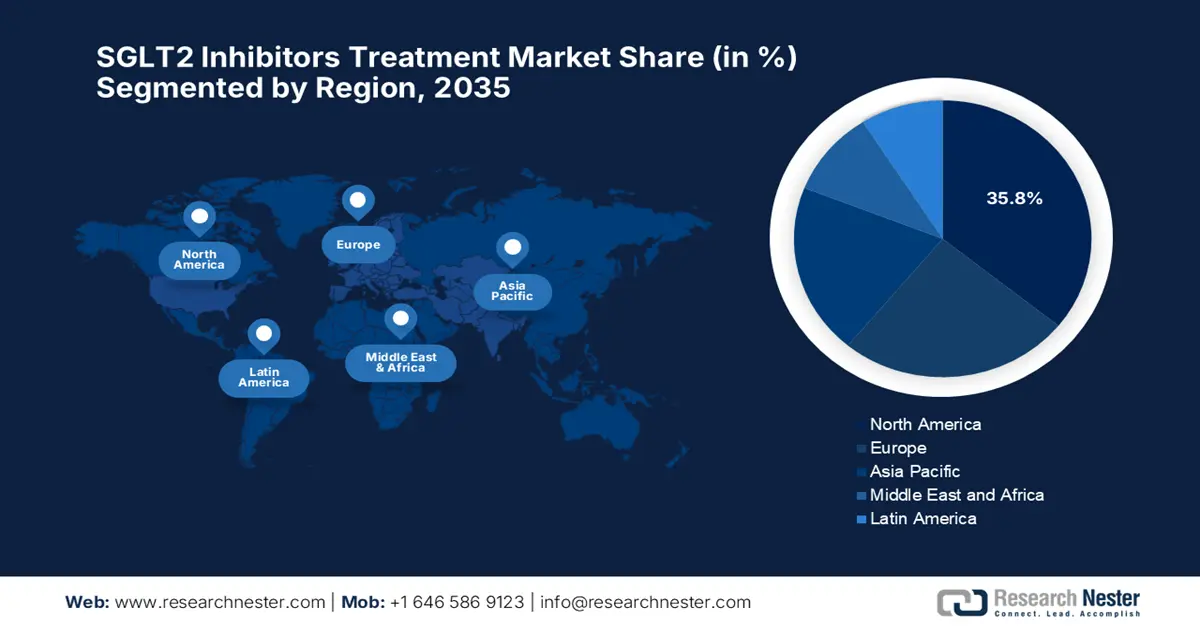

SGLT2 Inhibitors Treatment Market - Regional Analysis

North America Market Insights

North America is projected to hold the largest revenue share of 35.8% in the global SGLT2 inhibitors treatment market by the end of 2035. The region’s proprietorship in the field is attributed to the rising disease burden, regulatory advantages, and the presence of notable manufacturers. For instance, in June 2024, Astrazeneca notified that the U.S. FDA approved its Farxiga (dapagliflozin) for treating paediatric type-2 diabetes in patients aged 10 and above. It further underscored that the approval was based on the T2NOW Phase III trial, which expands Farxiga’s use from adults to children, hence denoting a positive market outlook.Canada has gained enhanced exposure in the market due to the increasing adoption of advanced therapies for managing the burden of chronic diseases. The country is a hub of innovative drugs, wherein both national and international entities are exhibiting significant growth potential. Health Canada also plays a major role in the country’s market, wherein the article from NIH in March 2024 revealed that Health Canada has approved four SGLT2 inhibitors called ertugliflozin, dapagliflozin, canagliflozin, and empagliflozin), with three currently marketed and five fixed-dose combinations. It also underscored that CADTH recommends reimbursement with conditions for almost all SGLT2 inhibitors except ertugliflozin in type 2 diabetes, and for dapagliflozin/empagliflozin in heart failure.

APAC Market Insights

Asia Pacific is likely to showcase rapid upliftment in the market owing to the increasing medical awareness, expanding healthcare infrastructure, and enhanced access to advanced therapies. Besides the countries such as China, India, and Japan dominate the regional market, supported by the existence of huge pharmaceutical firms. For instance, in February 2021, Taisho Pharmaceutical Co., Ltd., notified that it had submitted an application to Japan’s Ministry of Health, Labour and Welfare for approval to manufacture and market orally disintegrating films of its SGLT2 inhibitor drug, Lusefi. It was initially approved and launched in tablet form for treating type 2 diabetes, hence allowing a steady cash influx.

China is augmenting its leadership in the market due to the massive government support and domestic manufacturing capabilities. There has been a wider adoption of these inhibitors in the country, providing an encouraging opportunity for the domestic pioneers. For instance, in February 2024, the country’s National Medical Products Administration (NMPA) recently accepted Ganagliflozin Proline Tablets, an innovative SGLT2 inhibitor by Huisheng Pharmaceutical. The drug also offers an additional option for adult patients with type 2 diabetes to better control blood sugar, either alone or combined with metformin, hence a positive market outlook.

India is actively participating in the market, primarily propelled by large patient pools and growing adoption of these therapeutics. The country also benefits from the increasing government initiatives that are extensively striving to improve diabetes care. As of August 2025, data from MOH&FW through the NP-NCD program under the National Health Mission have implemented extensive initiatives to combat diabetes. The initiative includes the establishment of over 743 District NCD Clinics and 6,237 Community Health Center NCD Clinics to provide accessible care and early diagnosis. The program also focuses on financial support for diabetes medications and glucometers, thereby enhancing care in the country.

Europe Market Insights

Europe is projected to retain its position as the second most critical player in the SGLT2 inhibitors treatment market during the discussed timeframe. The growth in the region is heavily propelled by the endorsements by the clinical guidelines, which extensively support their use, especially among patients at high risk of heart failure and chronic kidney disease. Besides, the regulatory landscape is remarkably emerging with continued indications, thereby allowing broader adoption. Meanwhile, the innovations in terms of combination therapies are productively shaping the market, thereby positioning Europe at the forefront to generate revenue in this sector.

The U.K. is representing strong growth in the SGLT2 inhibitors treatment market, largely owing to the increasing awareness of the drug benefits and rising diabetic patient population. The country has become a targeted landscape for global investors, propelling a favorable business environment. For instance, in February 2025, Biocon Limited introduced a GLP-1 peptide, Liraglutide, for diabetes and obesity in the country, which will be marketed under the brand names Liraglutide Biocon for diabetes (Victoza) and Biolide for weight management (gSaxenda). Therefore, this launch complements and expands diabetes treatment options, potentially boosting the overall market growth.

France also holds a strong position in the SGLT2 inhibitors treatment market due to the extensive research ecosystem that encourages the development of new combination therapies. The guidelines by the country’s healthcare authorities support the use of SGLT2 inhibitors, which have helped drive adoption in both primary and specialized care settings. In June 2024, Insulet Corporation launched its Omnipod 5 automated insulin delivery system in the country, which is compatible with the Dexcom G6 continuous glucose monitor. The launch marks the first availability of the tubeless insulin pump system in the market of France, hence encouraging more integrated, personalized treatment approaches, ultimately supporting market growth