Rubber Processing Chemicals Market Outlook:

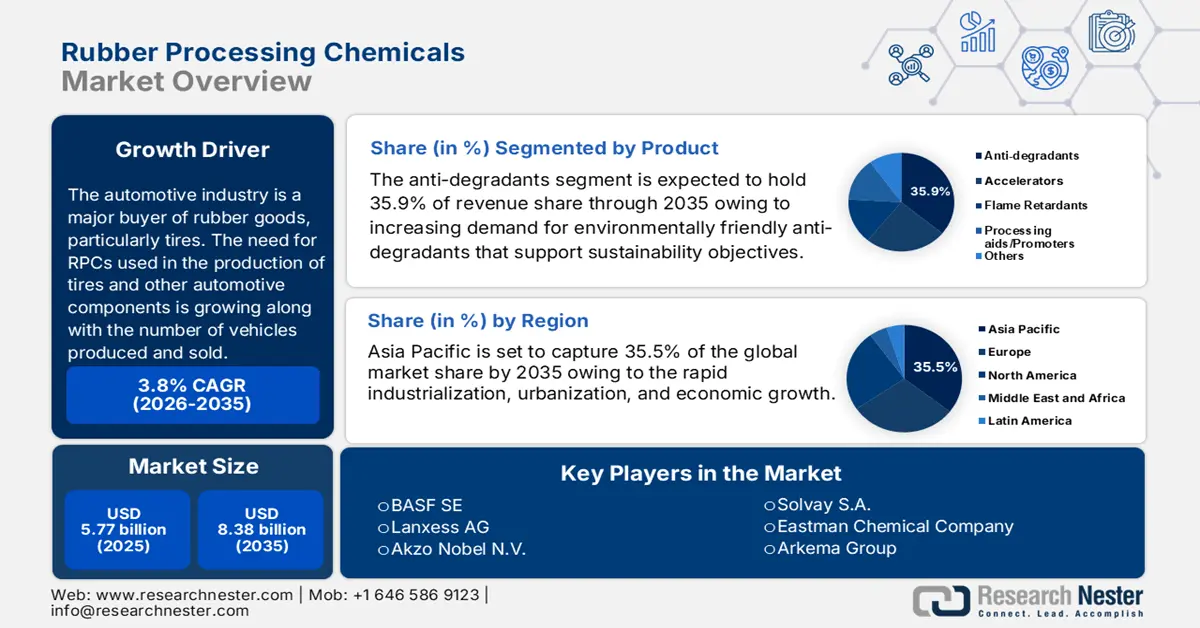

Rubber Processing Chemicals Market size was over USD 5.77 billion in 2025 and is projected to reach USD 8.38 billion by 2035, growing at around 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rubber processing chemicals is evaluated at USD 5.97 billion.

The automotive industry is a major buyer of rubber goods, particularly tires. The need for RPCs used in the production of tires and other automotive components is growing along with the number of vehicles produced and sold. For instance, 85.4 million motor vehicles were produced globally in 2022, a 5.7% increase over 2021. According to the Society of Indian Automobile Manufacturers (SIAM), the auto industry produced over 2,59,00,000 vehicles between April 2022 and March 2023, including passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles. This contrasts with 2,30,00,000 units produced between April 2021 and March 2022.

Eco-friendly items and sustainability are becoming popular. These developments are supported by the creation and application of recyclable or bio-based rubber processing chemicals, which propel market expansion in this area. For example, Dow Inc., a material science company increased the revenue of the rubber processing chemicals market in July 2024 by introducing NORDEL REN Ethylene Propylene Diene Terpolymers, a bio-based version of Dow's EPDM rubber compound used in consumer, automotive, and infrastructure applications, at the 2024 German Rubber Conference.

Key Rubber Processing Chemicals Market Insights Summary:

Regional Highlights:

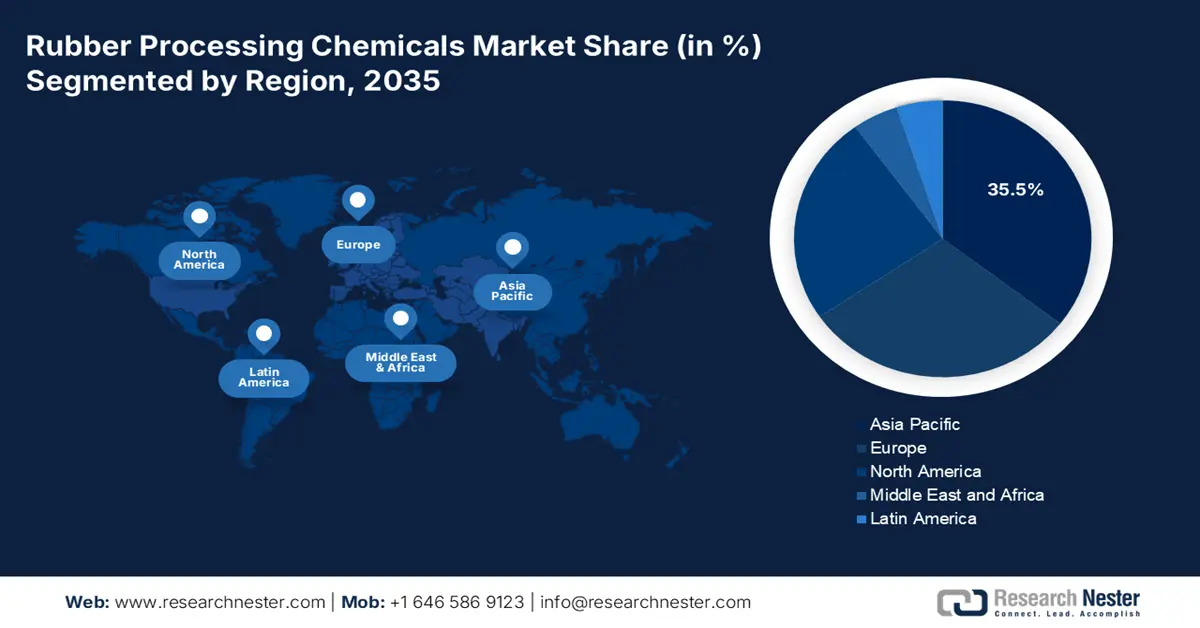

- Asia Pacific commands a 35.5% share in the Rubber Processing Chemicals Market, fueled by industrialization, automotive industry expansion, and growing demand for tires and rubber goods, supporting significant growth through 2035.

Segment Insights:

- The anti-degradants segment is forecasted to achieve a 35.9% share by 2035 in the rubber processing chemicals market, driven by demand for eco-friendly, high-performance rubber protectants.

- The Automotive Components segment of the Rubber Processing Chemicals Market is anticipated to hold a noteworthy share by 2035, driven by innovations in rubber chemistry enhancing vehicle efficiency.

Key Growth Trends:

- The development of electric automobiles

- Development of green and bio-based rubber compounds

Major Challenges:

- Strict laws about the detrimental effects of substances

- Health hazards

- Key Players: BASF SE, Lanxess AG, Akzo Nobel N.V., Solvay S.A., Eastman Chemical Company, Arkema Group, LG Chem Ltd., Nouryon, and Emerald Performance Materials LLC.

Global Rubber Processing Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.77 billion

- 2026 Market Size: USD 5.97 billion

- Projected Market Size: USD 8.38 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 13 August, 2025

Rubber Processing Chemicals Market Growth Drivers and Challenges:

Growth Drivers

-

The development of electric automobiles: Rubber processing chemicals are used in the manufacturing of electric vehicles for a variety of purposes, such as accelerators, lubricants, plasticizers, and anti-degradants. These chemicals are widely used in the manufacturing of various rubber polymer auto parts, such as tires, wipers, bumpers, and airbags, among others. The need for rubber processing chemicals, or additives, will eventually expand in tandem with the electric car industry's expansion. For instance, with sales of electric cars approaching 14 million in 2023, the sector is expanding rapidly. Between 2020 and 2023, the percentage of electric vehicles climbed from about 4% to 18%, as projected by the International Energy Agency (IEA). In the first quarter of 2024, almost 3 million electric vehicles were sold, which is 25% more than at the same time the previous year. With new purchases accelerating in the second half of the year, project sales of over 17 million by the end of the year represent a more than 20% year-over-year growth. As a result, electric cars may account for more than one in every car sold throughout the whole calendar year.

-

Development of green and bio-based rubber compounds: The development of green and bio-based rubber chemicals offers the rubber processing chemicals sector a bright future. The creation of natural and renewable substitutes for conventional rubber compounds derived from petroleum helps meet the rising consumer demands for more ecologically friendly and sustainable products. Rubber product manufacturers can now offer ecologically friendly solutions that appeal to eco-conscious consumers while also ensuring regulatory compliance with severe environmental laws owing to bio-based goods. Businesses can use agricultural resources and waste biomass to develop revolutionary bio-based antiozonants, plasticizers, and other rubber additives that are as effective as current petrochemical counterparts while lowering their total carbon footprint.

- Infrastructure development and construction project expansion: Construction projects and infrastructural expansion. As of May 2022, China's infrastructure projects in development or operation were valued at about USD 5 trillion. Likewise, the Ministry of Road Transport and Highways built 10,331 km of national highways in FY23. Durable rubber materials are necessary for the construction of infrastructure, such as buildings, bridges, and roadways. The rise in infrastructure projects necessitates the use of RPCs to enhance the properties of rubber materials.

Challenges

-

Strict laws about the detrimental effects of substances: To satisfy the unique needs of different rubber-based products, a variety of chemicals are needed during the rubber production process. Hazardous gasses are emitted during the rubber-making process, endangering both human health and the environment. The use of chemical additives in rubber preparation is closely regulated by several regulatory agencies, including the Environmental Protection Agency (EPA) and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). The National Library of Medicine (LIB) states that human health is impacted by exposure to chemical additives such as tetramethyl thiuram monosulfide, which is used as an accelerator in the manufacture of rubber.

-

Health hazards: Large amounts of wastewater are produced by industry, and if improperly managed, they can pose serious health hazards. Additionally, manufacturing processes including die casting and extrusion are linked to higher rates of lung, stomach, bladder, hematological, and other types of cancer. As a result, severe regulations controlling chemical use and wastewater treatment in processing facilities are enforced by regulatory agencies including the New Source Performance Standards (NSPS) and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). The use of substitutes like cellulose and stronger natural fibers made from processed vegetable oil plants has increased due to growing health and environmental concerns.

Rubber Processing Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 5.77 billion |

|

Forecast Year Market Size (2035) |

USD 8.38 billion |

|

Regional Scope |

|

Rubber Processing Chemicals Market Segmentation:

Product (Anti-degradants, Accelerators, Flame Retardants, Processing aids/Promoters)

Anti-degradants segment is projected to dominate rubber processing chemicals market share of around 35.9% by the end of 2035. Rubber materials are shielded from deterioration by external elements including heat, oxygen, and ultraviolet light by a class of compounds called anti-degradants. The increasing demand for environmentally friendly anti-degradants that support sustainability objectives is a noteworthy development in the market for chemicals used in rubber processing. Producers are creating formulas that offer efficient defense while reducing their negative effects on the environment. Furthermore, improvements in nanotechnology are improving anti-degradants' effectiveness and providing better performance attributes for rubber goods.

Application (Tire and Related Products, Automotive Components, Footwear Products, Industrial Rubber Products)

Based on the application, the automotive components segment in rubber processing chemicals market is likely to hold a noteworthy share by the end of 2035. Rubber-based items used in automobiles, such as tires, gaskets, seals, and hoses, are referred to as automotive components in the market for rubber processing chemicals. The increasing need for performance-enhancing additives to maximize tire efficiency, fuel economy, and safety is a noteworthy trend in this market. Furthermore, the creation of environmentally friendly rubber compounds supports innovation in chemical processing for automotive applications and is consistent with the sustainability objectives of the automotive sector. The industry's dedication to enhancing performance and environmental effects is shown in this development.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rubber Processing Chemicals Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific rubber processing chemicals market is predicted to dominate revenue share of over 35.5% by 2035. The region's rapid industrialization, urbanization, and economic growth are attributed to this dominance due to the increased need for rubber goods across a variety of industries. Growth in the region is mostly driven by the expanding manufacturing, construction, and automotive industries in countries like China, India, and Japan.

Rubber processing chemicals are in high demand in China. Over the years, both production and demand will keep increasing. By 2022, China's sales of rubber processing chemicals had increased by more than 5% to over USD 1 billion. The substantial growth of China's chemical sector and the expanding automotive aftermarket brought on by an increase in car sales are driving growth. Government regulations are therefore being created to allow the entry of well-known producers of chemicals used in rubber processing, which will lead to a large future rubber processing chemicals market expansion.

Over the last few decades, India's automotive sector has gradually expanded. Globally, the number of vehicles sold has risen dramatically, and more people are utilizing them. Every car needs tires, which are a necessary part of every vehicle and must be changed regularly. With a valuation of over USD 100 billion as of April 2022, India's automobile sector contributes 7.1% of its GDP and 8% of its total exports. 60% of Indian families own a car, per the 2021 National Family Health Survey. To satisfy the increasing demand from automakers, tire producers are increasing their production volumes as more automobiles are put on the road each year.

Europe Market Analysis

Europe is expected to experience a stable CAGR during the forecast period. Europe is renowned for its emphasis on sustainability and stringent environmental laws. With a strong automotive industry and industrial basis, Germany, France, Italy, and the UK are major rubber processing chemicals market contributors. The need for green rubber processing chemicals is driven by European consumers' and businesses' preference for sustainable and environmentally friendly products. The use of sustainable and non-toxic chemicals in manufacturing processes is mandated by strict rules in the European Union.

The German market for chemicals used in rubber manufacturing is fueled by environmental laws and a focus on sustainability. The country has strict laws and guidelines in place to encourage environmentally friendly production methods and lessen the effects of processing on the environment. As a result, environmentally friendly chemicals with low volatile organic compounds (VOCs) that comply with EU requirements have been developed. The manufacturers are spending money on R&D to create novel and sustainable chemicals for rubber production.

The rubber processing chemicals market in the UK may expand due to Germany's growing need for these chemicals due to its various end-user applications, such as the automotive industry. The market for rubber processing chemicals is expected to be driven by rising R&D expenditures for these chemicals due to government-enacted rules and significant competition from a number of alternative products and suppliers.

Key Rubber Processing Chemicals Market Players:

- Ecore International

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Lanxess AG

- Akzo Nobel N.V.

- Solvay S.A.

- Eastman Chemical Company

- Arkema Group

- LG Chem Ltd.

- Nouryon

- Emerald Performance Materials LLC

The rubber processing chemicals market has a constant need for new product development and innovation. Businesses in this industry devote resources to R&D projects that attempt to provide new and improved goods with enhanced longevity, performance, and environmental friendliness. These developments entail the addition of chemicals that strengthen rubber's properties, such as increased flexibility, heat tolerance, and durability.

Here are some leading players in the market:

Recent Developments

- In March 2024, LANXESS, a specialty chemicals firm, showcased its extensive line of tire industry additives and solutions at Tire Technology Expo 2024 in Hanover, Germany. The company showed how tire manufacturers can lessen their environmental impact both during production and after the product is finished from March 19 to 21.

- In April 2023, Ecore International announced that it acquired 360 Tire Recycling Group, a top tire recycling management business. Ecore's position in the tire and buffings collection is strengthened by this strategic partnership, which also helps the company acquire raw materials for its cutting-edge flooring and surfacing solutions. The global shift to a circular rubber economy also positions 360 Tire Recycling Group and Ecore as leaders.

- Report ID: 7164

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rubber Processing Chemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.