Scaffold Technology Market Outlook:

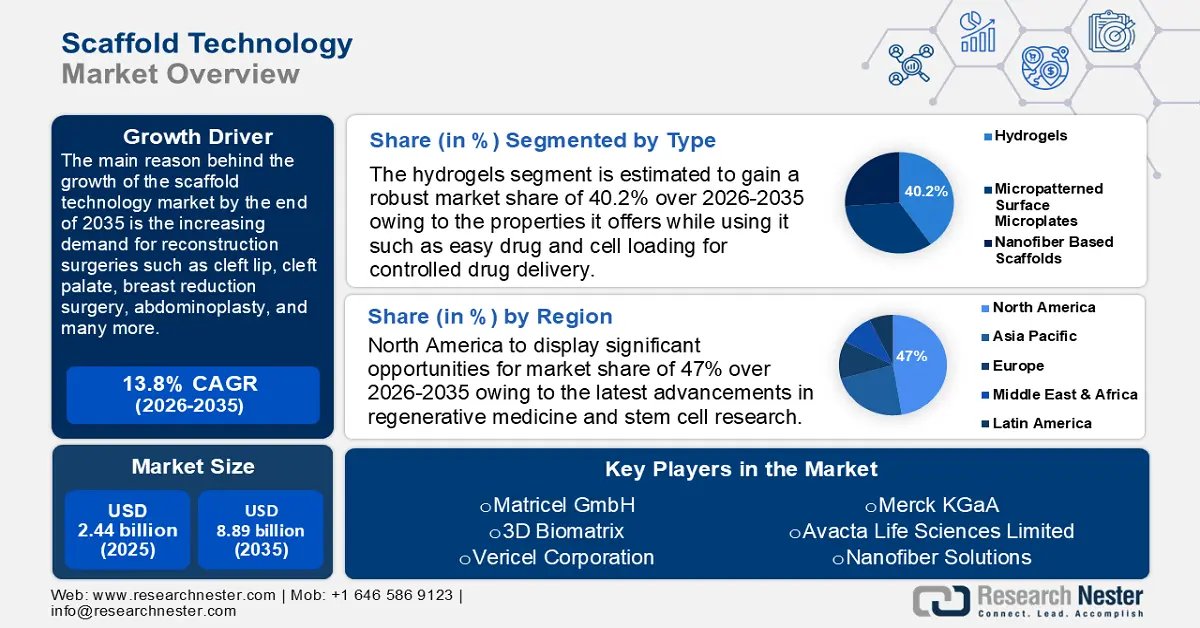

Scaffold Technology Market size was over USD 2.44 billion in 2025 and is poised to exceed USD 8.89 billion by 2035, witnessing over 13.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of scaffold technology is estimated at USD 2.74 billion.

Globally, there has been an increasing demand for reconstruction surgeries such as cleft lip, cleft palate, breast reduction surgery, oculoplasty, and abdominoplasty, influencing the scaffold technology market growth. According to a report by the International Society of Aesthetic Plastic Surgery (ISAPS) in September 2023, plastic surgeries increased by 11.2% compared to 2022 data. These include 14.9 million and 18.8 million surgical and non-surgical procedures respectively. Moreover, aesthetic surgeries witnessed a gain of 41.3% since 2019.

Key Scaffold Technology Market Insights Summary:

Regional Highlights:

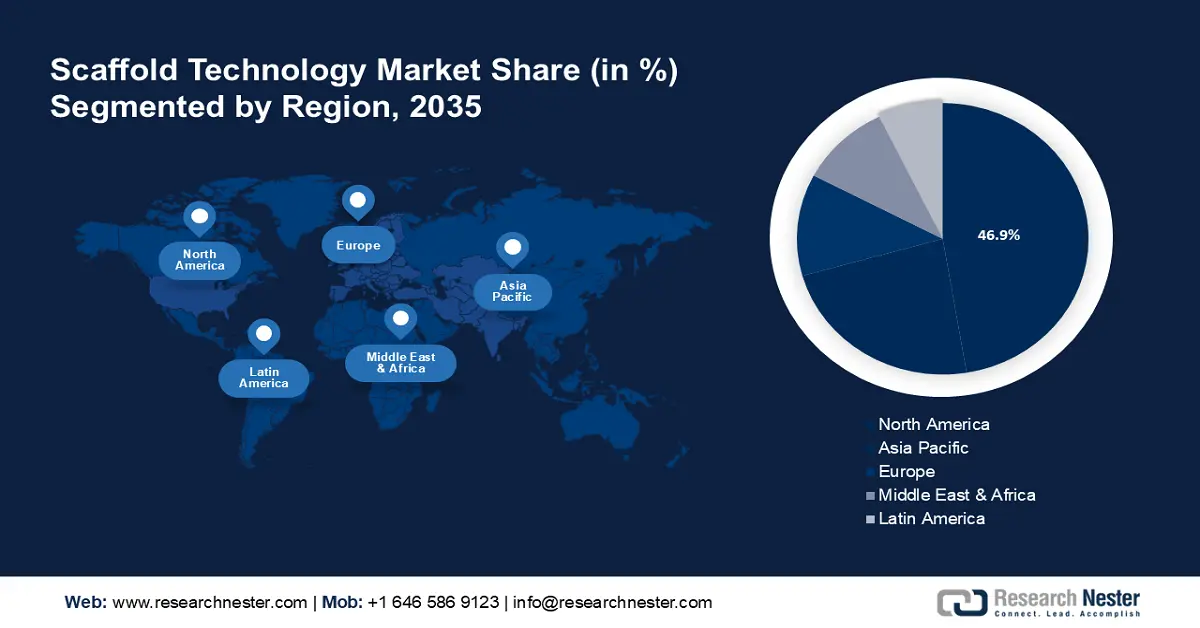

- The North America scaffold technology market achieves a 47% share by 2035, driven by rapid advancements in regenerative medicine and stem cell research.

- The Asia Pacific market will exhibit huge growth during the forecast timeline, driven by rising stem cell advancements and scaffold innovations across the region.

Segment Insights:

- The hydrogels segment in the scaffold technology market is expected to experience robust growth till 2035, driven by its effectiveness in controlled drug delivery and supportive advanced technologies.

- The stem cell therapy, tissue engineering & regenerative medicine segment in the scaffold technology market is set for the fastest growth over 2026-2035, fueled by increased use in medical procedures and innovations in regenerative technologies.

Key Growth Trends:

- Advancements in cell culture techniques

- Increasing usage of electrospun nanofiber scaffolds

Major Challenges:

- Safety risk

Key Players: Evonik, Tecan Trading AG, REPROCELL Inc., Matricel GmbH, 3D Biomatrix, Vericel Corporation, Merck KGaA, Avacta Life Sciences Limited, Nanofiber Solutions.

Global Scaffold Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.44 billion

- 2026 Market Size: USD 2.74 billion

- Projected Market Size: USD 8.89 billion by 2035

- Growth Forecasts: 13.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Scaffold Technology Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in cell culture techniques: Tissue engineering and cell therapy have a lot of opportunities attributed to improvements in 2D to 3D cell culture techniques. With higher rates of tissue regeneration, reparative, and anti-inflammatory effects after transplantation, spheroids increase the effectiveness of mesenchymal stem cells. The use of 3D scaffold cultures has benefited from this. In September 2023, Curi Bio launched two new platforms namely Nautilus and Stringray, aiming to help researchers study electrophysiology in both 2D and 3D cell cultures.

- Increasing usage of electrospun nanofiber scaffolds: The prevalence and associated complications with musculoskeletal and orthopedic are increasing worldwide. This demand for orthopedic engineering of tissues will act as a prominent factor for the development of scaffold technology revenue share. According to the Multidisciplinary Digital Publishing Institute (MDPI) in August 2023, electrospun scaffolds offer various advantages such as uniformity, structural flexibility, high surface area-to-volume ratio, compositional diversity, exceptional porosity, and many more. Additionally, the soft tissue repair market revenue has increased tremendously augmented by the influenced adoption and growing use of scaffold technology.

Challenges

- Safety risk: One of the main challenges facing the scaffold technology industry is the safety risks that come with installing and operating scaffolds. This also has to follow safety measures coupled with several environmental regulations which can add up the cost of these scaffold projects. Furthermore, accidents and injury incidents affect trust in scaffold solutions, resulting in increased scrutiny, liability worries, and resistance to implementing cutting-edge scaffold technologies, which hinders market expansion and utilization.

Scaffold Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.8% |

|

Base Year Market Size (2025) |

USD 2.44 billion |

|

Forecast Year Market Size (2035) |

USD 8.89 billion |

|

Regional Scope |

|

Scaffold Technology Market Segmentation:

Type Segment Analysis

The hydrogels segment in the scaffold technology market is poised to capture a share of 40.2% in the coming years, impacting the sector's scaffold technology landscape. Significant growth in the revenue share is anticipated owing to the properties it offers while using it such as easy drug and cell loading for controlled drug delivery. Moreover, the advanced technologies in this field support the market growth. For instance, in March 2021, Bio-Techne Corporation released Cultrex UltiMatrix for culturing pluripotent stem cells as they slow down the Basement Membrane Extract (BME) growth factor. It is a cutting-edge matrix hydrogel with enhanced tensile strength and the ideal extracellular matrix protein composition for regenerative medicine, personalized medicine, and drug discovery studies. Growth in this sector will boost the drug delivery devices value in the near future.

Application Segment Analysis

The stem cell therapy, tissue engineering & regenerative medicine segment is expected to be the fastest-growing segment with a lucrative size by the end of the forecast period. This growth is propelled by the increased usage of scaffolding technologies in colorectal procedures, reconstruction and aesthetic surgeries, tumor repair, soft tissue, and periodontology. Furthermore, researchers have been highly attracted to the diverse use of scaffold technology in the field of regenerative medicine in recent years. In addition, a German biotech company Co. don AG, was fully acquired by ReLive Biotechnologies, Ltd in Jan 2023. Credited to this, ReLive was able to carry out independent research and create affordable tissue-engineered products using 3D printing and stem cell technology.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End User |

|

|

Disease Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Scaffold Technology Market Regional Analysis:

North America Market Insights

North America industry is likely to dominate majority revenue share of 47% by 2035. The growth in this region is poised due to the latest advancements in regenerative medicine and stem cell research. According to a report by the National Library of Medicine in 2023, stem cell revenue share in 2022 was about USD 297 million and is propelled to observe a growth rate of 16.8% till 2027. This is led by various factors such as clinical trials with positive results along with high demand for regenerative medicine.

The increasing funding for regenerative medicine and stem cell research in the U.S. from the government and various private institutions. For instance, the California Institute for Regenerative Medicine (CIRM), awarded USD 43.8 million in funds for enhancing gene and stem cell therapy in California. Additionally, it is estimated that the state of California will fund an amount of USD 110 million from 2024 to 2028 for research studies.

There is a presence of prominent players in Canada who are launching and promoting new products for the development of scaffold technologies, such as STEMCELL Technologies, BlueRock Therapeutics, Ontario Institute for Regenerative Medicine, and many more. The presence of such key players will augment the stem cell treatment market share in the forecast period.

APAC Market Insights

Asia Pacific will also encounter huge growth in the scaffold technology market share during the forecast period with a notable size and will account for the second position. The latest innovations and production of various techniques are expected to propel the development of scaffold technologies in this region. Gelomics, an Australian company collaborated with Rousselot Biomedical in October 2023, regarding the supply of Rousselot X-Pure GelMA (gelatin methacryloyl) for using it as an extracellular matrix in tissue culture systems.

The increasing advancements in stem cells are fueled to act as a growth factor for scaffold techniques in China. In November 2022, more than 31000 hematopoietic stem cell transplantations (HSCTs) were done between 2020 and 2021 and reported to the Chinese Blood and Marrow Transplantation Registry Group.

Using state-of-the-art techniques in Japan for creating more precise artificial scaffolds is at a surge. According to a report in October 2021, the Okinawa Institute of Science and Technology Graduate University (OIST) uses a 3D scaffold that can guide while regenerating neurons in a particular direction.

Scaffold Technology Market Players:

- Akron BioProducts

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik

- Tecan Trading AG

- REPROCELL Inc.

- Matricel GmbH

- 3D Biomatrix

- Vericel Corporation

- Merck KGaA

- Avacta Life Sciences Limited

- Nanofiber Solutions

Scaffold technology market growth is predicted that these companies will occupy a tremendous share. Most of these companies are continuously collaborating, adopting M&A, and expanding their global footprint, for the growth of this industry using 3D cell culture and artificial scaffold materials such as collagen and gel and are set to be the major key players in this sector.

Some of the key players include:

Recent Developments

- In March 2023, the commercialization of 3D-printed scaffolds specifically designed for bone regeneration by BellaSeno and Evonik created a huge advancement in the fields of tissue engineering and regenerative medicine.

- In March 2022, Vor Bio and Akron BioProducts, two of the top suppliers of services and materials in the regenerative medicine sector, collaborated to develop and manufacture nucleases under cGMP guidelines.

- Report ID: 6342

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Scaffold Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.