SATCOM Market Outlook:

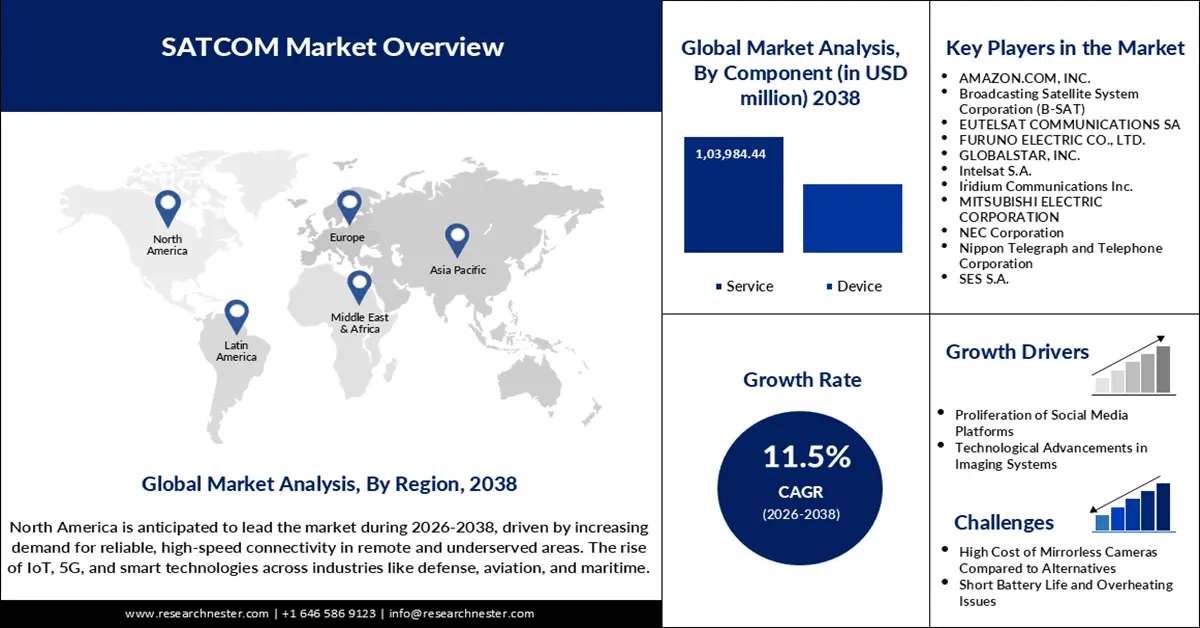

SATCOM Market size was valued at USD 37.1 billion in 2025 and is projected to reach a valuation of USD 166.4 billion by the end of 2038, rising at a CAGR of 11.5% during the forecast period, i.e., 2026-2038. In 2026, the industry size of SATCOM is estimated at USD 44.7 billion.

The SATCOM sector is rapidly expanding with growing demand for global connectivity and convergence of multi-orbit satellite constellations. In June 2025, Starlink obtained a license from India's telecommunications department to offer commercial satellite internet in rural and hilly areas, bridging the connectivity gap for over 40% of India's disadvantaged population. This is an example par excellence of the growing use of SATCOM to bridge digital divides in developing nations. Governments worldwide are investing heavily in satellite infrastructure to support broadband expansion, defense communications, and IoT applications. The transition to hybrid GEO-LEO networks is boosting service reliability and latency, opening up new opportunities for enterprise, government, and consumer markets.

Growth of SATCOM services in emerging markets and verticals is another significant trend. In May 2025, Eutelsat prolonged its satellite broadcasting agreement with BHS Media Group, utilizing its GEO-LEO constellation to deliver low-latency, high-definition video across the MENA region. This highlights SATCOM's function in content delivery and connectivity in emerging markets. The integration of SATCOM into countrywide broadband initiatives, such as India's Bharat Net initiative, is also progressing rapidly on the last-mile delivery to remote villages. With increasing government investment and technological advancement, the satellite communication market is poised for long-term growth and diversification.

Key SATCOM Market Insights Summary:

Regional Highlights:

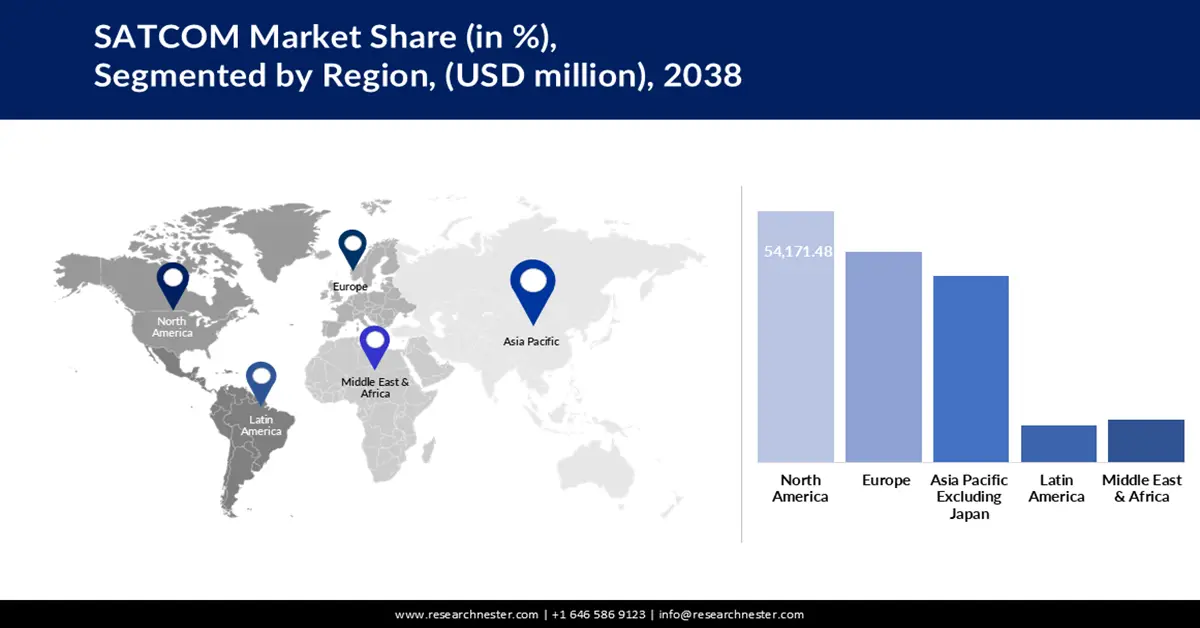

- North America is expected to command around 32.5% share in the SATCOM market by 2038, supported by advanced satellite constellations and substantial government as well as commercial investments.

- Asia Pacific excluding Japan is projected to expand at a notable CAGR of 12.3% between 2026 and 2038, owing to rapid urbanization, government-led connectivity programs, and increasing broadband demand.

Segment Insights:

- The services segment in the SATCOM market is projected to record a strong CAGR of 12.20% from 2026 to 2038, propelled by the rising demand for scalable managed SATCOM solutions and enhanced multi-orbit connectivity.

- The asset tracking and monitoring segment is anticipated to capture a 24.6% share by 2038, supported by increasing adoption of SATCOM for real-time tracking and regulatory mandates for connected fleet management.

Key Growth Trends:

- Optimized coverage and latency with multi-orbit satellite structures

- Growing requirement for secure SATCOM in defense and government

Major Challenges:

- Complex regulatory and licensing regimes

- Space congestion and space debris hazards

Key Players: SpaceX (Starlink), Airbus SE, SES S.A., Iridium Communications Inc., Viasat, Inc., Thales Group, Boeing, L3Harris Technologies, Honeywell International, Cobham Limited, EchoStar Corporation, Communications and Power Industries (CPI), Maxar Technologies Inc., General Dynamics Corporation.

Global SATCOM Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.1 billion

- 2026 Market Size: USD 44.7 billion

- Projected Market Size: USD 166.4 billion by 2038

- Growth Forecasts: 11.5% CAGR (2026-2038)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2038)

- Fastest Growing Region: Asia Pacific excluding Japan

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, South Korea, Australia, Brazil, United Arab Emirates

Last updated on : 23 September, 2025

SATCOM Market - Growth Drivers and Challenges

Growth Drivers

- Optimized coverage and latency with multi-orbit satellite structures: One of the key growth drivers is the adoption of multi-orbit satellite structures that combine GEO, LEO, and MEO constellations in a bid to maximize coverage and latency. In January 2025, Intelsat renewed its satellite services agreement with Alaska-based GCI to add LEO satellites with GEO infrastructure to further extend broadband connectivity to rural regions. This multi-orbit approach is indicative of the industry's push towards responsive, fail-safe connectivity solutions ideally adapted to diverse geographic and operational needs. The ability to integrate orbits supports latency-conscious applications while allowing SATCOM to penetrate more underserved markets, fueling market expansion.

- Growing requirement for secure SATCOM in defense and government: Another significant stimulus is the rising demand for SATCOM in the government and defense sector, where resilience and security of communications are critical. In October 2024, Intelsat completed the U.S. Army SATaaMS pilot program, highlighting managed multi-orbit SATCOM for field operations and logistics with hybrid terminals and real-time support. This success is propelling defense adoption of SATCOM-as-a-Service models, enhancing operational flexibility and network resilience. Investment by governments in secure SATCOMs is driving innovation and expanding the market's high-value segments.

Challenges

- Complex regulatory and licensing regimes: A significant challenge is the rising complexity in regulatory and licensing regimes globally, hindering satellite deployment and service launch. Starlink's June 2025 Indian license was a milestone, but many operators face prolonged approval cycles and spectrum allocation issues in other markets. It requires a gigantic investment and local partnership to deal with such regulatory landscapes, and it can stifle market entry and growth. Coordination of global standards remains a priority for the industry in order to enable smooth SATCOM operations globally.

- Space congestion and space debris hazards: Another challenge is the increasing threat of space traffic congestion and orbital debris threatening satellite safety and operational continuity. In January 2025, E-Space began launching demo satellites that will capture and deorbit orbital debris and address sustainability challenges in massive SATCOM deployments. The increasing number of satellites, especially in LEO, necessitates advanced space traffic management and debris mitigation strategies. Overlooking these challenges could impact the reliability of services and operational costs, posing a serious threat to the sustainable growth of the sector.

SATCOM Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 37.1 billion |

|

Forecast Year Market Size (2038) |

USD 166.4 billion |

|

Regional Scope |

|

SATCOM Market Segmentation:

Component Segment Analysis

The services sector is expected to witness a robust CAGR of 12.20% from 2026 to 2038 due to the increasing demand for agile, scalable managed SATCOM solutions and enhanced connectivity. Managed services allow customers in government, maritime, aviation, and enterprise markets to leverage multi-orbit networks without the cost of large initial investments. In May 2024, the U.S. Space Force initiated testing of hybrid SATCOM terminals featuring embedded cybersecurity modules that alternate between military and commercial networks, providing greater resilience and operational security. This shift to integrated, service-based models is growing market opportunities and driving innovation in SATCOM delivery. As organizations seek cost-effectiveness and agility, the services sector will continue to be significant in the satellite communication market.

Application Segment Analysis

The asset tracking and monitoring segment is anticipated to account for a 24.6% share until 2038, reflecting the growing use of SATCOM in real-time location and condition monitoring in logistics, marine, and air industries. Globalstar and Peiker began rolling out satellite-based eCall systems in Europe during January 2025, enhancing emergency response within the automotive sector. The action demonstrates SATCOM's increasing role in smart mobility and safety applications. The segment is underpinned by rising regulatory mandates for vehicle tracking and increasing connected fleets, driving long-term demand. As industries shift asset management to a digital process, SATCOM-enabled monitoring solutions are becoming inevitable, raising efficiency, safety, and regulatory compliance.

Our in-depth analysis of the satellite communication market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

SATCOM Market - Regional Analysis

North America Market Insights

North America is predicted to hold around 32.5% market share during the forecast period, led by advanced satellite networks and strong government and commercial investment. In April 2025, Amazon's Project Kuiper initiated full-scale deployments of over 3,000 planned LEO satellites, targeting underserved users with terminals backed by AWS infrastructure. The ambitious project is scheduled to disrupt global broadband in mid-2025, enhancing connectivity in remote and rural areas.US government programs backing satellite broadband under digital inclusion initiatives also contribute to the market growth.

The U.S. satellite communication market is garnering robust growth as the need for high-throughput, high-capacity connectivity on a global scale across defense, enterprise, and rural broadband markets accelerates. NASA is focused on expanding its Commercial SATCOM Services Program, inviting new entrants like Starlink and SES to provide scalable data links for lunar and low-Earth missions. The move is diversifying the supply base and responding to the needs of the Artemis program's infrastructure, while opening the market to agile private companies. The U.S. is experiencing rapid deployment of hybrid GEO-LEO networks, which allow for low-latency, high-capacity solutions to mission-critical applications.

Canada satellite communication (SATCOM) market is expanding steadily, led by local investment in rural connectivity and next-generation satellite infrastructure. Telesat enhanced its Lightspeed LEO constellation in February 2025 with phased array terminal contracts for enterprise and aero customers requiring dynamic switching between satellites and ground networks. The solution supports early service activation until late 2026 and aims to bridge connectivity gaps in remote and underserved regions. Canada's government Universal Broadband Fund is also accelerating SATCOM adoption, with plans to connect all households to high-speed internet by 2030. Canadian operators are also collaborating with Arctic and coastal communities on delivering connectivity in demanding environments, supporting economic development and public safety.

Europe Market Insights

Europe is anticipated to witness robust CAGR from 2026 to 2038, fueled by investments in sovereign satellite assets and integration with 5G networks. The European Union's 2025 commitment to deploying 290 satellites under the IRIS² program aims to enhance broadband and military-level connectivity. The initiative complements NATO operations and allows for commercial 5G expansion, enhancing Europe's stand-alone SATCOM network. These advances are driving Europe's strategic autonomy and market growth.

Germany satellite communication market is growing steadily, aided by its robust aerospace industry and government focus on secure communications. Viasat expanded its deal with Airbus in June 2024 to provide dual-band Ku/Ka SATCOM for Spain's C295 aircraft fleet, which enhances ISR and command-and-control capability. This partnership highlights Germany's role in European defense and secure airborne comms networks. The nation's investments in satellite research and development and integration with 5G networks are fueling innovation in multi-orbit SATCOM solutions. Germany's strategic position in European aerospace and defense industries is fueling market development and technological advancement.

The UK satellite communication market is witnessing robust growth fueled by government-funded space missions and commercial satellite deployment. BT, OneWeb, and CGI UK are among those participating, showing strong industry collaboration. High government interest in space-enabled digital infrastructure and defense communications is driving the development of SATCOM. Hybrid GEO-LEO deployment growth is enhancing quality of service and coverage, and positioning the UK as a hub for central European SATCOM.

APEJ Market Insights

Asia Pacific excluding Japan satellite communication market is projected to expand at a 12.3% CAGR between 2026 and 2038, with the growth in urbanization, government initiatives, and rise in demand for broadband connectivity. Domestic and Starlink operators are leading last-mile delivery drivers towards India's vision of digital inclusion. High demand exists in the geographically and demographically diverse region for hybrid satellite networks offering GEO, LEO, and MEO constellations. Government investment in smart cities, defense, and IoT applications also drives satellite communication (SATCOM) market growth.

China satellite communication market is growing rapidly, led by government policy and expanding satellite infrastructure. China is making significant investments in multi-orbit constellations and ground segment modernization to meet growing demand for broadband, IoT, and defense applications. The government's emphasis on space independence and export competitiveness is driving local SATCOM innovation and market expansion.

India satellite communication market is expanding rapidly, fueled by government initiatives and private investment in satellite broadband and military communications. The June 2025 Starlink license marks a key milestone, enabling the rollout of commercial satellite internet to rural and mountainous regions. India's Bharat Net program's integration of SATCOM is targeted at 600,000 villages without connectivity, facilitating digital inclusion and economic development. Government initiatives in secure communications and enhancing infrastructure are inviting global SATCOM operators to India and catalyzing indigenous innovation. In the wake of growing demand for broadband and IoT connectivity, India will probably become a leading SATCOM growth market in Asia Pacific.

Key Satellite Communication (SATCOM) Market Players:

- SpaceX (Starlink)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Airbus SE

- SES S.A.

- Iridium Communications Inc.

- Viasat, Inc.

- Thales Group

- Boeing

- L3Harris Technologies

- Honeywell International

- Cobham Limited

- EchoStar Corporation

- Communications and Power Industries (CPI)

- Maxar Technologies Inc.

- General Dynamics Corporation

The satellite communication market is highly competitive, with the leading international players investing in multi-orbit networks, advanced ground infrastructure, and managed services. Strategic alliances and technological development are crucial to maintaining market leadership in this ever-changing business. As demand for high-throughput, low-latency connectivity rises, competition will rise, and more will be achieved in satellite technology and network management.

Here are some leading companies in the market:

Recent Developments

- In May 2025, Globalstar opened its Satellite Operations Control Center in Louisiana. The advanced hub boosts support for emergency response and M2M services. It underscores Globalstar’s shift toward next-gen LEO infrastructure. The launch drew U.S. lawmakers and FCC representatives, signaling policy support.

- In March 2025, Semtech released the LR2021 transceiver for hybrid networks. It supports both terrestrial and SATCOM links with multi-PHY capabilities. The device enables long-range, low-power connectivity for IoT use cases. This enhances convergence between ground and space systems.

- In February 2025, Anuvu launched new SATCOM services for commercial aviation fleets in Southeast Asia. It offers regional airlines bandwidth-on-demand via Ku-band satellites. This supports inflight connectivity and live entertainment for budget carriers. The expansion reflects rising demand for connected travel experiences post-pandemic.

- In June 2024, SatixFy Technologies released advanced beamforming chipsets for satellite payloads. These support electronically steered antennas and onboard processing. They reduce satellite SWaP requirements while improving spectrum use. SatixFy’s innovation helps enable next-gen multi-beam satellite missions.

- Report ID: 7943

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

SATCOM Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.