Rubber Gloves Market Outlook:

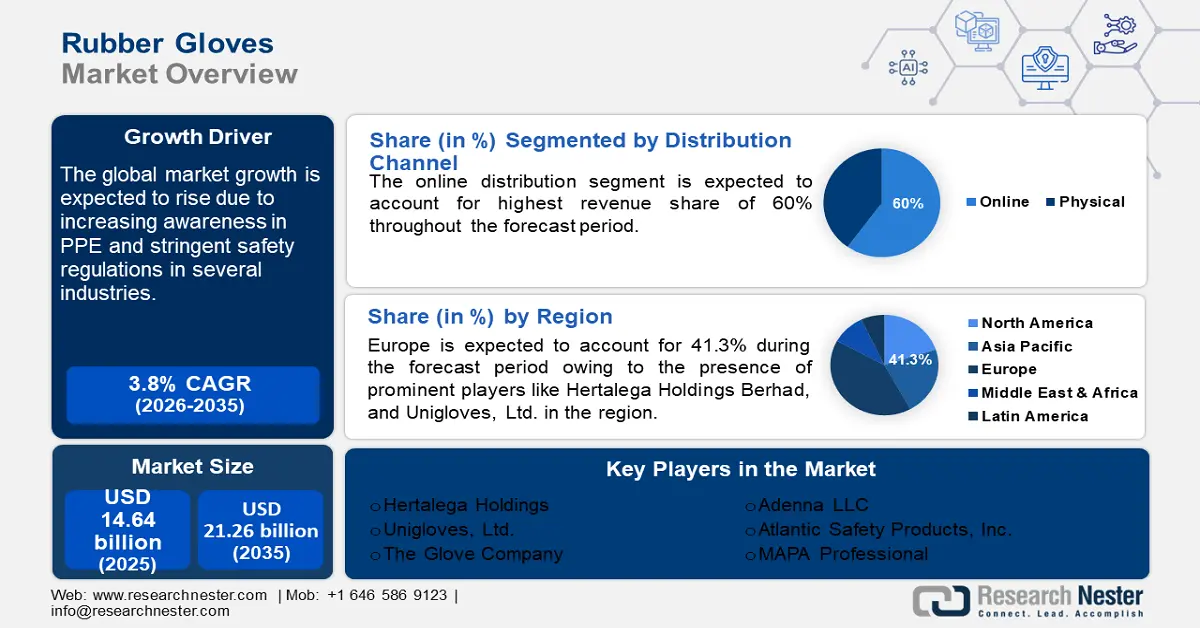

Rubber Gloves Market size was valued at USD 14.64 billion in 2025 and is expected to reach USD 21.26 billion by 2035, expanding at around 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rubber gloves is evaluated at USD 15.14 billion.

The market is driven by rising demand across industries such as healthcare, food processing, chemical handling, and manufacturing. Furthermore, increasing awareness about Personal Protective Equipment (PPE) has also boosted the adoption of rubber gloves in several sectors. Key activities in the rubber gloves market include the production of both natural rubber and synthetic gloves, such as nitrile and vinyl, to cater to the varying needs of different industries. The innovations are mainly centered around improving glove durability and comfort, in addition to allergy-free alternatives.

Growing awareness of workplace safety and hygiene, especially after the COVID-19 pandemic has significantly influenced the market growth. Moreover, manufacturers are focusing on biodegradable and eco-friendly alternatives to reduce waste. The rubber gloves market witnessed an increase in manufacturing capacity. According to a 2023 NPR report, glove-manufacturing projects in New Hampshire received USD 290 million in public funding, as a part of USD 1.5 billion federal government investments to boost U.S. production of medical gloves, masks, and gowns, and reduce the dependence on imports from Asia.

Key Rubber Gloves Market Insights Summary:

Regional Highlights:

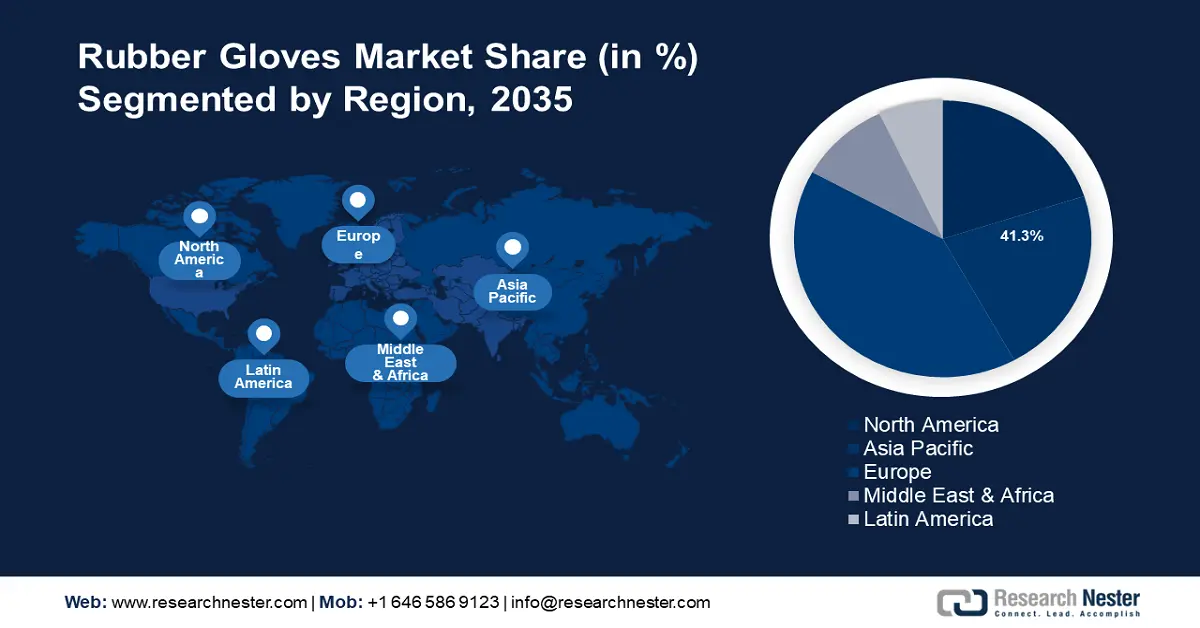

- Europe rubber gloves market is anticipated to capture 41.30% share by 2035, driven by growing awareness of gloves usage in various industries.

Segment Insights:

- The physical distribution segment in the rubber gloves market is anticipated to secure a 68.40% share by 2035, driven by its established infrastructure, enabling bulk supply and better quality control.

- The durable gloves segment in the rubber gloves market is expected to secure a dominant share by 2035, influenced by industries prioritizing cost-efficiency and worker protection over extended use.

Key Growth Trends:

- Multi-functionality of rubber gloves

- Stringent safety regulations

Major Challenges:

- Waste handling & disposal challenge

- Health hazards

Key Players: Hartalega Holdings Berhad, Unigloves Ltd., The Glove Company, MAPA Professional, Adenna LLC, Kossan Rubber Industries.

Global Rubber Gloves Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.64 billion

- 2026 Market Size: USD 15.14 billion

- Projected Market Size: USD 21.26 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (41.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Malaysia, China, Thailand, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Rubber Gloves Market Growth Drivers and Challenges:

Growth Drivers

-

Multi-functionality of rubber gloves: The multi-functionality of rubber gloves is a key driving factor of market growth. While in the industrial sector, these gloves offer protection against harmful substances, their use in household sectors offer cleaning and personal protection, especially during major disease outbreaks. The versatility of rubber gloves makes them indispensable in personal and professional sectors, thereby fuelling the rubber gloves market growth.

In the healthcare sector, rubber gloves are essential in maintaining hygiene and prevention of cross-contamination. In July 2021, Honeywell and Premier, Inc. announced a collaboration to expand the domestic production of nitrile exam gloves. This was aimed at producing at least 750 million domestically made nitrile exam gloves, to meet the shortages driven by COVID-19 and vaccine distribution. - Stringent safety regulations: Regulatory bodies around the world are enforcing stricter safety and hygiene standards in various industries, including food processing, pharmaceuticals, and chemical handling, boosting the use of rubber gloves for personal protection. In addition, high-cost compensation for not following the regulations is also effectively driving the rubber gloves market growth. Regulations implemented in recent years have also heightened the demand for high-quality, compliant rubber gloves.

The US FDA released an article in February 2024, stating that manufacturers are required to identify on the package labeling the materials used to make the medical gloves. It further stated that in case of a possible allergic reaction from certain materials, healthcare practitioners can choose made of synthetic materials such as nitrile. Factors like these are driving the manufacturers to develop safe-for-use rubber gloves that comply with the regulatory standards.

Challenges

-

Waste handling & disposal challenge: The vast number of single-use gloves discarded daily presents a significant challenge in the rubber gloves market growth. Most rubber gloves, particularly synthetic ones such as nitrile and vinyl are not biodegradable, leading to environmental concerns as they accumulate in landfills and cause plastic pollution. Incineration of these leads to the release of harmful chemicals into the environment.

This growing environmental impact is demanding more sustainable practices such as the development of biodegradable gloves, and stricter waste management regulations. This majorly applies to the healthcare and food processing sectors owing to the wider need for rubber gloves. This on a global scale remains a complex challenge for rubber glove manufacturers which may hinder the rubber gloves market growth in the upcoming years. - Health hazards: This primarily revolves around latex allergies and chemical exposure. Latex gloves can cause allergic reactions in a few individuals, ranging from mild skin irritations to severe respiratory issues. Powdered latex gloves proteins become airborne, further increasing the risk of breathing-related allergies. Owing to this, many industries are switching to alternatives that are of lesser risk but not completely risk-free. Frequent users may suffer from skin sensitivities.

Rubber Gloves Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 14.64 billion |

|

Forecast Year Market Size (2035) |

USD 21.26 billion |

|

Regional Scope |

|

Rubber Gloves Market Segmentation:

Product (Disposable, Durable)

The durable segment dominated the market share owing to their long-lasting use in industries requiring frequent and intensive hand protection. These are typically made from high-quality materials including nitrile, and latex. These are commonly used in sectors such as construction, manufacturing, chemical handling, and more. The demand is driven by industries prioritizing cost-efficiency, and worker protection over extended periods of use.

This segment also contributes to the increasing demand for sustainable solutions, as longer-lasting gloves contribute to waste reduction in comparison to disposable alternatives. In October 2023, a Vietnam-based glove manufacturer, Phu Duc Huy, announced plans to establish a nitrile glove manufacturing facility in Arkansas. It aims to cater to the growing demand for durable gloves and prioritize sustainable glove manufacturing.

Distribution Channel (Online, Physical)

The physical distribution segment will hold the largest rubber gloves market share of 68.4% by 2035 owing to its well-established infrastructure that supports large-scale logistics, allowing manufacturers to meet the bulk demand of industries. Furthermore, physical distribution offers reliability in supply chain management, ensuring timely deliveries and the ability to manage inventory better. Buyers prefer physical channels for bulk purchases as they offer room for negotiation and better control over quality assurance.

Moreover, physical distribution channels have strong integration with regional and local markets, enabling faster delivery times, and enhanced customer services. It further allows easier product demonstrations and immediate troubleshooting, along with managing regulatory compliance, effectively. Factors as such influence the segment growth, further driving the rubber gloves market.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Type |

|

|

Product |

|

|

Distribution Channel |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rubber Gloves Market Regional Analysis:

Europe industry is likely to account for largest revenue share of 41.3% by 2035. The growing awareness of gloves usage in different industries has been noticed in the region. The booming medical sector, driven by population growth and healthcare advancements is propelling the demand for durable and disposable gloves across the region. In addition, the food processing sectors including the dairy industry are also contributing significantly to the market growth in the region. This is because such industries require a sterile environment for food safety. This in turn is boosting the demand for rubber gloves.

India is the fastest-growing regional market in Asia Pacific and is projected to record significant growth during the forecast period. India’s growing pharmaceutical and biotechnology industries are contributing significantly to the rising consumption of gloves, majorly in the R&D settings. Additionally, the expansion of the country’s manufacturing sector, including chemical processing and food handling is driving the demand for industrial-grade durable gloves.

China rubber gloves market is projected to lead the regional market in terms of revenue in 2030. Driven by the vast industrial base, and expanding healthcare infrastructure, China is expected to witness a positive leap. The country is focused on improving workplace safety standards, in addition to emphasis on healthcare reforms, particularly post-pandemic. China is both a major consumer and producer of rubber gloves, contributing significantly to the global market growth.

Europe Market Analysis

Europe rubber gloves market is projected to experience steady growth during the forecast period. Demand for both disposable and durable gloves in the region has witnessed a surge, driven by a rise in medical treatments, surgeries, and infection control measures. Sustainability trends are also influencing the market growth significantly.

Post-pandemic healthcare reforms and the rising number of surgeries and medical examinations have boosted the need for rubber gloves in the UK. Additionally, stringent health and safety regulations across industries have increased demand for both durable and disposable gloves. Furthermore, UK focuses on reducing plastic waste and environmental impact. Which is projected to propel the rubber gloves market growth during the forecast period.

Germany’s robust industrial base has created a strong demand for durable rubber gloves designed for heavy-duty use. The country’s strict adherence to safety regulations in industries including automotive, chemicals, and pharmaceuticals ensures that gloves with high durability and resistance to chemicals are in high demand. Medical rubber gloves are on high demand in the country due to advanced medical infrastructure and aging population.

Rubber Gloves Market Players:

- Top Glove Corporation Bhd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hartalega Holdings Berhad

- Unigloves Ltd.

- The Glove Company

- MAPA Professional

- Adenna LLC

- Kossan Rubber Industries

- MCR Safety

- Atlantic Safety Products, Inc.

- Globus (Shetland) Ltd.

- Sempermed USA Inc.

Rubber gloves market expansion is predicted to witness a lucrative share during the forecast period. The market is dominated by the presence of several prominent players. These players adopt strategies such as expanding production capacity, improving supply chain efficiencies, mergers, and acquisitions, to strengthen the market presence. For instance, in April 2024, Ansell Ltd. announced the acquisition of 100% of the assets of Kimberly-Clark’s Personal Protective Equipment business (KCPPE) for USD 640 million. This acquisition aims to enhance the sales of specialist products designed for clean room applications. Market leaders have also diversified across both disposable and reusable gloves to cater to a broader range of industries.

Some of the key players include:

Recent Developments

- In June 2024, Unigloves Ltd. announced the acquisition of 50% equity interest in Spain-based PPE manufacturer Nitrex. The company further aims to acquire the remaining interest in the future.

- In March 2023, Ansell Limited completed the acquisition of Careplus Group in Careplus (M) Sdn Bhd., aiming to access additional surgical glove capacity to meet high market demand

- In December 2022, Dunlop Home Products announced the launch of a new line of gloves made with natural rubber that can easily decompose into the soil

- Report ID: 6432

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rubber Gloves Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.