Server Storage Area Network Market Outlook:

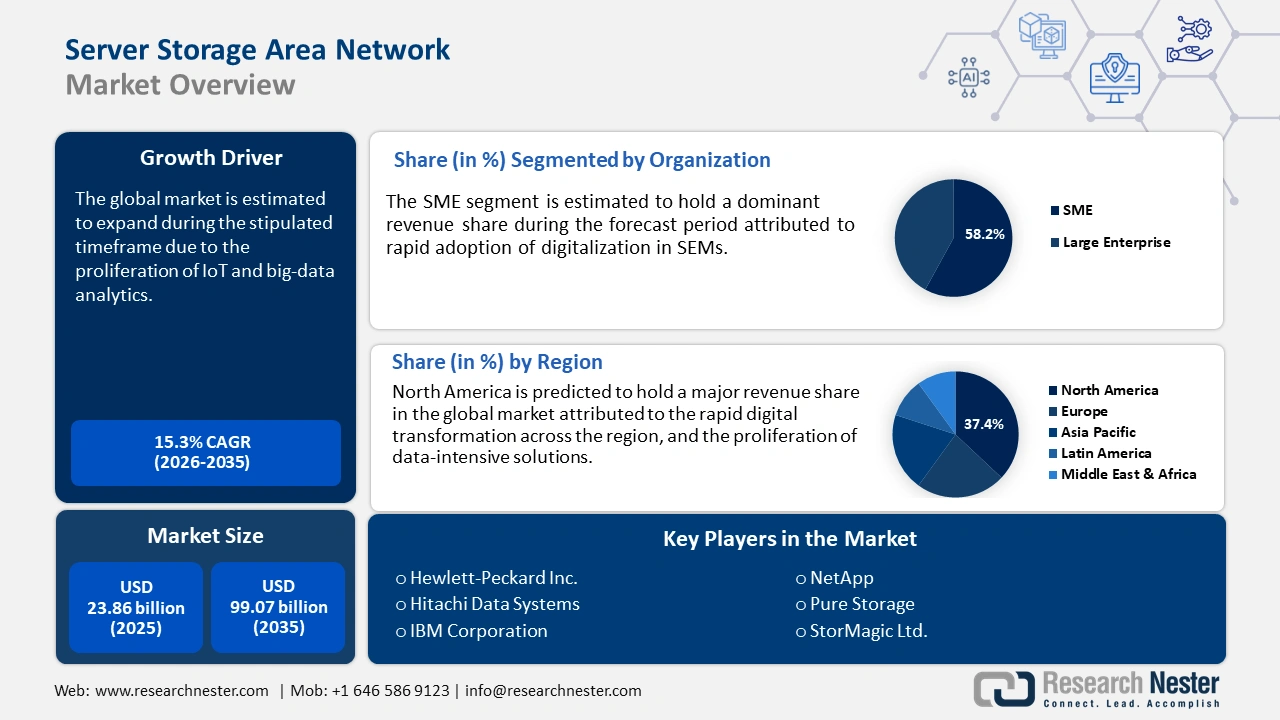

Server Storage Area Network Market size was over USD 23.86 billion in 2025 and is projected to reach USD 99.07 billion by 2035, witnessing around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of server storage area network is evaluated at USD 27.15 billion.

A major factor in the server storage area network market’s growth is the emergence of server storage area networks (SANs) as a critical component of enterprises seeking to seamlessly manage vast amounts of information. The proliferation of Internet of Things (IoT) devices and big data analytics has ensured that businesses are leveraging SANs for robust storage capabilities. For instance, organizations utilizing Oracle and Microsoft SQL Server databases rely on SANs to ensure high performance for their critical applications. For instance, Munder Capital Management reported successful utilization of Microsoft Hyper-V virtualization technology and Compellent SANs to revamp disaster recovery storage while reducing server cooling costs.

The server storage area network market is predicted to grow due to the rapid integration of AI in business operations which drives the requirement for advanced storage infrastructures. AI applications require instant data retrieval which makes SANs a critical component for organizations. The table below indicates AI adoption rates by selected sectors in the U.S.

Current and Future AI-Adoption Rates by Sectors (U.S.)

|

Sector |

Current Adoption Rate (2023) |

Expected Adoption Rate (Till 2024) |

|

Information |

13.8% |

21.8% |

|

Professional, Technical, and Scientific Services |

9.1% |

15.2% |

|

Accommodation and Food Services |

1.2% |

2.3% |

|

Construction |

1.2% |

2.0% |

Source: The U.S. Census Bureau

The server storage area network market is set to benefit from the predicted increase in AI adoption rates and with the global AI race intensifying, the rates are expected to increase exponentially by the end of 2037. The U.S. is a major market and the growth in the country bolsters the global market. Moreover, the rapid integration of cloud computing is reshaping the SAN landscape. Globally, the construction of mega data centers is on the rise, which in turn bolsters the demand for storage solutions that can offer scalability and efficiency. Additionally, the AI boom is a catalyst in heightened demand for memory chips requiring improved infrastructure development by the cloud service providers. With businesses continuing to navigate the evolving landscape, it is predicted that investments in advanced SAN solutions will be pivotal in maintaining competitive advantage. The table below indicates mega data center projects in the pipeline.

Major Data Center Projects

|

Project Name |

Estimated Completion Year |

|

Paris-Saclay Data Center Expansion, France |

2029 |

|

Microsoft Data Centre, Iowa |

2026 |

|

Google Data Centre, U.S. |

2025 |

|

Quantum Loophole Project, U.S. |

2024 |

|

Sines Data Center, Portugal |

2024 |

Key Server Storage Area Network Market Insights Summary:

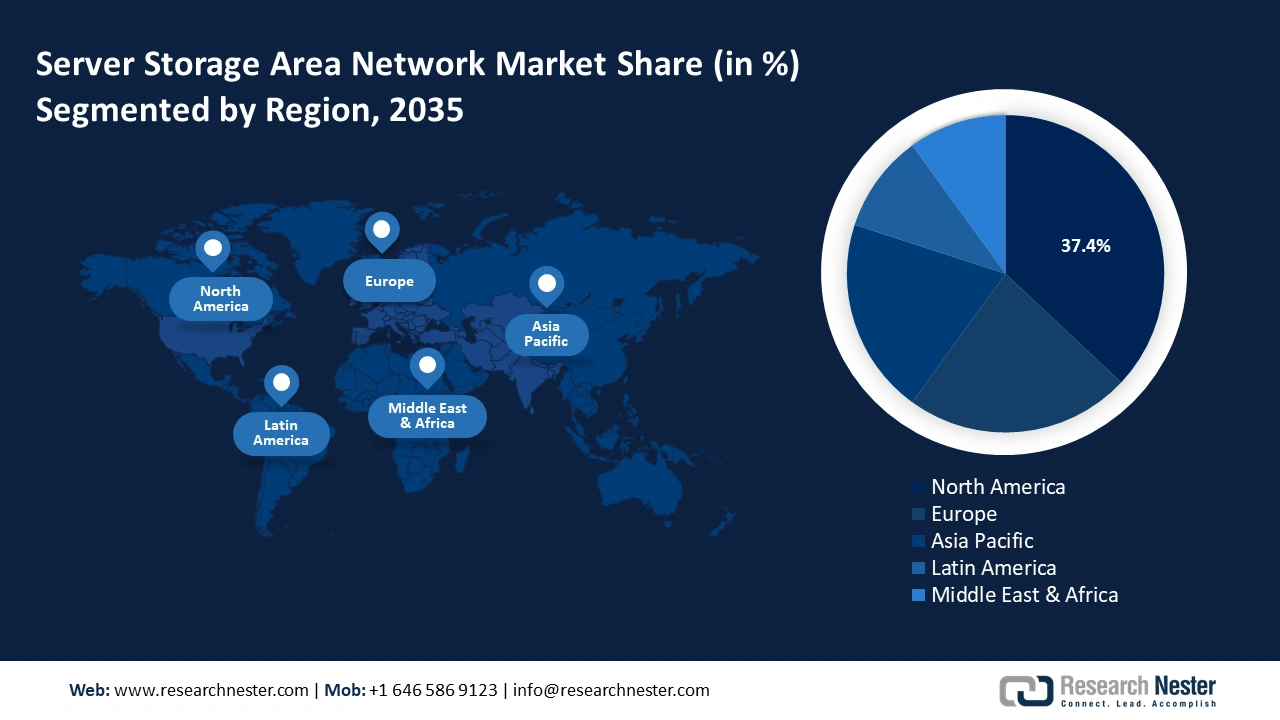

Regional Highlights:

- North America server storage area network market will account for 37.40% share by 2035, driven by rapid digital transformation and adoption of advanced storage solutions.

- Europe market will exhibit the fastest growth during the forecast period 2026-2035, fueled by rising demand for data management solutions and active EU investments.

Segment Insights:

- The sme segment in the server storage area network market is expected to hold a significant share by 2035, driven by the adoption of cloud-based and cost-effective storage solutions by SMEs.

- The hyperscale server san (type) segment in the server storage area network market is anticipated to expand by 2035, driven by escalating demand for large-scale data centers and scalable SAN infrastructure.

Key Growth Trends:

- Emergence of NVMe over Fabrics (NVMe-oF)

- Growing adoption of Software-Defined Storage (SDS)

Major Challenges:

- Performance degradation and downtime constraints

- Deployment and management complexities

Key Players: Hewlett-Packard Inc., Hitachi Data Systems, Dell EMC, IBM Corporation, NetApp, Fujitsu, Pure Storage, StorMagic Ltd..

Global Server Storage Area Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.86 billion

- 2026 Market Size: USD 27.15 billion

- Projected Market Size: USD 99.07 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Server Storage Area Network Market Growth Drivers and Challenges:

Growth Drivers

- Emergence of NVMe over Fabrics (NVMe-oF): The server storage area network market is expected to benefit from the breakthrough of NVMe over Fabric (NVMe-oF) due to reduced latency. The improvements over traditional storage protocols assist in the management of high-speed workloads. Enterprises operating in the BFSI sector are successfully deploying NVMe-oF to improve transaction speeds and ensure uninterrupted services during peak period. Industries relying on rapid data access are expected to benefit from NVMe-oF allowing SANs to leverage high-performance storage devices.

In August 2024, SANBlaze Technology Inc. announced the release of the industry’s first platform to support the NVMe PCIe Gen5 validation for client drives highlighting new entrants in the NVMe storage area network solutions market. The emergence of new players is a testament to the growth potential in the server storage area network market. - Growing adoption of Software-Defined Storage (SDS): The transition to SDS within SAN infrastructures improves flexibility for enterprises. Businesses can manage storage resources programmatically, aligning them with dynamic workloads without the challenge of traditional hardware. High demand is poised to emerge from the companies in the entertainment and media sector to store and retrieve massive video files seamlessly. The agility allows businesses to meet tight deadlines and quickly adapt to market demands, highlighting how SDS strengthens the SAN ecosystems by improving resource utilization. In August 2021, IBM announced the launch of advanced storage solutions to improve the management of data across a hybrid cloud environment for greater data availability to leverage the opportunities in the market.

- Rapid growth of hybrid storage solutions: The rising integration of hybrid SANs, combining the speed of flash storage with the cost-effectiveness of traditional hard drives is a major driver fueling market growth. The combination allows businesses to leverage performance and affordability together which assists companies in managing diverse workloads. Furthermore, robust demand for hybrid SANs is projected to emerge from e-commerce platforms to handle surges in customer traffic. The dual-tier approach enhances SAN network performance by optimizing data placement. The table below highlights e-commerce sales, with the increase in sales expected to drive the demand for SANs.

The U.S. e-commerce sales

|

Second Quarter (2023 and 2024) |

Third Quarter (2023 and 2024) |

Percentage Changes (Third and Second Quarter of 2024) |

|

Over USD 292 million in 2024 |

Over USD 300 million in 2024 |

1.1% (Third quarter) |

|

Over USD 282 million in 2024 |

Over USD 288 million in 2024 |

3.0% (Second quarter) |

Source: The U.S. Census Bureau

Challenges

- Performance degradation and downtime constraints: The server storage area network market can be affected by performance issues and downtime. Hardware failures, compatibility issues, and inefficient configurations are constraints in the market’s growth. The frequency of such issues can result in extended downtimes and reduction in backup windows which in turn affects the overall server efficiency. Vendors in the sector must invest to reduce the frequencies of performance degradation to successfully navigate the challenge.

- Deployment and management complexities: The complexity in SAN deployment can increase operational costs owing to intricate configurations. Additionally, the deployment requires specialized expertise and the lack of it in emerging server storage area network markets can prove to be a challenge in the sector’s expansion. Moreover, an increase in deployment times can add to the operational costs which can affect the end users.

Server Storage Area Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 23.86 billion |

|

Forecast Year Market Size (2035) |

USD 99.07 billion |

|

Regional Scope |

|

Server Storage Area Network Market Segmentation:

Organization Segment Analysis

SME segment is poised to capture over 58.2% server storage area network market share by 2035. The advent of cloud-based solutions is a major driver of the segment due to the expansion of accessibility to SMEs owing to cost-effective solutions. Additionally, the rapid growth of mobile users globally is projected to drive the demand for advanced storage solutions, boosting the sector’s expansion. SANs offer centralized storage management and high-speed data access which makes them attractive options for SMEs seeking to improve operational efficiency. Additionally, SMEs digitizing their operations is projected to ensure sustained demand for SAN solutions. In 2024, the OECD’s report indicated that 72% of SMEs use data to support decision-making highlighting the scope of demand for SAN solutions.

Type Segment Analysis

By type, the hyper-scale server SAN segment in server storage area network market is projected to expand during the forecast period. The escalating demand for large-scale data centers is poised to drive the growth of the segment. The hyperscale infrastructure requires SAN solutions that can efficiently manage vast amounts of data while ensuring scalability and high performance. Additionally, the adoption of SANs underscores their critical position in supporting the backbone of global digital services. The table below indicates the recent construction of hyper-scale data centers, which are poised to drive the demand for hyper-scale server SAN infrastructure.

Recent Hyper-Scale Data Center Operations

|

Date of Announcement |

Hyperscale Data Center Details |

|

January 2025 |

PowerHouse Data Centers and Poe Companies announced a partnership to develop the first hyper-scale data center campus in Kentucky, U.S. |

|

November 2024 |

Prime Data Centers announced the opening of its first hyper-scale data center in California, U.S. |

|

October 2024 |

Equinix announced an agreement to expand hyper-scale data centers in the U.S. |

Services (Professional, Managed)

The professional segment in server storage area network market is expected to register a significant revenue growth during the forecast period owing to rising demand for professional services, such as consulting services, support & maintenance services, and integration & deployment services. Professional service providers are expected to find lucrative opportunities to assist businesses in designing SAN architecture that aligns with scalability requirements. Additionally, support and maintenance services to address any issues during deployment are poised to minimize downtime and help enterprises maximize the ROI on SAN. In May 2024, HPE, a leading player in the market, announced building the foundation for next-generation data management with software-defined storage and AI-driven automation to simplify how enterprises optimize their storage workloads across public and on-prem cloud environments.

Our in-depth analysis of the global server storage area network market includes the following segments:

|

Organization |

|

|

Type |

|

|

Services |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Server Storage Area Network Market Regional Analysis:

North America Market Insights

North America in server storage area network market is set to capture over 37.4% revenue share by 2035. The market’s growth is attributed to the rapid digital transformation across the region driving the adoption of advanced storage solutions. The proliferation of data-intensive applications across North America has necessitated the need for scalable infrastructure, positioning SAN as a critical component in the IT environment. Moreover, the rapid installation and expansion of hyper-scale data centers in North America reflects a commitment to improving data storage capabilities which bodes well for the future of the server storage area network market. For instance, in January 2025, the U.S. announced investments worth USD 500 million in AI infrastructure which is poised to drive demand for SAN solutions.

The U.S. server storage area network market is estimated to hold a major share in North America. A significant driver of the growth is the advanced technological infrastructure in the U.S. coupled with the surging demand for efficient data management solutions. Trends analysis indicates the proliferation of data-intensive applications across multiple sectors, and the rapid expansion of data centers nationwide. Moreover, consultancy services offering support and maintenance of SAN infrastructure based in emerging economies are expected to benefit from the offshoring solutions from the U.S., creating lucrative opportunities within the market. In January 2025, Lenovo announced a definitive agreement to acquire Infinidat Ltd., a global provider of enterprise storage solutions. The acquisition and Lenovo’s expansion is expected to bloster the U.S. market.

The Canada server storage area network sector is poised to expand during the stipulated timeframe of the market’s analysis. The nationwide digitalization trends heightened by federal investments are a major cause of the sector’s growth. For instance, in May 2024, the Government of Canada announced investments worth USD 51.2 million for digital infrastructure projects. Moreover, in January 2025, the Canada-based private equity firm Novacap announced the closing of its first fund worth USD 1 billion dedicated to digital infrastructure. The rising investments benefit the Canada server storage area network market along with the North America market.

Europe Market Insights

The Europe server storage area network market is poised to exhibit the fastest growth during the forecast period after North America. The rising demand for data management solutions across Europe has created lucrative opportunities within the region. Moreover, the European Union (EU) has actively invested to heighten the digital transformation across various economies in the region. In December 2024, the European Council approved the commission’s white paper on how to master the EU’s digital infrastructure needs. The white paper highlights extensive digital transformations driven by technological progress in the previous decade. With the digital transformation in place, enterprises will be driving the demand for advanced server storage solutions benefiting the growth of the SAN market.

The Germany server storage area network market is estimated to hold a significant share in Europe. The market in Germany is predicted to experience robust demands for data management solutions. Moreover, the rapid adoption of IoT connections has driven the requirement for low-latency storage solutions in the country. SANs are essential in supporting real-time data analytics in industrial environments, and with the country boasting a well-established automotive sector, opportunities to integrate SAN solutions are expected to be rife. In December 2024, NorthC announced plans to build new data centers in Germany to meet the demand for scalable IT infrastructure in Europe, and highlights the opportunities to integrate SAN in the expanding data center infrastructure in the country.

The France server storage area network market is set to exhibit growth by the conclusion of 2035. The calls for localized data management in France are a major driver of the market’s growth. Organizations operating in various sectors require localized SAN infrastructures to ensure compliance with data regulations. Additionally, the rapid adoption of AI-driven analytics has bolstered the demand for SANs that can support high-performance computing workload, and can handle large data volumes efficiently. Moreover, initiatives such as Choose France are attracting a growing number of investments to improve the digital infrastructure of France creating a burgeoning SAN market in the nation.

Server Storage Area Network Market Players:

- Hewlett-Packard Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hitachi Data Systems

- Dell EMC

- IBM Corporation

- NetApp

- Fujitsu

- Pure Storage

- StorMagic Ltd.

The server storage area network market is poised to expand during the stipulated timeframe of the sector’s analysis. Key players in the market are investing to expand portfolios while forming industry partnerships. Major players that are offering customer-oriented services including support for deployment, and post-deployment management solutions are projected to maintain an advantage in the competitive market. In December 2024, Hammerspace and Supermicro announced a collaboration to provide a powerful and unified data platform for enterprise data centers and hybrid cloud storage.

Here are some key players in the server storage area network market:

Recent Developments

- In December 2024, KIOXIA America Inc. announced that the cryptographic module in KIOXIA CM7 Series PCIe 5.0 NVMe Enterprise SSDs was validated to meet the stringent Federal Information Processing Standard (FIPS). Earlier, KIOXIA had unveiled the PCIe 5.0 technology for storage and server applications with the KIOXIA CM7 Series NVMe SSD.

- In November 2024, MaxLinear Inc. and Quanta Cloud Technology (QCT) announced their Software-Defined Storage (SDS) solution at the 2024 Supercomputing Conference (SC24) in Atlanta. The solution combines MaxLinear’s ZFlush Panther III accelerated Zettabyte File System (ZFS) with advanced compression and QCT’s robust storage platform to create a scalable, high-performance storage solution.

- Report ID: 7079

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Server Storage Area Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.