RTLS in Healthcare Market Outlook:

RTLS in Healthcare Market size was over USD 3.15 billion in 2025 and is poised to exceed USD 16.77 billion by 2035, growing at over 18.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of RTLS in healthcare is estimated at USD 3.67 billion.

Real-time location systems (RTLS) in healthcare are gaining widespread popularity due to their real-time monitoring and management. Real-time location systems use various technologies such as infrared, ultrasound, and RFID to enhance patient care and improve operational efficiency. Around 25% of healthcare facilities employ real-time location systems in the U.S. for effective patient and asset management. Hospitals and clinics widely face issues including, equipment missing, which sometimes majorly hamper their cashflows questioning inventory management.

Key RTLS in Healthcare Market Insights Summary:

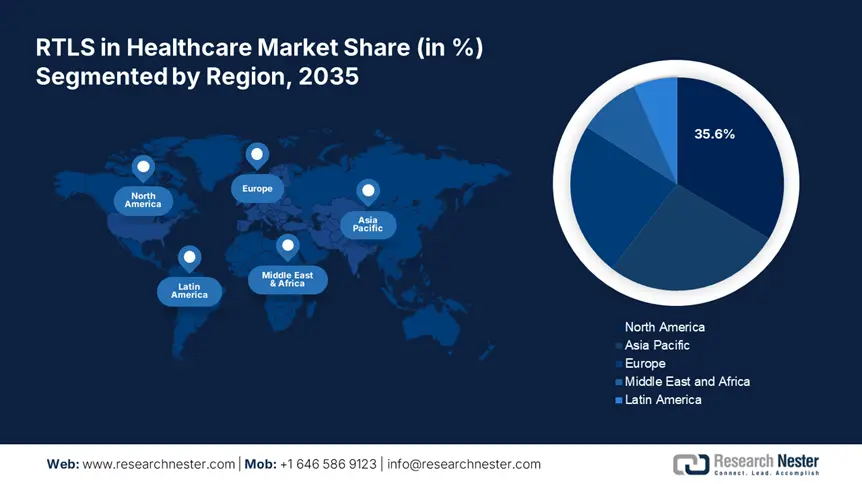

Regional Highlights:

- North America dominates the RTLS in Healthcare Market with a 35.6% share, driven by the presence of advanced healthcare infrastructure and key market players, fostering robust growth prospects through 2026–2035.

- The Asia Pacific RTLS in Healthcare Market is poised for rapid growth by 2035, driven by increasing spending on healthcare infrastructure and adoption of digital healthcare technologies.

Segment Insights:

- The Hardware segment is poised for substantial growth by 2035, driven by its simplicity and easy integration with existing infrastructure.

- The Senior Living Facilities segment is poised for substantial growth from 2026-2035, driven by the high operational efficiency of RTLS.

Key Growth Trends:

- Integration of RTLS with IoT

- RTLS transforming telehealth services

Major Challenges:

- High installation cost

- Data security concerns

- Key Players: Ubisense, Impinj, Inc., Hewlett Packard Enterprise Development LP, Zebra Technologies, Corporation, and Securitas Healthcare, LLC.

Global RTLS in Healthcare Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.15 billion

- 2026 Market Size: USD 3.67 billion

- Projected Market Size: USD 16.77 billion by 2035

- Growth Forecasts: 18.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 12 August, 2025

RTLS in Healthcare Market Growth Drivers and Challenges:

Growth Drivers:

-

Integration of RTLS with IoT: Working in healthcare facilities is quite stressful compared to working in other domains. For instance, according to the National Center for Biotechnology Information, healthcare workers experience stress at a rate of 70%, affecting patient care. The convergence of RTLS and IoT (the Internet of Things) in healthcare systems is anticipated to enhance data collection and analytics, leading to better decision-making, reduced workers’ stress levels, and improved patient care. IoT devices such as wearables and smart sensors continuously collect data on patient movements, vital signs, and asset utilization. This when integrated with RTLS offers a comprehensive view of workflows and resource use.

- RTLS transforming telehealth services: The increasing adoption of telehealth services is driving a high demand for effective and reliable asset management solutions, particularly through the integration of remote patient monitoring systems. The growing need for accurate location monitoring and tracking to enhance the functionality and effectiveness of telehealth solutions is also driving the adoption of RTLS. Furthermore, RTLS helps in scheduling appointments and mitigating waiting times, making telehealth a more attractive and viable option for patient care.

Challenges

-

High installation cost: The implementation of RTLS requires high upfront costs, as the hardware and software components are complex and expensive. Furthermore, RTLS is integrated with existing hospital information systems (HIS), electronic health records (EHR), and other IT infrastructure. This integration requires skilled IT professionals leading to increased labor costs. Hospitals with limited budgets often fail to install such advanced technologies, limiting the overall market growth.

- Data security concerns: Real-time location systems like any other networked technology are susceptible to cyberattacks. A data breach could expose sensitive patient information, leading to significant legal and financial consequences for healthcare providers. Thus, despite their potential benefits healthcare facilities may hesitate to adopt RTLS due to security concerns.

RTLS in Healthcare Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.2% |

|

Base Year Market Size (2025) |

USD 3.15 billion |

|

Forecast Year Market Size (2035) |

USD 16.77 billion |

|

Regional Scope |

|

RTLS in Healthcare Market Segmentation:

Component (Hardware, Software, Services)

Hardware segment is estimated to capture RTLS in healthcare market share of around 63.9% by the end of 2035 owing to its simplicity and easy integration with existing infrastructure. RTLS hardware such as RFID tags, sensors, and beacons are essential for tracking medical equipment, supplies, and patients in real-time, improving operational efficiency. The ongoing technological advancements are set to drive the demand for advanced RTLS hardware solutions, transforming the healthcare sector in the coming years.

End use (Senior Living Facilities, Hospitals & Healthcare Facilities)

In RTLS in healthcare market, senior living facilities segment is predicted to account for revenue share of around 45.5% by 2035 due to the high operational efficiency of RTLS. Real-time location systems mitigate the time healthcare staff spend on searching for equipment and patients. This efficiency allows caregivers to focus more on patient interaction and care. RTLS also aids senior care providers in reducing 50% of resident search and response time.

Our in-depth analysis of the RTLS in healthcare market includes the following segments:

|

Component |

|

|

Technology |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

RTLS in Healthcare Market Regional Analysis:

North America Market Forecast

North America industry is likely to dominate majority revenue share of 35.6% by 2035, due to the presence of advanced healthcare infrastructure and key market players. The governments in the region highly invest in advancing their healthcare facilities to offer cutting-edge services to both patients and medical practitioners and staff, driving RTLS sales.

The U.S. market is expected to increase at a high CAGR during the forecasted period owing to the presence of leading companies and rapid advancements in RTLS technology. The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes is driving high demand for advanced resource management solutions including RTLS in the country.

In Canada, supportive government policies and regulations, including, the Connected Care for Canadians Act is enhancing the adoption of modern healthcare facilities. In addition, the growing popularity of digital health platforms and rising prevalence of diseases are increasing the need for reliable and advanced asset management systems including RTLS.

Asia Pacific Market Statistics

Asia Pacific market is anticipated to rise at a rapid pace during the projected period owing to the increasing spending on the healthcare infrastructure, rising adoption of digital healthcare technologies, and growing emergence of technology start-ups. India, Japan, China, and South Korea are some of the most lucrative marketplaces in the region.

The healthcare sector of India is expanding at a rapid pace, and high budget allocation for infrastructure development and modern medical technologies are generating profitable opportunities for real-time location system producers. For instance, India’s union budget 2024-2025 has allocated around USD 10.70 billion to enhance accessibility and innovation in healthcare services.

Key RTLS in Healthcare Market Players:

- Ubisense

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Impinj, Inc.

- Hewlett Packard Enterprise Development LP

- Zebra Technologies, Corporation

- Securitas Healthcare, LLC.

- Midmark Corporation

- Sonitor Technologies

- AiRISTA Flow, Inc.

- Oracle Corporation

- GE HealthCare

- CenTrack, Inc.

- TeleTracking Technologies, Inc.

- Aruba Networks

- Alien Technology

- Advantech Co., Ltd.

- Stanley Healthcare

- Savi Technology

- GE Healthcare

- Litum

- Avalue Technology Inc.

Key players in the RTLS in healthcare market are employing several strategies such as advancements in current solutions, the introduction of advanced technologies, collaborations, mergers, and regional expansion. Leading companies are collaborating with other players and healthcare providers to develop innovative solutions and expand their market reach. They are also acquiring small or new companies with advanced solutions to expand their product folio and customer base.

Some of the key players include:

Recent Developments

- In July 2024, Litum announced the launch of a flexible subscription-based model Staff Duress. The company expects that this RTLS solution is expected to enhance operational efficiency in the healthcare segment.

- In April 2024, Aesculap, Inc. announced the launch of Aicon RTLS a real-time location service technology that aids in improving the efficiency of sterile processing departments. Aesculap revealed Aicon RTLS at the Healthcare Sterile Processing Association (HSPA) annual conference held in Las Vegas, between April 21-23.

- In February 2024, CenTrak, Inc. announced the launch of Connect, a next-gen cloud-based software platform to enhance real-time location systems. Connect is anticipated to gain widespread adoption in the healthcare sector owing to its advanced features.

- Report ID: 6502

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

RTLS in Healthcare Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.