Satellite-based 5G Network Market Outlook:

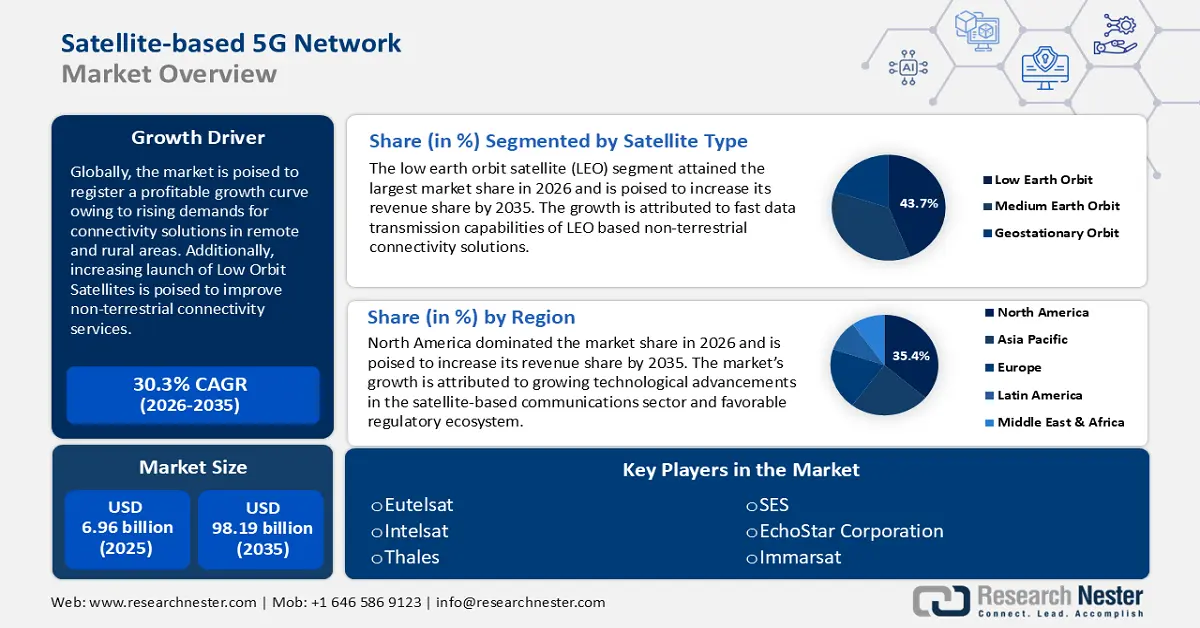

Satellite-based 5G Network Market size was valued at USD 6.96 billion in 2025 and is expected to reach USD 98.19 billion by 2035, expanding at around 30.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of satellite-based 5G network is evaluated at USD 8.86 billion.

The market’s profitable growth curve is attributed to rising demands for high-speed, low-latency connectivity. The convergence of 5G network and satellite technology offers seamless connectivity solutions to various sectors.

GSMA estimates 5G to cover one third of the world’s population by 2025. In February 2024, GSMA indicated 1.6 billion 5G connections globally, a figure that is expected to exponentially rise to 5.5 billion by 2030. The rapid growth of 5G connections is a major growth driver for the market, as terrestrial networks may not be able to support areas where the infrastructure is limited or nonexistent, allowing satellite-based 5G networks to fill the gap. Additionally, 5G provides reliable backhaul solutions for satellite networks to improve overall performance and reduce latency. The improved performance attracts individual consumers, businesses, and government sectors, fueling the satellite-based 5G network market’s profitable growth.

5G network slicing enables satellite-based networks to offer tailored services to various customer segments, from IoT applications to entertainment, which allows satellite-based 5G networks to stand out from other connectivity options. For instance, in August 2023, T-Mobile launched a network slicing beta for developers with participants including Google, Dialpad, Cisco, Zoom, and others to advance video calling applications. The future of the market is promising with the launch of new low orbit satellites (LEO) set to answer the rising demands for satellite-based 5G infrastructure. Key market players are positioned to capitalize on new opportunities arising in autonomous vehicles, smart devices, aviation, marine, and defense sectors.

Key Satellite-based 5G Network Market Insights Summary:

Regional Highlights:

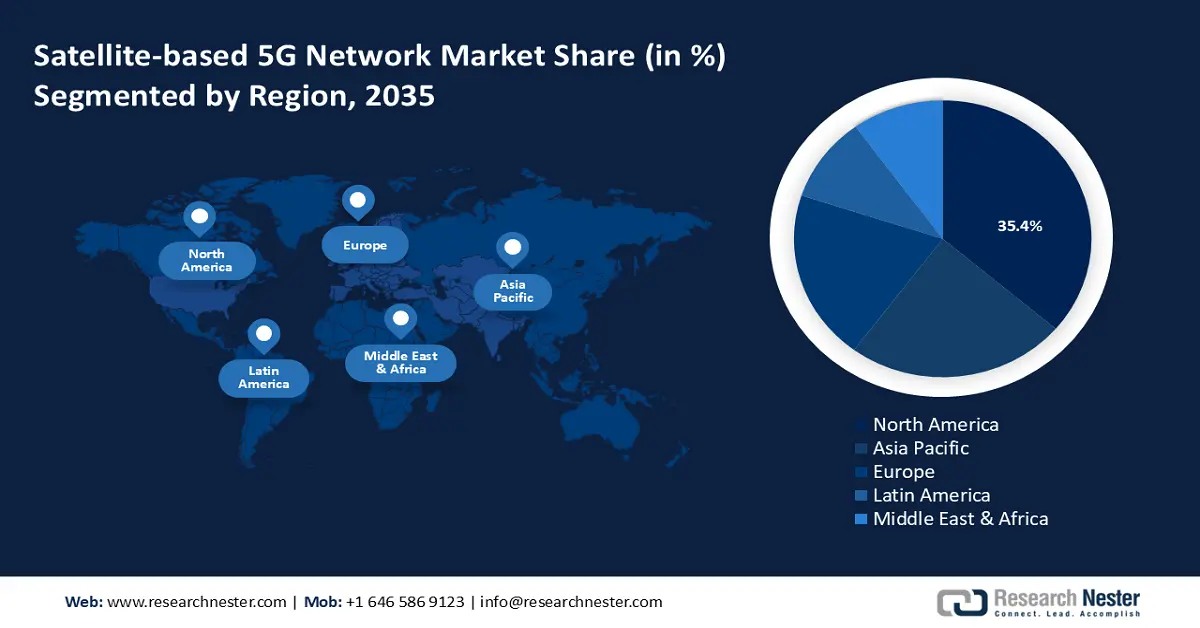

- North America satellite-based 5G network market will account for 35.40% share by 2035, fueled by significant technological advancements and supportive regulatory ecosystem.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, driven by demands to bridge the data divide and investment in satellite technologies.

Segment Insights:

- The low earth orbit (leo) satellite segment in the satellite-based 5g network market will command a 43.70% share by 2026-2035, fueled by faster data transmission and adoption in latency-sensitive applications.

- The medium earth orbit (meo) satellite segment in the satellite-based 5g network market is projected to see rapid growth till 2035, driven by MEO’s balance of latency and coverage, ideal for maritime and aviation connectivity.

Key Growth Trends:

- Rising demand for remote connectivity

- Growing adoption of autonomous vehicles and unmanned aerial vehicles (UAV)

Major Challenges:

- High costs of deployment

- Stiff competition of terrestrial networks

Key Players: Eutelsat, EchoStar Corporation, Thales, SES, Iridium Communications, ZTE, Viasat Inc., Telesat, Inmarsat.

Global Satellite-based 5G Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.96 billion

- 2026 Market Size: USD 8.86 billion

- Projected Market Size: USD 98.19 billion by 2035

- Growth Forecasts: 30.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 18 September, 2025

Satellite-based 5G Network Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for remote connectivity: The growing demand for seamless rural and remote connectivity is driving the satellite-based 5G network market. Remote connectivity also benefits the defense sector with high-speed connectivity solutions in places where terrestrial infrastructure is limited. Due to the limitations of traditional mobile networks and broadband, satellite-based 5G networks position themselves to effectively address the pain point.

Governments and global organizations have identified the potential of satellite-based connectivity solutions and are increasingly pushing to integrate them. For instance, in September 2023, the European Union announced the EU Secure Connectivity Program from 2023 to 2027 to build a multi-orbital satellite constellation focused on high-speed connectivity in remote areas. Owing to the tremendous growth potential, more companies are investing in non-terrestrial network solutions. For instance, in October 2024, Ramon.Space and Radisys announced a partnership to develop space resilient non-terrestrial 5G network solutions. - Growing adoption of autonomous vehicles and unmanned aerial vehicles (UAV): There is a global surge in adoption of autonomous vehicles (AVs) and unmanned aerial vehicles (UAVs) that require real-time communication with ground control systems. This boosts the demand for non-terrestrial satellite-based 5G solutions. For instance, in February 2023, NOVELSAT and Guidant announced a partnership to boost the safety of autonomous systems with space connectivity. universal connectivity is vital for autonomous mobility.

Additionally, unmanned aerial vehicles such as drones require universal connectivity to function, which traditional networks may be unable to provide. This has prompted commercial entities and government enterprises to increase funding for space connectivity solutions to boost air mobility. For instance, in July 2024, the UK Space Agency funded Skyports Drone Services and initiated Connectivity for Remote Orkney Future Transport (CROFT) to explore space technologies and 5G integration for drone deliveries. - Industry 4.0 initiatives and surge in IoT applications: The large-scale proliferation of IoT in smart devices that have integrated seamlessly into day-to-day life is driving demands for satellite-based 5G network connectivity solutions. IoT applications in sectors such as healthcare, logistics, agriculture, etc., require low-latency solutions to complement where terrestrial infrastructures fail. For instance, in April 2024, Intelsat and CNH announced a collaboration to install and operate rugged muti-orbit satellite terminals on CNH farm equipment operating in remote farmlands in Brazil leveraging Intelsat’s global network.

Additionally, there is a global push for Industry 4.0 to digitize the manufacturing sector, and 5G is set to play a pivotal role, boosting demands for satellite-based 5G solutions in areas where terrestrial infrastructure is limited.

Challenges

- High costs of deployment: The substantial capital required to launch and maintain satellite infrastructure is a major satellite-based 5G network market constraint. Deploying satellites of varying orbit heights involves significant costs in manufacturing to launch, and then there are additional maintenance costs. Additionally, a satellite-based 5G network must also be supported with a robust ground infrastructure, such as user terminals. This can lead to an increase in price of the eventual product in comparison with traditional 5G networks. The entry point barrier in the market for new players due to the high investment burden can also stymie the satellite-based 5G network market’s growth.

- Stiff competition of terrestrial networks: Satellite-based 5G networks face stiff competition from terrestrial 5G networks. Satellite-based connectivity solutions are susceptible to adverse weather conditions due to rain fade. Additionally, bandwidth limitations can cause congestion during peak usage, crippling service quality. This can deter consumers from adopting satellite-based 5G networks compared to traditional connectivity solutions. A major challenge is to be commercially viable in urban areas where alternatives like fiber-optic and terrestrial 5G networks are available to improve revenue segments.

Satellite-based 5G Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

30.3% |

|

Base Year Market Size (2025) |

USD 6.96 billion |

|

Forecast Year Market Size (2035) |

USD 98.19 billion |

|

Regional Scope |

|

Satellite-based 5G Network Market Segmentation:

Satellite Type Segment Analysis

Low earth orbit (LEO) satellite segment is projected to hold satellite-based 5G network market share of more than 43.7% by 2035. The segment is positioned to increase its revenue share by the end of 2035 exhibiting a profitable CAGR. The segment’s growth is attributed to LEO satellites faster data transmission capabilities in comparison to traditional geostationary satellites. LEO satellites are typically positioned at an altitude of 1200 miles or less. Major market players such as Eutelsat, SpaceX, and Amazon are deploying multiple LEO satellite constellations to support global 5G services leading to a robust growth of the segment.

Additionally, LEO satellites are positioned to support real-time applications requiring seamless connectivity such as telemedicine, gaming, and IoT infrastructure leading to opportunities in the latency-sensitive sectors. In March 2023, OQ Technology announced plans to increase its constellations from 3 to 10 in 2023 and improve its 5G narrowband IoT connectivity service based on 3GPP for non-terrestrial networks.

The medium earth orbit (MEO) segment is poised for rapid growth by the end of 2035 owing to its balanced offering between latency and coverage. MEO satellites are typically positioned at altitude ranges between 1234 to 22300 miles in orbit. The demands for MEO satellite connectivity services are rising owing to greater area coverage capabilities over traditional geostationary satellites. The segment is positioned to meet the demands for seamless connectivity solutions for maritime and aviation sectors across remote seas and oceans. For instance, in March 2024, Celcom Digi and SES signed a memorandum of understanding (MoU) to explore MEO satellite connectivity services across Malaysia and develop a local gateway for satellite communication (SATCOM) services in the country.

Frequency Band Segment Analysis

The Ku-band segment in satellite-based 5G network market is projected to rapidly increase in its revenue share owing to its increased usage for high-frequency and high-capacity communication. The European Space Agency specifies that Ku-band operates in the 12-18 GHz range, and the segment’s robust growth is attributed to its increasing usage of fixed and mobile satellite communications. Maritime, broadcast, and aviation applications are increasingly leveraging Ku-band owing to the smaller antennas used, making deployment easier and improving 5G suitability in environments that are usually deemed challenging. For instance, in July 2024, Intelsat announced the approval of the 3GPP Ku-band work package for standardization under guidelines by the International Telecommunications Union (ITU); the move bodes well for the use of the Ku-band spectrum as a fully standardized 5G solution in space.

Our in-depth analysis of the global market includes the following segments:

|

Satellite Type |

|

|

Frequency Band |

|

|

Application |

|

|

Component |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Satellite-based 5G Network Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 35.4% by 2035 owing to significant technological advancements in the satellite-based telecommunications sector and growing investments by key market players. The region is home to major market players such as Viasat Inc., SpaceX, Amazon, Intelsat, etc., deploying satellite constellations to leverage the future of 5G space connectivity. For instance, the Federal Communications Commission (FCC) is proactively seeking to make additional spectrums for 5G communications available and has made auctioning of high-band spectrum a priority. Supportive regulatory ecosystem boosts the satellite-based 5G network market’s growth in North America.

The U.S. dominates the market share in North America and is projected to increase its market share by the end of 2035. The U.S. benefits from a favorable regulatory ecosystem and rapid advances in satellite communication solutions. For instance, the Rural Digital Opportunity Fund (RDOF) aims to disburse over USD 20.4 billion over ten years to facilitate broadband and voice services to millions of small businesses and unserved homes across remote areas in the U.S. The first phase of the auction ended in 2020, and phase 2 aims to award USD 11.2 billion to winning bidders to ensure prioritizing higher speed networks with lower latency.

Additionally, ongoing projects to improve satellite-based communication services immensely benefit the satellite-based 5G network market’s growth. For instance, in November 2023, Lockheed Martin demonstrated the first fully regenerative advanced 5G non-terrestrial network satellite base station and plans to launch the first 5G mil payload for orbit in 2024.

Canada is projected to increase its market share in North America during the forecast period. The market benefits from government initiatives to improve telecommunications by leveraging satellite-based 5G connectivity solutions. For instance, in September 2024, the government announced an agreement with Telesat to provide them with USD 2.1 billion loan to complete and operate Lightspeed, i.e., a premier satellite network. The LEO satellite network is poised to improve 5G connectivity services across Canada, especially in rural areas.

Additionally, Canada has a vast geographical landscape with comparatively lower population density, making high-speed connectivity solutions vital for various industries in the country. The rising demand for low latency connectivity solutions in Canada is poised to continue boosting the growth of the market.

APAC Market Insights

The Asia Pacific satellite-based 5G network market is projected to register the fastest growth in the market. The profitable growth curve in APAC is attributed to demands for connectivity solutions for a large population and to bridge the limitations of terrestrial infrastructures in bridging the data divide. China, Japan, India, and South Korea are leading the market growth of the region. Governments in APAC are increasingly investing in satellite technologies to complement terrestrial 5G rollouts. For instance, in September 2024, KT Corp of South Korea along with its satellite subsidiary KT SAT announced the integration of KOREASAT 6 with a terrestrial 5G network leveraging the 5G non-terrestrial network (NTN) standard.

China holds a significant revenue share in APAC owing to the government's push for self-reliance in space connectivity. China has been actively deploying satellites to improve communications in remote areas. For instance, in February 2024, China Mobile launched two LEO satellites to trial 5G and 6G integration to push for terrestrial and satellite network integration. Additionally, mega projects such as the Spacesail project aim to have near about 15000 satellites in space to offer connectivity solutions. The large-scale push in China to integrate terrestrial and satellite-based 5G networks is poised to generate considerable revenue during the forecast period.

India is poised to increase its revenue share in the APAC satellite-based 5G network market by the end of the forecast period. The market in India provides tremendous potential for global and regional market players owing to high population density and multiple sectors requiring low-latency connectivity solutions. For instance, in March 2022, Omnispace and Nelco announced a collaboration to deliver 5G using Omnispace’s NGSO satellite network across different segments. Additionally, government focus on digitization benefits the growth of the satellite-based 5G network market by empowering local players to establish non-terrestrial 5G connectivity solutions. For instance, in May 2020, Vestaspace Technology announced that it will launch more than 35 high speed 5G satellite constellations across India and has installed eight ground stations to facilitate the launches.

Satellite-based 5G Network Market Players:

- Eutelsat

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EchoStar Corporation

- Thales

- SES

- Iridium Communications

- ZTE

- Viasat Inc.

- SpaceX

- Amazon

- Astrocast

- Inmarsat

- Telesat

- Lockheed Martin

- Honeywell

- Qualcomm Technologies

- OQ Technology

The global satellite-based 5G network landscape is poised for rapid growth during the forecast period. The sector is witnessing global players partnering with local telecommunications companies to integrate satellite-based 5G network services.

Here are some key players in the market:

Recent Developments

- In June 2024, the Pentagon extended contract with SpaceX for Starlink usage in Russia. The USD 14.1 million worth contract will be valid till November 2024.

- In May 2023, Honeywell introduced a new small Satcom system, i.e., Versawave with 5G for advanced air mobility market. Versawave with 5G will enable vehicle command, data transfer, and video streaming.

- In June 2023, Vodafone and SpaceMobile completed world’s first space-based 5G call using a conventional smartphone. AST Space Mobile broke its previous space-based cellular broadband data session by achieving a download rate of almost 14 Mbps.

- In July 2022, Ericsson and Thales, announce plans to leverage a network of Earth-orbiting satellites to use 5G non-terrestrial networks (5G NTN). The collaboration is poised to boost the connectivity of 5G in remote areas where terrestrial coverage is lacking.

- Report ID: 6521

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Satellite-based 5G Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.