Sepsis Therapeutics Market Outlook:

Sepsis Therapeutics Market size was valued at USD 4 billion in 2025 and is likely to cross USD 7.58 billion by 2035, registering more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sepsis therapeutics is assessed at USD 4.24 billion.

The increase in the number of critically ill patients, hospital-based infections, and surgical complications are readily driving the sepsis therapeutics market globally. According to the September 2024 WHO report, each year sepsis leads to 11 million deaths due to improper diagnostic tools and treatments. However, with technological advancements and continuous research and development, a focus on hemodynamic, sedative management, and optimizing fluid will result in a standard management of infections caused due to sepsis. Additionally, the shift towards immunoparalysis and organ function enhancement including cell-based therapy is positively amplifying the sepsis therapeutics market growth.

The optimization of antibiotic use is crucial to ensure successful outcomes, decrease adverse antibiotic effects, and prevent drug resistance. Based on this, it is the responsibility of clinicians and healthcare providers to diagnose suspicious cases of sepsis with broad-spectrum antimicrobials, a positive approach for the sepsis therapeutics market. In this regard, the 2023 OEC report has put down the trading data of antibiotics to understand the global availability required for their use to aid sepsis. In 2023, the world trade valuation of antibiotics was USD 11.2 billion and it is ranked as the 334th traded product worldwide with a product complexity of 1.04. Besides, between 2022 and 2023, its exports decreased by -1.3% that is from USD 11.4 billion to USD 11.2 billion.

Antibiotics Top Exporters and Importers

|

Exporters |

Importers |

||

|

China |

USD 4.84 billion |

India |

USD 1.95 billion |

|

Italy |

USD 0.17 billion |

Italy |

USD 962 million |

|

India |

USD 944 million |

United States |

USD 671 million |

|

Switzerland |

USD 660 million |

France |

USD 530 million |

|

United States |

USD 588 million |

China |

USD 407 million |

Source:OEC 2023

Key Sepsis Therapeutics Market Insights Summary:

Regional Highlights:

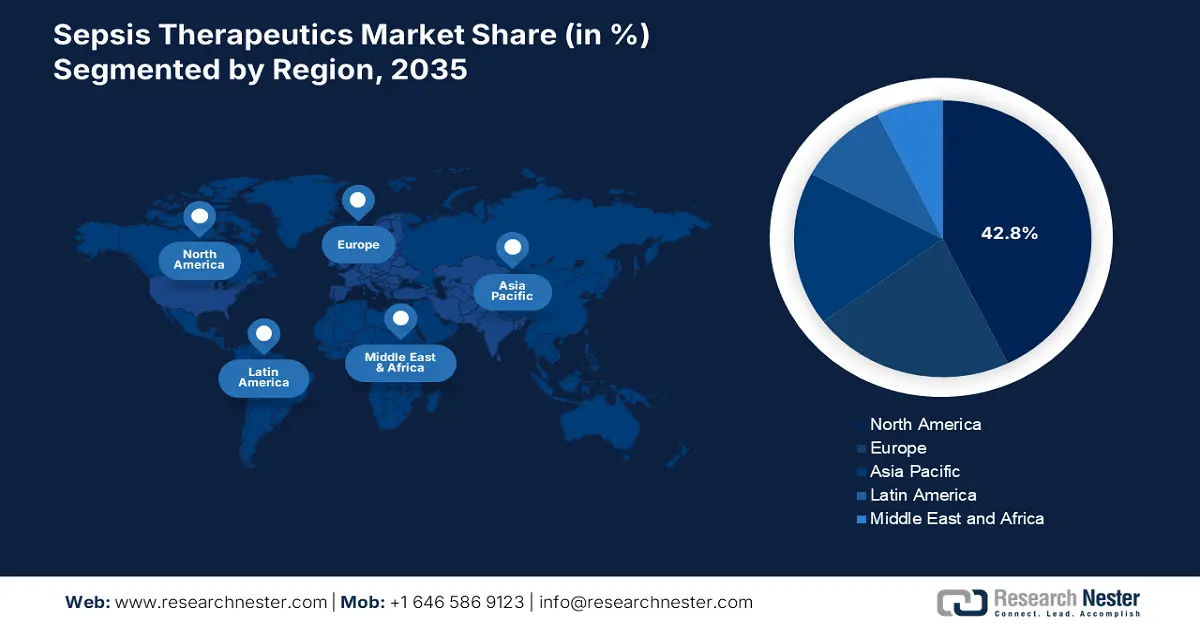

- North America leads the Sepsis Therapeutics Market with a 42.80% share, fueled by increasing awareness of sepsis complications and the adoption of advanced sepsis treatments, fostering robust growth by 2035.

- Asia Pacific’s sepsis therapeutics market is expected to see rapid growth by 2035, driven by rising sepsis incidence, aging population, and growing adoption of treatment solutions.

Segment Insights:

- The Parenteral segment is anticipated to exhibit a dominating growth rate from 2026 to 2035, propelled by the rapid onset of action and increased bioavailability of parenteral administration in antimicrobial therapy for sepsis.

- Cephalosporins segment are expected to hold a 65.1% share by 2035, propelled by their broad-spectrum activity against gram-positive and gram-negative bacteria in sepsis treatment.

Key Growth Trends:

- Advancements in novel medications

- Increased research and development

Major Challenges:

- Poor product substitutes

- Lack of diagnostic tools

- Key Players: Aridis Pharmaceuticals Inc, Astellas Pharma Inc., AstraZeneca plc, Eli Lilly and Company, GSK plc..

Global Sepsis Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4 billion

- 2026 Market Size: USD 4.24 billion

- Projected Market Size: USD 7.58 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Sepsis Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in novel medications: Innovation in nanomedicine and nanotechnology for the evolution of advanced therapeutics and diagnostic tools is highly driving the growth of the sepsis therapeutics market. As per an article published by NLM in April 2023, sepsis affects 25 million of the population internationally with a 40% increase in hospital mortality rates. To overcome this, immunostimulatory therapy as a novel medication has emerged as a promising therapy with the inclusion of cytokines, cellular therapies, and immune checkpoint inhibitors, suitable for the expansion of the sepsis therapeutics market.

- Increased research and development: Ongoing research and development in the overall healthcare industry has paved the way for innovations through investments by both organizations and administrative bodies. For instance, in January 2025, the Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator (CARB-X) is set to invest USD 3.5 million in Melio. The purpose is to ensure that Melio develops and implements a technical feasibility work plan for its culture-free platform designed to identify bloodstream infections including neonatal sepsis. Therefore, with such a generous contribution, the sepsis therapeutics market is poised to escalate globally.

Challenges

- Poor product substitutes: Traditional treatment options such as vasopressors, antibiotics, and supportive care measures cannot address complex sepsis cases, thus causing a challenge for the sepsis therapeutics market to grow. These approaches, however, are considered vital in the healthcare industry but are not suitable enough to cater to the underlying causes of the condition. Besides, sepsis is a long-term condition that requires a long process of recovery. Due to this reason, there has been no development of particular therapies or drugs for immediate relief, thus creating a negative impact on the market.

- Lack of diagnostic tools: At present, there has been no evolution of an appropriate diagnostic tool to rapidly detect and exclude infection, which in turn is restraining the expansion of the sepsis therapeutics market. This further creates a challenge for clinicians to conduct proper monitoring and evaluation of the infection that causes sepsis. Besides, the presence of strict regulations regarding the latest medical strategies results in the creation of a treatment gap for patients in intensive care units, thus limiting the market upliftment internationally.

Sepsis Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 4 billion |

|

Forecast Year Market Size (2035) |

USD 7.58 billion |

|

Regional Scope |

|

Sepsis Therapeutics Market Segmentation:

Drug Class (Cephalosporin, Aminoglycosides, Glycopeptide)

Based on the drug class, the cephalosporin segment is expected to capture over 65.1% sepsis therapeutics market share by 2035. It has a broad-spectrum activity against gram-positive and gram-negative bacteria, which makes it a preferred choice in the treatment of sepsis. As per a cohort study conducted by The Lancet Infectious Diseases in November 2023, the third-generation cephalosporin-susceptible (3GC-S) cohort and cephalosporin-resistant (3GC-R) cohort were analyzed among 2,512 patients suffering from enterobacterales bloodstream infection. The survival instinct was 25.2% with 3GC-S and 74.7% with 3GC-R, thus denoting a positive impact on the segment’s expansion.

Cephalosporin Impact on Enterobacterales Bloodstream Infections

|

Bacterial species |

3GC-S cohort |

3GC-R cohort |

|

Escherichia coli |

42.5% |

19.8% |

|

Klebsiella pneumoniae |

19.5% |

53.3% |

|

Other Klebsiella spp |

4.5% |

9.9% |

|

Enterobacter spp |

10.0% |

6.7% |

|

Serratia spp |

13.1% |

1.2% |

|

Pantoea spp |

1.8% |

3.2% |

|

Other Enterobacterales spp |

4.1% |

0.5% |

|

Polymicrobial |

4.5% |

5.5% |

Source: The Lancet Infectious Diseases in November 2023

Route of Administration (Parenteral, Oral)

In terms of the route of administration, the parenteral segment is anticipated to dominate the sepsis therapeutics market at a considerable rate throughout the assessed period. The aspect of rapid onset of action and increased bioavailability cater to immediate therapy benefits to patients, which is driving the segment growth. Parenteral administration such as antimicrobial therapy is an essential causal therapy option, as stated in the March 2020 NLM article, that is complemented by supportive measures of general intensive care therapy. In addition, small-scale epidemiology and medical history of patients fall under the category of practical and therapeutic decisions, which are positively impacting the market.

Our in-depth analysis of the global market includes the following segments:

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sepsis Therapeutics Market Regional Analysis:

North America Market Analysis

North America region in sepsis therapeutics market is anticipated to capture lucrative revenue share by the end of 2035. As per the March 2024 CDC report, an estimated 1.7 million adults in the region are affected with sepsis and almost 350,000 people face death at the time of their hospitalization. Based on this, the advancement of drug classes including aminoglycosides and glycopeptides along with the collective adoption across hospital and retail pharmacies are increasing the demand for sepsis treatments in the region. The awareness of this life-threatening complication and treatment solutions is expected to boost the market in the region.

The spurred urge in the U.S. sepsis therapeutics market is due to the surge in sepsis cases based on hospital-acquired infections. According to an article published by AAMC Organization in October 2023, sepsis has become the third leading cause of death in U.S. hospitals. With improper treatment, the risk of death increases from 4% to 9%. However, to get rid of this condition, the provision of antibiotics within an hour is the most suitable treatment. Besides, 73% of hospitals comprise a sepsis committee, but only 55% of hospitals deliver dedicated time for sepsis program leaders to focus on sepsis protocol in their hospitals. Therefore, the formation of Hospital Sepsis Program Core Elements is an appropriate guide to providing sepsis treatment.

Canada is subjected to establishing consensus on the pathogenesis and treatment of sepsis, which is positively driving the sepsis treatment market growth. As per an observational study published by NLM in April 2020, 2,056 patients were analyzed to determine the overall management of sepsis in the country. The study revealed that the admission rate was 36%, in-hospital mortality was 25%, and a rise in ICU admission rate to 51%. Therefore, improvement in timely physician assessment, time-to-lactate-drawn, time-to-antibiotics, and fluid resuscitation in community emergency departments is essential for an appropriate form of treatment of sepsis.

APAC Market Statistics

Asia Pacific is expected to emerge as the fastest-growing nation in the sepsis therapeutics market during the forecast timeline. Factors such as enhancement in the incidence rate of sepsis, lifestyle changes, and the aging population are driving the market expansion. As per the 2024 Asia Pacific Sepsis Alliance Organization report, half of the global sepsis cases are present in the Asia Pacific region. Besides, an article published by NLM in June 2022 stated that 48% of adults and 56% of children suffered from severe sepsis. Also, there has been causation of 90% of adult deaths due to lower respiratory tract infections and 70% of deaths are due to chest infections associated with sepsis. To overcome this, CytoSorb is highly recommended as a treatment solution in the region.

The increasing presence of hospitals in India is contributing to the effective management of the sepsis therapeutics market. Also, international organizations are playing a pivotal role in the availability of physicians in the country. For instance, in November 2024, CytoSorbents Corporation and Converge Biotech announced their strategic collaboration to inflate their combined market reach in the sepsis and critical care markets in the country with a broad synergistic product portfolio. The purpose was to provide a critical care sales force and a strong hospital network for the treatment of sepsis and other life-threatening illnesses.

China is feeding inflation in the sepsis therapeutics market with the availability of traditional medicines. A few traditional treatment options such as Shenfu injection, Xuebijing injection, Huanglian Jiedu decoction, Xijiao Dihuang decoction, and Dachengqi decoction ensure efficacy for the diagnosis and treatment of sepsis in the country, as stated in the January 2023 NLM article. Moreover, the September 2022 Frontiers Organization article noted that China's traditional medicines account for 4.5% of survival instinct when it comes to aiding sepsis conditions. These medicines comprise anti-DILI effects including glycyrrhetinic acid, baicalin, and ginsenoside Rg1, thus catering to the upliftment of the market.

Key Sepsis Therapeutics Market Players:

- Aridis Pharmaceuticals Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Astellas Pharma Inc.

- Eli Lilly and Company

- Enlivex Therapeutics Ltd.

- GSK plc.

- InflaRx GmbH

- La Jolla Pharmaceutical Co.

- Partner Therapeutics, Inc.

- Pfizer, Inc.

- Prenosis Inc.

- T2 Biosystems Inc.

The adoption and implementation of strategies to make expansions in market positions is the most effective reason for global companies to dominate the sepsis therapeutics market. Through strategic partnerships and collaborations as well as initiating advancements in medical technology to improve treatment outcomes, key players are making their presence available. For instance, in May 2022, Sepsis Alliance declared the launch of the Sepsis Innovation Collaborative (SIC), a multi-stakeholder public-private collaborative to develop a community with the inclusion of clinical, academic, patient advocacy, reimbursement, industry, research, and other stakeholders.

The purpose of the SIC was to protect lives through advanced innovative solutions to effectively manage infections, solve sepsis, and expand emergency care delivery to fortify the nation’s healthcare and public health preparedness, response, and recovery. In addition, the collaborative strategy ensured early diagnosis and intervention, developed a sepsis lexicon to ensure standard data analysis, addressed long-term healthcare challenges, and facilitated public-private communication with U.S. government agencies to expand health security. All these objectives are highly responsible for the upliftment of the sepsis therapeutics market internationally.

Here's the list of some key players:

Recent Developments

- In January 2025, Partner Therapeutics, Inc. stated its collaboration with the Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response (ASPR) at the U.S. Department of Health and Human Services to fund a phase 2 study in patients with sepsis to assess the safety and enable dose selection of LEUKINE.

- In October 2024, Prenosis Inc.’s Sepsis ImmunoScore, the first FDA-authorized AI diagnostic and predictive tool for sepsis, received one of TIME’s Best Inventions of 2024. It is transforming the anticipation, diagnosis, and treatment of sepsis, a condition responsible for millions of deaths worldwide.

- In December 2023, Enlivex Therapeutics Ltd. declared its complete enrollment of all 120 patients in its Phase II trial of Allocetra in patients with sepsis. The trial caters to the provision of standard care in patients with sepsis associated with pneumonia, biliary, urinary tract, or peritoneal infections.

- Report ID: 7268

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sepsis Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.