Rubber Vulcanization Market Outlook:

Rubber Vulcanization Market size was over USD 6.82 billion in 2025 and is anticipated to cross USD 12.45 billion by 2035, witnessing more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rubber vulcanization is assessed at USD 7.2 billion.

Vulcanized rubber is gaining widespread applications in conveyor belts, gaskets, seals, hoses, and vibration-damping materials. The swift growth in industries such as construction, mining, manufacturing, and aftermarket is influencing the sales of rubber vulcanization products. High-potential economies including Asia Pacific, Latin America, and the MEA are the most opportunistic marketplaces for rubber vulcanization companies owing to rapid industrialization and urbanization. The trade of automobiles, footwear, and industrial products is high in these regions, which opens lucrative doors for market players.

|

Vulcanized Rubber Thread and Cord |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

Thailand |

386 |

China |

308 |

|

Malaysia |

168 |

Bangladesh |

45.3 |

|

China |

107 |

Vietnam |

28.1 |

|

India |

19.6 |

Indonesia |

25.6 |

|

Vietnam |

9.57 |

Italy |

21.2 |

Source: OEC

The Observatory of Economic Complexity (OEC) study reveals that the vulcanized rubber thread and cord trade amounted to USD 756.0 million in 2022, holding the 2489th position as the most traded product. The product complexity index (PCI) of vulcanized rubber thread and cord ranked 1916th in 2022. Thailand and China are top exporters and importers of vulcanized rubber threads and cords, representing significant trade activities saturated in Asia Pacific. The market concentration, in 2022, using Shannon Entropy was captured at 2.29, explaining the dominance of 4 countries on export trade.

Key Rubber Vulcanization Market Insights Summary:

Regional Highlights:

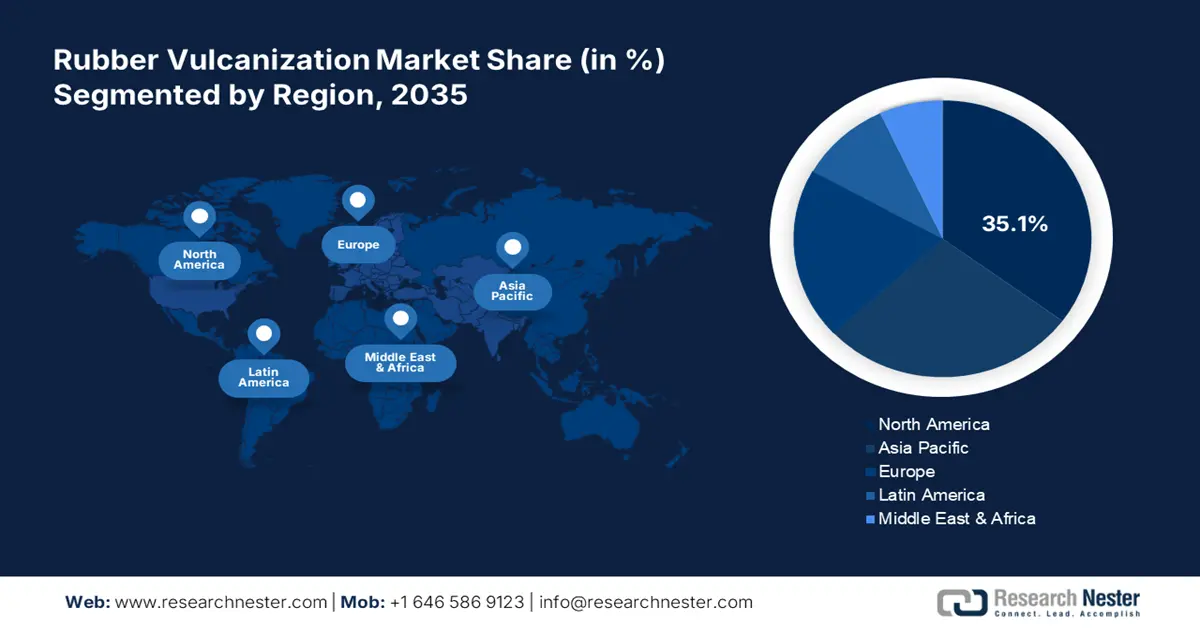

- North America dominates the Rubber Vulcanization Market with a 35.1% share, driven by the strong presence of automotive component and medical product manufacturing companies, fostering significant growth by 2035.

- The Asia Pacific Rubber Vulcanization Market is set for rapid growth by 2035, fueled by expanding mining projects, increased automobile registrations, and booming footwear industry.

Segment Insights:

- The Automotive segment is anticipated to maintain a dominant share in the Rubber Vulcanization Market from 2026-2035, driven by the global rise in EVs and high-performance tire demand.

- The Accelerator segment of the Rubber Vulcanization Market is expected to capture a 46.5% share by 2035, fueled by demand for faster vulcanization and high-volume industrial production.

Key Growth Trends:

- High use in the footwear industry

- Integration of advanced technologies

Major Challenges:

- Supply chain disruption of raw materials

- Environmental concerns

- Key Players: Arkema SA, Eastman Chemical Company, Kumho Petrochemical, Solvay S.A., and NTCS Group.

Global Rubber Vulcanization Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.82 billion

- 2026 Market Size: USD 7.2 billion

- Projected Market Size: USD 12.45 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Rubber Vulcanization Market Growth Drivers and Challenges:

Growth Drivers

- High use in the footwear industry: The boom in the footwear industry is representing profitable trade for vulcanized rubber products. Vulcanized rubbers are finding high applications in the production of comfortable and durable shoes and soles. The increasing demand for sports shoes and high-performance footwear is augmenting the consumption of vulcanized rubbers.

- Integration of advanced technologies: Considering the string regulations, key players are more focused on the sustainable and eco-friendly rubber vulcanization process. This includes innovations in sulfur-based vulcanization systems such as peroxide vulcanization. Furthermore, to maximize their production cycles, manufacturers are implementing automation and digital technologies. Automated systems monitor quality in real time and enhance the overall process with efficiency and low labor costs. The Industry 4.0 practices coupled with innovations are backing the rubber vulcanization market growth.

Challenges

- Supply chain disruption of raw materials: The supply chain fluctuations associated with raw materials such as rubber and chemicals including sulfur and accelerators put significant pressure on manufacturers. This further increases the cost of final products. Thus, supply chain disruptions leading to price volatility affect the profitability of companies operating in the market.

- Environmental concerns: The rubber vulcanization process releases harmful emissions owing to sulfur use, hampering human health. Several regulatory bodies across the world are imposing strict regulations on this sector to minimize the release of harmful gases and protect the environment. This is creating major challenges for key players to adopt sustainable and safer rubber vulcanization processes.

Rubber Vulcanization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 6.82 billion |

|

Forecast Year Market Size (2035) |

USD 12.45 billion |

|

Regional Scope |

|

Rubber Vulcanization Market Segmentation:

Application (Automotive, Medical, Industrial, Consumer Goods, Others)

The automotive segment is set to capture a dominant rubber vulcanization market share throughout the forecast period. The EV trend and high automobile ownership rates are fueling the sales of vulcanized rubbers. The growing demand for high-performance tires with specific characteristics such as durability, strength, and flexibility is propelling the sales of vulcanized rubbers. Thus, a global increase in automobile production is set to promote the sales of vulcanized rubber products. For instance, the International Energy Agency (IEA) revealed that around 14.0 million electric car sales were registered across the world, in 2023 and this number is expected to double in the years ahead. Furthermore, the OEC report estimates that the rubber tire trade stood at USD 95.4 billion in 2022. The exports were dominated by China (USD 19.6 billion) and imports by the U.S. (USD 19.0 billion). The rubber tire export trade registered a CAGR of 9.17% between 2021 to 2022.

Type (Accelerator, Vulcanizing Agent, Activator, Others)

The accelerator segment is poised to capture 46.5% of the global rubber vulcanization market share by 2035. The main reason backing the demand for accelerators is its ability to minimize the vulcanization process and ensure quality and faster production cycles. Vulcanized rubbers are exhibiting high demand from the construction, automotive, and manufacturing sectors and to meet these robust requirements manufacturers are making high consumption of accelerators. Apart from these industries, the use of vulcanized rubber is gaining traction in medical facilities for the production of tubes, gloves, and various other products. Overall, accelerators are set to hold a dominant share throughout the study period owing to high production requirements.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rubber Vulcanization Market Regional Analysis:

North America Market Forecast

North America rubber vulcanization market is expected to capture revenue share of over 35.1% by 2035. The strong presence of automotive component and medical product manufacturing companies is majorly propelling the sales of vulcanized rubbers in the region. The strict environmental regulations and innovations in rubber processing are propelling the market growth in the U.S. and Canada.

The U.S. automotive sector is a major driver for the sales of vulcanized rubbers as they are extensively used in the manufacturing of tires, seals, belts, gaskets, and hosses of automobiles. The growing demand for electric, hybrid, and ICE vehicles is pushing the demand for durable and high-performance vulcanized rubber products. For instance, the National Automobile Dealers Association (NADA) stated that new light-vehicle sales in the U.S. totaled a SAAR of 15.7 million units in April 2024. Furthermore, the IEA report estimates that 1.4 million electric vehicles were sold in the U.S. in 2023, 40% higher than the previous year. Thus, the U.S. is the most lucrative rubber vulcanization market companies.

Similar to the U.S., Canada’s strong automotive and tire manufacturing industry is pushing the sales of vulcanized rubbers. The majority of global automakers have manufacturing units in the country, which is propelling the consumption of vulcanized rubbers in these plants. The dominant mining and oil & gas sectors of the country are also major consumers of vulcanized rubber products. The expansion of these industries is directly fueling the sales of rubber vulcanization technologies. For instance, the Mining Association of Canada states that there are over 200 active mines in the country. Mining, quarrying, and oil and gas extraction contributed 7.8% to the country’s gross domestic product (GDP), in 2022. Overall, Canada is a win-win pool for rubber vulcanization companies.

Asia Pacific Market Statistics

The Asia Pacific rubber vulcanization market is poised to expand at the fastest pace during the study period. Expanding mining projects, a hike in automobile registrations, a boom in the footwear industry, and robust urban and industrial activities are fueling the sales of rubber vulcanization solutions. China and India are high-earning marketplaces for rubber vulcanization companies owing to a strong industrial and manufacturing base. Whereas, Japan and South Korea are expected to offer innovative rubber vulcanization technologies in the coming years.

China known as the largest industrial hub globally is set to witness robust sales of rubber vulcanization technologies in the coming years. High automobile production, the strong presence of chemical companies, and thriving manufacturing activities are augmenting the sales of rubber vulcanization solutions. The IEA study reveals that around 60% of the total EV sales were registered in China. It highlights that the automotive sector is the major user of rubber vulcanization solutions in the country.

In India, the supportive government policies for chemical production, swift mining activities, the positive market for EVs and other engine vehicles, and expanding medical solution manufacturing plants are propelling the sales of vulcanized rubber products. For instance, the India Brand Equity Foundation (IBEF) report states that the chemical and petrochemical demand in the country is anticipated to triple and reach USD 1.0 trillion by 2040. Being the 6th largest producer of chemicals, India is estimated to offer lucrative opportunities for rubber vulcanization market players in the coming years.

Key Rubber Vulcanization Market Players:

- LANXESS AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Arkema SA

- Eastman Chemical Company

- Kumho Petrochemical

- Solvay S.A.

- NTCS Group

- Duslo, a.s.

- Shandong Stair Chemical & Technology Co., Ltd

- Willing New Materials Technology Co., Ltd

- King Industries, Inc.

The rubber vulcanization market is competitive owing to the strong presence of industry giants. Innovations, investments in research and development activities, collaborations and partnerships, mergers and acquisitions, and global expansion are some of the marketing strategies widely employed by leading companies. Organic tactics are often observed to offer positive margin rates to key players. Industry giants are forming strategic collaborations with other players to drive innovations and boost market reach. To earn high profits, key players are also entering into untapped markets. Developing regions are offering high-earning opportunities for rubber vulcanization manufacturers due to swift industrial and urban activities.

Some of the key players include in market:

Recent Developments

- In January 2025, NTCS Group announced that it started the production and commercialization of polymer sulfur (insoluble sulfur) in granules for rubber vulcanization. Through this move, the company is expanding its operations in the rubber vulcanization market.

- In April 2023, Solvay S.A. announced the expansion of its industrial FFKM portfolio with a new Tecnoflon SHP product line. The addition includes fully fluorinated synthetic rubbers with high chemical and heat resistance.

- Report ID: 7041

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rubber Vulcanization Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.