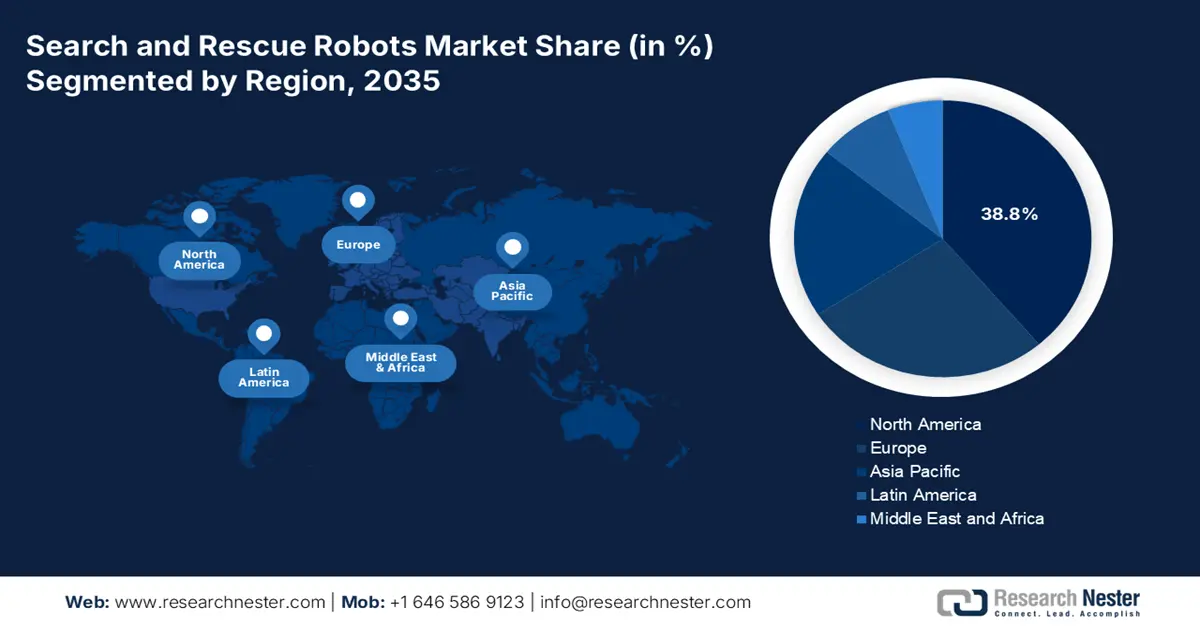

Search and Rescue Robots Market - Regional Analysis

North America Market Insights

North America is expected to maintain a dominant position in the search and rescue robots market and is poised to hold a share of 38.8% by 2035. The market is driven by the high defense spending, advanced technological adoption, and proactive federal initiatives integrating robotics into first responder protocols. The key drivers include the U.S. Department of Defense’s sustained procurement of unmanned ground systems and the formalization of drone programs by agencies such as FEMA and the U.S. Forest Service for disaster response. The primary trend is the push for interoperability and multi-domain operations supported by the DHS S&T standards. The supply-side trends focus on developing rugged autonomous platforms for CBRNE and wildfire applications, with investment fueled by grants such as FEMA’s AFG program.

The U.S. search and rescue robots market is defined by a demand shift from the standalone platforms to integrated interoperable systems for multi-domain operations. A primary trend is the institutional adoption of drones by public safety agencies, driven by proven operational utility. The NLM October 2022 study indicates that a snake-like tracked disaster relief robot and an OmniTread4 robot were developed by U.S. scientists. Further, the OmniTread4 is designed to carry out rescue missions and can survey the unknown terrain, such as caves. Moreover, the NIST continues to develop critical performance standards for such robots that guide procurement and ensure reliability in field operations. This push for standardization is directly supported by the federal funding channels, such as FEMA, enabling the local agencies to acquire and integrate these advanced robotic systems into their standard response protocols.

The Canada search and rescue robots market is strongly supported by the direct federal procurement and pre commercial testing programs aimed at operational deployment. A key demand driver is innovation, science, and economic development. Canada’s innovation solutions Canada program explicitly solicits autonomous systems and robotics for search and rescue, emergency response, remote operations, and arctic environments. The report from the Government of Canada in November 2024 depicts that under the autonomous systems and robotics call for prototypes, the government offers contract-based funding of up to CAD 550,000 for civilian applications and CAD 1.15 million for military components, signaling the measurable public sector spending commitment. The program highlights the operations-ready air, land, and marine robots capable of functioning in GPS-denied, cold-weather, and low-connectivity environments, aligning directly with Canada’s SAR needs.

APAC Market Insights

The Asia Pacific is the fastest-growing search and rescue robots market and is projected to grow at a CAGR of 10.8% during the forecast period 2026 to 2035. The search and rescue robots market growth is fueled by the region’s acute vulnerability to natural disasters and complex geopolitical tensions. A primary demand driver is the formal integration of robotic systems into the national disaster management frameworks. For example, Japan’s New Energy and Industrial Technology Development Organization has historically funded the development of robots for response to earthquakes and tsunamis, creating a pipeline for specialized technology. The trend is toward the indigenously developed systems suited for local terrain alongside strategic partnerships with Western firms for technology transfer, positioning APAC as a critical innovation and procurement hub.

Japan’s search and rescue robots market is shaped by the sustained government focus on disaster resilience and the operational integration of advanced technologies across the emergency response systems. The recurrent earthquake, typhoons, and floods have driven national and local authorities to adopt the AI-enabled situational awareness platforms that work alongside robotic and autonomous SAR assets. The Government of Japan's March 2025 report has shown that the AI-based disaster intelligence services, such as the Spectee Pro, are now widely used by the local governments and disaster response organizations supporting real-time decision-making during the rescue operations. Since its launch, the platform has secured with 100% retention, demonstrating the institutional reliance on technology-enabled SAR ecosystems. Its deployment during the2024 Noto Peninsula Earthquake underscores how Japan’s SAR strategy increasingly combines AI analytics with the field-deployed robots to improve victim localization, responder safety, and response speed.

Government Adoption Signals for Japan SAR Technology Ecosystem

|

Indicator |

Evidence (Government Source) |

Year |

Relevance to SAR Robots Market |

|

Government-backed disaster tech adoption |

Spectee Pro adopted by numerous Japanese local governments |

2020–2025 |

Demonstrates institutional demand for SAR-supporting technologies |

|

Number of public-sector & enterprise contracts |

1,100+ active contracts, near 100% retention |

2025 |

Indicates scale, reliability, and procurement maturity |

|

National disaster deployment |

Used during the 2024 Noto Peninsula Earthquake |

2024 |

Confirms real-world SAR operational use |

Source: The Government of Japan March 2025

The search and rescue robots market in China is being shaped by the strong municipal and national government investment in embodied intelligence, emergency response, modernization, and urban disaster preparedness. A clear demand signal comes from the Shanghain Municipal People’s Government’s December 2025 announcement, which is actively promoting the rescue robots via government-backed platforms such as the Global Developer Pioneers Summit 2025 and the International Embodied Intelligence Competition. These initiatives simulate the real emergency rescue scenarios where the robots perform rubble navigation, heavy load transport, and remote reconnaissance, core SAR functions. Shanghai has established a 100 billion yuan industry fund to support the embodied intelligence and robotics development, creating a sustained pipeline from the R&D to deployment. Government-supported facilities like the National and Local Co-Built Humanoid Robotics Innovation Center further enable testing and validation.

Europe Market Insights

The search and rescue robots market in Europe is actively expanding and is driven by the region’s focus on civil protection and defense modernization. The key demand drivers include the escalating frequency and severity of natural disasters such as floods and wildfires that have prompted substantial EU-wide investments in disaster risk management technologies via mechanisms. The primary market trend is the push for standardized interoperable robotic systems that can be deployed seamlessly across national borders during major emergencies. This is supported by the collaborative R&D programs under the European Defense Fund, which co-finance the development of next-gen robotic platforms for both the military and civilian first responders. The increasing integration of AI for autonomous navigation in complex environments and the use of robots for Chemical, Biological, Radiological, and Nuclear (CBRN) threat detection are shaping product development.

Germany’s dominance in the search and rescue robots market is underpinned by its unparalleled industrial manufacturing base, deep R&D expertise, and systematic approach to civil protection. The report from the GTA in 2025 indicates that Germany is the fifth-largest robot market in the world and is the home of the largest robot market in Europe. This data point is a powerful validation of Germany’s market leadership. The country’s dense ecosystem of industrial robotics manufacturers and integrators provides a direct technological foundation and supply chain advantage for developing robust, reliable SAR platforms. Further, Germany’s Vds Schadeverhutung publishes guidelines for firefighting and rescue equipment, influencing the technical standards that domestic manufacturers are primed to meet, thereby shaping both the domestic and broader market in Europe.

Service Robot Sales in 2024

|

Robot Category |

Units Sold |

Growth Rate |

Primary Applications |

|

Mobile Robots (Transport/Logistics) |

103,000 |

+14% |

Goods/cargo transport |

|

Hospitality Robots |

42,000 |

- |

Room service, guest assistance |

|

Agricultural Robots |

20,000 |

+6% |

Planting, harvesting |

|

Professional Cleaning Robots |

25,000 |

+34% |

Large-scale cleaning operations |

|

Search & Rescue/Security |

3,128 |

+19% |

Emergency response, security |

|

Medical Robots |

6,200 |

+36% (2023 base) |

Surgeries, diagnostics |

Source: GTAI 2025

The UK search and rescue robots market is shaped by the government-backed robotics adoption programs, emergency response modernization, and safety-driven automation priorities. The public investment in the robotics infrastructure is being channeled via the national centers and sector-focused initiatives that support the deployment-ready systems for hazardous and remote environments. The report from Tech UK in June 2025 notes that the National Robotarium, established with £22.4 million in public capital funding, is a key enabler, supporting robotics applications relevant to emergency response, offshore operations, and public safety missions. Further, the UK government’s offshore wind expansion target of GW by 2030 is driving the demand for autonomous inspection and intervention robots that reduce human exposure to high-risk rescue scenarios.