Sensor Based Sorting Machines for Mining Market Outlook:

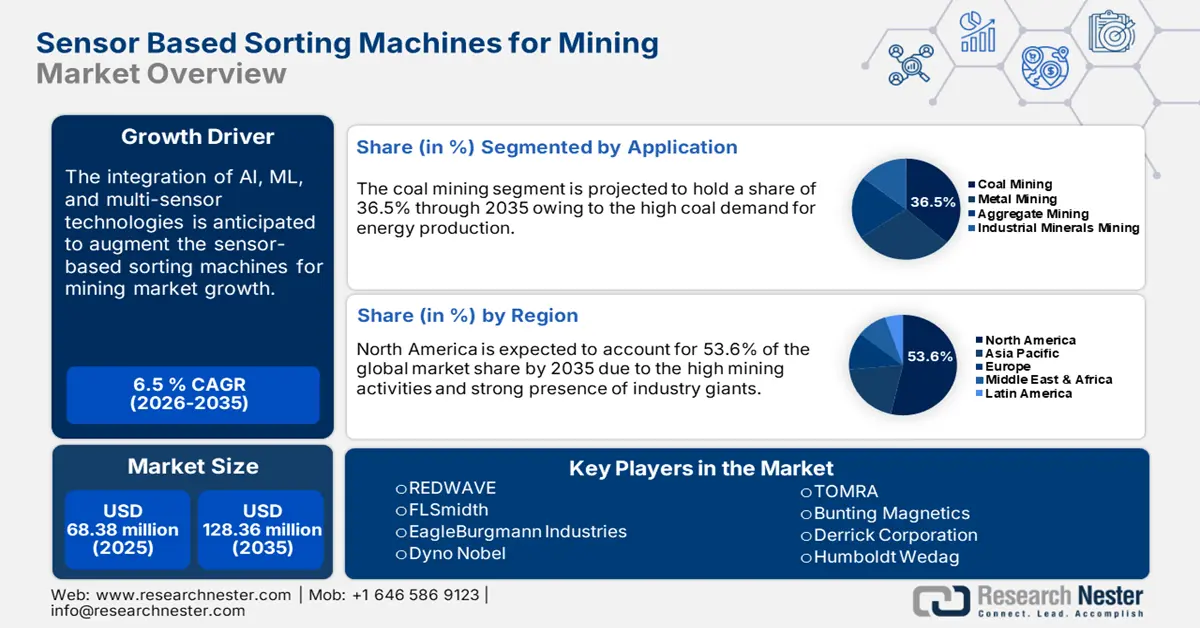

Sensor Based Sorting Machines for Mining Market size was valued at USD 68.38 million in 2025 and is likely to cross USD 128.36 million by 2035, registering more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sensor based sorting machines for mining is assessed at USD 72.38 million.

The rise in mining activities across the globe is augmenting the sales of advanced sensor based sorting machines. The advanced sorting technologies increase the processing efficiency, productivity, and sustainability of mining operations. Senor-based sorters accurately separate valuable minerals and ores from waste before they are forwarded for further processing. Automation and digitalization trends are also significantly contributing to the high sales of sensor based mining sorters.

Mining is one of the most vital sectors driving the world’s economy. Many industries are dependent on underground minerals for raw materials. The global sensor based sorting machines for mining market was estimated at 15,800.00bn kg in 2024. According to the National Mining Association, coal production from East of the Mississippi River, U.S. accounted for 577,954 short tons and 245,001 short tons from West Mississippi River, in 2023, respectively. Furthermore, the International Trade Administration (ITA) reveals that Chile is the top producer of copper and accounts for 24% of the global production and the second largest producer of lithium capturing around 30% share in the global production. These statistics underscore that the rising mining activities around the globe are set to offer lucrative opportunities for sensor based sorting machines for mining market.

Key Sensor Based Sorting Machines for Mining Market Insights Summary:

Regional Highlights:

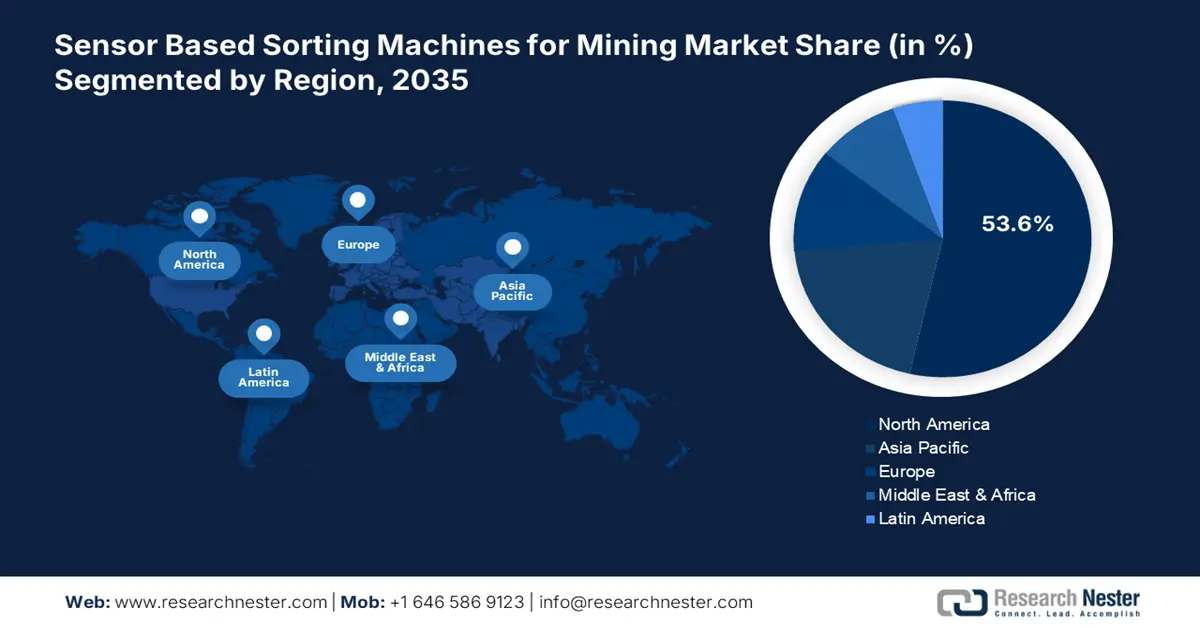

- North America dominates the Sensor Based Sorting Machines for Mining Market with a 53.6% share, fueled by urban mining trends and tech innovations, driving strong growth through 2026–2035.

- The Asia Pacific region is expected to achieve the fastest CAGR in the Sensor Based Sorting Machines for Mining Market from 2026 to 2035, driven by automation and rise in mining operations across APAC.

Segment Insights:

- The Coal Mining segment of the Sensor Based Sorting Machines for Mining Market is forecasted to exceed 36.5% share by 2035, driven by rising demand for high-quality coal and advanced sensor technologies.

- The Optical Sorters segment is expected to dominate by 2035, driven by their ability to process large volumes rapidly with precise material identification.

Key Growth Trends:

- Integration of advanced and multi-sensor technologies

- Urban mining & recycling

Major Challenges:

- High capital investment

- Technical challenges

- Key Players: REDWAVE, FLSmidth, EagleBurgmann Industries, Dyno Nobel, Boart Longyear, and Eriez Manufacturing Co.

Global Sensor Based Sorting Machines for Mining Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 68.38 million

- 2026 Market Size: USD 72.38 million

- Projected Market Size: USD 128.36 million by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (53.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Australia, Canada

- Emerging Countries: China, India, Japan, South Korea, Chile

Last updated on : 13 August, 2025

Sensor Based Sorting Machines for Mining Market Growth Drivers and Challenges:

Growth Drivers

-

Integration of advanced and multi-sensor technologies: The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), X-ray fluorescence technology, near-infrared (NIR) spectroscopy, and laser-induced breakdown spectroscopy (LIBS) technology is enhancing the overall performance of sensor based sorting machines in mining purposes. These technologies use algorithms to learn from previous sorting operations, predict material characteristics, and optimize the sorting parameters in real-time. Multi-sensor technologies such as LIBS and NIR enhance the flexibility and versatility of sorting processes.

For instance, in June 2023, TOMRA announced the launch of AUTOSTART PULSE a sorting machine with dynamic laser-induced breakdown spectroscopy (LIBS) technology. This machine offers peak precision, high-volume processing, and data-driven & high-purity sorting results. - Urban mining & recycling: The growing importance of urban mining and recycling is creating significant opportunities for manufacturers of sensor based sorting machines. These technologies precisely aid in recovering valuable metals such as gold, silver, and copper from electronic wastes. For instance, the demand for lithium-ion batteries is anticipated to increase by 7x by 2030. These batteries are equipped with materials such as cobalt, nickel, lithium, graphite, cobalt, and manganese. The rise in lithium-ion battery waste is set to augment the use of sensor based sorting machines in the coming years. For instance, in February 2024, ZenRobotics announced the launch of its fourth-generation waste-sorting robots. The ZenRobotics 4.0 is integrated with artificial intelligence to enhance the efficiency of waste sorting operations.

Challenges

-

High capital investment: The major factor challenging the sensor based sorting machines for mining market growth is the high initial investment in advanced technologies. Many small-scale and new companies find the installation of these systems expensive owing to their limited budgets. Thus, even though the return on investments is quite high in the long term, the huge initial investment is deterring some mining companies from adopting sensor based sorters.

-

Technical challenges: Working in mining environments has to often witness harsh and extreme temperatures, humidity, and dust. This challenges the performance, reliability, and durability of various machines including sensor based sorting systems. Maintenance of complex sensor equipment in such conditions leads to the need for skilled labor and technicians, increasing the operational costs.

Sensor Based Sorting Machines for Mining Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 68.38 million |

|

Forecast Year Market Size (2035) |

USD 128.36 million |

|

Regional Scope |

|

Sensor Based Sorting Machines for Mining Market Segmentation:

Type (Optical Sorters, X-ray Sorters, Laser Sorters, Metal Detectors)

The optical sorter segment is anticipated to hold a dominating share of the global sensor based sorting machines for mining market through 2035. Optical sorters are gaining high traction owing to their ability to process large amounts of materials in a short time. They are equipped with advanced sensors, lasers, and cameras that accurately aid in identifying and separating materials based on their visual properties. The growth in mining activities across the world is foreseen to drive the sales of optical sorter machines in the coming years. Many manufacturers are also introducing new optical sorting machines to grab opportunities from such trends. For instance, in May 2022, CIMBRIA introduced an advanced optical sorting machine with a combined multispectral vision system. This innovative technology accurately identifies the materials to be sorted, accelerating the overall production cycle.

Application (Coal Mining, Metal Mining, Aggregate Mining, Industrial Minerals Mining)

Coal mining segment is likely to hold more than 36.5% sensor based sorting machines for mining market share by 2035. The growing demand for high-quality coal for power generation and steel production is augmenting the sales of sensor based sorting machines. These technologies help meet these demands by precisely sorting coal based on quality parameters such as ash content, sulfur levels, and calorific value. The global coal mining industry was evaluated at USD 2.5 trillion in 2024. With over 8000 coal mining businesses across the world, the demand for sensor based sorting machines is exhibiting high demand. India, China, Indonesia, the U.S., and Australia are some of the top coal-producing countries, worldwide.

Our in-depth analysis of the sensor based sorting machines for mining market includes the following segments:

|

Type |

|

|

Application |

|

|

Capacity |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sensor Based Sorting Machines for Mining Market Regional Analysis:

North America Market Forecast

North America sensor based sorting machines for mining market is set to capture revenue share of over 53.6% by 2035. The presence of industry giants, continuous technological advancements, and supportive regulatory policies are augmenting the sales of sensor-based sorting machines in the region. The urban mining trend is anticipated to boost the overall sensor based sorting machines for mining market growth in the coming years in North America.

In the U.S., the rise in coal mining activities is set to boost the adoption of sensor-based sorting technologies. For instance, the U.S. Energy Information Administration (EIA) revealed that in 2022, around 594 million short tons of coal was produced in 21 U.S. states. Wyoming, West Virginia, Kentucky, Pennsylvania, and Illinois were the top coal-producing states in the country.

In Canada, the mining production reached a valuation of around USD 51.9 billion in 2022. The country is the prime producer of Potash followed by aluminum, diamonds, cobalt, gemstones, gold, fluorspar, platinum, and titanium concentrate. With over 200 mines, Canada is the most profitable marketplace for sensor-based sorting machine producers.

Asia Pacific Market Statistics

The Asia Pacific sensor based sorting machines for mining market is foreseen to increase at the fastest CAGR during the study period. Rapid digitalization coupled with automation, rise in mining activities, and expansion of international sensor-based sorting machine manufacturing units are collectively pushing the regional sensor based sorting machines for mining market growth. Japan, South Korea, Australia, China, and India are the high earning marketplaces for industry giants in Asia Pacific.

In China, the high coal mining activities are propelling the demand for sensor-based sorting machines. In 2023, the country’s coal production was totaled at 93.1 exajoules. As per the estimates by the International Energy Agency (IEA), the coal supply activities in the country accounted for 97,026,297 TJ in 2022.

In India, the vast presence of mines and supporting government policies and schemes are set to push the sales of sensor-based sorting machines in mining activities. The country is the 2nd largest crude steel and aluminum producer around the globe. The India Brand Equity Foundation (IBEF) reveals that in FY 22 there were around an estimated 1,319 reporting mines in the country. Furthermore, around 966 lakh tonnes of coal, 42 lakh tonnes of lignite, and 244 lakh tonnes of iron ore were produced in the country as of February 2024.

Key Sensor Based Sorting Machines for Mining Market Players:

- REDWAVE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FLSmidth

- EagleBurgmann Industries

- Dyno Nobel

- Boart Longyear

- Eriez Manufacturing Co.

- Mettler-Toledo International Inc.

- Metso Outotec

- Terex Minerals Processing Systems

- STEINERT

- Binder+Co

- TOMRA

- Bunting Magnetics

- Derrick Corporation

- Humboldt Wedag

- Sesotec GmbH

Key players in the sensor based sorting machines for mining market are employing several organic and inorganic tactics to earn high profits such as technological innovations, new product launches, collaborations & partnerships, mergers & acquisitions, and global expansions. By continuously introducing new products the sensor based sorting machines for mining market players are witnessing a competitive environment. Industry giants are collaborating with high-tech companies and partnering with other players to develop innovative sensor-based sorting machines for mining purposes. They are also acquiring smaller or new companies to expand their product offerings in minimum CAPEX. Regional expansion strategies are aiding them to enter into untapped markets to earn high gains and boost their sensor based sorting machines for mining market reach.

Some of the key players include:

Recent Developments

- In November 2024, TOMRA announced that it is set to provide its XRT sorting technology for Koura's Las Cuevas operation. This world's largest fluorspar mine is anticipated to receive XRT sorters by the early phase of 2025.

- In April 2023, REDWAVE introduced its next-gen sorting machine XRF Fine. This sorting machine accurately detects and sorts non-ferrous metals and is gaining traction in the metal recycling sector.

- Report ID: 6864

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sensor Based Sorting Machines for Mining Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.