Secure Access Service Edge Market Outlook:

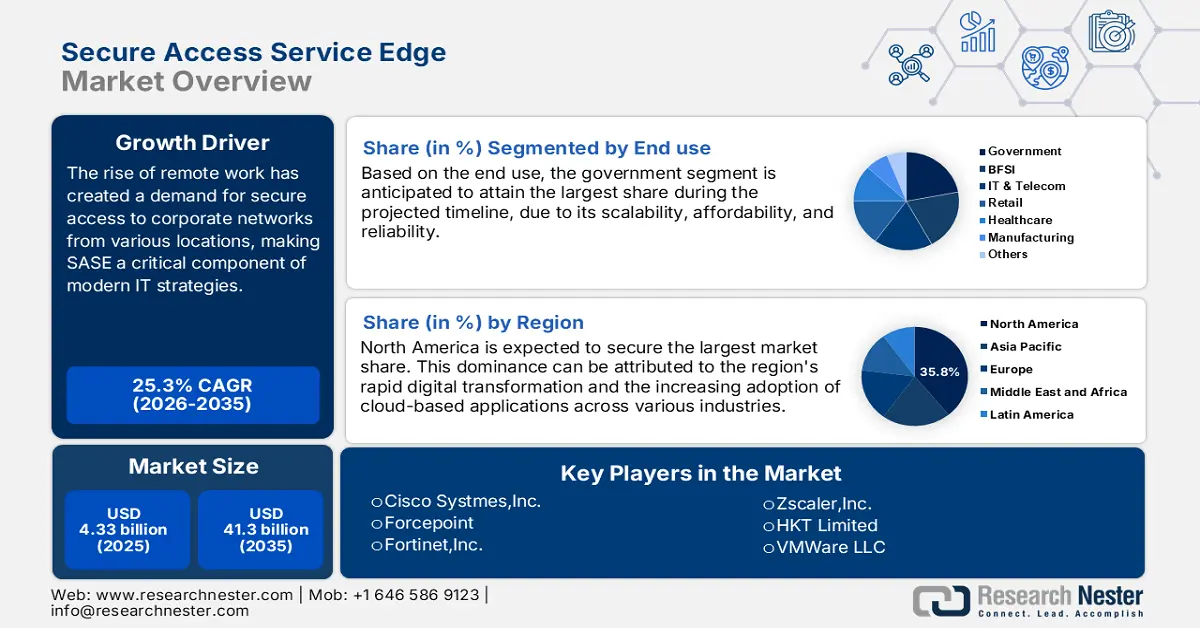

Secure Access Service Edge Market size was over USD 4.33 billion in 2025 and is poised to exceed USD 41.3 billion by 2035, growing at over 25.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of secure access service edge is estimated at USD 5.32 billion.

The secure access service edge market is expanding due to the increased need for comprehensive security frameworks to address rising cyber threats globally. According to the World Economic Forum, approximately 2,220 cyberattacks occur yearly up to over 800,000 attacks annually. Businesses are moving to cloud-based apps, which provide scalability and flexibility but also present security risks including illegal access and data breaches. By offering a cohesive architecture that integrates networking and security services, SASE solves these problems and empowers enterprises to adopt a zero-trust security paradigm that limits access to only approved users and applications. The growing emphasis on regulatory compliance and data protection has driven the adoption of SASE solutions, as companies seek to protect sensitive information while preserving operational efficiency.

Key Secure Access Service Edge Market Insights Summary:

Regional Highlights:

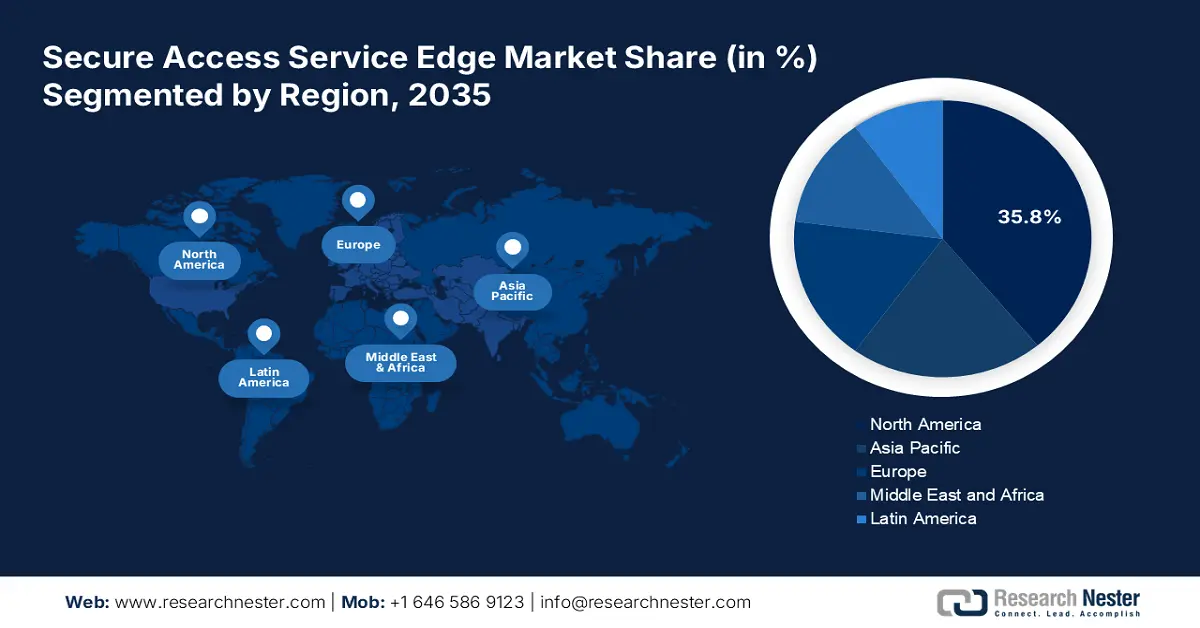

- North America's 35.8% share in the Secure Access Service Edge Market is fueled by the rollout of 5G networks and Edge AI technology offering decision-making at the network's edge, solidifying its lead in 2026–2035.

Segment Insights:

- The Security as a Service segment is projected to achieve a notable share by 2035, fueled by the flexibility of SaaS solutions adapting to evolving organizational and security needs.

- Government Secure Access Service Edge segment is expected to achieve a 20.80% share by 2035, driven by the rising popularity of scalable and flexible cloud computing in the government sector.

Key Growth Trends:

- Increasing cloud computing services

- Growing remote work trends

Major Challenges:

- Complex deployment

- Higher infrastructure costs

- Key Players: Cisco Systems, Inc., Forcepoint, Fortinet, Inc., Palo Alto Networks, Inc., Zscaler, Inc., HKT Limited, Tata Communications Limited, Proofpoint, Inc., Singtel, VMware LLC.

Global Secure Access Service Edge Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.33 billion

- 2026 Market Size: USD 5.32 billion

- Projected Market Size: USD 41.3 billion by 2035

- Growth Forecasts: 25.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Secure Access Service Edge Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing cloud computing services: Cloud computing and cybersecurity go hand in hand in the current digital era. The Google Cloud reported that leaders are growing their use of cloud-based services and products (41.4%), preparing to switch from legacy enterprise software to cloud-based solutions (33.4%), and moving on-premises workloads to the cloud (32.8%) as a result of the present macroeconomic environment.

Cloud data security is becoming increasingly crucial as more companies use cloud solutions. There is always a real risk of data breaches due to hacking, human mistakes, or exploiting built-in system weaknesses when private information is stored on public cloud servers. It is challenging to detect and respond quickly after perimeter defenses are compromised due to a lack of visibility into cloud infrastructure. By offering a unified strategy that combines network security and cloud access control, SASE tackles these issues. - Growing remote work trends: Remote work has transformed the business landscape with improved flexibility, talent globalization, and work-life balance. The World Economic Forum predicted that digital jobs worldwide will increase by about 25% to over 90 million positions by 2030. Many firms are modifying their security measures in response to the rapid adoption of remote work to prevent critical data from spreading outside the company. Uncentralized businesses employ personal devices, rely on home networks, and have virtually unfettered access to company infrastructure. As a result, fraudsters now find such companies to be a perfect place to operate.

To mitigate these challenges, companies are adopting SASE solutions, which provide real-time threat detection and analytics to identify and respond to cyber threats effectively. By implementing security rules and data privacy controls, SASE is anticipated to assist enterprises in adhering to industry requirements and data protection laws. Therefore, the SASE industry is witnessing enormous growth, driven by the surging demand for secure, cloud-centric network architectures. - Integration of advanced technologies: AI and machine learning are increasingly integrated into security systems to improve their threat identification and response capacity. In addition to enhancing overall security, this strategy lowers the chance of breaches, speeds up threat response, and increases organizational resilience. AI and ML improve SASE systems' autonomous reaction capabilities by carrying out pre-established security procedures without requiring human involvement.

Major companies are launching various technologies in the secure access service edge market that simplify the management and monitoring of complex infrastructure. For instance, in August 2023, Versa Networks revealed a series of improvements to VersaAITM, including secure generative AI tools, improved network, and security operational excellence, and new embedded generative AI capabilities to detect malicious activities in real-time.

Challenges

-

Complex deployment: To ensure compatibility and optimal performance, successfully integrating SASE with existing network and security infrastructures demands careful planning, precise configuration, and significant customization. Organizations must navigate various challenges, including data transfer, system integration, and comprehensive employee training. Transitioning from traditional security models to a SASE framework requires considerable resources and technical expertise, which may hinder the widespread adoption of SASE.

-

Higher infrastructure costs: SASE usually entails a move toward cloud-native design, which could necessitate upgrades or new infrastructure investments for businesses. This covers the price of SD-WAN appliances, cloud resources, edge computing equipment, and other hardware parts. Software components such as administration tools, networking features, and security services may have license fees associated with SASE solutions. Since SASE depends on the cloud for networking and security services, there can be fees related to bandwidth and data transfer, especially for big or data-intensive businesses. These factors may impede the secure access service edge market.

Secure Access Service Edge Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.3% |

|

Base Year Market Size (2025) |

USD 4.33 billion |

|

Forecast Year Market Size (2035) |

USD 41.3 billion |

|

Regional Scope |

|

Secure Access Service Edge Market Segmentation:

End use (BFSI, IT & Telecom, Retail, Healthcare, Government, Manufacturing)

Government segment is estimated to hold over 20.8% secure access service edge market share by the end of 2035. Cloud computing is becoming popular in the government sector due to its scalability, affordability, and flexibility. According to a survey conducted in January 2021, 70% of state and local governments prefer to host citizen and mission data in the cloud. Agencies can use cloud computing to access cutting-edge technology such as artificial intelligence (AI) and big data analytics, streamline operations, lower operating costs, and promote creativity. Furthermore, cloud services facilitate safe and cooperative settings, which is essential for managing private government information. The industry's dedication to enhancing responsiveness and efficiency in public administration and services is reflected in this spike in demand.

Service Standards (SD-WAN, SSE (Security Service Edge))

The SD-WAN segment in secure access service edge market is expected to hold a significant share by 2035. By separating network hardware from the control plane and facilitating centralized software-based management, SD-WAN services improve the functionality and administration of wide-area networks (WANs). SD-WAN becomes a crucial element in enabling safe and effective access to data and apps from any location when combined with SASE. In addition to providing dynamic and safe connectivity, it improves network performance.

Offering (Network as a service, Security as a service)

The security as a service segment in secure access service edge market will garner a notable share in the forecast period. Whether growing for more users, moving to new locations, or addressing new security concerns, these platforms can easily adjust to an organization's changing needs. In the dynamic field of network security, where requirements and threats are ever-changing, this flexibility is essential. Without requiring major reconfiguration or additional hardware investments, SaaS solutions enable businesses to quickly implement new security features, modify use, and address emerging concerns. Robust protection is guaranteed by this flexibility, which also synchronizes security capabilities with company expansion and technology breakthroughs.

Our in-depth analysis of the global secure access service edge market includes the following segments:

|

Offering |

|

|

Service Standards |

|

|

Organization Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Secure Access Service Edge Market Regional Analysis:

North America Market Statistics

North America secure access service edge market is set to hold revenue share of over 35.8% by the end of 2035. The market growth can be attributed to the rollout of 5G networks with Edge AI technology offering decision-making at the network's edge and more dependable communication. For instance, in 2023, North America accounted for 29% of all regional connections, making it a leader in deploying 5G. There were 197 million 5G connections at the end of 2023. These developments, however, present new security issues that conventional approaches might not be able to effectively address. SASE solutions provide a cloud-based security infrastructure that ensures secure remote access, and compliance monitoring, and safeguards data and apps from cyber-attacks.

In the U.S. the presence of major corporations has fueled the demand for SASE to protect their complex networks, applications, and data from increasing cyber-attacks. Also, the government is focusing on cybersecurity, particularly in defense and finance sectors which is also contributing to the secure access service edge market. According to a report by the White House, USD 10.9 billion in civilian cybersecurity funding is included in the President's Budget, supporting the defense of Federal IT and the Nation's most important data, including the American public's personal information. Moreover, rapid digital transformation and rising demand for secure and scalable network architectures are growing the demand for SASE in Canada.

Europe Market Analysis

Europe will witness substantial growth in the secure access service edge market by 2035. Major businesses are investing in IT infrastructure and cloud computing services at a rapid pace, which increases demand for sophisticated network and security solutions that can change to meet evolving business requirements. According to the European Union, in 2023, 42.5% of EU businesses purchased cloud computing services, primarily for office software, file storage, and email, a 4.2% increase in the purchase of these services than in 2021. Secure Access Service Edge (SASE) effectively addresses this need by delivering scalable and flexible solutions that combine networking and security functions into a unified cloud-based platform. This approach not only boosts security and efficiency but also helps enterprises adapt to their changing requirements.

The increased shift toward more remote and hybrid work has led to a notable upsurge in the U.K. secure access service edge market for Secure Access Service Edge (SASE) network solutions. Using SASE and other cloud-based security solutions has grown in the nation due to the spread of individual devices among widely dispersed workforces. The need for cybersecurity and digital transformation initiatives is expected to fuel this growth trend in the upcoming years. Furthermore, businesses are implementing SD-WAN as a component of a full SASE solution, frequently via a managed services provider or a fully managed SASE service.

Furthermore, Germany is an ideal location to deploy SASE technologies due to its strong and developed IT infrastructure. Additionally, businesses are renowned for emphasizing cost-effectiveness and efficiency, which aligns with SD-WAN's benefits, which include improved network performance and reduced networking costs. Additionally, there is a high demand for reliable and secure networking solutions in the German secure access service edge market, and secure access service edge provides enhanced security and centralized management features.

Key Secure Access Service Edge Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Forcepoint

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Zscaler, Inc.

- HKT Limited

- Tata Communications Limited

- Proofpoint, Inc.

- Singtel

- VMware LLC

Established, pure-play suppliers lead the fiercely competitive secure access service edge market, which is well-represented across several verticals and geographical areas. These suppliers can serve a wide range of clientele due to their extensive geographic reach and network of partners. Other suppliers are offering comparable goods and services in the fiercely competitive secure access service edge market.

Recent Developments

- In May 2024, Palo Alto Networks launched Prisma SASE 3.0, the latest breakthrough to future-proof and modernize the workforce. Prisma SASE 3.0 now includes Zero Trust to secure managed and unmanaged devices, the industry's first fully integrated business browser, AI-powered data security, and dynamic application acceleration up to five times faster.

- In January 2024, Zscaler, Inc., the cloud security leader, today announced Zscaler Zero Trust SASE, an industry-first, single-vendor SASE solution built with Zscaler Zero Trust AI to help organizations reduce cost and complexity while implementing Zero Trust security across users, devices, and workloads.

- Report ID: 6901

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Secure Access Service Edge Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.