Seam Tapes Market Outlook:

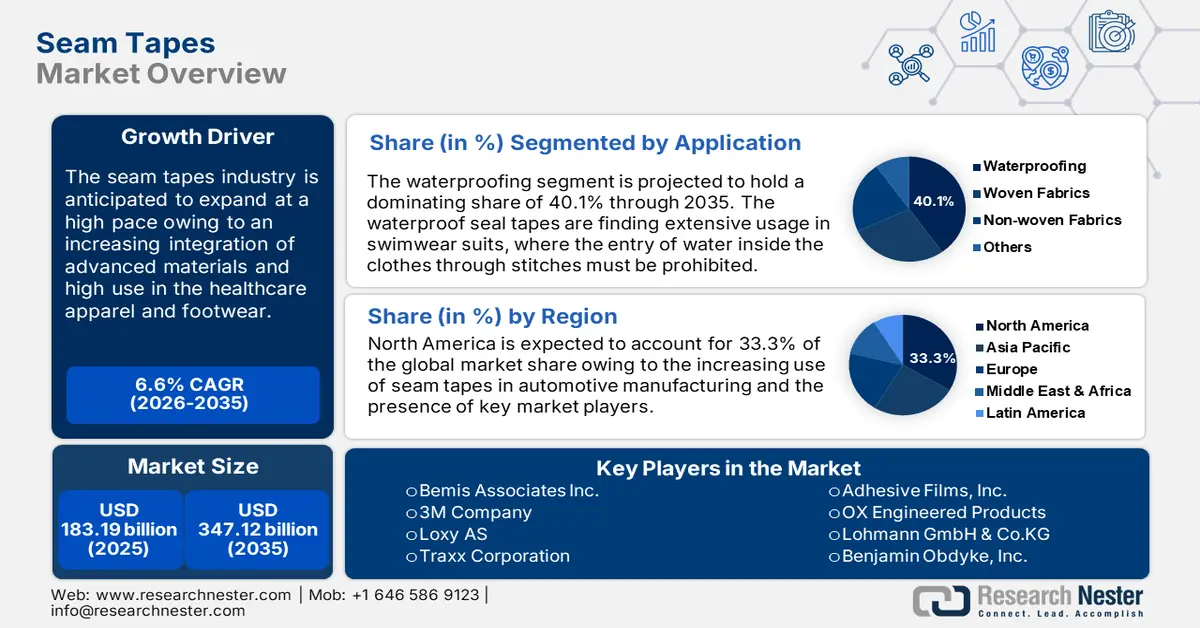

Seam Tapes Market size was valued at USD 183.19 billion in 2025 and is set to exceed USD 347.12 billion by 2035, registering over 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of seam tapes is evaluated at USD 194.07 billion.

The increasing application of seam sealing technology in apparel manufacturing and continuous innovations in adhesive formulations are expected to increase the demand for advanced seam tapes in the coming years. Advanced adhesive formulations offer sustainability, superior bonding strength, durability, and resistance to environmental factors. For instance, in September 2023, a research team from Purdue University developed a sustainable and cost-effective adhesive solution inspired by marine shellfish. This sealing solution is the best alternative to toxic chemical-based adhesive and is set to drive high applications in several sectors. Thus, such advanced formulations contribute to the long-lasting performance of seam sealing tapes, leading to their high usage.

Key Seam Tapes Market Insights Summary:

Regional Highlights:

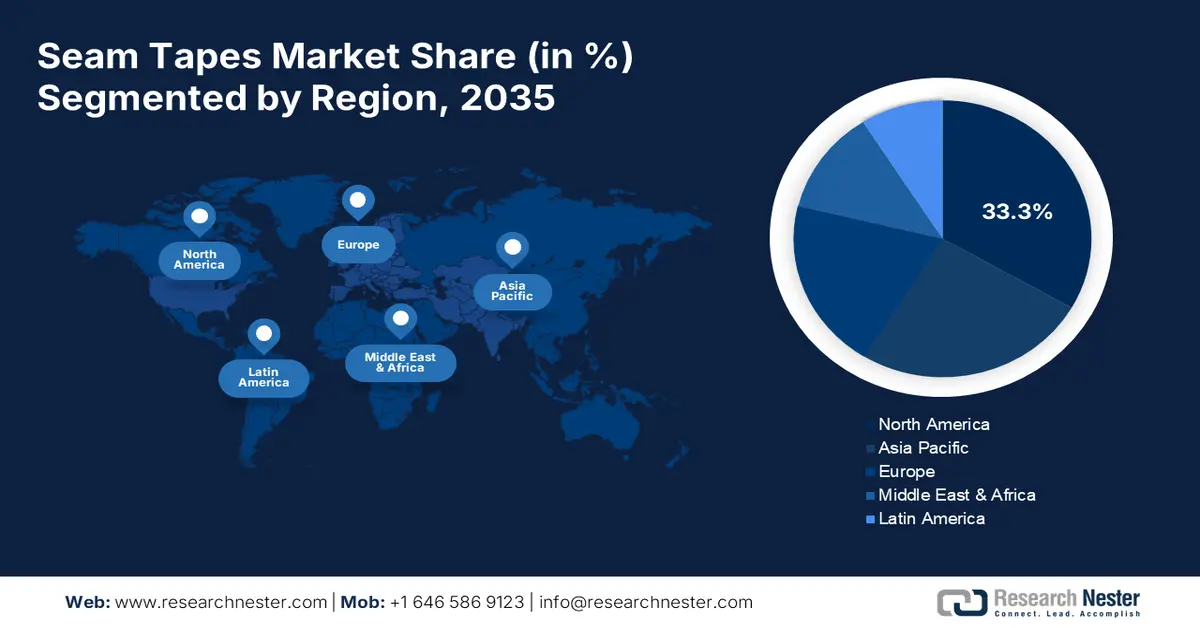

- North America dominates the Seam Tapes Market with a 33.3% share, fueled by R&D in seam sealing technologies and presence of leading industry players, driving strong growth by 2035.

- The Seam Tapes Market in Asia Pacific is anticipated to experience rapid growth through 2026–2035, driven by rising demand in automotive interiors, healthcare apparel, and sportswear.

Segment Insights:

- The Waterproofing segment is expected to achieve a substantial share by 2035, driven by effective water barrier properties in swimwear and outdoor product manufacturing.

Key Growth Trends:

- High demand for seam tapes in functional apparel

- High application in automobile manufacturing

Major Challenges:

- Emergence of advanced substitutes

- Lack of awareness of seam tapes

- Key Players: Himel Corp, Sattler SUN-TEX GmbH, Loxy AS, Traxx Corporation, Benjamin Obdyke, Inc., and Lohmann GmbH & Co.KG.

Global Seam Tapes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 183.19 billion

- 2026 Market Size: USD 194.07 billion

- Projected Market Size: USD 347.12 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Seam Tapes Market Growth Drivers and Challenges:

Growth Drivers

- High demand for seam tapes in functional apparel: The sales of seam tapes are rising owing to high demand in the sportswear sector for their gasp-filling properties and versatility. In water sports, swimsuits are manufactured with ultra-thin and ultrasonic sewing incorporated with seam sealing tapes. The innovations in fabric technology such as the introduction of waterproof and water-repellent fabrics are boosting the use of seam tapes in swimsuit production. Functional apparel such as sportswear, protective clothing, and activewear highly used by health-conscious and healthcare individuals are boosting the application of seam tapes. Thus, the rising demand for outdoor and performance wear is anticipated to augment the seam tapes market growth in the coming years.

- High application in automobile manufacturing: The automotive sector is one of the major users of seal tapes owing to their durability and high performance. Sealing tapes such as wire harness tapes and electrical tapes are used in vehicles for electrical wire protection from moisture and damage. Furthermore, in automobile engines, conducting shielding tapes are used due to their extra protectiveness. Manufacturers are also developing advanced sealing tapes to be used in vehicle interiors, batteries, and other components for an effective binding process. For instance, in January 2023, Lohmann GmbH & Co.KG revealed the launch of a new advanced sealing tape for low-emission bonding in vehicle interiors. The new ‘DuploCOLL LE 59xxx’ double-sided pressure-sensitive tape is manufactured in an energy-efficient manner to align with the sustainability trend and aid vehicles in mitigating carbon footprint.

Challenges

-

Emergence of advanced substitutes: Alternative sealing adhesives are also gaining traction that may hinder the sales of seam tapes to some extent. Some smart fabric producers are developing advanced sealing technology, which significantly limits the use of conventional seam tapes.

-

Lack of awareness of seam tapes: The limited awareness of seam tape use is expected to hinder their adoption rates, particularly in underdeveloped and developing regions. Many organizations from the textile, automotive, and construction sectors in these regions have less knowledge of the advantages associated with seam tape use such as durability, strength, and waterproofing, which can lower their sales.

Seam Tapes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 183.19 billion |

|

Forecast Year Market Size (2035) |

USD 347.12 billion |

|

Regional Scope |

|

Seam Tapes Market Segmentation:

Application (Waterproofing, Woven Fabrics, Non-woven Fabrics, Others)

Waterproofing segment is projected to capture seam tapes market share of over 40.1% by 2035. In the swimming suit production, the manufacturers make high use of seam sealing tapes as they effectively act as barriers to water entry points, ensuring a water-tight seal. Products such as tents, high-performance outwear, and footwear are also manufactured using advanced seam sealing tapes. Market players are constantly introducing advanced seam tape solutions with improved waterproofing qualities, contributing to segmental growth. For instance, in February 2023, Benjamin Obdyke, Inc. introduced an innovative seam sealing tape ‘HydroTape DS’. This product effectively mitigates moisture challenges owing to its waterproofing qualities.

End use Industry (Apparel & Footwear, Healthcare, Automotive, Military & Aerospace, Others)

The healthcare segment is foreseen to account for a major seam tapes market share through 2035. The seam tapes are exhibiting increasing use in the healthcare sector owing to their ability to effectively seal surgical gowns, tapes, and other medical clothing as it is necessary to ensure infection prevention in surgical or clinical settings. Innovations in fabric and adhesive technologies are also augmenting a high demand for advanced seam tapes. For instance, in November 2023, Lohmann GmbH & Co.KG announced the launch of DuploMED 85300 a long-wear, water-resistant, and breathable medical-grade skin adhesive. This sealing technology offers medical wearable devices, particularly continuous glucose monitoring with an outstanding wear-time of 28 days.

Our in-depth analysis of the seam tapes market includes the following segments:

|

Material Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Seam Tapes Market Regional Analysis:

North America Market Forecast

North America industry is likely to hold largest revenue share of 33.3% by 2035. The presence of industry giants is majorly influencing the sales of seam tapes in North America. Prime companies are investing heavily in research and development activities leading to the production of advanced seam sealing technologies, which further positively influence the sales of seam tapes in the region.

The U.S. seam tapes market is expected to increase at a high CAGR from 2026 to 2035 owing to their increasing use in smart fabric production. Seam tapes are a vital component in advanced clothing including emergency apparel kits, PPT kits, swimwear, and more. These sealing solutions offer high durability and eliminate the entry of exterior particles such as water and dust. Manufacturers based in the U.S. are also producing tools such as seamstick taper that contribute to the efficiency of seam tapes. For instance, in February 2024, Trivantage LLC announced the launch of a new seamstick taper tool, which aids in the smooth application of seam tapes to zippers. The tool received a Supplier Spotlight as a Best New Exhibitor Product at the Marine Fabricators Conference 2024.

In Canada, the strong presence of automotive manufacturing companies such as ABC Technologies Inc. and Stellantis Canada is supporting seam tape sales. The automotive sector is also one of the major end users of seam reinforcement tapes that are used in fixing the wire connection and interior of vehicles. The swiftly expanding automotive sector is expected to consistently drive the sales of seam tapes in the country.

Asia Pacific Market Statistics

The Asia Pacific seam tapes market is anticipated to register a rapid CAGR during the study period owing to its increasing applications in automotive interior and healthcare apparel. The region is witnessing high growth in the field of sports, which is healthily boosting the demand for advanced sportswear. The rise in the demand for advanced and high-performance sportswear products directly influences the sales of seam tapes, as these solutions are widely used in apparel for effective sealing purposes.

India has one of the largest textile industries in Asia Pacific and is the third largest exporter of textiles and apparel in the world. The government is continuously investing in advancing the textile industry, which is expected to push the sales of seam tapes in the coming years. For instance, according to the India Brand Equity Foundation, the Government of India approved USD 7.4 million for R&D in the textile sector.

China is the automotive leader in the world based on both production and sales, the continuous rise in the domestic production of vehicles is expected to generate profitable opportunities for seam tape manufacturers during the foreseeable period. According to a report by the International Trade Administration, the domestic production of vehicles in China is expected to reach 35 million by 2025. In automobile manufacturing these tapes play an important role in moisture control, fixing wire connections, and waterproofing.

Key Seam Tapes Market Players:

- Bemis Associates Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- Sealon

- Himel Corp

- Sattler Sun Tex GmbH

- Loxy AS

- Traxx Corporation

- Benjamin Obdyke, Inc.

- Lohmann GmbH & Co.KG

- Gerlinger Industries GmbH

- Adhesive Films, Inc.

- San Chemicals Ltd

- HB. Fuller Company

- Wacker Chemie AG

- Sika AG

- PPG Industries

- Huntsman Corporation

- DuPont de Nemours, Inc.

- OX Engineered Products

- Taiwan Hipster

Key players in the seam tapes market are investing in research and development activities to manufacture high-performance sealing solutions integrated with advanced materials such as polyurethane and polyvinyl chloride that offer better waterproofing and strength. Considering the sustainability trend, the companies are also focusing on the production of eco-friendly seam tapes to attract environmentally conscious users.

The industry giants are forming strategic partnerships with other players and research organizations to innovate sealing solutions, which will help them expand their product offerings. They are also collaborating with textile and automotive industry players to boost their market reach. Some of the key players include:

Recent Developments

- In January 2024, the Taiwan Textile Federation and Taiwan Hipster collaborated to develop a thermoplastic polyester elastomer (TPEE) adhesive film. This sealant solution offers seamless bonding that makes it a perfect fit for use in tents, advanced apparel, outdoor textiles, and bags.

- In November 2022, OX Engineered Products announced the launch of 3 new seam tape products isoRED GF Seam Tape, isoRED WF Seam Tape, and Titan Seam Tape. These products are finding wide applications in sheathing and construction applications.

- Report ID: 6648

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Seam Tapes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.