Global Screen Printing Inks Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Avient Corporation

- Deco Technology Group, Inc.

- DIC Corporation

- Dongguan Kedo Silicone Material Co., Ltd.

- EASTMAN KODAK COMPANY

- FUJIFILM Holdings Corporation

- Hubergroup

- Kolorcure Corporation

- Nazdar Ink Technologies

- Saati S.p.A.

- Speedball Art

- Teikoku Printing Inks Mfg. Co., Ltd.

- TAIYO HOLDINGS CO., LTD.

- Zeller+Gmelin

- Ongoing Technological Advancements

- Price Benchmarking

- SWOT Analysis

- Ink Type Analysis

- Recent News Analysis

- Strategical Development

- End User Analysis

- Gap Analysis

- Porter Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2019-2037, By

- Ink Type, Value (USD Million)

- Plastisol Inks

- Water-Based Inks

- UV Inks

- Solvent Type Inks

- Specialty Inks

- Discharge Inks

- Others

- PCB Inks

- Solder Mask Ink

- Conductive Ink

- Other Inks

- Printing Process, Value (USD Million)

- Manual Screen Printing

- Automated Screen Printing

- Hybrid Printing

- Product Form, Value (USD Million)

- Pre-Mixed Inks

- Concentrated Inks

- Ink Additives

- End User, Value (USD Million)

- Textile & Apparel Industry

- Advertising & Marketing

- Automotive & Transportation

- Consumer Electronics

- Medical & Healthcare

- Other End Users

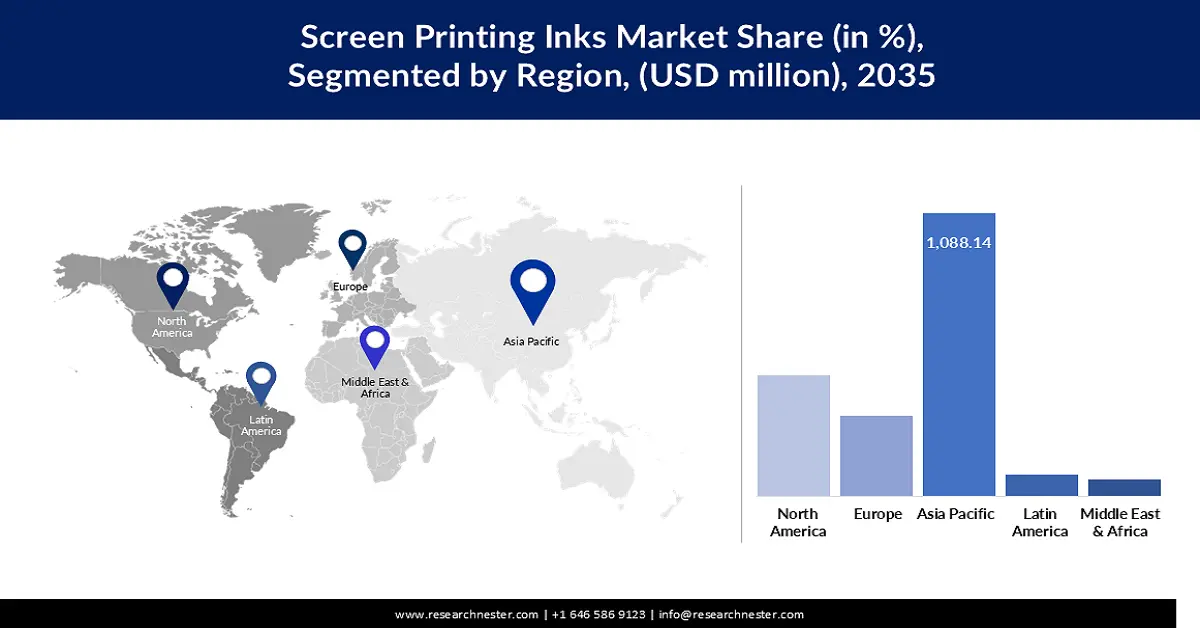

- Regional Synopsis, Value (USD Million)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Ink Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Ink Type, Value (USD Million)

- Plastisol Inks

- Water-Based Inks

- UV Inks

- Solvent Type Inks

- Specialty Inks

- Discharge Inks

- Others

- PCB Inks

- Solder Mask Ink

- Conductive Ink

- Other Inks

- Printing Process, Value (USD Million)

- Manual Screen Printing

- Automated Screen Printing

- Hybrid Printing

- Product Form, Value (USD Million)

- Pre-Mixed Inks

- Concentrated Inks

- Ink Additives

- End User, Value (USD Million)

- Textile & Apparel Industry

- Advertising & Marketing

- Automotive & Transportation

- Consumer Electronics

- Medical & Healthcare

- Other End Users

- Country Level Analysis Value (USD Million)

- US

- Canada

- Ink Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Ink Type, Value (USD Million)

- Plastisol Inks

- Water-Based Inks

- UV Inks

- Solvent Type Inks

- Specialty Inks

- Discharge Inks

- Others

- PCB Inks

- Solder Mask Ink

- Conductive Ink

- Other Inks

- Printing Process, Value (USD Million)

- Manual Screen Printing

- Automated Screen Printing

- Hybrid Printing

- Product Form, Value (USD Million)

- Pre-Mixed Inks

- Concentrated Inks

- Ink Additives

- End User, Value (USD Million)

- Textile & Apparel Industry

- Advertising & Marketing

- Automotive & Transportation

- Consumer Electronics

- Medical & Healthcare

- Other End Users

- Country Level Analysis Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Ink Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Ink Type, Value (USD Million)

- Plastisol Inks

- Water-Based Inks

- UV Inks

- Solvent Type Inks

- Specialty Inks

- Discharge Inks

- Others

- PCB Inks

- Solder Mask Ink

- Conductive Ink

- Other Inks

- Printing Process, Value (USD Million)

- Manual Screen Printing

- Automated Screen Printing

- Hybrid Printing

- Product Form, Value (USD Million)

- Pre-Mixed Inks

- Concentrated Inks

- Ink Additives

- End User, Value (USD Million)

- Textile & Apparel Industry

- Advertising & Marketing

- Automotive & Transportation

- Consumer Electronics

- Medical & Healthcare

- Other End Users

- Country Level Analysis Value (USD Million)

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Taiwan

- Thailand

- Singapore

- Philippines

- Vietnam

- New Zealand

- Malaysia

- Rest of Asia Pacific

- Ink Type, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Ink Type, Value (USD Million)

- Plastisol Inks

- Water-Based Inks

- UV Inks

- Solvent Type Inks

- Specialty Inks

- Discharge Inks

- Others

- PCB Inks

- Solder Mask Ink

- Conductive Ink

- Other Inks

- Printing Process, Value (USD Million)

- Manual Screen Printing

- Automated Screen Printing

- Hybrid Printing

- Product Form, Value (USD Million)

- Pre-Mixed Inks

- Concentrated Inks

- Ink Additives

- End User, Value (USD Million)

- Textile & Apparel Industry

- Advertising & Marketing

- Automotive & Transportation

- Consumer Electronics

- Medical & Healthcare

- Other End Users

- Country Level Analysis Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Ink Type, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Ink Type, Value (USD Million)

- Plastisol Inks

- Water-Based Inks

- UV Inks

- Solvent Type Inks

- Specialty Inks

- Discharge Inks

- Others

- PCB Inks

- Solder Mask Ink

- Conductive Ink

- Other Inks

- Printing Process, Value (USD Million)

- Manual Screen Printing

- Automated Screen Printing

- Hybrid Printing

- Product Form, Value (USD Million)

- Pre-Mixed Inks

- Concentrated Inks

- Ink Additives

- End User, Value (USD Million)

- Textile & Apparel Industry

- Advertising & Marketing

- Automotive & Transportation

- Consumer Electronics

- Medical & Healthcare

- Other End Users

- Country Level Analysis Value (USD Million)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Ink Type, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Screen Printing Inks Market Outlook:

Screen Printing Inks Market size was over USD 4.61 billion in 2025 and is projected to reach USD 6.26 billion by 2035, growing at around 3.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of screen printing inks is evaluated at USD 4.74 billion.

The screen printing inks market is expanding due to escalating demand from the textile, packaging, and electronics industries. Screen printing is still a popular option among manufacturers as it is versatile, durable, and can be used on many types of surfaces, such as fabric, glass, plastic, and metal. Manufacturers are concentrating on durable products that also reproduce color vibrantly and reduce volatile organic compound (VOC) emissions. As regulatory demands become more stringent and customer preferences change, industry players are anticipated to focus more resources on research and development.

The sustainable transition of the printing industry and market growth is further supported by government initiatives, primarily through regulations that limit VOC use. In May 2024, Mimaki introduced paper-based carton ink cartridges, replacing traditional plastic-based cartridges in order to be more sustainable without compromising print quality. Moreover, regulations that seek to decrease waste and emissions in industrial printing are motivating manufacturers to invest in biodegradable and water-based inks.

Key Screen Printing Inks Market Insights Summary:

Regional Highlights:

- Asia Pacific screen printing inks market will hold around 51% share by 2035, driven by rapid industrialization, growth of the textile and packaging industries, and government support for sustainable packaging solutions.

- North America market will exhibit significant growth during the forecast timeline, driven by increasing demand for high-quality printing inks, eco-friendly innovations, and advancements in screen printing equipment.

Segment Insights:

- The plastisol inks segment in the screen printing inks market is projected to capture a 38.9% share by 2035, fueled by high durability, vibrant color retention, and continued improvements in plastisol formulations.

- The automated screen printing segment in the market is projected to achieve a 57.4% share by 2035, attributed to technological advancements and the high efficiency of automated systems for large-scale printing.

Key Growth Trends:

- Expanding demand for sustainable printing solutions

- Fashion and textile industry growth and customized apparel demand

Major Challenges:

- Environmental pressures and regulatory compliance

- Disruption of supply chain and raw material shortages

Key Players: Avient Corporation, Deco Technology Group, Inc., DIC Corporation, Dongguan Kedo Silicone Material Co., Ltd., EASTMAN KODAK COMPANY, FUJIFILM Holdings Corporation, Hubergroup, Kolorcure Corporation, Nazdar Ink Technologies, Saati S.p.A., Speedball Art, Teikoku Printing Inks Mfg. Co., Ltd., TAIYO HOLDINGS CO., LTD., Zeller+Gmelin.

Global Screen Printing Inks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.61 billion

- 2026 Market Size: USD 4.74 billion

- Projected Market Size: USD 6.26 billion by 2035

- Growth Forecasts: 3.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (51% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

Screen Printing Inks Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding demand for sustainable printing solutions: The demand for water based and biodegradable screen printing inks is growing as a result of environmental concerns. In August 2023, Flint Group announced the introduction of K+E process inks for cartridge-free manufacturing, which is sustainable. The industry is being driven to use eco-friendly printing materials as corporate sustainability goals and stringent environmental regulations take effect. Nowadays, manufacturers are investing more in research to produce inks that have low environmental impact but still have high performance. Policy incentives and customer demand for greener products are driving this shift, cementing sustainability as a central market driver.

- Fashion and textile industry growth and customized apparel demand: The fashion and textile industry is expanding, and the need for customized apparel is increasing, which is propelling screen printing ink sales. In October 2023, International Coatings resumed production of Paramount White ink, responding to the high demand for durable textile printing solutions. On the other hand, the demand for high opacity and flexible inks is also projected to rise as direct-to-garment (DTG) printing continues to grow. Digital printing technologies that facilitate intricate and personalized designs also contribute to this trend. Therefore, brands are using these innovations to provide unique, high-quality apparel that fits consumer demands.

- Printed electronics and circuit printing: Screen printing inks are becoming key enablers in printed electronics, such as flexible circuits, RFID tags, and smart packaging. In September 2022, UbiQD expanded its partnership with SICPA beyond traditional printing on quantum dot-based security inks. The demand for high-precision conductive inks is anticipated to grow as a result of electronics miniaturization and flexible display. Research in new formulations of these inks to attain conductivity and durability is being driven by the integration of these inks in electronic devices. This development opens the door for more advanced security features and smarter, more efficient electronic components.

Challenges

-

Environmental pressures and regulatory compliance: Environmental regulations are becoming increasingly stringent, and screen printing inks are no exception, requiring constant reformulation of products to minimize harmful emissions. Innovation is also a necessity for manufacturers, but they have to ensure that their inks meet certain regulations that are put in place by both local and international bodies. Such regulatory changes, which are intended for the protection of the environment, also complicate the production process and necessitate constant control. This, in turn, places companies in the difficult position of having to balance innovation with compliance if they are to remain competitive in screen printing inks market.

- Disruption of supply chain and raw material shortages: Another major challenge is supply chain disruptions, especially the availability of raw materials required for specialized ink formulations. Production delays and increased lead times result from fluctuations in raw material supply, which have a direct impact on market stability. Sourcing sustainable materials that are in alignment with environmental standards is also a challenge for the manufacturers. Therefore, these disruptions compel companies to seek alternative sources and diversify their supply chains at elevated operational costs. Raw material availability and volatility are still considerable hurdles for the industry to sustain long-term growth.

Screen Printing Inks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.1% |

|

Base Year Market Size (2025) |

USD 4.61 billion |

|

Forecast Year Market Size (2035) |

USD 6.26 billion |

|

Regional Scope |

|

Screen Printing Inks Market Segmentation:

Ink Type Segment Analysis

Plastisol inks segment is expected to capture screen printing inks market share of over 38.9% by 2035, mainly owing to its high durability in textile applications and the retention of vibrant colors. In September 2023, INX International introduced new plastisol-based solutions designed for custom apparel and sportswear printers. There is rising demand for the segment’s performance in textile printing, which continues to drive adoption across fashion and promotional merchandise industries. Furthermore, due to its ease of use and ability to produce consistent results, it is increasingly favored by manufacturers. Enhancements in the formulations of plastisol are still being continued, and due to that, the segment is projected to garner market growth through 2035.

Printing Process Segment Analysis

In screen printing inks market, automated screen printing segment is poised to capture revenue share of over 57.4% by 2035, driven by technological advances and high efficiency in large-scale printing. In May 2024, Electronics For Imaging Inc. showcased advanced inkjet solutions at Drupa 2024, combining automated printing with high-speed production capabilities. Automated screen printing is now the preferred choice for high-volume applications owing to the improvements in speed and precision of these innovations. The automation technology has been integrated to reduce labor costs and has even minimized errors. With continued upgrades by manufacturers, automated solutions are likely to become more deeply entrenched as the backbone of industrial printing operations.

Our in-depth analysis of the global screen printing inks market includes the following segments:

|

Ink Type |

|

|

Printing Process |

|

|

Product Form |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Screen Printing Inks Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in screen printing inks market is set to dominate over 51% revenue share by 2035. High-performance printing inks are witnessing strong demand in the region due to the rapid industrialization of the region and the growth of the textile and packaging industries. In 2022, countries like China, Vietnam, Turkey, and India made up 56.8% of clothing exports globally, reflecting the increased need for high-quality printed textiles. When the e-commerce and customizable clothing trends are rising, screen printing ink manufacturers are increasing the production capacity for the key markets. Moreover, government endeavors to promote sustainable packaging solutions are propelling the adoption of eco-friendly print inks.

The screen printing inks market in India is growing steadily as the country’s textile and apparel industry is booming. As India is one of the major global exporters of clothing and textiles, the demand for high-quality screen printing inks will continue to grow. Water based and plastisol inks are gaining popularity for their eco-friendliness in the Indian printing industry. Moreover, investments in the sector are being driven by government incentives that encourage local textile production under the "Make in India" initiative. Moreover, the expansion of India’s packaging industry is accelerating the adoption of specialty printing inks for flexible as well as biodegradable packaging applications.

China leads the screen printing inks market due to its dominance in textiles, packaging, and industrial printing. According to Research Nester, China produced 14.41 million metric tons of packaging paper and paperboard in 2024, showing a rapid development of packaging industry. Demand for advanced screen printing inks used in flexible and eco-friendly packaging applications is being driven by this growth. Digital textile printing and the high volume garment production add to the demand for inks in the textile sector. Moreover, high-speed screen printing technologies are being invested in order to improve the efficiency and quality of industrial-scale printing operations. As environmental impact concerns grow, China has been advancing innovations in low-VOC or water-based printing inks.

North America Market Insights

North America region is expected to register significant growth till 2035. With industries moving towards eco-friendly and water-based printing inks, manufacturers are putting money and efforts into developing advanced formulations that help meet their sustainability goals. Innovation in digital screen printing is driving the region’s growth, improving efficiency and reducing production costs. In addition, the market demand is further supported by expanding consumer preferences for customized apparel and promotional products. Furthermore, advancements in screen printing equipment technologies are making inks compatible with an ever wider variety of substrates.

Supported by the expanding textile and packaging industries, the U.S. remains a dominant force in North America screen printing inks market. According to the National Council of Textile Organizations, in 2023, the US textile and apparel shipments totaled USD 65.8 billion in 2022, indicating a growing sector. Demand for specialized inks is driven by the increasing popularity of personalized clothing and high-quality printed fabrics. Apart from that, UV-curable and solvent-based inks are being innovated to improve printing durability and efficiency. However, the steady growth of eco-friendly screen printing inks is expected in the U.S. market due to growing investments in sustainable printing technologies.

Canada screen printing inks market is rising due to the increasing demand for promotional products, signage, and packaging applications. As manufacturers in Canada move towards more sustainable printing solutions, they are investing in water-based and low-VOC inks. Moreover, with the growth of the Canadian fashion and textile industry as well, there is a higher demand for advanced screen printing inks. The screen printing inks market is also being influenced by the expansion of e-commerce and online custom printing services. Manufacturers are working on biodegradable and energy-efficient screen printing solutions since regulatory policies are in favor of environmentally friendly inks.

Screen Printing Inks Market Players:

- Avient Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Deco Technology Group, Inc.

- DIC Corporation

- Dongguan Kedo Silicone Material Co., Ltd.

- EASTMAN KODAK COMPANY

- FUJIFILM Holdings Corporation

- Hubergroup

- Kolorcure Corporation

- Nazdar Ink Technologies

- Saati S.p.A.

- Speedball Art

- Teikoku Printing Inks Mfg. Co., Ltd.

- TAIYO HOLDINGS CO., LTD.

- Zeller+Gmelin

The screen printing inks market is highly competitive, with the presence of a large number of established players vying for market leadership through innovation and strategic expansion. Major companies like Avient Corporation, Deco Technology Group, Inc., DIC Corporation, Dongguan Kedo Silicone Material Co., Ltd., EASTMAN KODAK COMPANY, FUJIFILM Holdings Corporation, Hubergroup, Kolorcure Corporation, Nazdar Ink Technologies, Saati S.p.A., Speedball Art, Teikoku Printing Inks Mfg. Co., Ltd., TAIYO HOLDINGS CO., LTD., and Zeller+Gmelin have constantly been investing in product developments and expansion of the screen printing inks market. These companies benefit from huge research and powerful distribution networks to stay ahead of the curve in both mature and emerging markets. They have also set industry benchmarks by their focus on sustainability and technological innovation.

In November 2023, a breakthrough in the competitive landscape occurred when one of the top players, Nazdar Ink Technologies, launched a significant advance in screen printing ink that optimizes automated printing system performance. This further illustrates the increasingly competitive industry and also shows that the industry is committed to innovation and sustainability. Major players are proactively taking such strategic product launches along with continued investment in R&D to cater to market and regulatory demands. Continuous product innovations and strategic collaborations have made the competitive outlook strong for companies attempting to gain a larger share of the market.

Here are some leading companies in the screen printing inks market:

Recent Developments

- In September 2024, Electroninks launched a new conductive copper ink line, advancing metal complex ink offerings. This innovation enhances conductivity while reducing total ownership costs for manufacturers. The product is designed for high-performance applications, including flexible and printed electronics.

- In June 2024, Nazdar Ink Technologies introduced the 706V2 and 708V2 Series UV-LED curing inks, expanding compatibility with Mimaki LUS120, LUS150, and LUS170 inksets. These inks offer enhanced durability, color vibrancy, and adhesion across multiple substrates. The launch strengthens Nazdar’s presence in the UV-LED ink market.

- In June 2024, Avient Specialty Inks introduced Wilflex Revive and Rutland Evolve Bio Plastisol Inks, offering over 50% bio-derived content. These inks maintain industry standards while reducing environmental impact. The innovation aligns with the growing demand for sustainable printing solutions in the textile industry.

- In May 2024, Marabu released UltraGlass LEDGF, a BPA-free screen printing ink designed for LED applications. The hybrid system integrates UV-curing protective varnish for enhanced durability and environmental compliance. This innovation targets industrial and commercial printing applications.

- Report ID: 3757

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Screen Printing Inks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.