Security Service Edge Market Outlook:

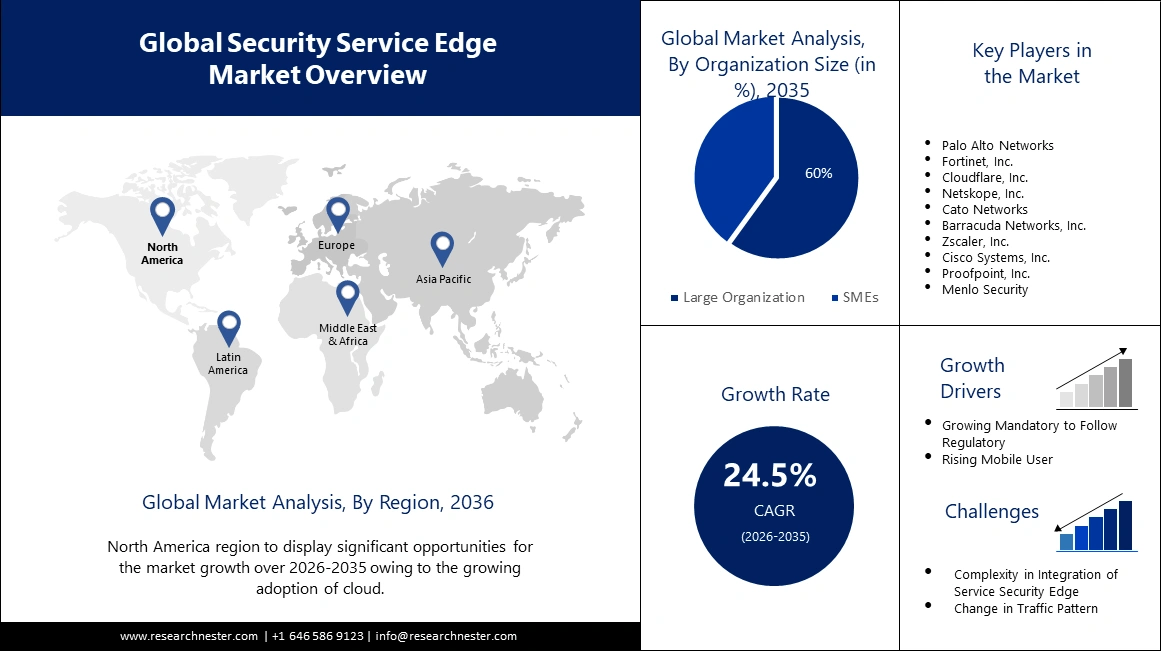

Security Service Edge Market size was over USD 6.58 billion in 2025 and is poised to exceed USD 58.87 billion by 2035, growing at over 24.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of security service edge is estimated at USD 8.03 billion.

The market growth is driven by the increasing remote working culture. After the pandemic hit, remote culture has compelled the development of meticulous security architecture that can offer secure data access. Moreover, the advancements in cloud computing are helping to improve security network administration and increase a company’s productivity. For instance, Flexer’s State of the Cloud 20222 report states that 80% of enterprise respondents reported adopting Microsoft Azure for public cloud deployments which has resulted in security service edge market growth.

In addition to these, a factor that is believed to fuel the market growth is the adoption of zero-trust network access. It provides controls, adaptive access, and improved data protection, all of which are the dynamic requirements of remote work. To lower the risk of data breaches, this framework makes sure that access is determined by a real-time risk assessment.

Key Security Service Edge Market Insights Summary:

Regional Highlights:

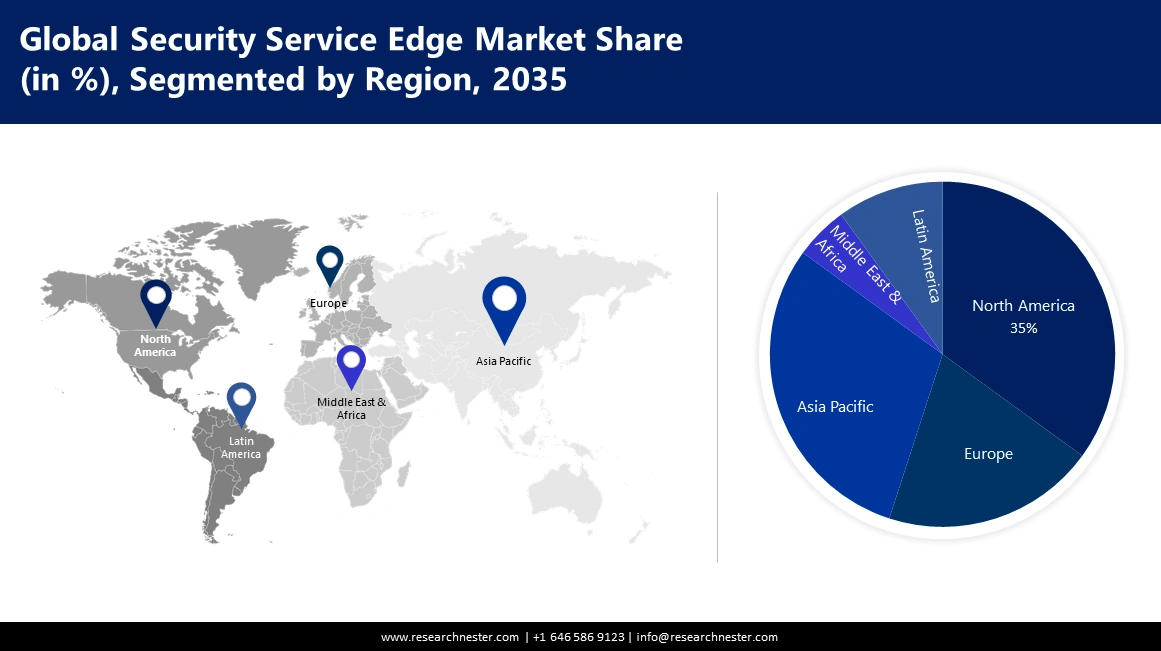

- North America security service edge market will dominate around 34% share by 2035, driven by government cybersecurity policies and cloud security compliance.

- Asia Pacific market will account for 25% share by 2035, driven by high spending on IT security and adoption of regional security frameworks.

Segment Insights:

- Security as a service segment in the security service edge market is expected to achieve 53% growth by the forecast year 2035, driven by cloud-based security solutions enabling secure, location-independent access.

- The large enterprise segment in the security service edge market is projected to hold a 34% share by 2035, attributed to large IT budgets and adoption of security service edge technologies for asset protection.

Key Growth Trends:

- Compulsion to Follow Regulatory and Data Protection Laws

- Ability to Unite Networking and Security Capabilities into a Single Platform

Major Challenges:

- Compulsion to Follow Regulatory and Data Protection Laws

- Ability to Unite Networking and Security Capabilities into a Single Platform

Key Players: Zscaler, Inc., Cisco Systems, Inc., Palo Alto Networks, Inc., Netskope, Inc., Cloudflare, Inc., Forcepoint LLC, Broadcom Inc. (Symantec), Versa Networks, Inc., Fortinet, Inc., McAfee, LLC.

Global Security Service Edge Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.58 billion

- 2026 Market Size: USD 8.03 billion

- Projected Market Size: USD 58.87 billion by 2035

- Growth Forecasts: 24.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Security Service Edge Market Growth Drivers and Challenges:

Growth Drivers

-

Compulsion to Follow Regulatory and Data Protection Laws- Cyber-attacks that have evolved over the years have massively hit organizations, causing huge losses. For instance, 323972 internet users reported being the target of phishing attempts in 2021. This indicates that phishing attacks fooled half of the consumers who experienced data breaches & in 2022, data breaches cost companies USD 4.35 million on average. At the pandemic's peak, phishing attacks increased by 220%. Today, organizations are constantly trying to implement advanced security solutions to combat such disruptive attacks. With the introduction of advanced information security service solutions, compliance with applicable government data protection laws is mandatory. Data protection directives play a key role in solving growing business and data protection issues.

- Ability to Unite Networking and Security Capabilities into a Single Platform- The latest network models have many access points to store data between cloud platforms and between servers & applications. Securing and managing these networks & safely accessing different data can be a complex and time-consuming procedure. The work is constantly becoming more difficult due to the introduction of new technologies. The introduction of security solutions on a single platform securely makes easy access to data.

- Cost Savings by Combining Multiple Security and Network Access- The incorporation of multiple security and network access technologies into a single platform, often offered through subscription pricing, depicts a remarkable chance within the security service edge market. This opportunity focuses on cost effectiveness where organizations can achieve significant savings. By combining various security and networking tools into a single security service platform, companies can streamline their IT spending.

Challenges

-

Traffic Aggression and Client Encounter- Changing traffic patterns and the shift to work remotely have complicated this challenge, as users require reliable, high-quality access to applications from different locations. Additionally, changing accessibility complicates the equation by not ensuring compatible application and network performance. These issues must be addressed by optimizing traffic routing, implementing quality of service measures, and ensuring that security measures do not compromise network performance.

- Security service architecture and its components come with high upfront implementation costs and lack of standardization.

- A lack of understanding of cloud resources and cloud security architecture.

Security Service Edge Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.5% |

|

Base Year Market Size (2025) |

USD 6.58 billion |

|

Forecast Year Market Size (2035) |

USD 58.87 billion |

|

Regional Scope |

|

Security Service Edge Market Segmentation:

By Offering Segment Analysis

The security as a service segment is predicted to account for 53% share of the global security service edge market by 2035. The segment growth can be attributed to the cloud-based delivery of security solutions that are usually discovered in business intelligence and data centers. Security as a service has become an obligatory element of the market everywhere as it allows secure access to apps and service edges without location being a barrier. Moreover, security service combines with enterprise infrastructure for securing access from internal & external threats. For instance, Allot Ltd. announced a strategic partnership deal with Amazon Web Services (AWS) in February 2022. Allot Ltd. provides cutting-edge network intelligence and security-as-a-service solutions for communication service providers and companies.

By Organization Size Segment Analysis

The large enterprise segment is predicted to account for 34% share of the global security service edge market by 2035. The reorganization of security policies and architecture by large enterprise to include security service edge technology, in order to protect critical assets from a diverse cyber-attack. Large enterprise widely adopting the security services as they access to large IT budgets. Additionally, large businesses are prone to identification problems due to their large workforces and associated networking infrastructure using these services to access data securely.

Our in-depth analysis of the global market includes the following segments:

|

Offering |

|

|

Organization Size |

|

|

End User Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Security Service Edge Market Regional Analysis:

North American Market Insights

The security service edge market in the North America region is anticipated to hold the largest with a share of about 34% by the end of 2035. To protect against cyber-attacks, the regional government is making strict policies to strengthen security. For instance, the article published by Duo Security announced after analyzing the data that authorization at the moderate impact level under the Federal Risk and Authorization Management Program ensures cloud services like Duo meet strict data security needs and capabilities by federal agencies. Furthermore, the adoption of linked devices and growing automation in the region are predicted to cause a major increase in the market that is helping to secure data and avoid attacks.

APAC Market Insights

The Asia Pacific region encounters a significant surge during the forecast period and grabs the position of second largest with an estimated share of 25% by the end of 2035. Businesses in China, Japan, and India are spending a lot of money to protect the security of their IT infrastructure as a result of threats and security concerns. Moreover, the security framework regulations are being adopted, especially in South Asia which is expected to boost the regional market. For instance, in September 2021- Cato networks which is the provider of the world’s first SASE platform- Cato Networks declared that SecureCraft Pte. Ltd. has become a member of the channel partner program for Cato in Malaysia & Singapore.

Security Service Edge Market Players:

- Fortinet

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Palo Alto Networks

- Kyndryl Inc.

- Zscaler, Inc.

- VMware

- Netskope

- Cato Networks

- Proofpoint

- Aryaka

- Citrix

Recent Developments

- 2 February, 2024: Fortinet and WiCyS collaborated to address the cybersecurity skills gap as cyber risks continues to grow so does the demand for skilled information security professionals. Threat actors are finding different ways to upgrade their operations, using cybercrime as a service, generative artificial intelligence and other tools to increase the volume and sophistication of their attacks.

- 4 December, 2023: Zscaler Threatlabz, leader in cloud security services released annual report which focused on increase rate of threat ​​​​finds that most cyber-attacks hidden in encrypted traffic. Around 86% of cyber-attacks are delivered through encrypted channels, with manufacturing the most targeted industry.

- Report ID: 5829

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Security Service Edge Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.