Sequencing Reagents Market Outlook:

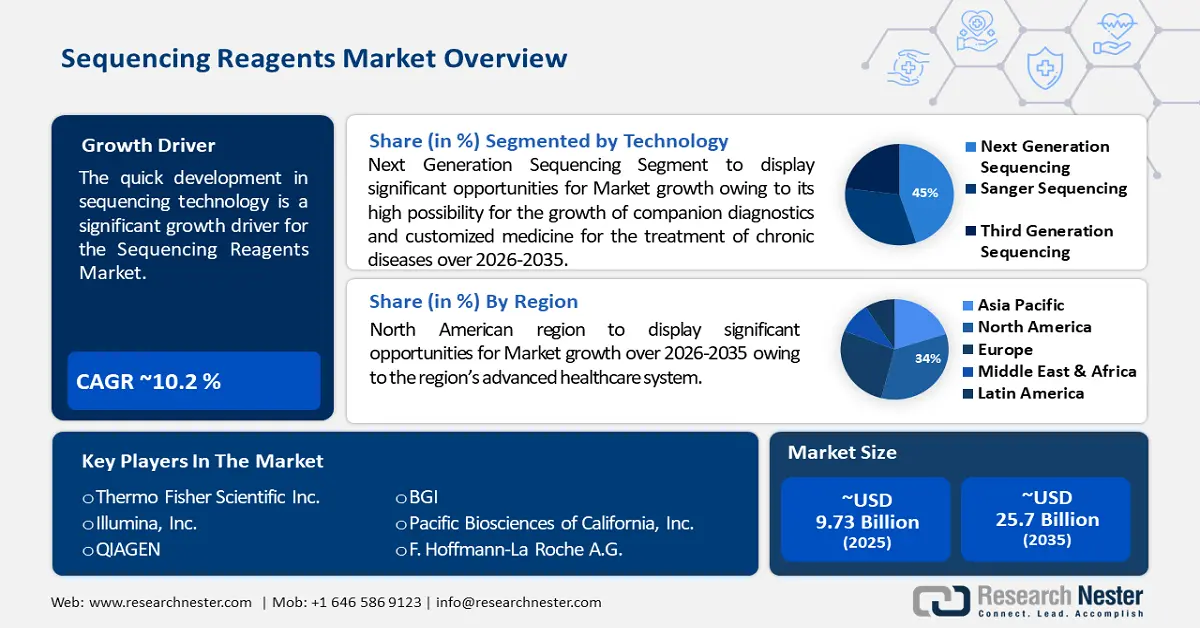

Sequencing Reagents Market size was valued at USD 9.73 billion in 2025 and is likely to cross USD 25.7 billion by 2035, expanding at more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sequencing reagents is assessed at USD 10.62 billion.

The quick development in sequencing technology will primarily propel the market of market by the end of 2036. Illumina sequencing creation, sequencing by blend (SBS), may be an extensively approved next-generation sequencing (NGS) creation across the globe. Illumina sequencing instruments and reagents back considerably parallel sequencing utilizing an exclusive plan that acknowledges single bases as they are connected into growing DNA strands.

Another reason behind the massive growth of the sequencing reagents market is the limited costs of genetic sequencing. The HGP included beginning with mapping and after that sequencing the human genome. The previous was required at the time since there was something else no 'framework' for organizing the real sequencing or the coming about arrangement information. The maps of the human genome served as 'scaffolds' on which to put through personal portions of amassed DNA grouping. These genome-mapping endeavors were very costly but were basic at the time for producing an exact genome arrangement. It is troublesome to appraise the costs related to the 'human genome mapping phase' of the HGP, but it was certainly within the numerous tens of millions of dollars. The evaluation has taken a toll on creating that beginning 'draft' human genome arrangement is approximately USD 300 million around the world, of which NIH generally has 50-60%.

Key Sequencing Reagents Market Insights Summary:

Regional Highlights:

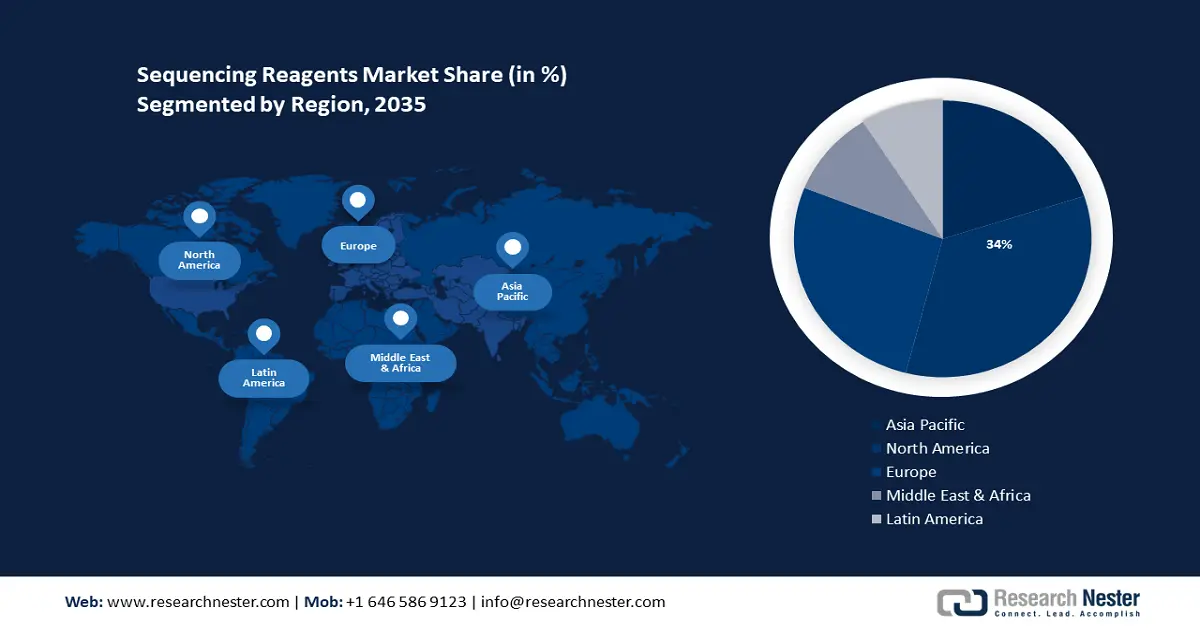

- North America sequencing reagents market achieves a 34% share by 2035, fueled by the region’s advanced healthcare system and leadership in medical innovations.

Segment Insights:

- The next-generation sequencing segment in the sequencing reagents market is forecasted to hold a 45% share by 2035, driven by its potential for companion diagnostics and personalized medicine in chronic diseases.

- The oncology segment in the sequencing reagents market is projected to hold a 38% share by 2035, driven by increased use of next-generation sequencing for cancer diagnosis and treatment worldwide.

Key Growth Trends:

- Increasing technological Modifications in Sequencing Technology

- Increasing Existence of Supporting Government Programs of Genome Sequencing

Major Challenges:

- Shortage of Gerome Sequencing Resources in Growing Countries

- Shortage of Advantageous Compensation Policies

Key Players: Thermo Fisher Scientific, Inc., Illumina, Inc., QIAGEN, BGI, Pacific Biosciences of California, Inc., F. Hoffmann-La Roche A.G., Oxford Nanopore Technologies, Agilent Technologies, Inc., Fluidigm Corporation, ArcherDX, Inc., Myriad Genetics. Inc., Eurofins Scientific, Takara Bio Inc., Mitsui Information Co., Ltd.

Global Sequencing Reagents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.73 billion

- 2026 Market Size: USD 10.62 billion

- Projected Market Size: USD 25.7 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Sequencing Reagents Market Growth Drivers and Challenges:

Growth Drivers

- Increasing technological Modifications in Sequencing Technology - The sequencing scene has significantly changed over the final few a long time. With the critical drop in sequencing costs and the presentation of imaginative disobedient organizations, opting for a suitable sequencer has ended up an increasingly intricate errand. Oxford Nanopore Innovations (ONT) offers a one-of-a-kind approach to sequencing by specifically perusing DNA or RNA arrangements through nanopores. This empowers the discovery of basic variations such as single nucleotide variations, but moreover, more complex ones counting auxiliary variety and methylation, all from a single test. The ease of library arrangement and their non-reliance on complex optical frameworks makes them open and reasonable innovations, clarified Rosemary Sinclair Dokos, SVP of Item and Program Administration at Oxford Nanopore Innovations. The increasing prevalence of DNA digital data storage systems will also help in advancing the sequencing reagents market.

- Increasing Existence of Supporting Government Programs of Genome Sequencing - Here, genomics is becoming a principal apparatus in the understanding of well-being and malady movement. The world-leading genomic framework that the UK has created has put it at the head of genomic information capacity and inquired about globally. Genomics is anticipated to make a central column of future UK well-being benefit conveyance by the NHS. Subsidizing came from the Joined together States government through the National Organizing of Wellbeing (NIH) as well as various other bunches from around the world. Most of the government-sponsored sequencing was performed in twenty universities and investigation centers within the Joined together States, the United Kingdom, Japan, France, Germany, and China, working within the Universal Human Genome Sequencing Consortium (IHGSC).

- Rising Investment of Private and Public Bodies - Each genome has roughly 3.2 billion DNA base sets, and the way they are organized, or varieties and transformations in their design, can give clues about the individual's well-being or sick well-being, acquired or obtained. In any case, there has not been an appraisal of either the current accessibility of NGS or the method for creating a strong proof base.

Challenges

- Shortage of Gerome Sequencing Resources in Growing Countries - The intriguing field of DNA sequencing requires an understanding of bioinformatics, chemistry, and science. As a result, people who embrace DNA sequencing require specific preparation. Also, researchers can utilize capable computational and factual strategies to translate the useful data bolted in DNA arrangements much appreciated to the consideration of genomic information science. These information science strategies are utilized within the field of genomic medication to help analysts and clinicians understand how varieties in DNA affect human well-being and illness. The utilization of numerous modern instruments still requires the installment of permit expenses, which are regularly out of the budgetary reach of numerous teachers in creating nations, indeed even though a few devices are given beneath open-source licenses. As a result, one of the greatest deterrents to industry development is the need for assets, such as sequencing reagents for DNA sequencing, in destitute countries.

- Shortage of Advantageous Compensation Policies

- Increase in Regulatory Appearance for Next-Generation Sequencing Processes

Sequencing Reagents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 9.73 billion |

|

Forecast Year Market Size (2035) |

USD 25.7 billion |

|

Regional Scope |

|

Sequencing Reagents Market Segmentation:

Technology Segment Analysis

The next-generation sequencing segment in the will grow the most by the forecast period and will hold almost 45% in the sequencing reagents market because of its high possibility for the growth of companion diagnostics and customized medicine for the treatment of chronic diseases. Next-generation sequencing (NGS) may empower more centered and profoundly personalized cancer treatment, with the National Comprehensive Cancer Arrange and European Society for Restorative Oncology rules presently prescribing NGS for everyday clinical hone for a few tumor sorts. Be that as it may, NGS usage, and thus persistent get to, changes over Europe; a multi-stakeholder collaboration is required to set up the conditions required to progress this disparity. In that respect, the analysts set up European Collusion for Customized Pharmaceutical (EAPM)-led master boards amid the primary half of 2021, counting key partners from over 10 European countries covering restorative, financial, quiet, industry, and legislative mastery. NGS tests are ordinarily run to realize a foreordained scope, which is the normal profundity of sequencing overall focused on genome positions. Scope at any genome arrangement can be calculated, after mapping sequencing peruses to the reference genome, by tallying the number of autonomous peruses that cover that position and thus will propel the sequencing reagents market.

Application Segment Analysis

The oncology segment is expected to hold around 38% share of the global sequencing reagents market by 2035, owing to the increasing implementation of next-generation sequencing for cancer diagnosis and treatment across the world. Next-generation sequencing testing selection rates have expanded in later a long time, with rates for progressed non–small cell lung cancer (aNSCLC), metastatic colorectal cancer (mCRC), metastatic breast cancer (mBC), and progressed melanoma expanding from less than 1% in 2011 to approximately 40% in 2022. Thus, it will help this segment to have the largest growth in the sequencing reagents market.

Our in-depth analysis of the global sequencing reagents market includes the following segments:

|

Type |

|

|

Technology |

|

|

Application |

|

|

Reagent Type |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sequencing Reagents Market Regional Analysis:

North American Market Insights

The sequencing reagents market in the North America region will have the biggest growth during the forecast period with a revenue share of around 34%. This growth will be noticed owing to the region’s advanced healthcare system. The Joined together States positions 4th in the World Record of Healthcare Development, with an in-general score of 54.96, behind as it were Switzerland, Germany, and the Netherlands. Americans are as a rule the primary to pick up major unused therapeutic propels, progresses regularly found at American colleges and created by American companies. As a result, the U.S. positioned to begin with for both Choice (57.67) and Science & Innovation (75.15).

European Market Insights

The sequencing reagents market in the Europe region will also encounter huge growth during the forecast period and will hold the second position owing to the rising concentration on customized medicine and high healthcare investment in countries like the United Kingdom and Germany. With its 743 million inhabitants spread over 44 nations, counting the 27 countries inside the EU, Europe may be a critical player within the worldwide financial landscape. Moreover, by 2040 care will be sorted out around the citizens instead of around the teachers that drive the existing healthcare frameworks. These changes will influence the businesses and working models of all partners, counting unused non-traditional companies entering the healthcare space. Thus, it will help the European region to have significant growth in the sequencing reagents market.

Sequencing Reagents Market Players:

- Thermo Fisher Scientific, Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Illumina, Inc.

- QIAGEN

- BGI

- Pacific Biosciences of California, Inc.

- F. Hoffmann-La Roche A.G.

- Oxford Nanopore Technologies

- Agilent Technologies, Inc.

- Fluidigm Corporation

- ArcherDX, Inc.

Recent Developments

Total Genomics, the US backup of Chinese next-generation sequencing instrumented organization MGI Tech, disclosed its most noteworthy throughput sequencer at the yearly assembly of Propels in Genome Science and Innovation.

Thermo Fisher Scientific Inc, the world pioneer in serving science, recently reported the dispatch of an unused CorEvitas syndicated clinical registry in generalized pustular psoriasis (GPP). This registry, which is open to enrollment, is CorEvitas' 10th syndicated illness registry and addresses a neglected requirement for real-world proof (RWE) related to the clinical and patient-reported results of patients with GPP.

- Report ID: 5883

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sequencing Reagents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.