Serverless Architecture Market Outlook:

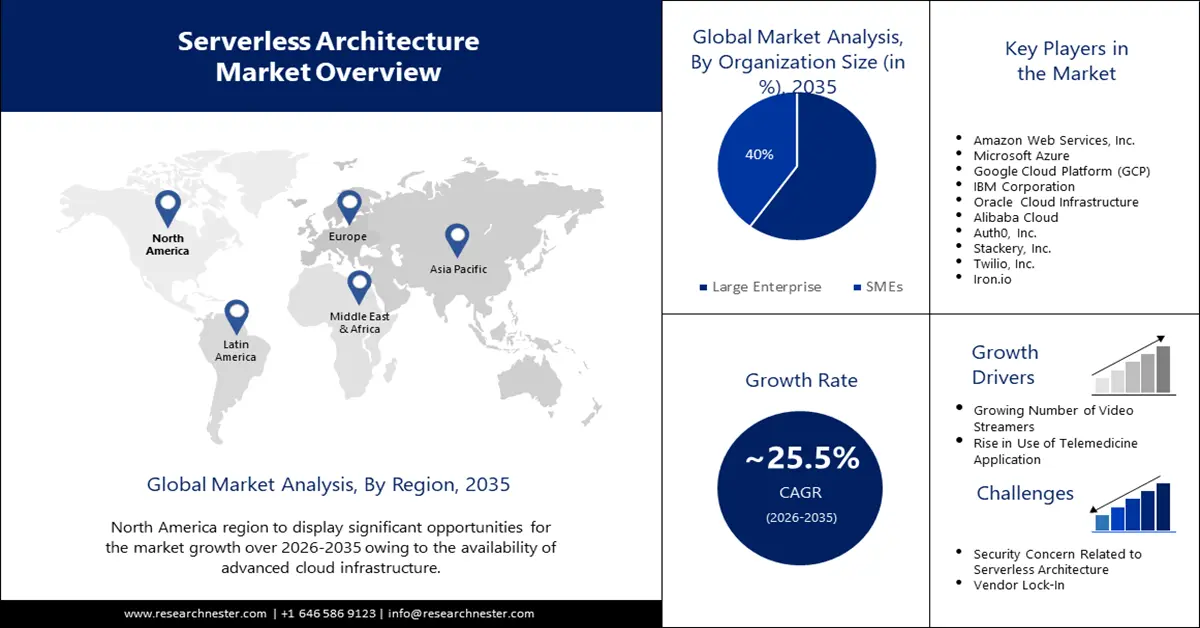

Serverless Architecture Market size was valued at USD 15.29 billion in 2025 and is set to exceed USD 148.2 billion by 2035, registering over 25.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of serverless architecture is estimated at USD 18.8 billion.

The growth of the market can be attributed to the growth in demand for e-commerce, which is further boosting building of e-commerce website. Globally, there are between about 11 million and approximately 23 million e-commerce sites, and new ones are being launched every single day. Hence, the demand for serverless architecture is growing. Web applications including e-commerce sites, content management systems, and social media platforms are frequently built using serverless architectures. Web applications may scale automatically in response to changes in demand thanks to serverless computing, which frees developers from server management duties and allows them to concentrate on building code.

Moreover, since developers may concentrate on writing code rather than maintaining infrastructure, serverless architecture offers faster application development and deployment. Launched in 2008, the iOS App Store had about 499 apps available. Today, nearly 6 million apps are accessible on the iOS and Android platforms, covering every app and game genre and specialty. Serverless architectures are also popular for IoT and mobile apps that need quick data processing and response times. Mobile and Internet of Things (IoT) applications could provide users with quicker and more dependable user experiences by leveraging serverless functionalities to process data at the edge of the network.

Key Serverless Architecture Market Insights Summary:

Regional Highlights:

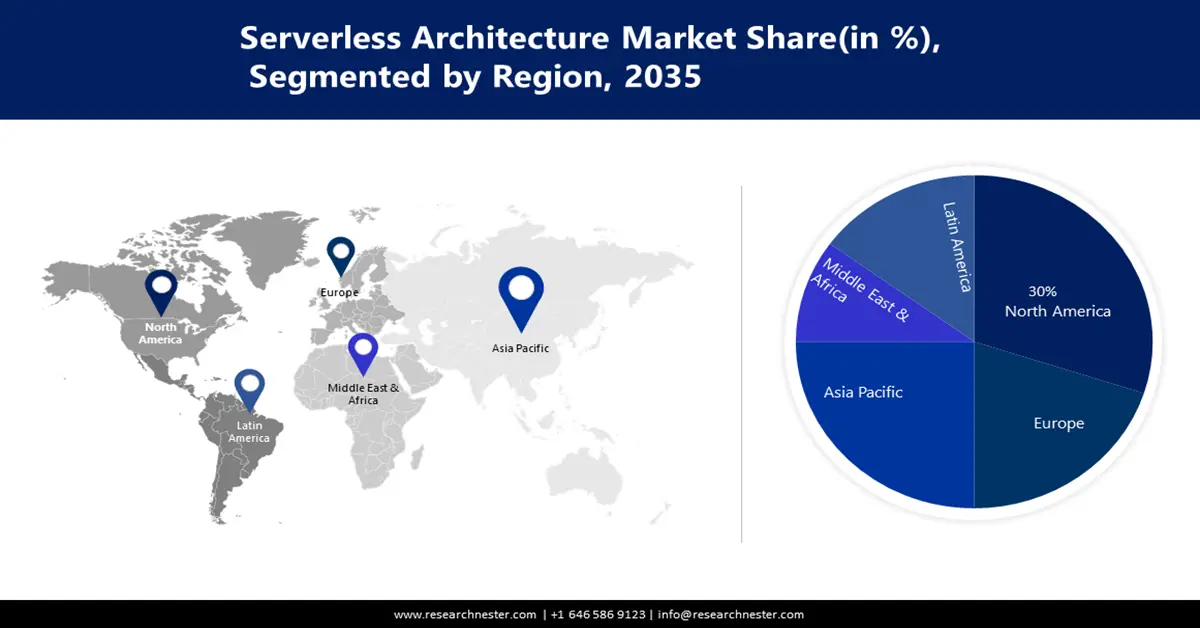

- North America serverless architecture market will dominate more than 38.8% share by 2035, driven by advanced cloud infrastructure and growing cloud deployment.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, driven by a surge in cloud popularity and need for fast application deployment.

Segment Insights:

- The public cloud segment in the serverless architecture market is projected to experience significant growth during 2026-2035, driven by scalability, affordability, and availability of public cloud services.

- The large enterprise segment in the serverless architecture market is expected to maintain the highest market share by 2035, driven by the growing number of large enterprises adopting serverless architecture for scalability and cost-effectiveness.

Key Growth Trends:

- Growing Number of Video Streamers

- Rise in Use of Telemedicine Application

Major Challenges:

- Growing Number of Video Streamers

- Rise in Use of Telemedicine Application

Key Players: Amazon Web Services, Inc., Microsoft Azure, Google Cloud Platform (GCP), IBM Corporation, Oracle Cloud Infrastructure, Alibaba Cloud, Auth0, Inc., Stackery, Inc., Twilio, Inc., Iron.io.

Global Serverless Architecture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.29 billion

- 2026 Market Size: USD 18.8 billion

- Projected Market Size: USD 148.2 billion by 2035

- Growth Forecasts: 25.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 10 September, 2025

Serverless Architecture Market Growth Drivers and Challenges:

Growth Drivers

- Growing Number of Video Streamers - About 84% of American households had access to a streaming video service as of December 2021. Streaming video apps frequently employ serverless architecture. In addition to delivering video material to end users, serverless functions may be utilized to handle video processing chores including encoding, transcoding, and resizing. Hence, with growing video streamers the serverless architecture market is estimated to grow.

- Rise in Use of Telemedicine Application - In 2022, telemedicine was used by about 36% of Americans over the age of 18. For applications such as telemedicine that need to be scalable, compliant with healthcare laws, and handle data in real-time, healthcare businesses are utilizing serverless architecture.

- Surge in Online Education - More than 2 million students are pursuing their higher education entirely online, globally currently. In the education sector, serverless architecture is being utilized to develop and deploy applications that need to be scalable and affordable, such student analytics systems and online learning platforms. Hence, it is anticipated to boost the growth of the serverless architecture market in the upcoming years.

- Growth in Online Shopping - Over the past few years, there has been an increase in the number of online shoppers across the globe. There are about 79 million more online buyers in 2023 than there were in 2022, a rise of approximately 2% annually. However, online shopping platforms frequently see increases in traffic during busy times including the holidays and sales occasions. Owing to serverless architecture, the platform could automatically scale up or down in response to these traffic surges, guaranteeing that it could manage the increased demand without the need for manual assistance.

- Upsurge in People Playing Games - Globally, there are around 2 billion active video game players. Around the world, about 3 billion gamers are projected to exist by 2024. Hence, the demand for serverless architecture is growing. Gaming firms are utilizing serverless architecture to design and implement gaming applications that need scalability and real-time data processing, such as multiplayer games and game analytics systems.

Challenges

- Security Concern Related to Serverless Architecture

- Vendor Lock-In - One potential serverless architecture market limitation is vendor lock-in, that occurs when a company gets dependent on a specific cloud service supplier's serverless platform. This may make it more difficult for the business to switch to a different supplier, which could pose an issue if the current provider increases rates or alters the services it offers.

- Unpredictable Cost of Serverless Architecture

Serverless Architecture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.5% |

|

Base Year Market Size (2025) |

USD 15.29 billion |

|

Forecast Year Market Size (2035) |

USD 148.2 billion |

|

Regional Scope |

|

Serverless Architecture Market Segmentation:

Organization

The serverless architecture market is segmented and analyzed for demand and supply by organization size into large enterprise, and SMEs. Out of which, the large enterprise segment is anticipated to garner the highest revenue by the end of 2035. The growth of the market can be attributed to growing number of large enterprises. In 2021, there were predicted to be about 351,519 large enterprises with 250 or more employees worldwide, up from approximately 337,520 in 2020. Hence, the adoption of serverless architecture is growing. Large businesses are capable of handling unforeseen, abrupt spikes in traffic or demand via serverless architecture. Serverless architecture ensures that applications could handle any level of traffic without the need for manual intervention by automatically scaling up or down. Moreover, large businesses that might have to cope with the high costs of owning and maintaining their own servers and data centers may find that serverless architecture is a cost-effective alternative. Instead of needing to maintain a predetermined amount of capacity, serverless architecture allows businesses to simply pay for the computer resources they really utilize.

Deployment Model

The global serverless architecture market is also segmented and analyzed for demand and supply by deployment model into public cloud, and private cloud. Amongst which, the public cloud is estimated to have the significant growth over the forecast period. As a result of their scalability, availability, and affordability, public clouds including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are frequently chosen for serverless architecture. Public clouds may provide on-demand access to a variety of serverless services and resources, which could be quickly and simply scaled up or down to suit changing demand. In addition to its pay-as-you-go pricing options, which allow businesses to only pay for the resources they use, public cloud is also cost-effective for serverless architecture. Advanced technologies including machine learning, artificial intelligence, and big data analytics are readily available through public cloud providers and may be incorporated into serverless applications. These technologies could be also provided by private cloud. However, a private cloud might not provide the same level of scalability and flexibility as a public cloud and may cost more to set up and maintain. Since public cloud companies have more money to devote to R&D, private cloud providers might not provide the same level of access to cutting-edge technologies. Hence, the demand for public cloud is more in serverless architecture.

Our in-depth analysis of the global market includes the following segments:

|

By Deployment Model |

|

|

By Application |

|

|

By Organization Size |

|

|

By Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Serverless Architecture Market Regional Analysis:

North American Market Insights

North America region is poised to dominate around 38.8% market share by 2035, fueled by advanced cloud infrastructure and growing cloud deployment. Approximately 43% of conventional small firms use cloud hosting or infrastructure. This contrasts with about 73% of corporations and approximately 65% of small tech companies in US. Major cloud service providers with a significant presence in North America, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, give businesses access to a variety of serverless services and resources. As a result of this, implementing serverless architecture and reaping its benefits has become simpler for businesses in North America. Moreover, the high emphasis on innovation and technology is another element boosting the market in the region. Many businesses in North America are at the cutting edge of innovation and are constantly looking for ways to enhance their processes and beat out the competition. A flexible and scalable way to create and deploy applications, serverless architecture is a desirable alternative for businesses wishing to update their IT infrastructure. Therefore, all these factors are anticipated to expand the growth of the market in the region.

APAC Market Insights

The Asia Pacific serverless architecture market is estimated to be the second largest, to have the highest growth. In recent years, there has been a noticeable surge in the popularity of the cloud throughout the region, with many organizations moving their IT infrastructure there. Given the need to build and deploy applications fast and effectively, serverless architecture has experienced a significant increase in demand. Moreover, large and diverse companies as well as small and medium-sized firms make up the consumer base in the Asia Pacific region. In a variety of sectors, including manufacturing, retail, healthcare, and more, this results in a significant need for serverless architecture.

Europe Market Insights

Additionally, the serverless architecture market in Europe region is also estimated to have significant growth over the forecast period. European businesses are paying more attention to data security and privacy, and serverless architecture may assist them comply. Additionally, the market is growing in Europe owing to the legal climate there. The region has recently implemented more stringent data privacy laws, which has increased demand for cloud services that could assist businesses in meeting these standards. Moreover, the availability of a competent workforce is another element boosting the serverless architecture industry in Europe. The technical workforce in Europe is sizable and highly educated, making it well-suited to assist the creation and application of serverless architectures.

Serverless Architecture Market Players:

- Amazon Web Services, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Corporation

- Oracle Cloud Infrastructure

- Alibaba Cloud

- Auth0, Inc.

- Stackery, Inc.

- Twilio, Inc.

- Iron.io

Recent Developments

- To make enterprise adoption of cloud native technologies simpler, Oracle Cloud Infrastructure expands its app development portfolio with new serverless containers, messaging services, and capabilities.

- mazon Web Services, Inc. made available Fargate 1.4. With this update to their serverless container platform, Docker Engine is no longer used and shared Elastic File System storage is supported. This release makes it simple to run stateful workloads in container programmes.

- Report ID: 4845

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Serverless Architecture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.