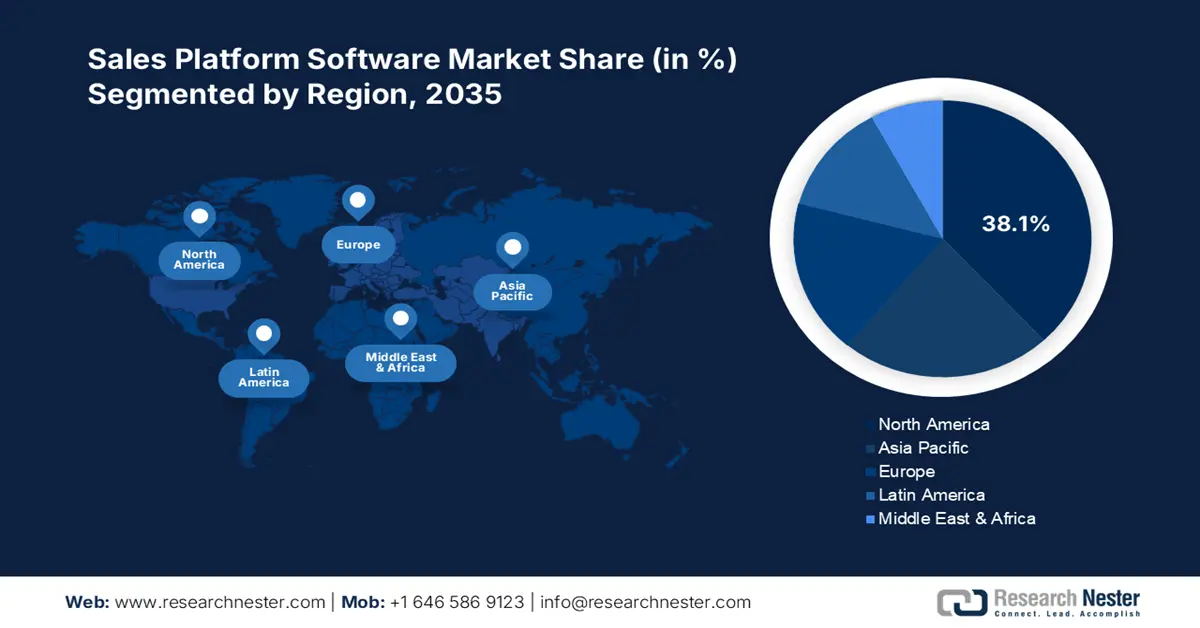

Sales Platform Software Market - Regional Analysis

North America Market Insights

The North America sales platform software market is foreseen to capture 38.1% of the global revenue share through 2035. The growth in the AI-powered CRM and sales engagement tools by the larger enterprises is creating a profitable environment for sales platform software producers. The strong presence of end users in both the U.S. and Canada is fueling the adoption of SaaS solutions. These technologies aid in predictive analytics and streamlining sales pipelines. The supportive regulatory policies are expected to accelerate the adoption of sales platform software solutions in the years ahead.

The adoption of sales platform software solutions in the U.S. is forecast to expand at a high pace during the study period. The growing popularity of AI-enhanced CRM systems and predictive sales analytics is fueling the adoption of cloud-based enterprise solutions. The digitalization trend is increasing the use of cloud-based solutions in the public sector. The Federal Communications Commission (FCC) reveals that in 2023, more than 20.0 million U.S. households enrolled for the Affordable Connectivity Program. This boosted the adoption of the cloud-enabled digital services, including sales platforms.

The digitalization trends among SMEs and investments in rural connectivity infrastructure in Canada are poised to fuel the revenues of sales platform software companies in the years ahead. The Innovation, Science, and Economic Development’s increasing investments in digital accessibility are also estimated to fuel the trade of sales platform software during the foreseeable period. The consistent government support is set to accelerate the production and commercialization of sales platform software in the country.

APAC Market Insights

The Asia Pacific sales platform software market is anticipated to increase at a 12.1% CAGR between 2026 and 2035. The digital transformation movement across APAC countries is opening lucrative doors for sales platform software manufacturers. The strong existence of end users in China and India is fueling the demand for sales platform software solutions. The positive foreign direct investment policies and public entities' interest in cloud-based platforms are further increasing the installation of sales platform software technologies.

In China, the increasing adoption of digital tools by both SMEs and big enterprises is likely to double the revenues of key players in the coming years. The supportive government policies, such as Made in China and the Five-Year Plan, are poised to fuel the production of advanced technologies, including sales software in the country. The rise in public-private investments is set to increase the domestic production of sales platform software solutions in the years ahead.

The digital movement of India is attracting several sales platform software companies to invest in the market. Digital Bharat and Made in India programs are increasing the number of new companies in the country. The boom in public-cloud investments is anticipated to drive the adoption of sales platform software. The Press Information Bureau (PIB) disclosed that internet connections in India grew from 251.5 million in 2014 to 969.6 million in 2024. It also reveals that the digital economy is expanding quickly, making up 11.74% of the country’s income in 2022–23 and expected to reach 13.42% by 2024-25. Overall, investing in India is anticipated to double the revenues of key players.

Europe Software Market Insights

The Europe sales platform software market is estimated to increase at the fastest pace from 2026 to 2035. The region’s strong digital infrastructure and high internet penetration are prime factors boosting the adoption of sales platform software solutions. The rising shift toward omnichannel commerce is also contributing to high demand for digital sales tools. The EU’s Digital Strategy and regulations, such as GDPR, are further accelerating the adoption of sales platforms with advanced data privacy and compliance features.

The U.K. leads the demand for sales platform software solutions, owing to its advanced digital economy and robust e-commerce trade. The increasing popularity of cloud computing is also opening high-earning doors for key players. The retail, financial, and professional service enterprises are prime end users of AI-enabled sales platforms. The government’s push for digital transformation is pushing the application of sales platform software solutions.

The Germany market is estimated to be driven by industrial automation and digitalization. The strong adoption of digital solutions in both B2B and B2C sectors is propelling the trade of sales platform software. The country’s Digital Strategy 2030 initiative is further boosting sales platform software adoption across several industries.