Security Cameras Market Outlook:

Security Cameras Market size was valued at USD 16.9 billion in 2025 and is projected to reach USD 81.4 billion by the end of 2035, rising at a CAGR of 19.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of security cameras is estimated at USD 20.1 billion.

The global security cameras market is poised for tremendous growth, highly propelled by rising urbanization, smart city initiatives, stringent security regulations, and heightened demand for AI-based surveillance systems. In this regard, the Ministry of Electronics and Information Technology (MeitY) in April 2024 mandated compulsory testing for essential security parameters for CCTV cameras under the STQC scheme and counseled all the government agencies to follow these updated procurement guidelines to ensure proper system security, thereby addressing concerns towards foreign-origin devices. Simultaneously, security advisories are strongly focused on encryption, penetration testing, and controlled access protocols to protect data, whereas the laws strictly prohibit privacy infringements through any type of unauthorized surveillance, thus positively impacting security cameras market growth.

The security cameras market also benefits from significant incentives and safety protocols amended by the governments to enhance safety across commercial, industrial, and public infrastructure. In this context, OVSJG disclosed that the Private Security Camera Rebate Program (PSCRP) in Washington, D.C., offers rebates up to USD 500 for residential and USD 750 for non-residential properties to cover the cost of security cameras and glass break sensors, requiring registration with the Metropolitan police department. It became effective from May 15, 2024, wherein individuals can reapply for additional rebates after four years or if vandalism occurs. It also mentioned that from October 1, 2025, nonprofits and small businesses that have below USD 2.5 million in sales can claim rebates for interior cameras and sensors, hence denoting a positive market outlook.

Key Security Cameras Market Insights Summary:

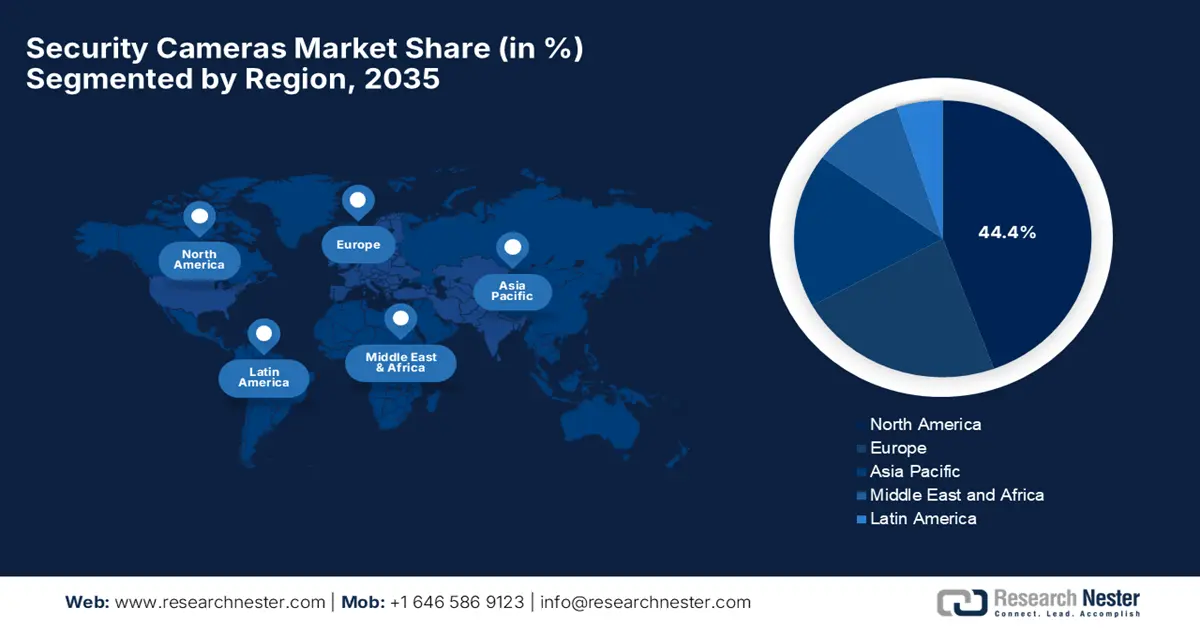

Regional Highlights:

- North America is expected to dominate the security cameras market with a commanding 44.4% revenue share by 2035, reflecting strong adoption of advanced smart surveillance solutions, reinforced by regulatory emphasis on public safety and rapid AI-driven product innovation.

- Asia Pacific is projected to witness the fastest expansion through 2026–2035, as accelerating urbanization and smart city initiatives stimulate large-scale deployment of AI-enabled and IP-based surveillance systems across public and commercial infrastructure.

Segment Insights:

- Infrared Bullet Cameras are anticipated to lead the security cameras market by capturing a 38.7% revenue share by 2035, supported by their enhanced low-light imaging capabilities and growing utilization in mission-critical residential, commercial, and public safety applications.

- Indoor Cameras are forecast to secure a notable share by 2035, benefiting from widespread installations in homes, offices, and commercial spaces, bolstered by smart connectivity features and integrated video analytics.

Key Growth Trends:

- Smart city initiatives & public infrastructure

- Technological advancements

Major Challenges:

- High initial investment and implementation costs

- Privacy and data security concerns

Key Players: Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems GmbH, Hanwha Vision Co., Ltd., Avigilon Corporation.

Global Security Cameras Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.9 billion

- 2026 Market Size: USD 20.1 billion

- Projected Market Size: USD 81.4 billion by 2035

- Growth Forecasts: 19.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Vietnam, Indonesia

Last updated on : 23 December, 2025

Security Cameras Market - Growth Drivers and Challenges

Growth Drivers

- Smart city initiatives & public infrastructure: Smart city deployments across the globe include extensive video surveillance systems for urban safety, traffic management, crowd monitoring, and law enforcement. Simultaneously, governments’ investments in public safety infrastructure are also major revenue boosting factors for the security cameras market. The government of India’s economic survey in 2024-25 found that across 100 smart cities, more than 84,000 CCTV cameras have been installed to enhance crime prevention and public monitoring. It also mentions that 1,884 emergency call boxes and automated systems for red light violation detection and number plate recognition have been deployed. Therefore, such measures collectively strengthen citizen safety and ensure more efficient urban security management, continuously fueling the market’s upliftment.

- Technological advancements: Transition to IP-based, wireless, and HD/UHD cameras increases image quality, scalability, and connectivity, attracting a wider group of audience, which in turn prompts more players to make investments in the security cameras market. In September 2025, Axis Communications introduced its latest multisensory security technologies, which include bispectral PTZ cameras, AI-powered bullet cameras, multilayer radars, and a smart air quality sensor with two-way audio at GSX 2025. These devices integrate thermal, visual, radar, and environmental sensing with advanced AI analytics and edge processing to enhance real-time situational awareness. Moreover, it was built on an open, scalable platform, and the innovations aim to provide smarter, connected, and secure solutions for complex environments.

- Rising security & safety concerns: The continued increasing crime rates, theft, vandalism, terrorism threats, and unauthorized access are encouraging businesses, governments, and homeowners to make investments in surveillance solutions, thereby accelerating the security cameras market growth. As evidence in the Delhi budget for 2025‑26, the government announced that it has allocated funds to expand the city’s smart surveillance system, which also includes the installation of 50,000 additional cameras along with the existing 2,80,000 cameras. This investment is part of broader infrastructure and connectivity initiatives that are efficiently supported by the central roads fund and urban development fund. Hence, the existence of such large-scale government deployments underscores the ever-increasing demand and growth potential of the security cameras market.

Challenges

- High initial investment and implementation costs: The security camera systems, which are incorporated with AI and LiDAR-integrated solutions, necessitate burgeoning investments in terms of hardware, software, and installation. This, in turn, can be restrictive for small and medium enterprises, limiting adoption in the security cameras market. Similarly, hardware, expenses for maintenance, software updates, and cloud storage can add strain on budgets. In addition, integrating legacy infrastructure with modern systems also adds to both complexity and cost. Hence, the existence of these financial barriers can ultimately slow down market growth in price-sensitive regions, whereas vendors must balance pricing strategies, demonstrate clear ROI to overcome the challenges.

- Privacy and data security concerns: The continued evolution of connected surveillance systems raises privacy and cybersecurity issues. A few of the security cameras collect data that includes facial recognition, movement patterns, and other personal information. This, in turn, can be misused, leading to legal risks if not used and managed efficiently. In this regard, the regulatory frameworks, such as GDPR in Europe, impose strict compliance requirements, making global deployment highly complex. Therefore, companies need to make investments in encryption, secure storage, and transparent data policies, in which failure can hinder customer adoption, making data security a critical challenge in the security cameras market.

Security Cameras Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.1% |

|

Base Year Market Size (2025) |

USD 16.9 billion |

|

Forecast Year Market Size (2035) |

USD 81.4 billion |

|

Regional Scope |

|

Security Cameras Market Segmentation:

Type Segment Analysis

By the conclusion of forecast duration, infrared bullet cameras will command the largest revenue share of 38.7% in the security cameras market. The camera offers superior low-light performance and wider adoption across residential, commercial, and public safety. For instance, in November 2024, i-PRO Co. Ltd. announced that it has launched a new line of high-zoom bullet cameras, which feature advanced edge AI, long-range IR LEDs, and 10x/30x zoom for precise monitoring in environments such as highways, ports, and stadiums. The cameras leverage long-range (up to 250m/820ft) infrared LED capabilities and offer 2MP, 5MP, and 4K resolutions across 20 models in the X- and S-series. Further, these cameras are especially designed for mission-critical applications, and they enhance city surveillance, transportation hubs, and critical infrastructure security, hence denoting a wider segment scope.

Application Segment Analysis

In the application segment, indoor cameras are expected to capture a significant revenue share in the security cameras market. The widespread utilization in homes, offices, and the commercial sector, coupled with smart connectivity features, is propelling the extensive growth of the segment. In October 2024, the Ministry of Consumer Affairs declared that the Food Corporation of India will upgrade its analog CCTV system to a modern IP-based surveillance network across 561 depots, with approximately 23,750 cameras, with a collective goal of enhancing high-resolution monitoring, scalability, and remote access. It also mentioned that the system will feature advanced video analytics, motion detection, trip wire, and camera tampering alerts, along with a centralized command control centre and network operating centre for real-time oversight. Besides, pilot installations of environmental and humidity sensors will also improve the monitoring of indoor conditions in storage depots.

Professional Service Segment Analysis

In the security cameras market, the consulting services segment will grow with a lucrative revenue share over the discussed timeframe. The segment’s growth is highly subject to its capability in offering security assessments, customized solutions, and strategic guidance to enterprises. In addition, the rising complexity of security threats and regulatory compliance requirements is encouraging organizations to opt for expert guidance for surveillance system design and implementation. These services also help enterprises to optimize camera placement, integrate AI and analytics, and ensure interoperability with existing IT infrastructure. Moreover, there has been a growing adoption of smart city projects and critical infrastructure monitoring, efficiently boosting demand for professional security consulting. Since businesses increasingly prioritize proactive risk management, the consulting segment is expected to witness the utmost revenue over the years ahead.

Our in-depth analysis of the security cameras market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Professional Service |

|

|

Resolution |

|

|

End user |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Security Cameras Market - Regional Analysis

North America Market Insights

North America is the dominant player in the security cameras market, capturing the largest revenue share of 44.4% by the end of 2035. The region’s progress in this field is fueled by rising crime rates, technological improvements, and regulations regarding public safety. The region is witnessing heightened demand for smart surveillance systems, encouraging continuous innovations and partnerships among key players. In this regard, Arlo Technologies in May 2025 introduced Arlo Secure 6, which is a next-generation smart home security subscription service that consists of AI-based innovations such as fire detection, advanced audio alerts, event captions, and video search for enhanced monitoring that enhances the Arlo cameras' capabilities. The company also notes that this service builds on existing person, vehicle, and custom detection, providing users with deeper insights and faster responses to emergencies, hence contributing to overall security cameras market growth.

The U.S. is progressing in the security cameras market, influenced by the presence of pioneering market players that are consistently putting efforts into offering innovative solutions to various sectors. The country’s market also benefits from supportive initiatives that are enhancing security infrastructure. As of the September 2025 report, the Nonprofit Security Grant Program (NSGP), which is managed by FEMA, provides funding to nonprofit organizations at high risk of terrorist attacks to support target hardening and physical security enhancements. For fiscal year 2025, a total of USD 274.5 million was made available, and that was equally split between urban area (NSGP-UA) and state (NSGP-S) programs, building on previous years’ funding. Therefore, this drives demand for security cameras by funding physical security upgrades, including CCTV and IP-based surveillance, in high-risk nonprofit facilities. Further, such a program highlights the role of government grants and institutional adoption in expanding the market potential.

The security cameras market in Canada is gaining momentum owing to a rise in safety concerns, increased adoption of surveillance technologies, and government initiatives which are aimed at enhancing public security. Both commercial and residential sectors in the country are making strong investments in IP-based, wireless, and AI-enabled cameras to improve monitoring and crime prevention. In this context, the Manitoba government in December 2025 launched a USD 10 million business security rebate program to help small businesses repair property damage and invest in security upgrades, which also includes security and doorbell cameras, alarm systems, and motion detectors. It also mentioned that this program provides rebates up to USD 2,500 per location on a first-come, first-served basis, thereby aiming to enhance community safety and deter crime.

APAC Market Insights

The security cameras market in the Asia Pacific is expected to register the fastest growth due to the aspects of urbanization, growing public safety concerns, and rising adoption of smart city initiatives. Governments and private enterprises in the region are deploying AI-enabled and IP-based surveillance systems to enhance monitoring capabilities. Hikvision India in May 2024 reported that it showcased its AIoT-enabled video security products at the security and fire expo West India in Mumbai, by highlighting innovations in terms of AI, robotics, and IoT technologies. The display also included advanced cameras, smart hybrid systems, thermal solutions, access control, and intelligent traffic management systems for industrial, commercial, and public sector applications. The firm notes that this event also featured technical seminars emphasizing security solutions and Hikvision India’s commitment to innovation and the Make-in-India initiative, hence denoting a positive market outlook.

China is augmenting its leadership over the regional security cameras market owing to large-scale government investments in public safety, smart city infrastructure, and industrial surveillance. The country’s market also benefits from strong local manufacturing capabilities and a growing awareness of private security needs. In September 2024, AFDATA reported that the country’s smart policing video big data application solution demonstrates large-scale government deployment of AI-enabled security cameras to support public safety and smart city governance. It was built on nationwide initiatives such as Skynet and Xueliang, and the platform integrates extensive video surveillance points with facial recognition and big-data analytics to achieve no-blind-spot monitoring. In addition, the advanced functions, such as personnel clustering, behavior analysis, and early-warning systems, enhance proactive crime prevention and policing efficiency.

In India, the security cameras market is efficiently growing on account of rising urban crime rates, government-backed smart city projects, and heightened demand for security cameras in commercial complexes, transport hubs, as well as residential societies. For instance, Honeywell in June 2025 launched its first-ever domestically designed and produced CCTV camera portfolio in the country, which is the 50 Series, by aligning with the Atmanirbhar Bharat initiative. It also stated that the class 1 certified cameras feature intelligent video analytics, enhanced imaging, gyro-based stabilization, and enterprise-grade cybersecurity, which are mainly targeted at critical infrastructure and commercial sectors. These cameras were developed at Honeywell’s Bengaluru center in collaboration with VVDN Technologies, whereas the portfolio strengthens India’s security ecosystem by promoting design in India, make in India, and make for the world.

Europe Market Insights

Europe represents one of the most prominent landscapes for the security cameras market, positively influenced by strict regulations on public safety, rising urbanization, and the adoption of intelligent surveillance systems. Both public and private sectors are making investments in high-definition cameras to improve monitoring efficiency. In December 2025, Hanwha Vision announced the launch of its first-ever ruggedised PTZ camera range, which is designed to deliver reliable, AI-powered surveillance in extreme and mission-critical environments such as ports, transportation hubs, and urban infrastructure. Besides, it is efficiently built to withstand harsh weather, strong winds, and challenging lighting conditions, and the camera combines advanced imaging, long-range zoom, and intelligent analytics powered by the Wisenet 9 AI chipset. In addition, the camera leverages military-grade durability, built-in cybersecurity, and integration with major video management systems, hence setting a high standard for resilient and intelligent surveillance solutions.

In Germany, the security cameras market is stimulated by industrial automation, smart infrastructure projects, and a focus on enhancing public and corporate security. The country strongly emphasizes data security and compliance in surveillance implementations, encouraging more players to operate in the country. In November 2025, FUJIFILM Europe GmbH announced the regional premiere of its new FUJINON SX400 surveillance camera at the Milipol 2025 security and defence exhibition, which was held in Paris. The camera is especially designed for civil and military surveillance applications, supporting use cases such as infrastructure protection, event security, and environmental monitoring. The firm also mentioned that it comprises an advanced optical zoom, high-speed autofocus, image stabilization, and haze reduction technologies to deliver clear imagery over distances of up to 1 km.

In the U.K., the security cameras market is growing exponentially due to the heightened public safety concerns, government-backed CCTV initiatives, and private sector adoption in retail, transport, and commercial buildings. The country’s market also benefits from increasing integration with smart city projects and digital infrastructure. In this context, the Greater London Authority in December 2024 reported that London’s CCTV network had received a major upgrade, with more than 300 new and enhanced cameras installed across the capital, supported by a £30 million (USD 40.1 million) investment from the Mayor of London to expand full fibre connectivity. The article also mentioned that these improvements deliver higher-quality footage, faster incident response, and reduced running costs, which helps local authorities, Transport for London, and the Met Police enhance public safety and pursue offenders more effectively, hence denoting a positive market outlook.

Key Security Cameras Market Players:

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zhejiang Dahua Technology Co., Ltd. (China)

- Axis Communications AB (Sweden)

- Bosch Security Systems GmbH (Germany)

- Hanwha Vision Co., Ltd. (South Korea)

- Avigilon Corporation (Canada/U.S.)

- Panasonic Corporation (Japan)

- Honeywell Security (U.S.)

- Uniview Technologies Co., Ltd. (China)

- Vivotek Inc. (Taiwan)

- IDIS Co., Ltd. (South Korea)

- Sony Group Corporation (Japan)

- Mobotix AG (Germany)

- Arecont Vision (U.S.)

- GeoVision Inc. (Taiwan)

- Hangzhou Hikvision Digital Technology Co., Ltd. is recognized as the world’s largest security camera manufacturer, which has a broader product portfolio spanning video surveillance hardware, AI-powered analytics, and integrated security solutions. The company leverages stronger expertise in terms of computer vision, AI chips, and large-scale manufacturing to serve government, commercial, and residential customers across the globe. Moreover, Hangzhou also focuses on end-to-end solutions, smart city deployments, and expanding AIoT applications across sectors of transportation, energy, and industrial security.

- Zhejiang Dahua Technology Co., Ltd. is yet another dominant force in this field, which is best known for its range of video surveillance products, including IP cameras, recorders, and intelligent video systems. Besides, the company focuses on AI-based analytics, edge computing, and vertical-specific solutions for sectors such as retail, transportation, and critical infrastructure. Further, Dahua’s competitive strength lies in cost-efficient manufacturing, rapid product innovation, and a strong presence in emerging markets.

- Axis Communications AB is a pioneer in the field of network cameras and is widely regarded as a technology and quality leader in the premium segment. Besides, the company is strongly focused on high-performance cameras, video management software, and analytics, with a strong concern for cybersecurity, reliability, and open-platform architecture. Axis primarily serves enterprise, government, and infrastructure customers.

- Hanwha Vision Co., Ltd. is formerly Hanwha Techwin, is one of the most prominent suppliers of professional video surveillance solutions. Also, the firm is best known for its Wisenet camera lineup, advanced AI analytics, and strong cybersecurity positioning. In addition, Hanwha’s strategy revolves around AI-based video intelligence, compliance with global security regulations, and expansion in North America and Europe, with a prime focus on enterprise and critical infrastructure applications.

- Bosch Security Systems GmbH operates as part of the Bosch Group, which offers high-quality surveillance cameras, video analytics, and integrated security solutions. The company is focused on reliability, data security, and integration with broader building and safety systems. Bosch’s competitive approach is to make continued innovations in AI and edge analytics, strong R&D capabilities, and serve regulated industries.

Below is the list of some prominent players operating in the global security cameras market:

The global security cameras market is highly competitive, which hosts large multinational firms along with specialized niche players. Leading pioneers such as Hikvision, Dahua, Axis, and Bosch intensely compete in terms of technology, AI integration, and international distribution networks, whereas other firms such as Hanwha Vision and Avigilon are emphasizing analytics and cybersecurity. In December 2024, Triton announced that it had agreed to acquire Bosch’s security and communications technology product business, which is a global leader in video surveillance, access control, intrusion detection, and professional communication solutions. BSCT operates in more than 90 locations across 50+ countries, thereby generating over €1 billion (approximately USD 1.08 billion) in revenue. Further, Triton is also planning to drive growth by investing in BSCT’s brands, technology, sales force, and go-to-market strategies, reinforcing its focus on expanding in the security and professional audio sectors.

Corporate Landscape of the Security Cameras Market:

Recent Developments

- In August 2025, Arlo Technologies introduced a new lineup of AI-based smart home security cameras, which includes indoor and outdoor Pan-Tilt models with 360-degree coverage and updated essential, pro, and ultra-series cameras offering up to 4K HDR video.

- In July 2025, Sparsh CCTV, Innoviz Technologies, and Cron AI announced that they entered into a partnership to deliver an integrated LiDAR-camera-AI perception platform for perimeter security, intelligent transport systems, railways, and critical infrastructure across India.

- In March 2025, the City of Brampton announced the installation of 360-degree cameras and license plate recognition technology at 50 traffic intersections to enhance public safety, providing Peel Regional Police with real-time data for crime prevention and investigations.

- Report ID: 5194

- Published Date: Dec 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Security Cameras Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.