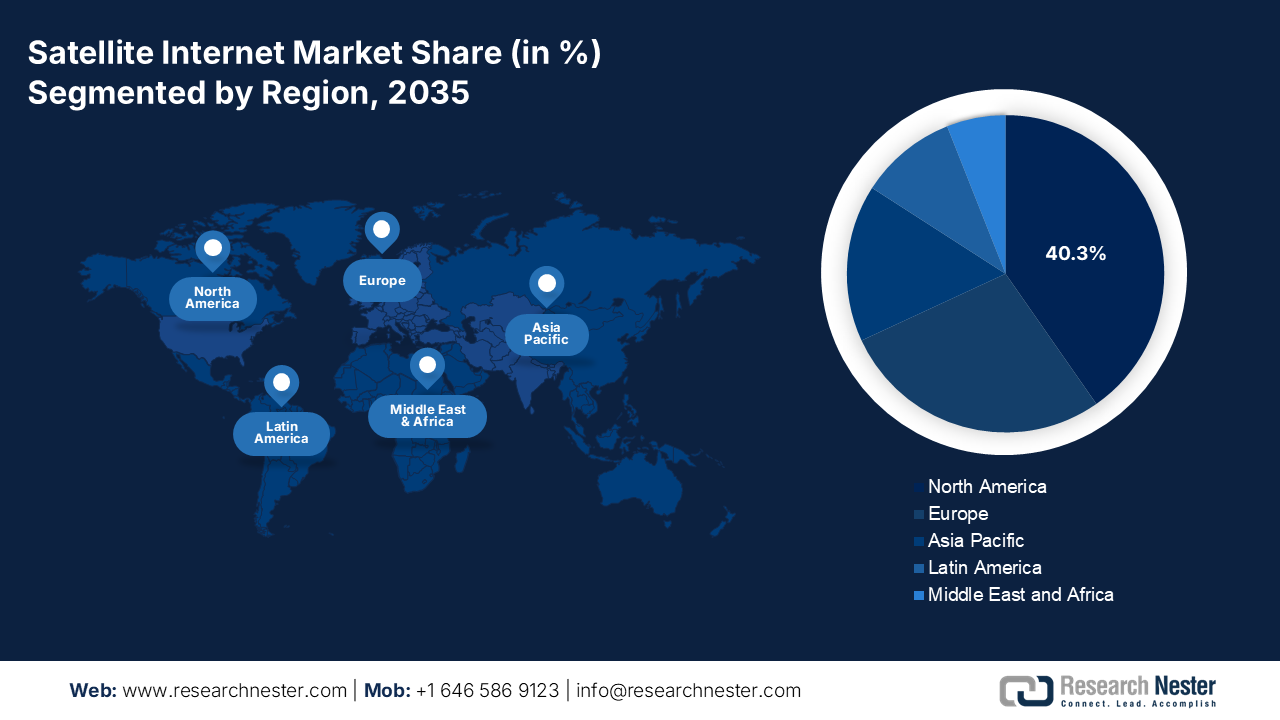

Satellite Internet Market - Regional Analysis

North America Market Insights

North America market is expected to hold the revenue share of 40.3% by 2035. The market is driven by the high consumer adoption, significant government spending, and the presence of the leading constellation operators such as SpaceX and ViaSat. The key trends include the rapid deployment of the low-earth orbit networks providing low-latency broadband and strategic integration with the 5G infrastructure. A primary demand driver is the U.S. government’s massive investment in the universal broadband exemplified by the BEAD program that recognizes satellite as a vital solution for the unserved rural and remote communities. Further, stringent federal procurement for the resilient and mobile defense communications provides a stable, high-value revenue stream. In Canada, parallel national initiatives focus on connecting the most remote northern and indigenous communities.

The U.S. is the dominant player in North America in the satellite internet market. The trend is the convergence of the public subsidy programs and the commercial deployment of LEO. The report from Congress.gov in November 2024 has depicted that the shift from the GEO-based broadband to commercially viable LEO satellite deployments enabled by declining launch costs and electronics miniaturization, and marked by the start of LEO broadband services, directly expands service performance, coverage economics, and addressable demand, thereby accelerating government and enterprise adoption and driving overall market growth. Since the start of LEO broadband services, multiple U.S. based providers have advanced large-scale constellation deployments aimed at national and global connectivity. Further, the integration of satellite connectivity into terrestrial 5G networks and consumer devices is moving the technology from a standalone backup to an embedded component of the national communications infrastructure.

Major GEO and LEO Satellite Providers in the U.S.

|

Provider |

Download Speeds |

Upload Speeds |

Latency |

Lifespan |

|

Amazon (LEO) |

400 Mbps-1 Gbps |

Unknown |

Unknown |

5 years |

|

SpaceX (LEO) |

25-220 Mbps |

5-20 Mbps |

25-100+ ms |

5 years |

|

Hughes Network Systems (GEO) |

Up to 100 Mbps |

5 Mbps |

Low |

15 years |

|

Viasat (GEO) |

Up to 150 Mbps |

3 Mbps |

638 ms |

15 years |

Source: Congress.gov in November 2024

In Canada, the satellite internet market is defined by the geography-driven public policy and strategic investment in the sovereign space capacity. The central trend is executing the universal broadband fund’s USD 3.225 billion mandate to connect all the people in Canada by 2030, with satellite as the essential solution for the remote North and Indigenous communities, based on the Government of Canada report in August 2025. This public investment is uniquely coupled with the direct federal support for the domestic Telesat Lightspeed LEO constellation to create a dedicated national capacity and service guarantees for high-cost service areas. This model of using public capital to de-risk the critical domestic infrastructure ensures connectivity in strategically vital regions such as the Arctic. The market is a clear example of satellite internet being deployed as a public utility for national cohesion and sovereignty.

APAC Market Insights

The Asia Pacific is the fastest-growing market and is expected to grow at a CAGR of 16.3% during the forecast period 2026 to 2035. The market is driven by the massive unserved population, expansive geography, and aggressive government digitalization agendas. Unlike mature Western markets, growth here is propelled by the combination of bridging the urban-rural digital divide and meeting the explosive data demands of maritime aviation and enterprise sectors. China and India are the two markets focusing on sovereign constellation networks for strategic autonomy, and India is leveraging public-private models to connect hundreds of thousands of villages. A key regional trend is the focus on integrated satellite-terrestrial networks with mobile operators partnering with the satellite providers to extend coverage. Japan and South Korea, while having high terrestrial penetration, are driving innovation in satellite-enabled IoT and 5G backhaul, positioning the region as both a volume market and a technology incubator.

China’s satellite internet market is strategically driven by the state-led initiatives to achieve technological sovereignty and secure communications. The central project is the GuoWang constellation led by the state-owned China Satellite Network group, aiming to deploy over 12,992 LEO satellites. This initiative is a core component of the national digital infrastructure designed to provide autonomous coverage for the civilian and strategic needs, including the remote regions and the Belt and Road initiative. For illustrative purposes, the data from the IFRI in April 2023 indicates that the investment, which explicitly includes the satellite internet and the space-ground integrated networks, was a key allocation in the national plans, with the related sector investment exceeding USD 20 billion. This massive investment ensures China will dominate the regional market, focusing on the closed loop ecosystem development domestics manufacturing, and export of integrated solutions.

India’s market is characterized by explosive growth through public-private partnerships aimed at bridging a vast digital divide. The government’s Digital India and rural broadband initiatives create a foundational demand, with the satellite positioned as the key technology for connecting villages. A move was the partnership between the government’s commercial arm, NewSpace India Limited, and OneWeb to deliver pan-India LEO broadband services. This model uses the ISRO’s launch capabilities and private sector agility. A report from the PIB in July 2025 depicts that for the year 2023 to 2024, the Department of Space was allocated ₹12,543.91 crore, with a significant portion directed toward satellite communication and navigation projects. This public funding, combined with the private investment, positions India as the world's second-largest and fastest-growing national market.

Department of Space Budget Allocation

|

Year |

Budget |

|

2021-2022 |

13949.09 |

|

2022-2023 |

13700.00 |

|

2023-2024 |

12543.91 |

|

2024-2025 |

13042.75 |

|

2025-2026 |

13416.20 |

Source: PIB July 2025

Europe Market Insights

Europe in the satellite internet market is a mature yet strategically evolving segment driven by the European Union’s policy objective of achieving a gigabit society by 2030. This goal mandates universal high capacity connectivity positioning satellite technology as the vital solution for covering the continent's persistent rural and remote coverage gaps that terrestrial networks cannot address cost-effectively. A key trend is the strong integration of satellite into secure government satellite communications programs for defense and institutional use, with significant national investments from countries such as Germany and France. The market is also characterized by the rise of pan-European commercial initiatives, such as the partnership between Eutelsat (France) and OneWeb (UK), creating a multi-orbit service provider to offer integrated GEO and LEO services.

Germany is leading the market and is driven by the government and enterprise demand for secure, resilient communications rather than mass consumer broadband. The report from the DECIX data in November 2025 has demonstrated that 58% of the population in Germany is already aware of the satellite-based internet services, yet actual usage remains limited at around 5%, indicating that the market is still in an early adoption phase. The demand elasticity is strong; approximately 70% of the respondents expressed willingness to use satellite internet if consistent connectivity quality could be guaranteed, regardless of the location, highlighting the substantial latent demand. This gap between the awareness trial and intent underscores a clear growth opportunity tied to service reliability, performance assurance, and integration into national broadband strategies.

The UK satellite internet market is defined by the strategic pivot to sovereign space capabilities following its departure from the EU, with the government’s acquisition of OneWeb serving as the central pillar. This move is a part of the broader National Space Strategy aimed at securing independent global connectivity, boosting the domestic space industry, and providing resilient services for defense and government. The UK’s focus extends to becoming a leader in space sustainability and regulation. Beyond the stat-backed constellation, there is a significant commercial activity in satellite manufacturing, ground segment technology, and launch services. Further, the UK government invested in space based connectivity initiatives, underscoring the scale of the public commitment. This positions the UK to capture a leading share in the European market through a unique model of direct state ownership in a global commercial operator, balancing sovereign control with commercial ambition.