Scleroderma Therapeutics Market Outlook:

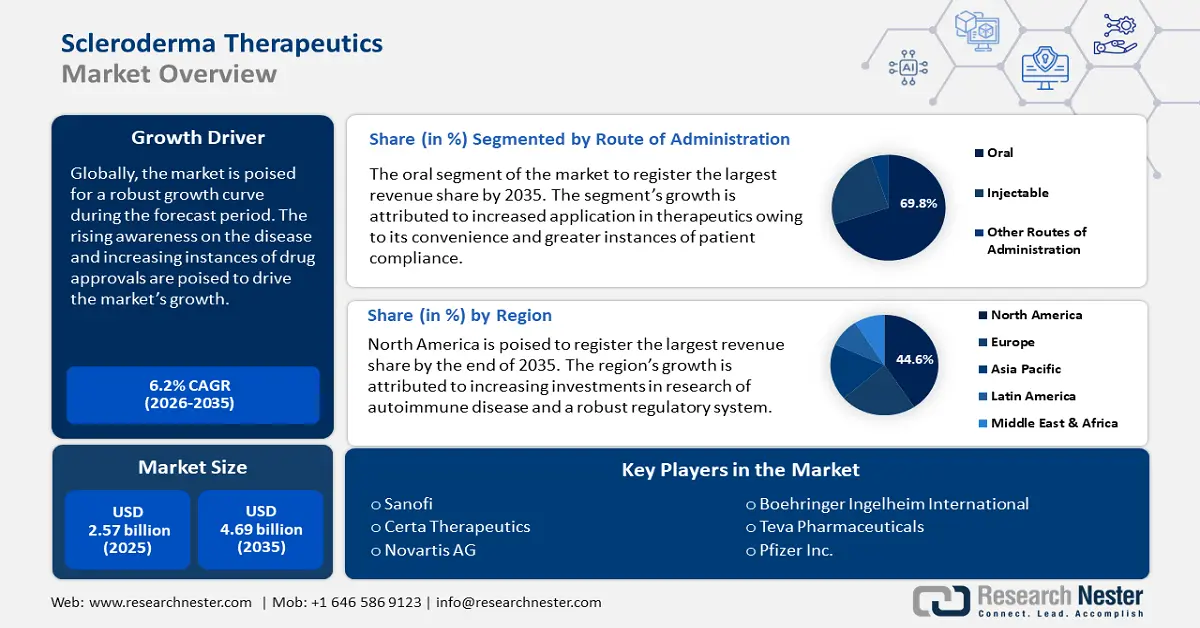

Scleroderma Therapeutics Market size was valued at USD 2.57 billion in 2025 and is expected to reach USD 4.69 billion by 2035, expanding at around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of scleroderma therapeutics is assessed at USD 2.71 billion.

The growth of the market is attributed to advancements in drug development of immunomodulatory therapies such as Methotrexate, and anti-fibrotic therapies that include Mycophenolate. Globally, awareness of scleroderma is increasing rapidly, leading to increased demand for therapeutics.

A major growth driver of the global scleroderma therapeutics market is the rising investment of pharmaceutical companies in scleroderma-specific drugs. The market can also benefit from advancements in regenerative therapeutics such as stem cell treatment that can mitigate scleroderma symptoms. Opportunities in emerging markets arise with rising awareness of the disease and countries across the world establishing a robust rare disease framework to provide economic support to patients as well as investments in research. Additionally, improvements in physical and occupational therapy benefit in improving patients’ life quality while undergoing scleroderma treatment. This benefits the growth of the market by boosting adoption and demand for scleroderma therapeutics. For instance, in March 2022, the National Library of Medicine highlighted exercise intervention of 70% to <90% maximum heart rate or below that prescribed by allied health practitioners or exercise professionals to benefit patients diagnosed with scleroderma or systemic sclerosis.

Advancements in diagnostic technologies have made early detection of scleroderma easier, boosting demands for advanced therapeutics. The global scleroderma market is poised to benefit from increasing collaborations between pharmaceutical companies, biotech firms, and research institutions to develop a curative treatment or therapeutics that can improve the quality of life of diagnosed patients. A robust collaborative ecosystem can also help in targeting specific disease mechanisms, benefiting the sector’s growth curve. The alarming rise of autoimmune diseases globally further assists the demand for scleroderma therapeutics, fueling a robust growth of the market by the end of the forecast period.

Key Scleroderma Therapeutics Market Insights Summary:

Regional Highlights:

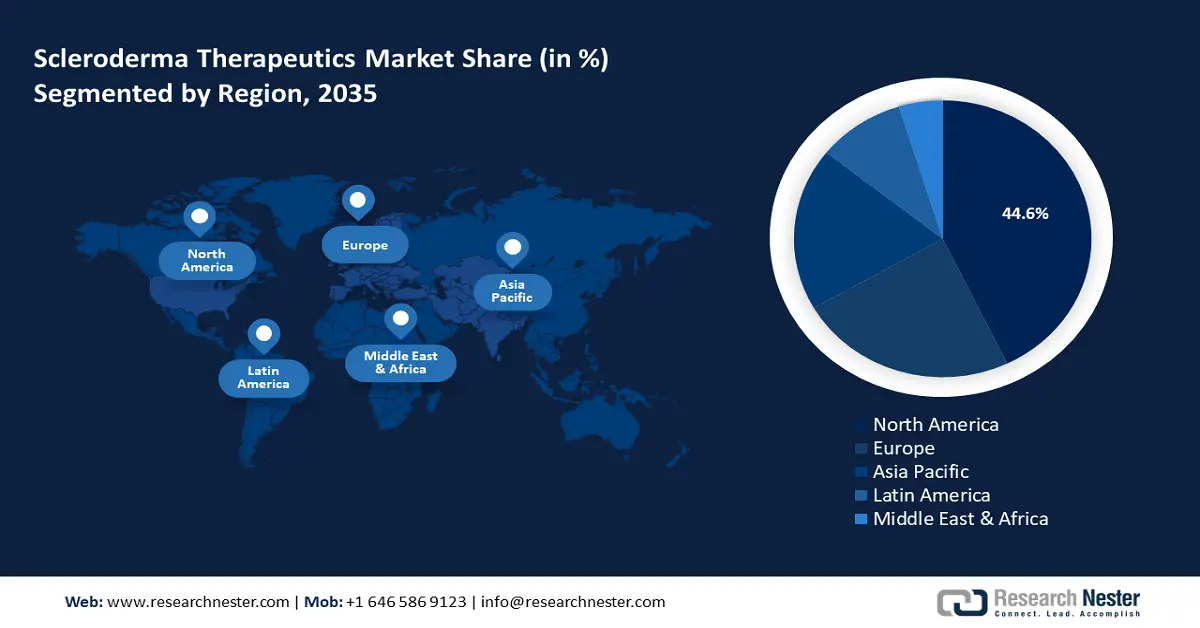

- North America leads the Scleroderma Therapeutics Market with a 44.6% share, propelled by rising scleroderma diagnoses and an established supportive regulatory ecosystem, ensuring significant growth through 2026–2035.

- Europe's scleroderma therapeutics market is forecasted for rapid growth through 2035, driven by collaboration between research institutions, private companies, and public health bodies.

Segment Insights:

- The Injectable segment is expected to experience significant growth from 2026 to 2035, driven by rising adoptions for treating severe cases of systemic sclerosis.

- Immunosuppressors segment are projected to hold a 31.5% share by 2035, fueled by increasing adoption to control immune responses in autoimmune diseases.

Key Growth Trends:

- Rising prevalence of autoimmune disorders

- Growing government and organization funding for rare disease research

Major Challenges:

- High cost of treatment and limited accessibility

- Lengthy drug approval process

- Key Players: Sanofi, Novartis AG, Certa Therapeutics, Pfizer Inc., Teva Pharmaceuticals, Boehringer Ingelheim International, Bristol-Myers Squibb Company, Biogen, F. Hoffman La-Roche Ltd., Bayer AG, Galderma Laboratories, Aisa Pharmaceuticals.

Global Scleroderma Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.57 billion

- 2026 Market Size: USD 2.71 billion

- Projected Market Size: USD 4.69 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: Germany, UK, France, Italy, Spain

Last updated on : 14 August, 2025

Scleroderma Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of autoimmune disorders: The growing prevalence of autoimmune disease is leading to increasing research to develop immunomodulatory therapy, benefiting the growth of the global scleroderma therapeutics market. For instance, in March 2024, the National Health Council highlighted autoimmune disease affects approximately 50 million U.S. residents and compiled studies indicating an alarming 3% to 12% increase annually. Rising awareness and healthcare spending on combating the surge of autoimmune disease creates a robust pipeline of clinical trials in targeted treatment options. The trends are beneficial for scleroderma therapeutics and improving their efficacy.

- Growing government and organization funding for rare disease research: Governments across the world are creating rare disease frameworks to identify patients diagnosed and provide them with the necessary care, as well as invest in finding orphan drugs. Rising investments benefit the growth of the market. An increasing percentage of countries are creating guidelines for the treatment of scleroderma. For instance, the Brazilian Society of Rheumatology released guidelines for the treatment of scleroderma highlighting the treatment of Raynaud’s phenomenon, prevention of digital ulcers, and more.

Financial incentives, grants for rare diseases, and favorable regulatory ecosystem incentives companies to invest in scleroderma research. Apart from government funding, robust support from non-profit organizations is poised to boost the sector’s growth. For instance, in October 2023, the Scleroderma Research Foundation (SRF) announced that Boehringer Ingelheim will contribute an experimental agent to CONQUEST, i.e., an innovative clinical trial platform created by SRF. - Increasing investments in stem cell research: The global scleroderma therapeutics market is poised to register a growth curve due to increasing investments in stem cell research. Stem cell research can help in new drug discovery and development, and heighten tissue repair. As per the European Society for Blood and Marrow Transplantation (EBMT) registry, scleroderma is the second most autoimmune disease to be treated with HSCT after multiple sclerosis. Stem cell research targets the underlying cause of tissue damage and has the potential to develop therapeutics that answer the unmet need in scleroderma treatment. Due to the potential of this approach, the market is positioned to register a surge in growth by the end of the forecast period.

Challenges

- High cost of treatment and limited accessibility: Scleroderma treatments can be costly and the long-term nature of the treatment can put a severe economic burden on the patients. This creates a market challenge in emerging economies with low rates of disposable income or lack of health insurance. The long-term treatment costs can be a deterrent in established markets as well. Severe cases may require more intensive treatments, adding to costs. Additionally, due to the rarity of the disease, health infrastructures in many emerging economies may not have the adequate expertise or diagnostic tools to offer adequate care limiting the growth of the scleroderma market.

- Lengthy drug approval process: The rarity of scleroderma cases can be a challenge in attaining quick regulatory approval for treatments as clinical trials may suffer from underrepresentation in research. Small sample sizes and diverse disease manifestations can be a deterrent in formulating effective scleroderma therapeutics. Additionally, it also leads to the approval process becoming more time-consuming as companies may find it challenging to meet all criteria set by the regulatory bodies. This can delay market entry of new treatments stifling the growth of the scleroderma therapeutics market.

Scleroderma Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 2.57 billion |

|

Forecast Year Market Size (2035) |

USD 4.69 billion |

|

Regional Scope |

|

Scleroderma Therapeutics Market Segmentation:

Route of Administration (Oral, Injectable, Other Routes of Administration)

By route of administration, the oral segment is set to account for scleroderma therapeutics market share of more than 69.8% by the end of 2035. The growth of the segment is attributed to convenience of oral administration and greater patient compliance leading to increasing adoption of the oral route for administration. Methotrexate such as Trexall, Rheumatrex, Otrexup, Rasuvo, and CellCept (Mycophenolate Mofetil) are oral drugs administered to treat scleroderma. Immunosuppressants and anti-fibrotic agents are administered orally to manage scleroderma by slowing its progression.

The segment growth can be attributed to its accessibility compared to the other routes of administration. Additionally, the oral segment of the global scleroderma therapeutics sector can benefit from advancements in new formulations leading to targeted oral therapies that can minimize side effects. In May 2024, Azurity Pharmceuticals Inc., announced approval of their mycophenolate mofetil oral suspension (MYHIBIN) by the FDA. A favorable regulatory ecosystem is positioned to boost the continued growth of the oral segment by the end of the forecast period.

The injectable segment of the market is poised to increase its revenue share during the forecast period. The growth of the segment is attributed to rising adoptions to treat severe cases of systemic sclerosis with rapid disease progression. This route of administration offers rapid therapeutic effects for patients with life-threatening complications such as pulmonary hypertension which occurs in up to 40% of patients suffering from scleroderma as per the University of Michigan Health. The segment is positioned for further growth by the end of the forecast period with advancements in biologics. For instance, in September 2024, the FDA approved Roche’s injectable version of multiple sclerosis therapy under the brand name Ocrevus.

Drug Class (Immunosuppressors, Phosphodiesterase 5 inhibitors – PHA, Endothelin Receptor Antagonists, Prostacyclin Analogues, Calcium Channel Blockers, Analgesics, Other Drug Classes)

In scleroderma therapeutics market, immunosuppressors segment is expected to account for revenue share of more than 31.5% by the end of 2035. The segment’s growth is attributed to the increasing adoption of immunosuppressors to control the immune response, as scleroderma is an autoimmune disease. Immunosuppressors are used to slow disease progression and reduce kidney inflammation in patients. The demand for immunosuppressors is growing with the rising prevalence of autoimmune diseases globally.

The increasing research on the treatment of autoimmune disease is positioned to continue to growth of the segment by the end of the forecast period. For instance, in June 2023, the Johns Hopkins Medicine Team suggested microparticle-delivered therapy is a significant step in the treatment of autoimmune disease, and microparticles can be designed to deliver specific therapeutic agents, i.e., immunosuppressors to precise locations in the body.

Our in-depth analysis of the global market includes the following segments:

|

Route of Administration |

|

|

Drug Class |

|

|

Indication |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Scleroderma Therapeutics Market Regional Analysis:

North America Market Forecast

North America scleroderma therapeutics market is set to capture revenue share of over 44.6% by 2035. The market’s growth is attributed to the rising diagnosis of scleroderma in the region and an established supportive regulatory ecosystem. The market’s profit share is led by the U.S. and Canada in North America. Additionally, an advanced healthcare infrastructure in the region ensures patients are provided access to timely care leading to increased demands for scleroderma therapeutics. In January 2022, Paracine received U.S. FDA clearance to launch a trial in the U.S. in patients with hand dysfunction due to diffuse cutaneous scleroderma.

The U.S. registers the largest market share in the North America scleroderma therapeutics market. The country’s strong regulatory environment incentivizes innovation through programs such as the Orphan Drug Act. For instance, in September 2024, the calcium channel blocker Profervia of Aisa Pharmaceuticals was granted FDA orphan drug status as a treatment for scleroderma. The domestic market’s growth is assisted by the advancements in research led by major pharmaceutical companies in the region. An increase in scleroderma diagnosis benefits clinical trials with a high rate of patient enrolment benefiting advancements in new therapeutics.

The Canada market for the scleroderma therapeutics sector is poised to increase its revenue share by the end of 2035. The market benefits from rising awareness regarding autoimmune disease and the universal healthcare system in the country reducing patient’s economic burden. Non-profit organizations such as Scleroderma Canada are advocating for increased funding for therapeutics research and creating a network of patients diagnosed with the disease to form a community to offer urgent care. Additionally, the rise in cases of scleroderma in children is poised to increase demands for therapeutics. For instance, in July 2024, the Lancet Regional Health-Americas released a report stating scleroderma cases were on the rise in Quebec among children. The report additionally highlighted declining mortality rates but the uneven geographic distribution of cases requires tailored interventions.

Europe Market Analysis

The scleroderma therapeutics market in Europe is poised to register the fastest growth by the end of the forecast period. The growth of the market in Europe is attributed to collaboration between research institutions, private companies, and public health bodies leading to advancements in research. A favorable regulatory ecosystem in the region fostered by the European Medicines Agency (EMA) bolsters the market’s growth. France, Germany, and the United Kingdom are leading the revenue share in Europe. For instance, in August 2023, MediciNova was granted a patent in Europe for potential scleroderma treatment by the use of an investigational small molecule called MN-001 (Tipelukast) from the European Patent Office.

France is a leading market in the scleroderma therapeutics sector of Europe. The domestic market in the country benefits from government funding of research on rare diseases. The French National Plan for Rare Diseases from 2018 to 2023 focused on treatment for all and the next French National Plan for Rare Diseases is poised to be based on boosting R & D and innovation. The market is additionally boosted by the emphasis on early diagnostics and specialized care fueling demands for therapeutics. Patient support organizations such as Association des Sclérodermiques de France benefits the sector’s growth by raising awareness and pooling resources for better scleroderma care. In September 2024, French pharmaceutical powerhouse Sanofi stated their Tolebrutinib demonstrated 31% delay in time of onset of confirmed disability progression in non-relapsing secondary progressive scleroderma phase 3 study.

Germany is poised to increase its revenue share in the scleroderma therapeutics market of Europe by the end of the forecast period. The domestic market benefits from efforts to build a patient registry that is positioned to assist clinical trials. For instance, the German Network for Systemic Sclerosis (DNSS), i.e., interdisciplinary collaboration of 25 clinical centers focused on systemic sclerosis research, created a patient registry in 2023 and around 5000 patient cases have been recorded. Advanced care for scleroderma is provided in the country via specialized rheumatology centers improving access to therapeutics. The domestic market also benefits from research contributions from the Federation of European Scleroderma Associations (FESCA) and recent regulatory approvals of therapeutics for scleroderma care in Europe. For instance, in July 2023, the EMA granted FT011 of Certa orphan drug status in Europe with a 7-year market exclusivity if the therapy is approved.

Key Scleroderma Therapeutics Market Players:

- Sanofi

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Certa Therapeutics

- Pfizer Inc.

- Teva Pharmaceuticals

- Boehringer Ingelheim International

- Bristol-Myers Squibb Company

- Biogen

- F. Hoffman La-Roche Ltd.

- Bayer AG

- Galderma Laboratories

- Aisa Pharmaceuticals

The global scleroderma therapeutics market is positioned for a profitable growth curve during the forecast period. Key market players in the sector are investing in clinical trials for new therapeutics for scleroderma treatment, and in acquisitions to improve distribution channels in emerging markets.

Here are some key players in the market:

Recent Developments

- In March 2024, Cabalette Bio announced FDA granted orphan drug designation to CABA-201 for the treatment of scleroderma. CABA-201 consists fully human CD19-CAR T cell investigational therapy for the treatment of the disease.

- In February 2024, Certa Therapeutics FT011 was granted U.S. FDA fast track for the treatment of scleroderma or systemic sclerosis. The fast-track designation was granted based on results of the Phase 2 study that highlighted treatment of scleroderma patients with FT011 for 12 weeks resulted in clinically meaningful improvement in 60% of patients treated with FT011 400mg and 20% of patients in the FT011 200 mg group.

- Report ID: 6664

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Scleroderma Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.