- An Outline of the Session Replay Software Market

- Market Definition

- Market Segmentation

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Solution Providers

- End Users

- Secondary Research

- Market size estimation

- Summary of the Report for Key Decision Makers

- Forces of the Market Constituents

- Factors/drivers impacting the growth of the market

- Market Trends for better business practices

- Key Market Opportunities for Business Growth

- Based on the deployment type

- Based on the enterprise size

- Based on the end user

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulations: How they would aid businesses?

- Industry Risk Analysis

- Economic Outlook: Challenges for Global Recovery and its Impact on Global Session Replay Software Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Technology Transition and Adoption Analysis

- Industry Value Chain Analysis

- Analysis on Case Studies

- Analysis on Application of Session Replay

- End User Analysis

- Analysis on Product Features adding to the market growth

- Analysis on Privacy issues around Session Replay

- Analysis on US Data Privacy Laws (GDPR vs CCPA)

- Analysis of Generic large players vs players who target a specific niche

- Key Players Analysis

- Competitive Positioning: Strategies to differentiate a company from its competitors

- Competitive Model: A Detailed Inside View for Investors

- Market Share Analysis, 2023

- Company Profiles

- Fullstory, Inc.

- Detailed overview

- Assessment of key offering

- Analysis on growth strategies

- Exhaustive analysis on key financial indicators

- Recent developments

- Mouseflow

- Hotjar Ltd.

- Smartlook

- SENTRY

- Dynatrace LLC

- Datadog

- Lucky Orange LLC

- SessionStack

- Glassbox

- LogRocket, Inc.

- Session Rewind

- Open Replay

- Content Square

- Heap, Inc. (Auryc)

- Fullstory, Inc.

- Global Session Replay Software Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Cloud, 2023-2036F (USD Million)

- On-Premises, 2023-2036F (USD Million)

- Global Session Replay Software Market Outlook & Projections, Opportunity Assessment by Enterprise Size, 2023-2036

- Small & Medium Enterprises, 2023-2036F (USD Million)

- Large Enterprises, 2023-2036F (USD Million)

- Global Session Replay Software Market Outlook & Projections, Opportunity Assessment by End User, 2023-2036

- E-Commerce, 2023-2036F (USD million)

- Hospitality, 2023-2036F (USD million)

- Fintech, 2023-2036F (USD million)

- Others, 2023-2036F (USD Million)

- Global Session Replay Software Market Demand Outlook & Projections, Market Performance by Country, 2023-2036

- North America, 2023-2036F (USD Million)

- Europe, 2023-2036F (USD Million)

- Asia Pacific, 2023-2036F (USD Million)

- Latin America, 2023-2036F (USD Million)

- Middle East & Africa, 2023-2036F (USD Million)

- Global Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Cross Analysis of Deployment Type w.r.t End User (USD Million), 2023

- North America Session Replay Software Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Market Segmentation Analysis 2023-2036

- North America Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Cloud, 2023-2036F (USD Million)

- On-Premises, 2023-2036F (USD Million)

- North America Session Replay Software Market Outlook & Projections, Opportunity Assessment by Enterprise Size, 2023-2036

- Small & Medium Enterprises, 2023-2036F (USD Million)

- Large Enterprises, 2023-2036F (USD Million)

- North America Session Replay Software Market Outlook & Projections, Opportunity Assessment by End User, 2023-2036

- E-Commerce, 2023-2036F (USD million)

- Hospitality, 2023-2036F (USD million)

- Fintech, 2023-2036F (USD million)

- Others, 2023-2036F (USD Million)

- North America Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Europe Session Replay Software Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Market Segmentation Analysis 2023-2036

- Europe Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Cloud, 2023-2036F (USD Million)

- On-Premises, 2023-2036F (USD Million)

- Europe Session Replay Software Market Outlook & Projections, Opportunity Assessment by Enterprise Size, 2023-2036

- Small & Medium Enterprises, 2023-2036F (USD Million)

- Large Enterprises, 2023-2036F (USD Million)

- Europe Session Replay Software Market Outlook & Projections, Opportunity Assessment by End User, 2023-2036

- E-Commerce, 2023-2036F (USD million)

- Hospitality, 2023-2036F (USD million)

- Fintech, 2023-2036F (USD million)

- Others, 2023-2036F (USD Million)

- Europe Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Asia Pacific Session Replay Software Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Market Segmentation Analysis 2023-2036

- Asia Pacific Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Cloud, 2023-2036F (USD Million)

- On-Premises, 2023-2036F (USD Million)

- Asia Pacific Session Replay Software Market Outlook & Projections, Opportunity Assessment by Enterprise Size, 2023-2036

- Small & Medium Enterprises, 2023-2036F (USD Million)

- Large Enterprises, 2023-2036F (USD Million)

- Asia Pacific Session Replay Software Market Outlook & Projections, Opportunity Assessment by End User, 2023-2036

- E-Commerce, 2023-2036F (USD million)

- Hospitality, 2023-2036F (USD million)

- Fintech, 2023-2036F (USD million)

- Others, 2023-2036F (USD Million)

- Asia Pacific Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Latin America Session Replay Software Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Market Segmentation Analysis 2023-2036

- Latin America Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Cloud, 2023-2036F (USD Million)

- On-Premises, 2023-2036F (USD Million)

- Latin America Session Replay Software Market Outlook & Projections, Opportunity Assessment by Enterprise Size, 2023-2036

- Small & Medium Enterprises, 2023-2036F (USD Million)

- Large Enterprises, 2023-2036F (USD Million)

- Latin America Session Replay Software Market Outlook & Projections, Opportunity Assessment by End User, 2023-2036

- E-Commerce, 2023-2036F (USD million)

- Hospitality, 2023-2036F (USD million)

- Fintech, 2023-2036F (USD million)

- Others, 2023-2036F (USD Million)

- Latin America Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Middle East & Africa Session Replay Software Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Market Segmentation Analysis 2023-2036

- Middle East & Africa Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

- Cloud, 2023-2036F (USD Million)

- On-Premises, 2023-2036F (USD Million)

- Middle East & Africa Session Replay Software Market Outlook & Projections, Opportunity Assessment by Enterprise Size, 2023-2036

- Small & Medium Enterprises, 2023-2036F (USD Million)

- Large Enterprises, 2023-2036F (USD Million)

- Middle East & Africa Session Replay Software Market Outlook & Projections, Opportunity Assessment by End User, 2023-2036

- E-Commerce, 2023-2036F (USD million)

- Hospitality, 2023-2036F (USD million)

- Fintech, 2023-2036F (USD million)

- Others, 2023-2036F (USD Million)

- Middle East & Africa Session Replay Software Market Outlook & Projections, Opportunity Assessment by Deployment Type, 2023-2036

Session Replay Software Market Outlook:

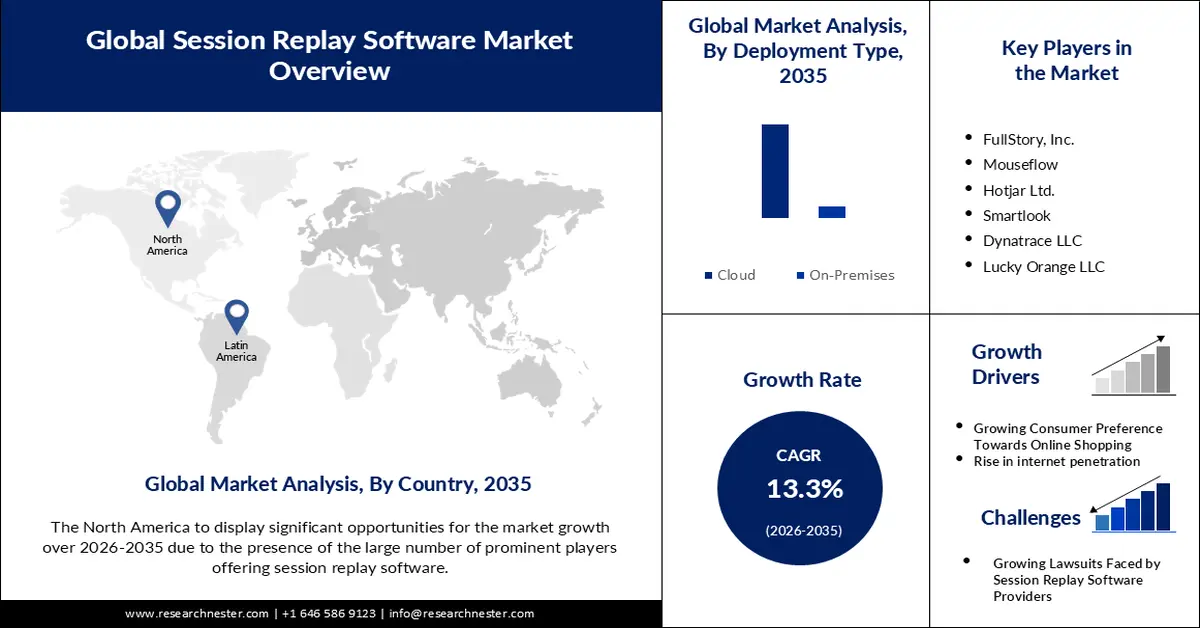

Session Replay Software Market size was valued at USD 502.32 million in 2025 and is likely to cross USD 1.75 billion by 2035, expanding at more than 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of session replay software is assessed at USD 562.45 million.

Factors attributing to the global market growth are usability of the software in identifying customer needs and user navigation and identification of website or application experience issues faced by the user in real-time.

Moreover, the growth of the e-commerce sector across the globe accelerates the market's growth. The e-commerce industry is rapidly evolving and the need for customer handling optimization tools is growing rapidly in the B2B and B2C E-commerce, further driving the need for session replay software as a way to conduct user research. B2B E-commerce is considered the industry with the lowest conversion rate at 1.8%, according to a study.

Key Session Replay Software Market Insights Summary:

Regional Insights:

- North America is projected to secure a 35% share by 2035 in the session replay software market, owing to strong provider penetration, expanding e-commerce activity, and accelerated regional digital adoption.

- The Asia Pacific region is expected to witness substantial CAGR growth by 2035, supported by increasing emphasis on user-experience enhancement and rising integration of advanced analytics and AI tools.

Segment Insights:

- By 2035, the cloud segment is projected to capture 87% share in the session replay software market, bolstered by its expanding role in enhancing user experience and supporting widespread multi-cloud adoption.

- The fintech segment is forecast to grow at a 14.3% CAGR through 2035, underpinned by rising deployment of session replay tools to improve customer responsiveness on digital financial platforms.

Key Growth Trends:

- Rising Adoption of Session Replay Software to Improve Conversion Rates

- Growing Use of Automation and Artificial Intelligence for Session Replay Integration

Major Challenges:

- Growing Lawsuits Faced by Session Replay Software Providers

- Session Replay Software May Affect User Device Performance

Key Players: FullStory, Inc., Mouseflow, Hotjar Ltd., Smartlook, SENTRY, Dynatrace LLC, Datadog, Lucky Orange LLC, SessionStack, Glassbox, LogRocket, Inc., Session Rewind, Open Replay, Contentsquare, and Heap, Inc. (Auryc).

Global Session Replay Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 502.32 million

- 2026 Market Size: USD 562.45 million

- Projected Market Size: USD 1.75 billion by 2035

- Growth Forecasts: 13.3%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, United Kingdom, Germany

- Emerging Countries: Brazil, South Korea, Australia, Canada, Singapore

Last updated on : 21 November, 2025

Session Replay Software Market - Growth Drivers and Challenges

Growth Drivers

- Rising Adoption of Session Replay Software to Improve Conversion Rates – Session replays help to resolve many website and application-related issues including bug fixes, customer onboarding, and customer engagement. Session replay software records the customer clicks and feedback as well as lets the user sync the visitor recordings with Jira, Slack, and other tools to optimize the conversion rate. On average, businesses spend USD 2,000 a month on CRO tools, with an average ROI of 223%.

- Growing Use of Automation and Artificial Intelligence for Session Replay Integration – According to a recent survey, data-driven organizations are 23 times more likely to acquire customers, 5 times more likely to retain customers, and 17 times more likely to be profitable. Artificial intelligence can sort through every issue that session replay possesses, which humans cannot. For instance, in March 2023, the release of DataRobot AI Platform 9.0, along with enhanced partner integrations, AI Accelerators, and revised service options, was announced by DataRobot.

- Launch of New Mobile Application- In June 2022, around 36,000 iOS mobile apps were launched worldwide in the App Store. The new mobile application can use a session replay atmosphere to improve the user interface.

Challenges

- Growing Lawsuits Faced by Session Replay Software Providers - In the US, the vast majority of wiretapping complaints centered on charges that businesses secretly recorded customer service phone calls. The majority of these lawsuits were filed by CIPA Sections 632 and 632.7, and several of them have reached substantial settlements. For instance, Fifth Third Bank and its vendor resolved a CIPA dispute earlier this year for a stunning USD 50 million; Wells Fargo resolved a related lawsuit for USD 28 million. Lawsuits that accuse session-replay technology of being a type of wiretapping began to gain traction around 2018 and continued into 2020.

- Session Replay Software May Affect User Device Performance

- Risk of Unethical Encounters by the Customers

Session Replay Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 502.32 million |

|

Forecast Year Market Size (2035) |

USD 1.75 billion |

|

Regional Scope |

|

Session Replay Software Market Segmentation:

Deployment Type Segment Analysis

The cloud segment share in the session replay software market is predicted to reach 87% during the projected time frame. The growth of the segment is due to the several benefits offered by cloud-based session replay software. Besides, the growth is driven by the increasing importance of user experience and engagement in the online marketplace. According to recent statistics, more than 75% of organizations have adopted a multi-cloud strategy and about 65% of the organization's infrastructure is cloud-based. Some of the key players in the cloud-based session replay software market include companies like Dynatrace LLC and others. IBM Tealeaf Customer Experience on cloud server provides session replay, mobile analytics, and hybrid cloud capabilities to assist organizations in eliminating customer frustration with web and mobile applications.

End-User Segment Analysis

Session replay software market from the fintech segment is expected to expand at 14.3% CAGR owing to the increase in the adoption of session replay to provide prompt customer attention on their banking websites and fintech-as-a-service platform. According to the Invest India, the fintech sector in India witnessed funding accounting to 14% share of global funding. Moreover, the integration of technologies such as artificial intelligence (AI) and analytics in financial is expected to create incremental growth opportunities for the session replay software market in the coming years.

Our in-depth analysis of the global session replay software market includes the following segments:

|

Deployment Type |

|

|

Enterprise Size |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Session Replay Software Market - Regional Analysis

North American Market Insights

North America industry is expected to dominate majority revenue share of 35% by 2035. The growth of the market can be attributed majorly to the high penetration of session replay software providers in the country such as FullStory, Inc., Datadog, Dynatrace LLC, and Hotjar Ltd, among others. The rapid growth of e-commerce retail is also driving the growth for session replay software as retail companies are the ones who subscribe to session replays for better customer analysis to boost their product sales. According to the US Census Bureau, Estimated U.S. retail e-commerce sales for the first quarter of 2023 were USD 272.6 billion, an increase of 3% (0.9%) from the fourth quarter of 2022. Moreover, the government of the region is highly focused on digital technology adoption in the region, further driving the development of the session replay industry.

APAC Market Insights

The Asia Pacific session replay software market is anticipated to experience a significant CAGR development throughout the projection year. The region is expected to hold significant growth owing to the growing focus on user experience optimization and the rising adoption of advanced tools. The advent of Industry 4.0 is causing extensive change in the Indian manufacturing industry's business operations. Around 54% of Indian companies have adopted analytics and artificial intelligence and this upward trend is here to stay.

Session Replay Software Market Players:

- FullStory, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Recent Development

- Regional Presence

- Mouseflow

- Hotjar Ltd.

- Smartlook

- SENTRY

- Dynatrace LLC

- Datadog

- Lucky Orange LLC

- SessionStack

- Glassbox

- LogRocket, Inc.

- Session Rewind

- Open Replay

- Content Square

- Heap, Inc. (Auryc)

Recent Developments

- SENTRY announced updates to its Performance service, making it the first and sole tool to auto-detect and notify developers on the common backend, frontend, and mobile performance issues. The platform keeps redefining application monitoring by speaking to the developers who were ignored by earlier APM technologies. Sentry is expanding the usability and scalability of its solution with a more reasonable price structure, which is helping Performance see a 97% increase in income year over year.

- Dynatrace LLC announced the addition of Session Replay for native mobile applications to its Digital Experience Module. In order to improve mobile apps for performance, feature adoption, and conversions, digital teams will be given a movie-like view of a mobile user's experience. This will allow teams to witness every click, swipe, and tap from the user's point of view.

- Report ID: 4193

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Session Replay Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.