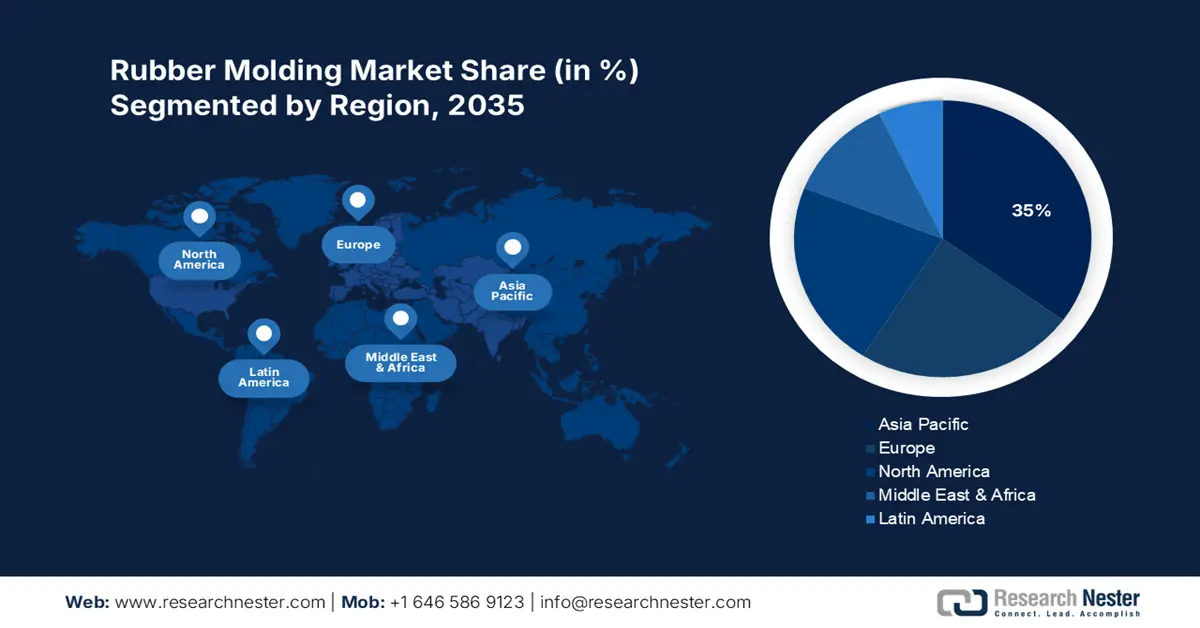

Rubber Molding Market Regional Analysis:

APAC Market Statistics

Asia Pacific in rubber molding market is anticipated to hold over 35% revenue share by the end of 2035. The region is a leading hub for automotive production housing major manufacturing. The growing demand for electric vehicles (EVs) and fuel-efficient vehicles has increased the need for high-performance rubber molded components, such as gaskets, seals, and vibration control parts, which are essential for vehicle durability and efficiency.

As a global leader in electronic manufacturing, China requires rubber-molded parts for insulation, sealing, and vibration damping in devices. The growing production of smartphones, wearables, and other electronics drives the demand for precise-engineered rubber components. The expansion of the healthcare sector in China, demands medical-grade rubber molded products used in equipment, devices, and surgical tools. Rising health awareness and government investment in healthcare infrastructure

In India, the government focuses on infrastructure development, including roads, bridges, and smart cities, driving demand for rubber molding products like seals, gaskets, and vibration-dampening materials. Over 2021–2026, the total infrastructure capital expenditure is projected to increase at a CAGR of 11.4%. These components are vital for ensuring structural stability and durability in construction projects. Furthermore, the adoption of advanced technologies like injection molding and 3D printing allows manufacturers to produce high-precision rubber components efficiently. These advancements help meet the growing demand for complex, customer-designed parts across industries.

Europe Market Analysis

Europe has a strong focus on sustainability and encourages the use of recycled and eco-friendly rubber materials. Initiatives promoting the circular economy are driving innovation in rubber molding, ensuring products are environmentally friendly while meeting industry standards for durability and performance. The region’s regulatory frameworks for quality and safety in the automotive, healthcare, and construction sectors encourage the adoption of premium rubber molded components. Manufacturers must comply with strict EU standards, driving the production of high-performance, precision-engineered rubber parts.

Germany has a strong commitment to sustainability and green technology. The environmental and resource-efficient technology market in Germany is estimated to be worth 9% of the global market, and it is projected to increase at a rate of roughly 8% per year until 2030. This has led to increased demand for eco-friendly and recyclable rubber materials in manufacturing. The push for sustainable practices across industries is prompting manufacturers to develop and use more environmentally friendly rubber molding processes and materials, benefiting the rubber molding market’s growth.

The aerospace and electronics sectors in the UK are evolving rapidly, requiring specialized rubber components for insulation, sealing, and protection. With an annual revenue of around £20 billion, the UK leads the European industry and has the biggest aerospace and defense sector outside of the US. These industries rely on rubber-molded products for various applications, including vibration dampening, electrical insulation, and fluid sealing. The expansion of these sectors, particularly in advanced technologies like electric aviation and consumer electronics, is driving increased demand for rubber molding solutions.