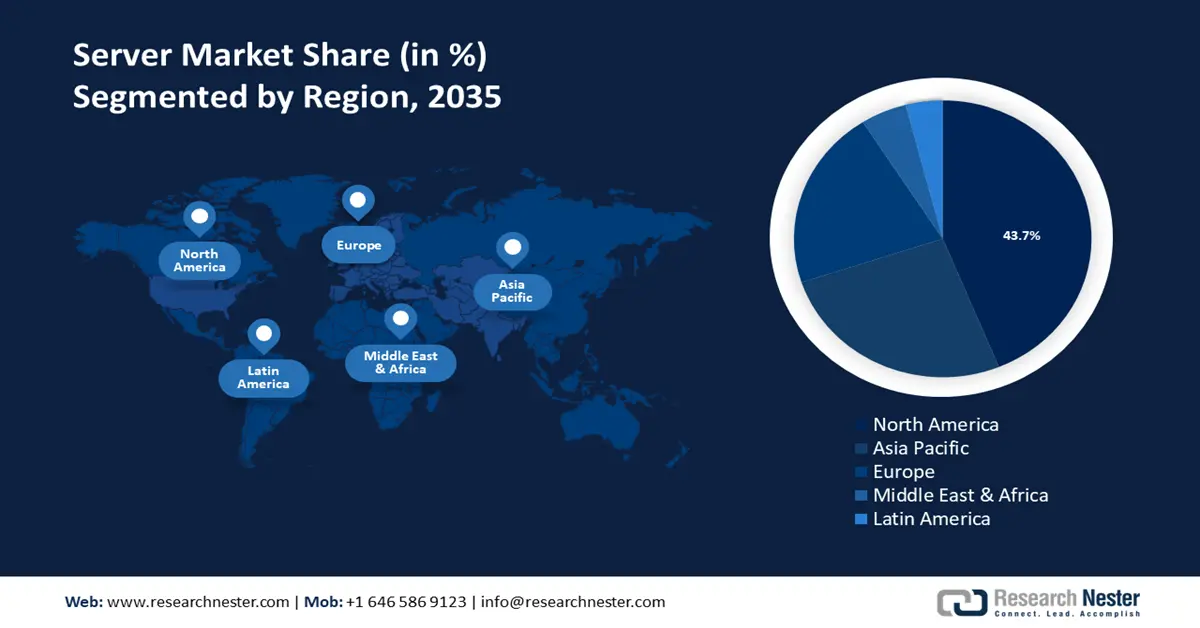

Server Market Regional Analysis:

North America Market Analysis

North America industry is likely to account for largest revenue share of 43.7% by 2035. The industry is expanding due to the existence of a sophisticated IT infrastructure, which is propelling the demand for servers. The market's demand is being driven by the increased presence of the major players in technology. The rising demand from regional countries' data centers for servers is driving the market growth. For instance, North America is in the lead with 62% of all data center investments made in 2023 and 69% of all data center investments made through April 2024.

As far as economies go, the U.S. leads the world. According to the United Nations Conference on Trade and Development's Digital Economy Report 2021, the nation is also home to 50% of the world's hyper-scale data centers. The Bureau of Economic Analysis also projects that in 2022, the actual value added to the digital economy will increase by 6.3%. This is anticipated to fuel the expansion of the U.S. server market during the forecast period, together with the existence of significant businesses like Microsoft, Hewlett Packard Enterprise Size Development LP, Dell Inc., and Amazon Web Services, Inc.

The integration of artificial intelligence, the Internet of Things (IoT), and sensors, together with Canada's growing inclination of big corporations towards cloud-based services rather than on-premise services, are propelling the server market's expansion throughout the country.

Asia Pacific Market Analysis

Asia Pacific server market is expected to experience a stable CAGR during the forecast period. Due to the increasing industrial infrastructure development and the rise of the start-up culture in the corporate sector, which is propelling the growth of the server market, the region is anticipated to see the fastest growth in the demand for servers. The expansion of the market in the area is being driven by the escalating rivalry between the producers and retailers of servers and related technologies.

Japan is one of the top nations in the world for technical advancement and uptake, which has greatly aided in the expansion of the national market during the projection period. Among the significant projects is the collaboration between NVIDIA and Mitsui & Co., Ltd. to allow pharmaceutical businesses in Japan to utilize the Tokyo-1 NVIDIA DGX supercomputer.

The India server market has grown as a result of various factors, including increased digitalization, the development of the digital economy, and government initiatives to encourage the use of cloud computing. To drive the nation's digital future, for example, the Data Security Council of India and Google unveiled a new program in November 2022 called Secure with Cloud, which aims to empower the government and public sector to adopt and transform the cloud.