Sand Blasting Machines Market Outlook:

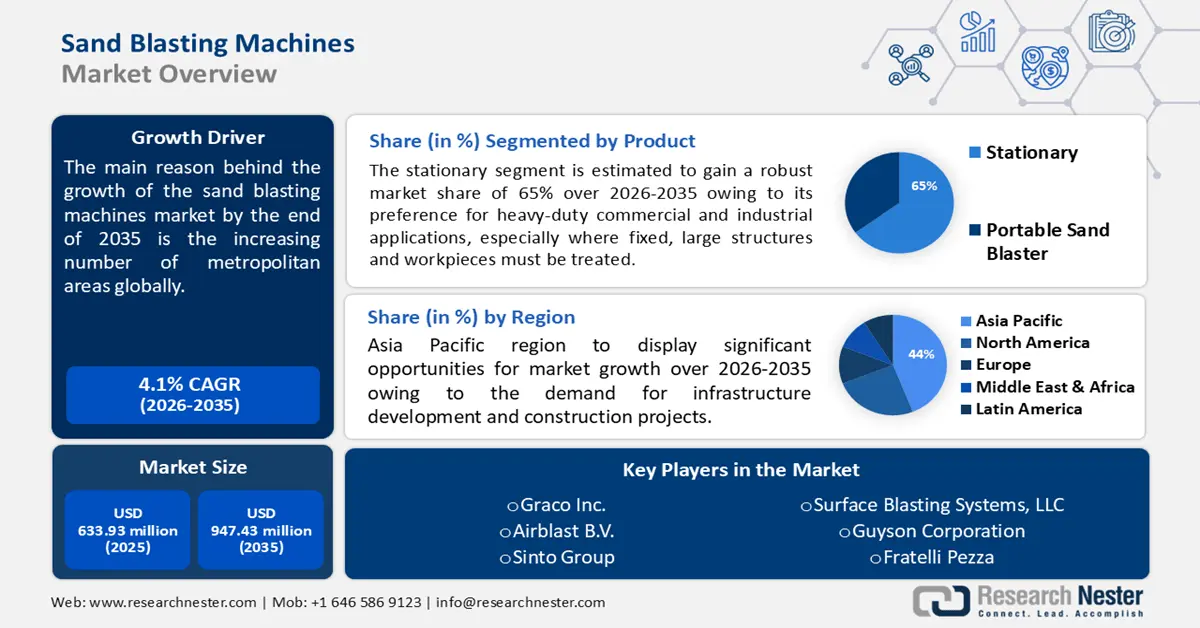

Sand Blasting Machines Market size was over USD 633.93 million in 2025 and is anticipated to cross USD 947.43 million by 2035, growing at more than 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sand blasting machines is assessed at USD 657.32 million.

Sand blasting machines play a crucial role in the construction sector and the market expansion is primarily attributed to the increasing infrastructure development in metropolitan areas. According to a report by the World Bank in 2023, about 50% of the population worldwide lives in urban areas. Additionally, it was projected that the global urban population will showcase an increase of about 1.5 times, crossing more than 6 billion by 2045. The construction industry is also growing, accredited to rising industrialization and increasing government infrastructure spending. In addition, sandblasting machines are essential in the construction sector, especially in the last stages of refining and finishing, for achieving smooth surfaces.

Key Sand Blasting Machines Market Market Insights Summary:

Regional Highlights:

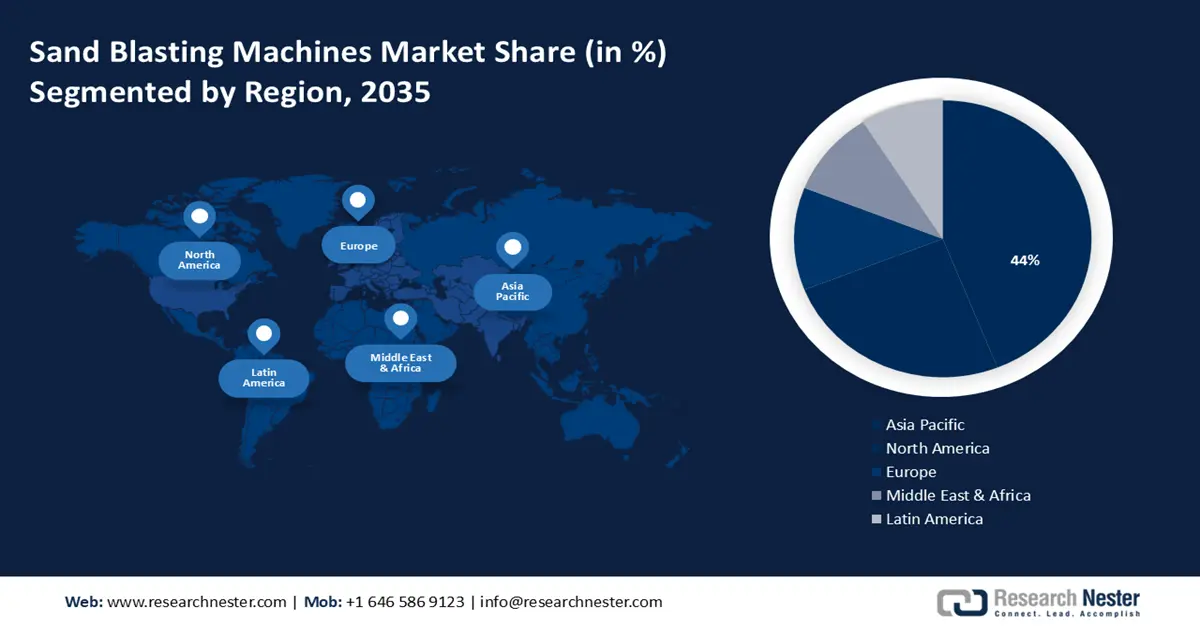

- The Asia Pacific sand blasting machines market achieves a 44% share by 2035, driven by rising infrastructure development, construction projects, and rapid heavy-duty manufacturing growth.

Segment Insights:

- The stationary segment segment in the sand blasting machines market is projected to hold a 65% share by 2035, influenced by preference for heavy-duty commercial/industrial applications requiring fixed setups.

- The automatic operation segment in the sand blasting machines market is anticipated to see substantial growth till 2035, driven by industry shift toward automation in surface preparation and increased productivity.

Key Growth Trends:

- Increasing application in several industries

- Growing urbanization and investments

Major Challenges:

- Lack of skilled professionals

- Prevalence of corrosion and other risks

Key Players: Axxiom Manufacturing, Inc., Wheelabrator, Norton Sandblasting Equipment, Graco Inc., Airblast B.V., Sinto Group, Surface Blasting Systems, LLC, Guyson Corporation, Fratelli Pezza.

Global Sand Blasting Machines Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 633.93 million

- 2026 Market Size: USD 657.32 million

- Projected Market Size: USD 947.43 million by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 17 September, 2025

Sand Blasting Machines Market Growth Drivers and Challenges:

Growth Drivers

- Increasing application in several industries: There is a high usage of sand-blasting machines in various sectors such as automotive, shipbuilding, manufacturing, construction, defense, and marine & aerospace. Since sandblasters can remove contaminants, paint, and rust from vehicle surfaces, there is an increasing demand for such machines in the automotive landscape. According to a report by the European Automobile Manufacturers’ Association in 2023, more than 85.0 million vehicles were produced globally, witnessing an increase of about 5.7% in 2021. Additionally, the automotive robotics revenue share has increased, augmented by the propelled adoption and growing usage of sand blasters.

- Growing urbanization and investments: Urbanization has been considered one of the major key driving forces for the sand blasting industry owing to the building of residential, and commercial infrastructure. Our World Data published a report in 2024 stating that about 44% of the world's population lives in cities, while 43% lives in suburbs and towns, and around 13% in rural areas in 2020.

Furthermore, with the expanding global population, coupled with the lucrative economic growth in developing countries, there is also a significant increase in infrastructural investments by both government and private organizations. World Bank in 2023, estimated that private participation in infrastructure (PPI) investments in 2023 accounted to be USD 86 billion, which was a marginal increase from USD 85 billion, the average of the previous five years.

Challenges

- Lack of skilled professionals: Sand blasting machines require a person with specialized training in machine operations. Replaceable particulate filter respirators and head & body part protective gear are a few examples of preventive equipment. In addition, if the worker exhibits any neglect in adhering to the procedure, there is a tremendous risk to their health.

- Prevalence of corrosion and other risks: Sand blasting machines are used by original equipment manufacturers (OEM) and aftermarket sales organizations in the automotive sector to clean, strengthen, and polish different metal surfaces. One big issue faced by the automotive industry is corrosion. It harms different components' physical durability and strength.

Sand Blasting Machines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 633.93 million |

|

Forecast Year Market Size (2035) |

USD 947.43 million |

|

Regional Scope |

|

Sand Blasting Machines Market Segmentation:

Product Segment Analysis

The stationary segment in the sand blasting machines market is poised to capture a share of 65% in the coming years, impacting the sand blasting machines landscape. Significant growth in the revenue share is driven by the preference for heavy-duty commercial and industrial applications, especially where fixed, large structures and workpieces must be treated. According to a report by the UN Industrial Development Organization in 2023, there was an increase of about 2.3% in the industrial landscape globally, encompassing mining, electricity, waste management, manufacturing, water supply, and several other utilities.

This is particularly applicable for applications requiring a stationary setup for efficiency and accuracy, such as cleaning large metal structures, tanks, and buildings. Additionally, shipbuilding, steel production, and bridge building sectors require sectors that require considerable surface preparation and therefore, prefer stationary sand blasters. Growth in these sectors will fuel the heavy duty trucks value in the near future.

Operation Segment Analysis

Automatic segment in the sand blasting machines market is expected to observe substantial growth till 2035. The market for automatic operation sand blasters is fueled by the boosted shift toward automation in surface preparation goods and production across a variety of industries. Researchers at Research Nester published a report in 2024, estimating that about 75% of companies globally are estimated to use industrial automation, resulting in 10-12% increase in their productivity. Moreover, sand blasting machines that operate automatically are recognized for their speed, which surpasses the manual alternatives and leads to shorter project times and faster task completion.

End use (Automotive, Construction, Marine, Oil & Gas, Metal Fabrication & Manufacturing)

The automotive segment is predicted to dominate the sub-segments in the end use of the sand blasting machines market share with a lucrative size. These machines are used by automakers and service shops to prepare the surfaces of vehicles for painting. This is essential to guarantee paint adhesion and a high-quality finish. According to a report by ACEA in 2023, more than 85.4 million vehicles were produced globally, which is an increase of about 5.7% as compared to 2021. Furthermore, sandblasting machines are an essential tool to the automotive end-use industry driven by their adaptability, efficiency, and precision. These machines are crucial for preserving the appearance, safety, and performance of cars.

Our in-depth analysis of the sand blasting machines market includes the following segments:

|

Product |

|

|

Operation |

|

|

Blasting Type |

|

|

Tank Capacity |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sand Blasting Machines Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 44% by 2035. The growth in this region is poised due to the rising infrastructure development and construction projects, attracting new businesses and consumers. World Bank July 2024 published a report, in which they provided more than 12 billion to developing countries to support infrastructure development, while highlighting that several developing countries have to spend about 4.5% of GDP for basic improvements in energy, digital, transport, and several other sectors.

China's ever-growing economy and rapid growth in heavy-duty manufacturing are set to fuel the sand blasting revenue share. The market has a primary use case in the country’s robust stainless steel industry and is a crucial raw material in shipbuilding, medical engineering, aerospace, etc. To meet the increasing steel demand, TISCO with Rösler built the vertical shot blast machine in September 2023. Similar innovations and the growing emphasis on the development of smart cities will further support the market expansion.

The Japan market is driven by ongoing innovations such as robotic blasting, air blasting, vacuum blasting, and dental sand blasting. Atsuchi Tekko is a prominent market player and offers shot peening for an extensive array of materials. Moreover, the automated sand blasting adoption in manufacturing vacuum equipment, semiconductors, and plate displays is fostering growth in the country.

North America Market Insights

Sand blasting machines market size for North America region is estimated to register significant growth through 2035. The region will account for the second position in this landscape attributed to the increasing demand for the construction sector. In addition, according to a report by the U.S. Bureau of Census in 2024, there was an increase of about 4.1% in the country’s spending on construction in 2020.

The growth in infrastructure projects, commercial structures, and housing complexes, in the U.S. is expected to boost the demand for the sand blasting machines sector. According to the U.S. Department of Treasury November 2023, as the income increases, it is expected that there will be more infrastructure per capita investments as compared to lower-income countries.

Sand blasting in Canada is in high demand owing to the prevalence of major key players such as Manus Abrasive Systems and QuickBlast. Moreover, automotive manufacturing will also act as a primary growth driver for this landscape. A recent report in 2024, sales of light vehicles in Canada are expected to gain a growth rate of about 9.6% with more than 1.9-million-unit sales.

Sand Blasting Machines Market Players:

- BlastONE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Axxiom Manufacturing, Inc.

- Wheelabrator

- Norton Sandblasting Equipment

- Graco Inc.

- Airblast B.V.

- Sinto Group

- Surface Blasting Systems, LLC

- Guyson Corporation

- Fratelli Pezza

The sand blasting machines market growth is predicted to observe a significant share during the forecast period. With the increasing construction, manufacturing, and automotive industries, various companies are adapting to the latest trends and are set to be the major key players in this sector. Several companies are continuously expanding, making agreements, collaborating, and joining ventures for the growth of this industry.

Some of the key players include:

Recent Developments

- In March 2023, BlastOne effectively closed the acquisition of VertiDrive B.V. This calculated action brings cutting-edge solutions for painting and blasting process automation and strengthens BlastOne's capacity to provide client assistance.

- In March 2022, Wheelabrator introduced a new digital tool that monitors and shows a shot-blast machine's total efficacy. It makes it possible for operators to locate problems and obstructions that prevent their blast machines from operating at maximum efficiency.

- Report ID: 6330

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.